Berry Markets 2025 Review: Everything You Need to Know

Executive Summary

Berry Markets is an unregulated forex broker that offers reasonable trading costs and diverse trading platforms. However, it faces significant challenges with customer service quality and transparency concerns that affect client satisfaction. This berry markets review reveals a broker that provides 24/7 customer support and user-friendly trading platforms. The company supports forex, commodities, indices, and stock CFD trading across MT4 and MT5 platforms, giving traders access to multiple markets.

According to available user feedback, Berry Markets has received 3 positive reviews highlighting its user-friendly interface and reasonable fee structure. Additionally, there is 1 negative exposure review raising concerns about service quality and transparency issues that potential clients should consider. The broker appears to cater to traders seeking access to multiple asset classes who may have lower expectations for customer service excellence.

The platform offers a wide range of trading options with competitive fee structures. This makes it potentially suitable for cost-conscious traders who prioritize low costs over premium services. However, the lack of regulatory oversight and documented customer service issues present significant considerations for potential clients who value protection and support. This evaluation suggests Berry Markets may be appropriate for traders who prioritize platform functionality and cost efficiency over regulatory protection and premium customer support services.

Important Notice

Due to Berry Markets' unregulated status, investors across different regions may face varying levels of legal protection and risk exposure. The absence of regulatory oversight means that standard investor protection mechanisms may not be available to clients. Additionally, dispute resolution processes could be limited compared to regulated brokers who must follow strict guidelines.

This review is based on available user feedback, platform characteristics, and industry standard evaluation criteria. Given the limited publicly available information about Berry Markets' specific operational details, potential clients should conduct thorough due diligence before engaging with this broker to ensure it meets their needs.

Rating Framework

Broker Overview

Berry Markets operates as an unregulated forex broker headquartered in Saint Vincent and the Grenadines. The company positions itself as a multi-asset trading provider, offering access to forex, commodities, indices, and stock CFDs through popular trading platforms that traders recognize. Despite its unregulated status, the broker attempts to maintain a professional trading environment with 24/7 customer support services available to all clients.

The broker's business model focuses on providing diverse trading opportunities across multiple asset classes while maintaining what it describes as reasonable trading costs. Berry Markets utilizes the widely recognized MT4 and MT5 trading platforms, which are industry standards known for their reliability and comprehensive trading tools that professionals use. The company's approach appears to target traders who prioritize platform functionality and cost efficiency over regulatory assurance and premium customer service experiences.

This berry markets review indicates that while the broker offers essential trading services, the lack of regulatory oversight raises important questions about investor protection and operational transparency. Potential clients must carefully consider these factors before opening accounts with the company.

Regulatory Status: Berry Markets operates without regulatory oversight, which means it does not fall under the supervision of major financial regulatory bodies. This unregulated status presents significant considerations for potential clients regarding investor protection and dispute resolution mechanisms that are typically available with regulated brokers.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available sources. Potential clients must make direct inquiry with the broker for comprehensive payment options and processing times.

