Regarding the legitimacy of CITY CREDIT forex brokers, it provides LFSA and WikiBit, (also has a graphic survey regarding security).

Is CITY CREDIT safe?

Pros

Cons

Is CITY CREDIT markets regulated?

The regulatory license is the strongest proof.

LFSA Market Making License (MM)

Labuan Financial Services Authority

Labuan Financial Services Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

CITY CREDIT INVESTMENT BANK LIMITED (Labuan Investment Bank)

Effective Date: Change Record

--Email Address of Licensed Institution:

kkchan@cccapital.netSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 11(D1), Main Office Tower, Financial Park Complex, Jalan Merdeka, 87000 Labuan F.T.Phone Number of Licensed Institution:

087-582 268Licensed Institution Certified Documents:

Is City Credit Safe or a Scam?

Introduction

City Credit Capital (CCC) is a brokerage firm that has established itself in the forex market since its inception in 2001. With a focus on providing online trading services to both retail and institutional investors, City Credit Capital aims to offer a range of financial instruments, including forex and CFDs. However, as the forex industry is rife with potential scams and unreliable brokers, it is crucial for traders to carefully evaluate the legitimacy and safety of any brokerage they consider. This article seeks to provide a comprehensive assessment of City Credit Capital, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety measures.

To conduct this investigation, we analyzed multiple sources, including user reviews, regulatory information, and expert evaluations. Our assessment framework focuses on key areas such as regulation and legality, company history, trading conditions, customer fund safety, and user feedback, allowing us to draw informed conclusions about whether City Credit is safe or potentially a scam.

Regulation and Legality

The regulatory status of a brokerage is one of the most critical factors in determining its legitimacy and safety. City Credit Capital is regulated by the Financial Conduct Authority (FCA) in the UK, which is known for its stringent regulatory standards. Below is a summary of the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 232015 | United Kingdom | Active |

The FCA's oversight ensures that City Credit Capital adheres to high standards of financial conduct, including client fund segregation and regular reporting. This regulatory framework is designed to protect traders and enhance the overall integrity of the trading environment. Furthermore, as an FCA-authorized firm, clients are covered by the Financial Services Compensation Scheme (FSCS), which compensates up to £50,000 in the event of insolvency.

However, it is important to note that City Credit Capital has faced scrutiny regarding its regulatory compliance in the past, and there are concerns about its operational status. Recent reports indicate that the firm has moved operations offshore, raising questions about its ongoing FCA authorization. This shift necessitates a careful evaluation of whether City Credit is safe, as operating without robust regulation can expose traders to increased risks.

Company Background Investigation

City Credit Capital was founded in 2001 and has since grown to become a recognized player in the forex trading sector. The company is headquartered in the UK and has developed a diverse client base, including retail traders and institutional investors. The ownership structure is relatively opaque, with limited information available about its shareholders or parent companies, which raises transparency concerns.

The management team at City Credit Capital is composed of professionals with extensive experience in the financial services industry. This expertise is essential for navigating the complexities of forex trading and ensuring a high level of service. However, the lack of detailed information regarding the management's backgrounds may lead potential clients to question the firm's transparency.

In terms of information disclosure, City Credit Capital provides essential details about its services and trading conditions on its website. However, the overall transparency could be improved, as potential clients may find it challenging to access comprehensive information about the company's operations, historical performance, and regulatory compliance. This lack of clarity can contribute to uncertainty about whether City Credit is safe for trading.

Trading Conditions Analysis

When evaluating a brokerage, understanding its trading conditions is vital for assessing overall safety and reliability. City Credit Capital offers a range of trading instruments primarily focused on forex and CFDs. The overall fee structure is competitive, but traders should be aware of specific costs associated with trading.

The following table summarizes the core trading costs associated with City Credit Capital:

| Fee Type | City Credit Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1-2 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by City Credit Capital are on the higher end compared to industry averages, the absence of commission fees may be attractive to some traders. However, traders should remain cautious regarding any hidden fees or additional charges that may not be immediately apparent.

Moreover, the potential for high overnight interest rates can impact trading profitability, particularly for those who hold positions overnight. It is essential for traders to fully understand the fee structure and any unusual policies that could affect their trading experience. This analysis raises the question of whether City Credit is safe, as unexpected costs can lead to dissatisfaction and financial losses.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a brokerage's credibility. City Credit Capital implements several measures to safeguard client funds, including the segregation of client accounts from company funds. This practice is crucial for ensuring that traders' assets are protected in the event of financial difficulties faced by the brokerage.

