Deus 2025 Review: Everything You Need to Know

Summary

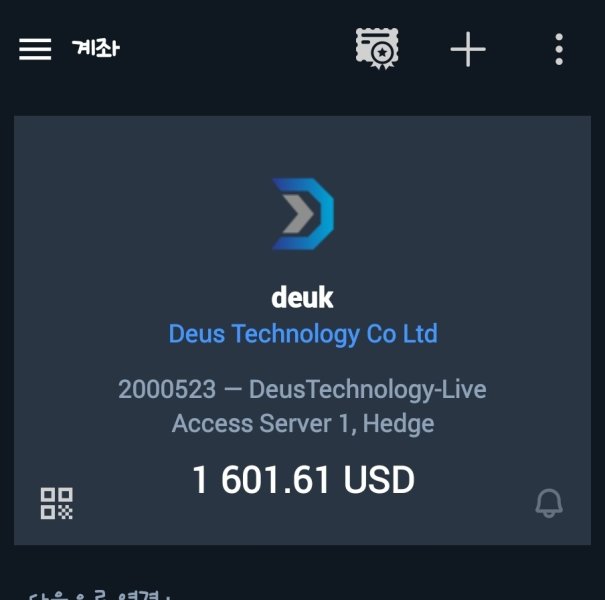

This deus review gives you a complete look at Deus. This trading platform has been marked as an unlicensed broker with serious risks that you should know about. Many sources say DEUS shows major warning signs. Investors should think carefully before using this platform. The company is run by Tim Plummer, who used to work at IG. He leads Deus X Markets, which wants to start "brokerage services" to make it easier to set up trading companies. The platform offers swap and synthetic trading with a focus on tokenized assets and algorithmic stablecoins. But the main problem is that it has no license and comes with big risks. This platform seems to target high-risk investors who want new ways to trade. However, it lacks proper rules and oversight, making it wrong for most traders who want safe and legal trading places.

Important Notice

Cross-Regional Entity Differences: DEUS has not given specific rule information across different areas. This makes it especially worrying for investors from other countries. The platform's unlicensed status means that investors from any region face big risks without any protection from regulators. People investing across borders should be very careful when thinking about this platform.

Review Methodology: This review uses public information, user feedback from different sources including IMDb ratings, and warnings from regulators. The assessment has not included on-site visits or direct testing of the platform's services. Readers should do their own research before making any investment choices.

Rating Framework

Based on what we know, here are the ratings for six key areas:

Broker Overview

Company Background and Leadership

Deus X Markets works under Tim Plummer, who used to be an IG executive and now serves as Chief Executive Officer. The company wants to launch "brokerage services" with the goal of making it easier to start trading brokerage companies. This background shows some industry experience through its leadership, though we don't know when the company started or its detailed history from what we can find. Having a former IG executive might give some trust to the leadership team. But this does not make up for the basic regulatory problems with the platform.