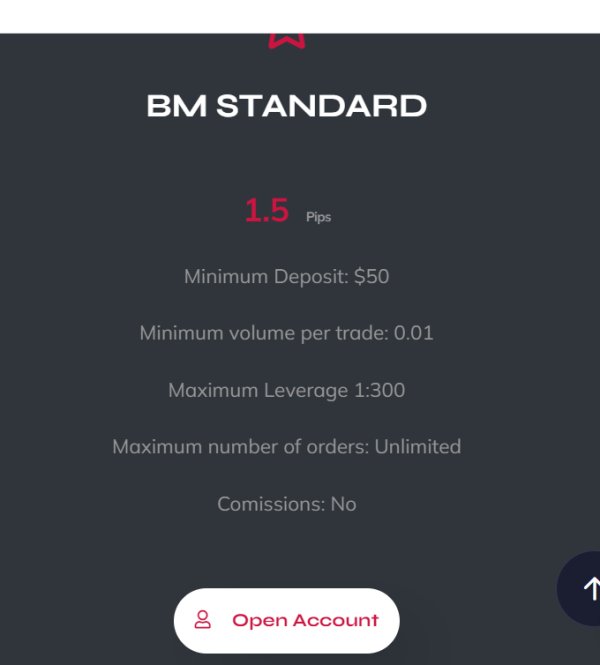

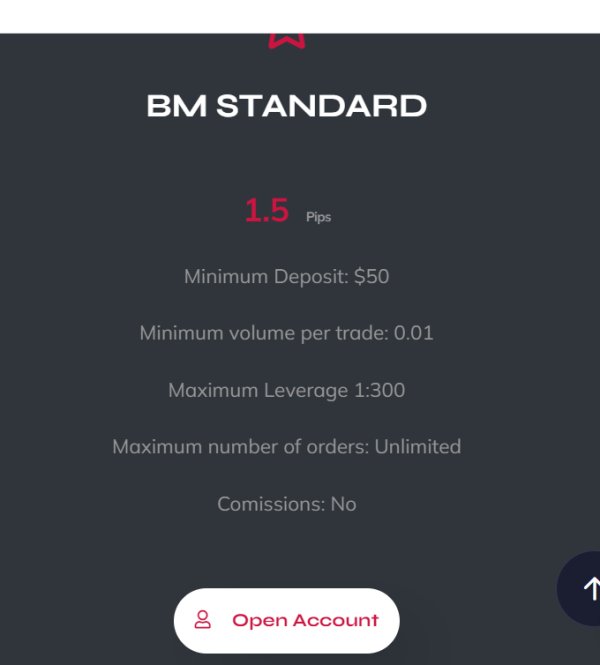

Minimum Deposit Requirements: The minimum deposit requirement for opening an account with Berry Markets is not specified in available documentation. Traders should contact the broker directly to understand their initial funding requirements.

Bonus and Promotions: Information regarding promotional offers, welcome bonuses, or ongoing promotional campaigns is not provided in current available sources. Interested traders should inquire directly about any available incentives or promotional programs.

Tradeable Assets: Berry Markets offers trading opportunities across forex pairs, commodities, indices, and stock CFDs. This provides traders with diversified market access through a single platform for multiple investment strategies.

Cost Structure: The broker advertises reasonable trading fees, though specific information about spreads, commissions, and other trading costs requires direct verification with the company. Accurate pricing details should be confirmed before opening an account.

Leverage Ratios: Specific leverage offerings and maximum leverage ratios are not detailed in available source materials. Traders should verify leverage options directly with Berry Markets to understand their trading capacity.

Platform Options: Berry Markets provides access to both MT4 and MT5 trading platforms. These industry-standard tools offer traders comprehensive functionality for market analysis and trade execution.

Regional Restrictions: Information about geographical trading restrictions or country-specific limitations is not specified in available sources. Potential clients should verify their eligibility based on their location.

Customer Support Languages: While the broker offers 24/7 support services, specific language availability beyond the standard support options is not detailed in current documentation. Multilingual support options should be confirmed directly with the company.

This berry markets review highlights the need for potential clients to conduct direct inquiries for specific operational details not covered in publicly available information.

Account Conditions Analysis

The account conditions offered by Berry Markets remain largely undisclosed in available public information. This makes it challenging to provide comprehensive analysis of their account structure for potential traders. Without detailed information about account types, minimum deposit requirements, or specific account features, potential traders cannot make fully informed decisions about the suitability of Berry Markets' offerings for their trading needs.

The absence of clear account condition information raises transparency concerns, particularly for an unregulated broker where detailed operational information becomes even more crucial for client decision-making. Industry best practices typically involve clear disclosure of account types, ranging from basic accounts for beginners to premium accounts for high-volume traders, each with distinct features and requirements that help clients choose appropriate options.

Without specific details about account opening processes, verification requirements, or special account features such as Islamic accounts for Muslim traders, this berry markets review cannot provide the comprehensive account analysis that traders typically require. The lack of publicly available information about account conditions suggests that potential clients must rely on direct communication with the broker to understand their options and make informed decisions.

Professional traders typically expect detailed information about account tiers, associated benefits, and any restrictions or requirements that may affect their trading activities. The limited transparency in this area represents a significant gap in publicly available information that could impact trader confidence and decision-making processes when evaluating Berry Markets as their potential broker.

