Is Citi Fx safe?

Pros

Cons

Is Citi Fx Safe or Scam?

Introduction

Citi Fx is a forex broker that has garnered attention in the foreign exchange market, primarily for its claims of providing competitive trading conditions and a user-friendly trading platform. However, in a landscape rife with both legitimate brokers and scams, it is crucial for traders to carefully evaluate the credibility of any trading platform before committing their funds. The forex market is known for its volatility and the potential for significant financial loss, making it essential for traders to choose brokers that are trustworthy, regulated, and transparent.

This article aims to provide an objective analysis of Citi Fx by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. The investigation draws on various sources, including regulatory databases, customer reviews, and expert analyses, to present a comprehensive overview of whether Citi Fx is a safe trading option or a potential scam.

Regulation and Legitimacy

One of the most critical aspects of evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards and practices that protect clients' interests. In the case of Citi Fx, the lack of robust regulatory oversight raises significant concerns.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | None | UK | Not Regulated |

| ASIC | None | Australia | Not Regulated |

| CySEC | None | Cyprus | Not Regulated |

Citi Fx has not been registered with any top-tier regulatory authorities, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This absence of regulation is a red flag, as it suggests that the broker operates without the scrutiny and accountability that come with being regulated by a reputable body. Additionally, the broker has been reported to use false licensing information, claiming to be regulated when it is not. This deceptive practice is a common tactic employed by scam brokers to mislead potential clients.

The quality of regulation is paramount; brokers supervised by top-tier regulators are generally required to maintain higher capital reserves, segregate client funds, and provide investor protection mechanisms. Without such oversight, traders are at a higher risk of losing their investments without recourse. Therefore, the lack of regulation for Citi Fx significantly undermines its credibility and raises questions about the safety of funds deposited with them.

Company Background Investigation

Citi Fx's history and ownership structure are also essential elements to consider when assessing its legitimacy. The broker claims to operate in the UK and presents itself as a reputable financial service provider. However, investigations reveal a lack of verifiable information regarding its establishment, ownership, and management team.

The absence of a transparent company history is concerning. Reliable brokers typically provide detailed information about their founders, management team, and company milestones. In contrast, Citi Fx has been criticized for its lack of transparency, which is a common characteristic of fraudulent operations. A credible broker should openly share details about its leadership and operational practices, allowing potential clients to assess their expertise and reliability.

Moreover, the management teams background is crucial for establishing trust. Experienced professionals with a strong track record in finance and trading can enhance a broker's credibility. However, Citi Fx has not provided sufficient information about its management, which further obscures its legitimacy.

In summary, the lack of transparency regarding Citi Fx's company background and management team raises serious concerns about its trustworthiness. Traders should be wary of engaging with a broker that does not provide clear and accessible information about its operations and leadership.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its overall value proposition. Citi Fx claims to offer competitive trading conditions, but a closer examination reveals several potential issues.

Citi Fx's fee structure is particularly concerning, as it lacks clarity and may include hidden charges that could significantly impact traders' profitability. Heres a comparison of key trading costs:

| Fee Type | Citi Fx | Industry Average |

|---|---|---|

| Spread for Major Pairs | 2.5 pips | 1.0-1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spread for major currency pairs at Citi Fx is reported to be significantly higher than the industry average, which could deter traders from executing trades profitably. Additionally, the absence of a clear commission structure raises concerns about potential hidden fees that could be levied on trades or withdrawals.

Moreover, the broker's policy on overnight interest is reportedly quite high, which can accumulate significant costs for traders holding positions overnight. This lack of transparency regarding costs is a common tactic among scam brokers, who often impose exorbitant fees that are not disclosed upfront.

In conclusion, the trading conditions at Citi Fx do not align with industry standards, and the potential for hidden fees and high costs raises red flags. Traders are advised to exercise caution and thoroughly investigate any broker's fee structure before committing their funds.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. Citi Fx's approach to fund security has been called into question due to its lack of regulatory oversight and transparency regarding its financial practices.

