Regarding the legitimacy of EQUITRADE forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is EQUITRADE safe?

Business

License

Is EQUITRADE markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RevokedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Equitrade Markets Ltd

Effective Date:

2006-02-13Email Address of Licensed Institution:

jasoncook@equitrade.co.ukSharing Status:

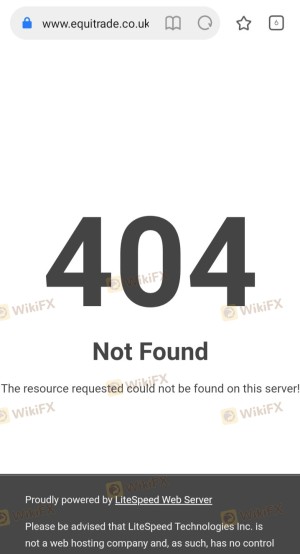

No SharingWebsite of Licensed Institution:

www.equitrade.co.ukExpiration Time:

2024-08-09Address of Licensed Institution:

Kemp House 152-160 City Road London EC1V 2NX UNITED KINGDOMPhone Number of Licensed Institution:

+44 07441425783Licensed Institution Certified Documents:

Is Equitrade Safe or Scam?

Introduction

Equitrade is a relatively new player in the forex market, having been established in 2018. Based in the United Kingdom, it aims to provide a platform for forex trading and other financial services. As the forex market is rife with both legitimate brokers and scams, it is crucial for traders to conduct thorough evaluations before committing their funds. This article aims to provide a comprehensive assessment of Equitrade, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The evaluation is based on various online sources, including user reviews and regulatory databases, to ensure a balanced and factual representation.

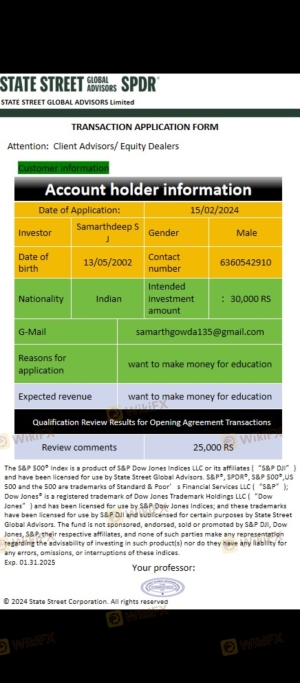

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is one of the most critical aspects for traders to consider. Equitrade claims to be regulated by the Financial Conduct Authority (FCA) in the UK, which is known for its stringent oversight of financial institutions. A broker's regulatory status not only legitimizes its operations but also provides a layer of protection for traders. Below is a summary of Equitrade's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 441877 | United Kingdom | Verified |

While the FCA is a reputable regulator, it is essential to delve deeper into the quality of regulation and compliance history. Reports indicate that Equitrade has received multiple complaints, raising concerns about its operational integrity. Although no negative regulatory disclosures have been found, the low score of 1.51 out of 10 on platforms like WikiFX suggests that traders should proceed with caution. The combination of being relatively new and having a low score indicates potential risks that traders need to be aware of.

Company Background Investigation

Equitrade was founded in 2018, which makes it a relatively young company in the financial services sector. The ownership structure of Equitrade is not entirely transparent, and details about its management team are scarce. This lack of information can be a red flag for potential investors, as transparency is a key indicator of a trustworthy broker.

The absence of a well-established history can create uncertainty about the company's stability and reliability. Traders should ideally look for brokers with a proven track record of navigating market fluctuations and maintaining compliance with regulatory standards. Furthermore, the company's website does not provide comprehensive information about its management team or operational history, which could be a cause for concern regarding its credibility.

Trading Conditions Analysis

Understanding the trading conditions offered by Equitrade is vital for prospective traders. The broker's fee structure and trading conditions can significantly impact profitability. Reports suggest that Equitrade has a relatively high spread, which could affect trading costs. The following table summarizes the core trading costs associated with Equitrade:

| Fee Type | Equitrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 4 pips | 1-2 pips |

| Commission Structure | None reported | Varies (typically low) |

| Overnight Interest Range | Not disclosed | Varies widely |

The high spread of 4 pips for major currency pairs is notably higher than the industry average of 1-2 pips. This could indicate that traders may face higher transaction costs, which could erode profit margins. Furthermore, the lack of clarity around commission structures and overnight interest rates raises questions about hidden fees that may not be immediately apparent to traders.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. Equitrade claims to implement various measures to protect client funds, including segregation of client accounts. However, details regarding investor protection schemes, such as the Financial Services Compensation Scheme (FSCS) in the UK, are not readily available. This lack of information makes it difficult to assess the level of protection that traders would have in the event of a broker's insolvency.

Moreover, there have been reports of issues related to fund withdrawals, with several users claiming they were unable to access their funds after making deposits. Such incidents can significantly undermine trust and raise alarms regarding the broker's operational integrity. It is crucial for traders to ensure that their chosen broker has robust security measures and a transparent approach to fund management.

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reliability. A review of various user experiences reveals a concerning trend of complaints against Equitrade. Common issues reported by users include difficulties in fund withdrawals and unresponsive customer service. The following table categorizes the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor response time |

| Account Blocking | High | Unresponsive |

| Misrepresentation | Medium | No clear response |

For instance, one user reported that after depositing $588 and achieving a profit of $4,000, they were unable to log in to their account. Another user mentioned that their account was blocked after a small deposit, leaving them without recourse. Such complaints highlight a pattern of behavior that could indicate potential fraudulent activity, warranting caution for prospective traders.

Platform and Trade Execution

The trading platform's performance is another critical aspect to consider. Equitrade offers a trading interface that is reportedly user-friendly, but there are concerns about execution quality. Traders have reported instances of slippage and high rejection rates on orders, which can adversely affect trading outcomes.

The overall stability of the platform is also a concern, with some users citing downtime during critical trading periods. The lack of transparency regarding order execution practices raises questions about whether the broker engages in any manipulative practices that could disadvantage traders.

Risk Assessment

Engaging with Equitrade carries certain risks that potential traders should be aware of. The following risk assessment summarizes the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | New broker with multiple complaints |

| Fund Security | High | Reports of withdrawal issues |

| Transparency | High | Lack of information on management |

| Trading Costs | Medium | Higher spreads than industry average |

To mitigate these risks, potential traders are advised to conduct thorough research, consider starting with smaller amounts, and remain vigilant about any unusual activity on their accounts.

Conclusion and Recommendations

After a comprehensive analysis, it is evident that Equitrade raises several red flags that could classify it as a potentially risky broker. The combination of a low regulatory score, multiple user complaints, and a lack of transparency regarding trading conditions and fund security suggests that traders should exercise extreme caution.

For those considering trading with Equitrade, it is advisable to start with minimal investments and continuously monitor account activity. Additionally, traders may want to explore more established and reputable alternatives, such as brokers with a proven track record and robust regulatory oversight, to safeguard their investments.

In summary, while Equitrade may offer some trading opportunities, the associated risks and concerns should not be overlooked.

Is EQUITRADE a scam, or is it legit?

The latest exposure and evaluation content of EQUITRADE brokers.

EQUITRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EQUITRADE latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.