Berry Markets provides access to the MT4 and MT5 trading platforms, which represent industry-standard tools offering comprehensive charting capabilities, technical analysis tools, and automated trading support. These platforms are widely recognized for their stability, functionality, and extensive customization options, providing traders with professional-grade trading environments that meet industry expectations.

The availability of both MT4 and MT5 platforms suggests that Berry Markets caters to traders with varying preferences and technical requirements across different experience levels. MT4 remains popular for its simplicity and extensive third-party tool compatibility, while MT5 offers enhanced features including additional timeframes, more technical indicators, and improved backtesting capabilities for advanced users.

However, specific information about additional research and analysis resources, educational materials, or proprietary trading tools is not detailed in available sources. Many competitive brokers supplement standard platforms with market analysis, economic calendars, trading signals, and educational resources to enhance the trading experience and provide added value to their clients.

The absence of detailed information about educational resources, market research capabilities, or additional analytical tools represents a gap in this evaluation that limits comprehensive assessment. Professional traders often require comprehensive market analysis, real-time news feeds, and educational materials to support their trading strategies effectively and make informed decisions.

Without specific details about automated trading support, expert advisor compatibility, or additional analytical resources, traders must verify these capabilities directly with Berry Markets. This verification process is necessary to understand the full scope of available tools and resources that support successful trading activities.

Customer Service and Support Analysis

Berry Markets advertises 24/7 customer support availability, which represents a positive aspect of their service offering for traders who need assistance. However, user feedback indicates significant concerns about service quality, with documented complaints about poor customer service experiences and transparency issues that affect overall client satisfaction and trust.

The disconnect between advertised round-the-clock support and actual user experiences suggests potential issues with support quality, response times, or problem resolution effectiveness. Quality customer service typically involves not only availability but also competent, helpful, and timely responses to client inquiries and concerns that resolve issues efficiently.

User feedback highlighting poor service quality raises important questions about the broker's ability to handle client concerns effectively, particularly given their unregulated status where quality customer service becomes even more critical for maintaining client confidence and resolving disputes. Without regulatory oversight, clients depend heavily on the broker's internal support systems for problem resolution.

The lack of specific information about support channels, response time guarantees, or multilingual support capabilities further limits the assessment of Berry Markets' customer service infrastructure. Professional brokers typically offer multiple contact methods including live chat, email, and telephone support with clear response time commitments that set appropriate client expectations.

Without detailed information about staff expertise, escalation procedures, or specialized support for different client types, this evaluation relies primarily on user feedback indicating service quality concerns. Potential clients should carefully consider these documented issues when evaluating Berry Markets as their trading partner and support provider.

Trading Experience Analysis

User feedback describes Berry Markets' platform as user-friendly, suggesting that the basic trading interface provides acceptable functionality for executing trades and managing positions effectively. The utilization of MT4 and MT5 platforms typically ensures reliable order execution and comprehensive trading capabilities that meet industry standards for professional trading environments.

However, specific information about order execution quality, including details about slippage rates, requote frequency, or execution speed during high-volatility periods, is not available in current sources. These factors significantly impact the actual trading experience and overall platform performance under various market conditions that traders encounter regularly.

The absence of detailed information about mobile trading applications limits the assessment of Berry Markets' mobile trading experience, which has become increasingly important for modern traders. Mobile access allows traders to manage their accounts and respond to market opportunities flexibly throughout the day.

Without specific data about platform stability during peak trading hours, server uptime statistics, or technical performance metrics, this berry markets review cannot provide comprehensive analysis of the actual trading environment quality. These technical factors significantly affect the reliability and effectiveness of trading operations for active traders.

The lack of detailed information about spread stability, liquidity provision, or trading environment characteristics means that potential clients must rely on limited user feedback and direct testing. This testing approach helps evaluate the actual trading experience quality offered by Berry Markets before committing significant funds to the platform.

Trust and Reliability Analysis

Berry Markets operates without regulatory oversight, which represents the most significant trust and reliability concern for potential clients seeking secure trading environments. The absence of regulation from recognized financial authorities means that standard investor protection mechanisms, segregated client funds requirements, and regulatory compliance monitoring are not applicable to this broker's operations.