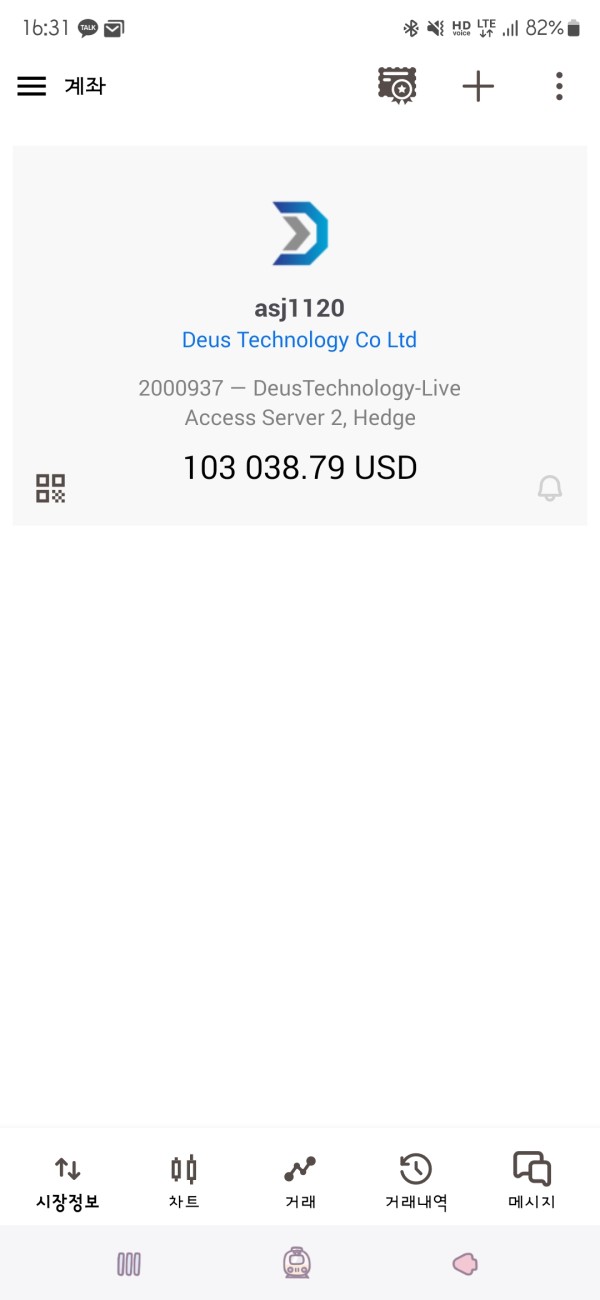

Business Model and Platform Offerings

The platform works through swap trading platforms and synthetic trading platforms. It focuses mainly on tokenized assets and algorithmic stablecoins. This business model tries to offer new financial products in the growing digital asset space. But the lack of proper regulatory licensing raises serious questions about whether these offerings are real and safe. The platform's way of providing trading services without the right regulatory oversight creates big risks for potential users. This is true regardless of how new their proposed products might be.

Regulatory Status: No specific regulatory information has been mentioned in available sources. This is a major red flag for any trading platform. The lack of regulatory oversight means users have no protection against potential fraud or bad behavior.