Additionally, as mentioned earlier, City Credit Capital is regulated by the FCA, which mandates strict guidelines for fund protection. Clients' funds are held in tier-1 banks, providing an added layer of security. However, it is important to note that City Credit Capital does not offer negative balance protection, which can expose traders to the risk of losing more than their initial deposit.

While there have been no significant reported incidents of fund mismanagement or security breaches, the recent shift of operations offshore raises concerns about the ongoing commitment to client fund safety. Traders must remain vigilant and consider the implications of trading with a broker that may not be subject to the same regulatory scrutiny as it was in the past.

Customer Experience and Complaints

Customer feedback is a valuable source of insight into a broker's reliability and service quality. An analysis of user experiences with City Credit Capital reveals a mixed bag of reviews. While some clients report positive experiences with the trading platform and customer support, others express frustration over withdrawal issues and lack of responsiveness.

The following table outlines the primary complaint types and their severity levels:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

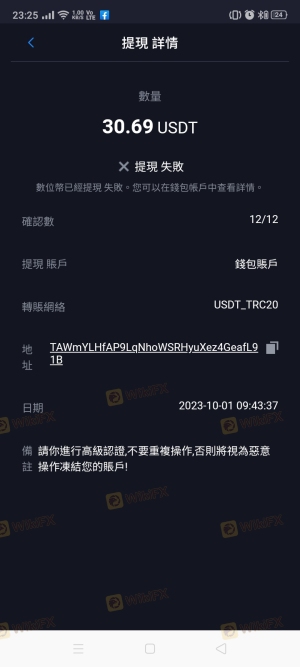

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Generally responsive |

| Platform Performance | Low | Mostly positive |

Typical complaints include difficulties in processing withdrawals, which can raise red flags regarding the broker's reliability. In some cases, clients have reported delays in receiving their funds, leading to concerns about whether City Credit is safe for trading.

One notable case involved a trader who successfully made profits but faced challenges when trying to withdraw funds. Despite multiple attempts to contact customer support, the response was slow, and the issue remained unresolved for an extended period. This situation highlights the importance of assessing a broker's responsiveness and reliability in addressing customer concerns.

Platform and Execution

The performance and stability of a trading platform significantly influence the overall trading experience. City Credit Capital offers its proprietary platform, "Markets Trader," alongside the popular MetaTrader 4 (MT4) platform. Users have reported that the platforms are generally stable, with a user-friendly interface and a variety of trading tools.

However, some traders have raised concerns about order execution quality, particularly regarding slippage and re-quotes. Instances of slippage can impact profitability, especially in volatile market conditions. Traders must be aware of these potential issues when considering whether City Credit is safe for their trading activities.

Moreover, there have been no substantial reports of platform manipulation, but traders should remain vigilant and monitor their trading conditions closely. Understanding the execution quality and any potential issues can help traders make informed decisions about their trading strategies and risk management.

Risk Assessment

Using City Credit Capital entails certain risks that traders should be aware of. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Recent offshore operations raise concerns. |

| Fund Safety | Medium | Lack of negative balance protection. |

| Customer Service | High | Reports of slow response times and complaints. |

| Trading Costs | Medium | Higher spreads than industry average. |

To mitigate these risks, traders should conduct thorough research before opening an account with City Credit Capital. It is advisable to start with a demo account to familiarize themselves with the platform and trading conditions. Additionally, setting strict risk management measures, such as limiting leverage and monitoring trade sizes, can help protect against potential losses.

Conclusion and Recommendations

In conclusion, while City Credit Capital is a regulated broker with a history of providing trading services, there are several concerns that traders should consider before engaging with the platform. The recent shift of operations offshore raises questions about its ongoing regulatory compliance and safety. Additionally, customer feedback suggests that there may be issues with withdrawal processing and customer support responsiveness.

Therefore, it is essential for traders to exercise caution and conduct their due diligence when considering whether City Credit is safe for trading. For those seeking reliable alternatives, brokers with strong regulatory oversight and positive user reviews should be prioritized. Some recommended alternatives include well-established brokers that are fully regulated by tier-1 authorities and have a proven track record of customer satisfaction.

Ultimately, traders should carefully assess their trading needs and risk tolerance before choosing a broker, ensuring that they have a safe and secure trading environment.

Is CITY CREDIT a scam, or is it legit?

The latest exposure and evaluation content of CITY CREDIT brokers.

CITY CREDIT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CITY CREDIT latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.