User feedback indicates transparency issues, which compound the concerns associated with the unregulated status and create additional challenges for client confidence. Transparency problems can manifest in various ways, including unclear pricing, hidden fees, or inadequate disclosure of trading conditions and company operations that affect client relationships.

The combination of unregulated status and documented transparency concerns creates a challenging trust environment for potential clients who value security and protection. Without regulatory oversight, clients must rely entirely on the broker's self-reported policies and procedures for fund security and operational integrity, which increases risk exposure significantly.

The presence of negative user feedback regarding transparency and service quality suggests potential issues with operational reliability and client relationship management that could affect trading success. These concerns are particularly significant for an unregulated broker where external oversight and protection mechanisms are absent from the business model.

Without information about third-party audits, financial reporting, or industry certifications, potential clients have limited means to verify Berry Markets' operational integrity and financial stability independently. This lack of verification options requires clients to accept higher levels of risk when choosing this broker for their trading activities.

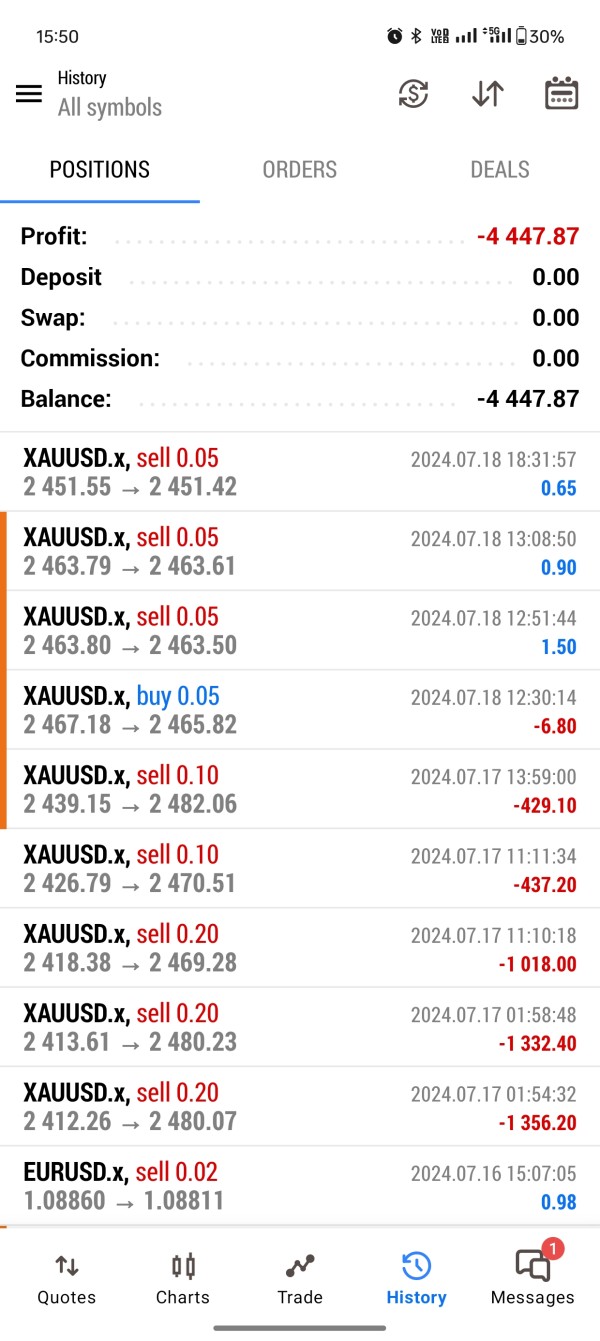

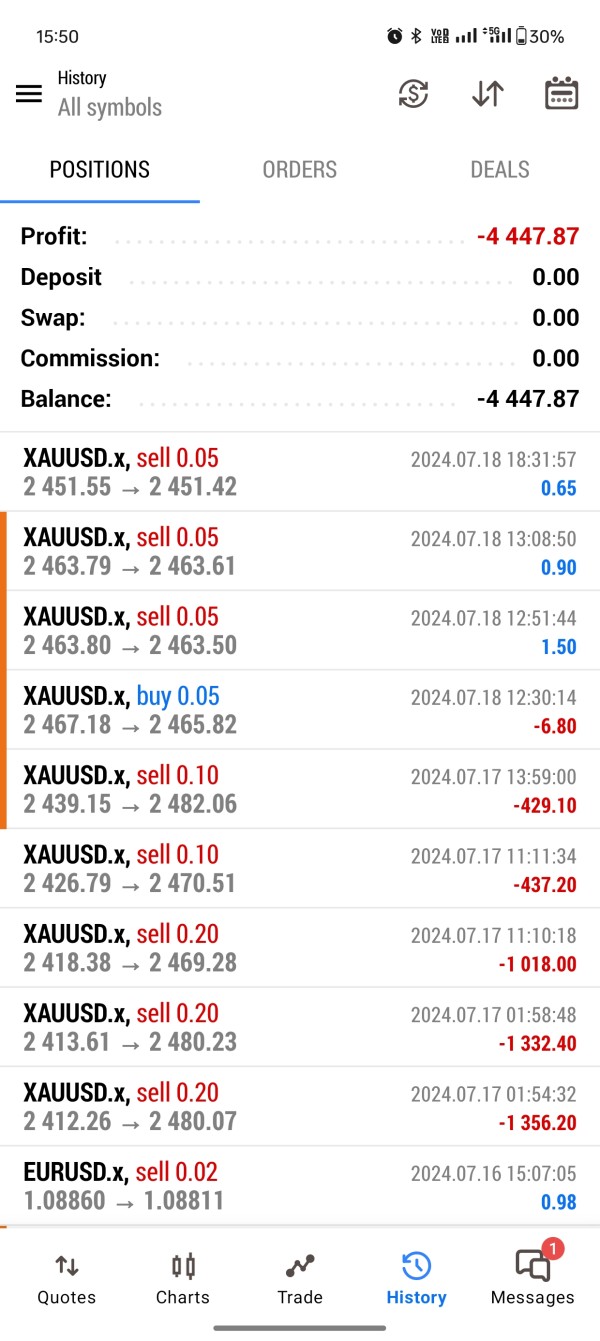

User Experience Analysis

Available user feedback presents a mixed picture of the Berry Markets experience, with 3 positive reviews highlighting platform usability and reasonable fees. These positive reviews are balanced against 1 negative exposure review raising service quality concerns that potential clients should consider carefully. This mixed feedback suggests that user experiences vary significantly, potentially depending on individual trading needs and service expectations.

The positive feedback emphasizing platform user-friendliness and reasonable fee structures indicates that Berry Markets may satisfy basic trading requirements for some users effectively. However, the negative feedback regarding customer service quality suggests that users requiring significant support or facing issues may encounter frustrating experiences that impact their trading success.

