Is EMRFX safe?

Business

License

Is EMRFX Safe or a Scam?

Introduction

In the fast-paced world of forex trading, EMRFX has emerged as a broker that claims to provide traders with access to various currency pairs and trading tools. Established in 2017, this broker positions itself as a competitive player within the forex market, targeting traders looking for a reliable trading platform. However, with the rise of online trading, the potential for scams has also increased, leading traders to exercise caution when selecting a broker. The importance of thorough evaluation cannot be overstated, as the wrong choice can result in significant financial losses. In this article, we will investigate whether EMRFX is a safe option for traders or if it raises red flags that could indicate fraudulent practices. Our assessment will be based on a comprehensive review of regulatory status, company background, trading conditions, customer experiences, and overall risk factors.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining the safety of a forex broker. A well-regulated broker is more likely to adhere to industry standards, ensuring the protection of client funds and fair trading practices. EMRFX claims to be regulated by the Vanuatu Financial Services Commission (VFSC) and the Australian Securities and Investments Commission (ASIC). However, it is essential to verify the validity of these claims and understand the implications of their regulatory status.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | 40272 | Vanuatu | Revoked |

| Australian Securities and Investments Commission (ASIC) | 410316 | Australia | Revoked |

The above table highlights that EMRFX has faced revocation of its licenses, which raises significant concerns about its legitimacy. While the VFSC and ASIC are reputable regulatory bodies, their revocation of EMRFX's licenses indicates serious compliance issues. This lack of regulatory oversight is a crucial factor for traders to consider, as it suggests that EMRFX may not be operating within the legal frameworks designed to protect investors. Without effective regulation, traders face a higher risk of encountering issues such as withdrawal problems or even outright fraud.

Company Background Investigation

Understanding the history and ownership structure of EMRFX is essential for evaluating its credibility. The broker was founded in 2017 and is reportedly based in Australia. However, further investigation reveals a lack of transparency regarding its ownership and management team. The absence of publicly available information about the company's background raises questions about its operational integrity.

A thorough background check on the management team and their professional experience is vital. A broker with experienced and reputable management can instill confidence in traders. Unfortunately, EMRFX does not provide sufficient information to assess the qualifications of its management. This lack of transparency can be a warning sign, as reputable brokers typically disclose their leadership team's credentials and experience.

Moreover, the company's transparency regarding its business practices and financial disclosures is crucial for building trust. EMRFX's failure to provide clear information about its operations and ownership structure diminishes its credibility. Traders should be wary of brokers that are not forthcoming with essential information, as it may indicate an attempt to obscure potential risks.

Trading Conditions Analysis

The trading conditions offered by a broker play a significant role in the overall trading experience. EMRFX claims to provide competitive spreads and various trading instruments; however, a closer look reveals some concerning aspects of its fee structure. The broker's spreads start at 4 pips for major currency pairs, which is significantly higher than the industry average.

| Fee Type | EMRFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 4 pips | 1.0 - 1.5 pips |

| Commission Model | Not disclosed | Varies by broker |

| Overnight Interest Range | Not disclosed | Varies by broker |

The table above illustrates that EMRFX's spreads are considerably higher than what is typically found in the industry. High spreads can eat into a trader's profits, making it challenging to achieve favorable trading outcomes. Additionally, the lack of transparency regarding commission models and overnight interest rates further complicates the evaluation of EMRFX's trading conditions. Traders are encouraged to seek brokers that provide clear and competitive pricing structures to ensure they are receiving fair value for their trades.

Client Fund Safety

Client funds' safety is a paramount concern for any trader. EMRFX claims to implement various security measures to protect client funds. However, the effectiveness of these measures is questionable, given the broker's regulatory issues. The absence of a robust regulatory framework means that EMRFX may not be required to adhere to stringent safety protocols.