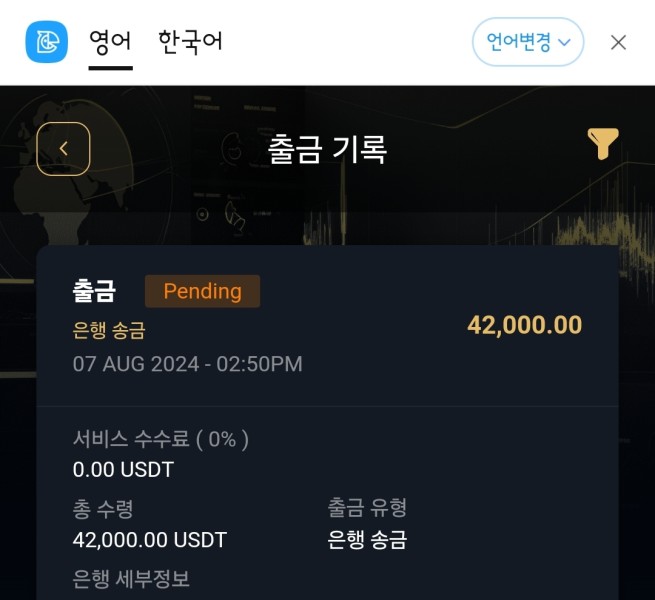

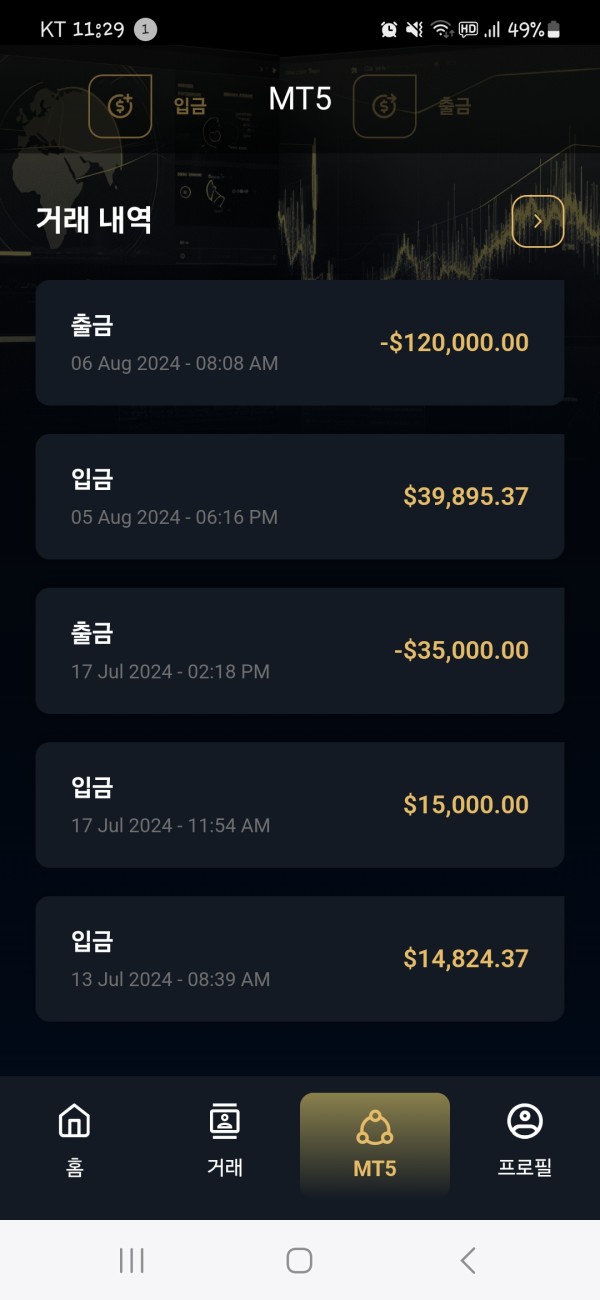

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not available in the source materials. This makes it hard for potential users to understand how they would fund their accounts or get their money.

Minimum Deposit Requirements: No information about minimum deposit requirements has been provided. This leaves potential users without important financial planning information.

Bonuses and Promotions: Details about bonuses and promotional offers are not mentioned in available sources. Though this may be less important given the platform's regulatory concerns.

Tradeable Assets: The platform focuses on tokenized assets and algorithmic stablecoins. This represents a narrow but specialized range of trading tools in the digital asset space.

Cost Structure: Specific information about trading costs, spreads, commissions, or fees is not available. This makes it impossible to judge how competitive the platform is in terms of pricing.

Leverage Ratios: No information about available leverage ratios has been provided in the source materials.

Platform Options: Users can access swap trading platforms and synthetic trading platforms. Though detailed technical details are not available.

Regional Restrictions: Specific information about geographical restrictions or availability is not mentioned in the available sources.

Customer Service Languages: No information about supported languages for customer service has been provided.

This deus review shows big information gaps that potential users should consider as extra warning signs when looking at the platform.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions for Deus remain mostly hidden. This presents a big concern for potential traders. Without specific information about account types, minimum deposit requirements, or account opening procedures, users cannot make smart decisions about whether the platform meets their trading needs. The lack of clear account condition information is especially bad for a trading platform. These details are basic to user experience and financial planning.

The lack of openness about account features such as Islamic accounts, different tier structures, or special account benefits makes concerns about the platform's legitimacy even worse. Professional trading platforms usually provide complete information about their account offerings. The lack of such details in this deus review suggests either poor communication practices or possibly intentional hiding of information. Users looking for reliable trading platforms should expect clear, detailed account information before putting in any funds.

Deus offers swap trading platforms and synthetic trading platforms. It focuses on tokenized assets and algorithmic stablecoins. While these tools represent new approaches to digital asset trading, the limited scope of offerings may not meet the diverse needs of most traders. The platform's focus on synthetic trading and tokenized assets suggests a specialized approach that may appeal to smart traders familiar with these tools.

However, the lack of information about research resources, educational materials, market analysis tools, or automated trading support greatly limits the platform's appeal. Modern trading platforms usually provide complete research capabilities, educational resources for different skill levels, and strong analytical tools. The lack of these standard features, combined with the regulatory concerns, makes it hard to recommend Deus as a complete trading solution for most investors.

Customer Service and Support Analysis

Information about customer service and support capabilities is clearly missing from available sources. This raises serious concerns about user support quality. Professional trading platforms usually provide multiple contact channels, including live chat, email, phone support, and complete FAQ sections. The lack of detailed customer service information makes it impossible to assess response times, service quality, or problem-solving capabilities.

Without clear information about customer support hours, available languages, or service channels, potential users cannot be confident about getting good help when needed. This lack of customer service details is especially concerning for a trading platform. Timely support can be crucial for solving trading issues, account problems, or technical difficulties. The lack of openness in this area adds to the overall risk profile of the platform.

Trading Experience Analysis

The trading experience on Deus cannot be properly assessed due to not enough information about platform stability, execution speed, or user interface quality. While the platform offers swap and synthetic trading capabilities, there are no available details about order execution quality, platform reliability, or mobile trading options. These factors are crucial for judging whether a platform can provide good trading experiences.

The lack of user feedback about trading performance, platform functionality, or technical issues makes it impossible to gauge the actual trading experience. Professional traders require reliable platforms with fast execution, minimal downtime, and easy-to-use interfaces. Without this information, this deus review cannot recommend the platform based on trading experience quality. This adds to the overall concerns about choosing this broker.