The limited volume of available user feedback makes it challenging to identify consistent patterns in user satisfaction or common complaint areas across different client types. More comprehensive user feedback would provide better insights into typical user experiences and satisfaction levels across different trading styles and account sizes.

User feedback suggests that Berry Markets may be most suitable for self-sufficient traders who prioritize cost efficiency and platform functionality over premium customer service and regulatory protection. Traders with higher service expectations or those requiring significant broker support may find the experience less satisfactory than alternatives in the market.

This berry markets review indicates that potential users should carefully consider their support needs and risk tolerance when evaluating Berry Markets as their trading partner. User experiences appear to vary significantly based on individual requirements and expectations, making personal evaluation essential for making informed decisions.

Conclusion

Berry Markets presents a mixed proposition for forex traders, offering diverse trading options and reasonable costs but facing significant challenges due to its unregulated status and documented customer service issues. While the broker provides access to popular MT4 and MT5 platforms with multiple asset classes, the lack of regulatory oversight and transparency concerns require careful consideration by potential clients who value protection and reliability.

The broker appears most suitable for experienced, self-sufficient traders who prioritize platform functionality and cost efficiency over regulatory protection and premium customer service. Traders comfortable with higher risk tolerance and minimal support requirements may find Berry Markets acceptable for their trading needs and investment strategies.

However, the combination of unregulated status, customer service quality concerns, and limited transparency makes Berry Markets unsuitable for traders seeking comprehensive regulatory protection, premium support services, or maximum operational transparency in their broker relationships. These factors create significant risks that many traders may find unacceptable for their trading activities and financial security.