Is Deus safe?

Business

License

Is Deus A Scam?

Introduction

Deus, a forex broker operating under the domain deusfinancial.com, has emerged as a point of interest in the trading community, particularly for those seeking to engage in forex and CFD trading. With the allure of high returns and a diverse range of trading instruments, it is essential for traders to exercise caution when evaluating such brokers. The forex market is rife with opportunities, but it also harbors risks, especially when it comes to unregulated or poorly reviewed brokers. This article aims to provide a comprehensive assessment of Deus, focusing on its regulatory status, company background, trading conditions, customer safety, user experiences, platform performance, and associated risks. The analysis is based on a thorough review of available online resources, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in determining its legitimacy and trustworthiness. Regulation serves as a protective measure for traders, ensuring that brokers adhere to industry standards and maintain a level of transparency. In the case of Deus, the broker operates without any valid regulatory oversight, which raises significant concerns regarding the safety of client funds and the overall integrity of the trading environment.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of a regulatory license indicates that Deus does not comply with the stringent requirements set by recognized authorities such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. Furthermore, the UK's FCA has issued warnings against Deus, highlighting its operation without proper authorization. This lack of oversight not only diminishes the broker's credibility but also exposes traders to potential fraud and financial loss.

Company Background Investigation

Deus Technology Co. Ltd, the parent company of the broker, claims to provide a range of financial services, including forex and CFD trading. However, the company's history is marred by a lack of transparency regarding its ownership structure and operational history. Established in 2019, the company has not demonstrated a robust track record in the financial services sector.

The management team behind Deus has not been adequately disclosed, leaving potential clients with little information about their expertise or qualifications. This lack of clarity raises red flags about the broker's reliability and commitment to ethical trading practices. Moreover, the companys website fails to provide essential information regarding its physical address and contact details, further complicating efforts to verify its legitimacy.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for traders to make informed decisions. Deus presents itself as a competitive broker, but its lack of transparency regarding fees and trading costs is concerning. The absence of clear information about spreads, commissions, and overnight interest rates can lead to unexpected costs for traders.

| Fee Type | Deus | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Not Specified | Varies |

The vague nature of Deus's fee structure suggests that traders may encounter hidden costs that could significantly impact their trading profitability. Furthermore, the lack of detailed information about withdrawal fees and processing times raises concerns about the broker's transparency and fairness in its dealings.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Unfortunately, Deus does not offer adequate protections for trader investments. There is no evidence of segregated accounts or investor protection schemes to safeguard client deposits. The absence of negative balance protection further exacerbates the risk for traders, as they could potentially lose more than their initial investment.

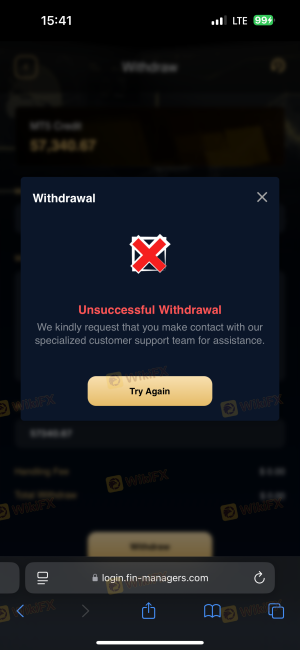

Historical accounts of financial disputes and withdrawal issues associated with Deus indicate a troubling trend. Traders have reported difficulties in accessing their funds, which is a common characteristic of scam brokers. This lack of accountability and security poses a significant risk to anyone considering trading with Deus.

Customer Experience and Complaints

User feedback is a critical component in assessing the reliability of a broker. In the case of Deus, numerous complaints have surfaced, highlighting issues such as difficulty withdrawing funds, poor customer service, and a lack of transparency in trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Lack of Transparency | Medium | Limited |

| Poor Customer Support | High | Unresponsive |

Typical complaints include reports of traders being unable to withdraw their funds, which raises serious concerns about the broker's operational integrity. In some instances, users have expressed frustration over unresponsive customer support, indicating a lack of commitment to resolving issues. These patterns of behavior are often indicative of a broker that may not have the best interests of its clients at heart.

Platform and Trade Execution

The trading platform offered by a broker plays a crucial role in the overall trading experience. Deus claims to provide a user-friendly platform; however, reports suggest that users have experienced issues with platform stability and order execution. Traders have reported instances of slippage and rejected orders, which can severely impact trading outcomes.

The quality of order execution is a vital factor for traders, especially in a fast-paced market like forex. If a broker's platform is unreliable, traders may find themselves at a disadvantage, potentially leading to significant financial losses. Furthermore, any signs of platform manipulation should be taken seriously, as they can indicate a lack of ethical standards within the brokerage.

Risk Assessment

Engaging with a broker like Deus comes with inherent risks that traders must be aware of. The lack of regulation, transparency, and customer support raises several red flags.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Financial Risk | High | Potential loss of funds without recourse. |

| Operational Risk | Medium | Platform instability and execution issues. |

To mitigate these risks, traders should conduct thorough research before engaging with any broker. It is advisable to consider established and regulated brokers that offer greater transparency and security for client funds.

Conclusion and Recommendations

In summary, the evidence suggests that Deus exhibits numerous characteristics commonly associated with scam brokers. The absence of regulatory oversight, combined with a lack of transparency regarding trading conditions and client fund safety, raises significant concerns. Traders are strongly advised to exercise caution when considering this broker for their trading needs.

For those seeking trustworthy alternatives, it is recommended to explore established brokers that are regulated by reputable authorities. Brokers such as FXTM, IG, and OANDA offer robust protections for client funds and a transparent trading environment. Ultimately, traders should prioritize safety and transparency when choosing a forex broker to ensure a secure trading experience.

Is Deus a scam, or is it legit?

The latest exposure and evaluation content of Deus brokers.

Deus Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Deus latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.