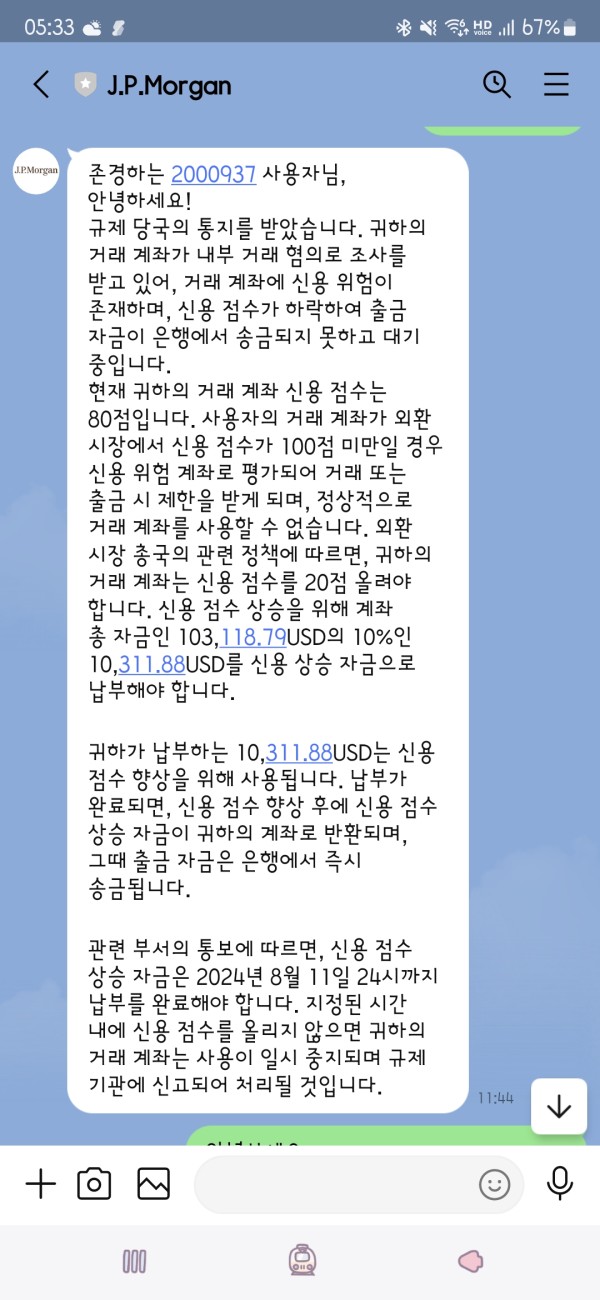

Trust Level Analysis

The trust level for Deus is critically low. It earns a 2/10 rating due to its unlicensed status and associated warning flags. Multiple sources have identified DEUS as an unlicensed broker with big risks, including potential fraud and theft warnings. The lack of regulatory oversight means users have no protection against bad behavior, fund theft, or platform closure.

The platform's lack of openness about regulatory compliance, fund safety measures, and operational procedures further hurts trust. While having former IG executive Tim Plummer may provide some leadership credibility, this does not make up for the basic lack of regulatory protection. Users have reported concerns about potential fraudulent activities. The lack of proper licensing means there are no regulatory ways to address such issues or protect investor funds.

User Experience Analysis

User experience feedback is limited but concerning. IMDb ratings show a 5/10 score based on available reviews. This moderate rating suggests mixed user experiences, though the small sample size and platform context make it hard to draw final conclusions about trading platform satisfaction. The presence of user warnings about potential fraud and theft risks greatly impacts the overall user experience assessment.

Without detailed information about interface design, registration processes, account verification procedures, or fund management experiences, it's challenging to provide a complete user experience evaluation. The warnings about potential fraudulent activities and the platform's unlicensed status create an inherently poor user experience environment. This is true regardless of technical interface quality. Users looking for positive trading experiences should prioritize regulated platforms with transparent operations and positive user feedback.

Conclusion

This deus review reveals big concerns about the platform's suitability for most traders. As an unlicensed broker with multiple warning flags, DEUS presents major risks that outweigh any potential benefits from its new trading approaches. The platform's focus on tokenized assets and synthetic trading may appeal to high-risk investors seeking alternative trading methods. But the lack of regulatory protection makes it unsuitable for mainstream trading needs.

The main advantages include leadership by an experienced former IG executive and new trading platform concepts. However, the disadvantages are overwhelming: lack of regulatory licensing, not enough transparency, limited customer service information, and user warnings about potential fraudulent activities. The platform's 2/10 trust rating reflects these serious concerns. Potential users should prioritize regulated alternatives that offer proper investor protection and transparent operations.