Is Daman Securities safe?

Pros

Cons

Is Daman Securities A Scam?

Introduction

Daman Securities, established in 1998 and based in Dubai, positions itself as a prominent player in the forex market, offering a range of trading services across various asset classes. As a financial brokerage firm, it aims to provide clients with innovative financial solutions and access to local, regional, and international markets. However, the potential risks associated with trading, particularly with unregulated brokers, necessitate a cautious approach by traders. Evaluating the credibility of forex brokers is essential to protect investments and ensure a safe trading environment. This article employs a comprehensive investigation framework, utilizing multiple sources, including regulatory information, company history, trading conditions, and customer experiences, to assess whether Daman Securities is safe or a scam.

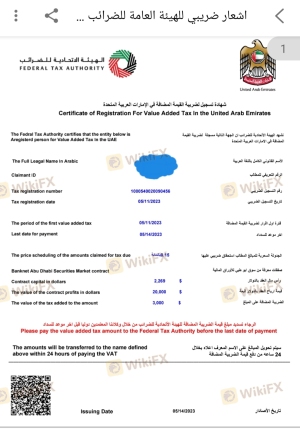

Regulation and Legitimacy

The regulatory status of a brokerage is crucial in determining its legitimacy. Daman Securities claims to be regulated by the Securities and Commodities Authority (SCA) of the United Arab Emirates. However, several reviews indicate a lack of valid regulatory information, raising concerns about its operational oversight. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Commodities Authority (SCA) | N/A | United Arab Emirates | Not Verified |

The absence of a valid license raises significant red flags regarding the safety of trading with Daman Securities. Regulatory oversight is paramount in ensuring that brokers adhere to industry standards and protect client funds. Without proper regulation, investors may face heightened risks, including potential fraud and mismanagement of funds. Furthermore, the history of compliance and transparency in its operations remains questionable, as there are no publicly available records confirming its adherence to regulatory requirements.

Company Background Investigation

Daman Securities has been part of the financial landscape in the UAE since its inception in 1998. The company has evolved over the years, expanding its services to include various financial instruments and trading platforms. However, the ownership structure and transparency of the company raise concerns. The details regarding its ownership and management team are not extensively documented, which can hinder trust among potential clients.

The management team consists of professionals with experience in finance and trading, yet the lack of detailed biographies and professional histories makes it challenging to assess their qualifications fully. Transparency in information disclosure is vital for establishing credibility, and Daman Securities appears to fall short in this regard. Without clear communication about its leadership and operational practices, potential investors may approach with caution.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Daman Securities provides various trading instruments, including forex, stocks, and commodities. However, the specific fee structure and trading costs are not clearly outlined, leading to potential confusion for traders. Below is a comparison of core trading costs:

| Cost Type | Daman Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1.0 - 2.0 pips |

| Commission Structure | Not Specified | Varies by broker |

| Overnight Interest Range | Not Specified | Varies by broker |

The lack of transparency regarding trading fees and conditions can be a significant issue for traders. Unclear commission structures and hidden fees can lead to unexpected costs, diminishing profitability. It is crucial for traders to have a clear understanding of the costs associated with trading to make informed decisions.

Client Fund Safety

The safety of client funds is a top priority for any reputable broker. Daman Securities claims to implement measures to protect client funds, yet the specifics of these measures are not adequately detailed. Analyzing the company's approach to fund segregation, investor protection, and negative balance protection is essential.

Daman Securities should ideally segregate client funds from its operational funds to ensure that client money is safeguarded in the event of insolvency. Furthermore, investor protection schemes, if any, should be clearly communicated to clients. The absence of documented historical issues related to fund safety is a positive sign; however, the lack of transparency in this area can lead to skepticism among potential clients.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of Daman Securities reveal mixed experiences from clients. Common complaints include difficulties in fund withdrawals, unclear communication regarding fees, and inadequate customer support. Below is a summary of the main complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Fee Transparency | Medium | Inconsistent info |

| Customer Support | High | Limited availability |

Several clients have reported challenges in withdrawing their funds, which is a significant concern for any trader. The company's response to these complaints appears to be slow and often lacks clarity. For instance, one user reported being unable to access their funds despite fulfilling all necessary requirements, highlighting potential issues with the company's operational integrity.

Platform and Trade Execution

The trading platform's performance is crucial for a positive trading experience. Daman Securities offers various platforms for trading, yet the reviews indicate concerns regarding the stability and execution quality of these platforms. Issues such as slippage and order rejections have been reported, which can adversely affect trading outcomes.

Traders require a reliable and efficient platform to execute trades swiftly and accurately. Any indications of platform manipulation or inconsistencies in trade execution can significantly undermine trust in the broker. Therefore, it is essential to evaluate the platform's reliability before engaging in trading activities.

Risk Assessment

Engaging with Daman Securities presents several risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of valid regulation raises concerns. |

| Fund Safety | Medium | Insufficient transparency in fund protection measures. |

| Customer Support | High | Frequent complaints about responsiveness and clarity. |

To mitigate these risks, potential clients should conduct thorough research, consider starting with minimal investments, and ensure they fully understand the trading conditions before proceeding. Engaging with a regulated broker with a strong reputation may also be a prudent alternative.

Conclusion and Recommendations

In conclusion, while Daman Securities has established itself as a player in the forex market, significant concerns regarding its regulatory status, transparency, and client experiences raise questions about its safety. The lack of valid regulation and unclear trading conditions suggest that traders should exercise caution.

For those considering trading with Daman Securities, it is advisable to conduct extensive research and be aware of the potential risks involved. If you are a trader seeking reliable options, consider exploring brokers with recognized regulatory oversight, transparent fee structures, and positive customer feedback. Ultimately, ensuring a safe trading environment should be a top priority for any investor.

In summary, is Daman Securities safe? The evidence suggests that potential traders should approach with caution and consider alternative, more transparent, and regulated options in the market.

Is Daman Securities a scam, or is it legit?

The latest exposure and evaluation content of Daman Securities brokers.

Daman Securities Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Daman Securities latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.