A critical aspect of fund security is the segregation of client funds from the broker's operational funds. This practice ensures that traders' money is protected in the event of bankruptcy or financial difficulties faced by the broker. Additionally, investor protection schemes provided by regulatory bodies can offer an additional layer of security. Unfortunately, due to EMRFX's revoked licenses, it is unclear whether such protections are in place.

Historical incidents involving fund safety issues can also indicate a broker's reliability. While no specific incidents have been reported for EMRFX, the mere fact that it operates without effective regulation raises concerns about its commitment to safeguarding client funds. Traders should be cautious and conduct thorough research before entrusting their money to brokers with questionable safety measures.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews and experiences from current and former clients can provide insights into a broker's performance and service quality. EMRFX has received a mix of feedback, with several complaints highlighting issues related to withdrawals and account management.

| Complaint Type | Severity | Company Response |

|---|---|---|

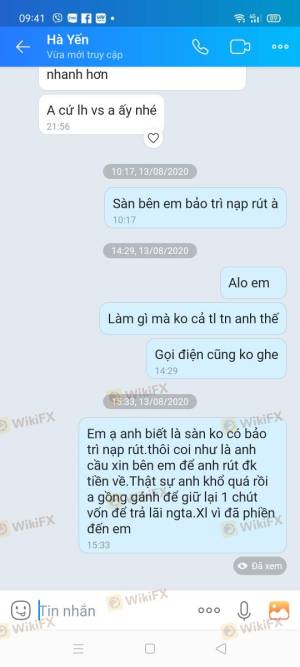

| Withdrawal Issues | High | Slow response times |

| Account Locking | Medium | No clear communication |

| Price Manipulation | High | Denied by the broker |

The table above outlines some common complaints associated with EMRFX. Withdrawal issues, in particular, are a significant red flag, as they can indicate potential fraud or mismanagement. Reports of slow response times and lack of communication during critical situations further exacerbate concerns about the broker's customer service quality.

In one notable case, a trader reported being unable to withdraw funds after experiencing a loss, leading to frustration and distrust. Such experiences can deter potential clients from engaging with EMRFX, as the inability to access funds is a significant concern for traders.

Platform and Execution

The trading platform's performance is crucial for a smooth trading experience. EMRFX claims to offer the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. However, user reviews suggest that the platform may experience stability issues, affecting order execution quality.

Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. The presence of such issues raises concerns about the broker's commitment to providing a reliable trading environment. Additionally, any signs of platform manipulation, such as price manipulation or unfair trading practices, can further erode trust in EMRFX.

Risk Assessment

Using EMRFX as a trading platform presents various risks that potential clients should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of effective regulation raises concerns about legitimacy. |

| Fund Safety | High | Revoked licenses and unclear safety measures pose risks to client funds. |

| Customer Service | Medium | Complaints about withdrawal issues and slow response times. |

| Trading Conditions | Medium | High spreads and unclear fees may affect trading profitability. |

Given the high-risk levels associated with EMRFX, traders should proceed with caution. It is advisable to consider alternative brokers with stronger regulatory oversight and a proven track record of reliability.

Conclusion and Recommendations

In conclusion, the investigation into EMRFX raises several concerns regarding its safety and legitimacy. The revoked regulatory licenses, high spreads, and troubling customer feedback suggest that EMRFX may not be a reliable choice for traders. While some traders may find value in the platform, the risks associated with this broker are significant.

For traders seeking a safer trading environment, it is recommended to consider brokers that are well-regulated by top-tier authorities, have transparent fee structures, and demonstrate a commitment to client fund safety. Brokers like EverFX and IC Markets have established reputations and regulatory compliance, making them more suitable alternatives for traders looking to navigate the forex market safely.

In light of the findings, it is clear that EMRFX is not safe and may pose significant risks to traders. Caution is advised, and thorough research is essential when selecting a forex broker.

Is EMRFX a scam, or is it legit?

The latest exposure and evaluation content of EMRFX brokers.

EMRFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EMRFX latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.