Citi Fx does not appear to implement standard safety measures such as segregating client funds from its operational funds, which is a critical practice among regulated brokers. Segregation ensures that clients' deposits are protected in the event of the broker's insolvency. Without this protection, traders risk losing their funds entirely if the broker encounters financial difficulties.

Additionally, there is no information available regarding investor protection schemes that would typically safeguard traders' investments in case of broker failure. Reputable brokers often participate in compensation schemes that offer financial recourse to clients. The absence of such measures at Citi Fx further heightens the risk associated with trading through this broker.

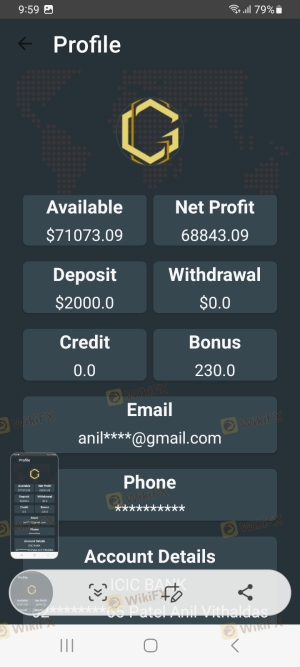

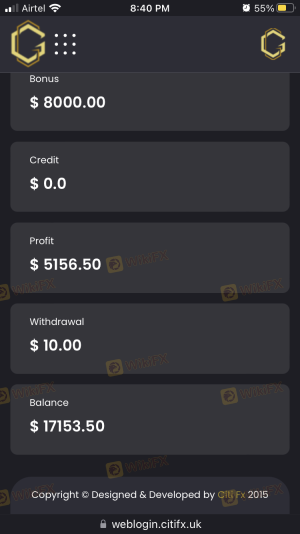

Historically, there have been reports of fund withdrawal issues and complaints from users who have struggled to access their money after depositing it with Citi Fx. Such issues are often indicative of fraudulent practices, where brokers make it challenging for clients to withdraw their funds as a means to retain their investments.

In summary, the lack of established safety measures for customer funds at Citi Fx is a significant concern. Traders should prioritize brokers that offer robust fund protection policies and transparent financial practices to ensure the safety of their investments.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. In the case of Citi Fx, numerous user reviews and complaints highlight a troubling pattern of negative experiences.

Common complaints about Citi Fx include issues with fund withdrawals, poor customer service, and lack of responsiveness from the support team. Many users report that once they deposited funds, the broker became unresponsive, making it difficult to retrieve their money. This pattern of behavior is typical of scam brokers, who often prioritize acquiring deposits over providing adequate support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency Concerns | High | None |

Two notable cases illustrate the severity of these complaints. In one instance, a trader reported being unable to withdraw funds after several attempts, with the broker citing various excuses for the delays. In another case, a user mentioned that customer service representatives were unhelpful and dismissive when addressing concerns about account management.

The overall sentiment among users is one of dissatisfaction, with many advising potential clients to avoid Citi Fx altogether. The prevalence of negative reviews and unresolved complaints raises significant concerns about the broker's operational integrity and commitment to customer service.

In conclusion, the customer experience at Citi Fx is marred by numerous complaints regarding withdrawal issues and inadequate support. This feedback serves as a warning to potential traders about the risks associated with this broker.

Platform and Trade Execution

A broker's trading platform and execution quality are critical factors that can significantly impact a trader's success. In the case of Citi Fx, the platform's performance and reliability have come under scrutiny.

Users have reported mixed experiences with the Citi Fx trading platform, with some praising its user-friendly interface while others have experienced issues with order execution. Concerns about slippage and rejected orders have been raised, which can severely affect trading outcomes, especially during volatile market conditions.

The lack of transparency regarding the platform's operational stability and execution quality is concerning. Traders rely on fast and reliable execution to capitalize on market opportunities, and any delays or issues can lead to substantial losses.

Furthermore, there have been allegations of potential platform manipulation, a tactic often employed by scam brokers to mislead traders about their performance. Such manipulation can create an illusion of profits, luring traders into investing more funds before ultimately denying them access to their money.

In summary, while some users may find Citi Fx's platform functional, the reports of execution issues and potential manipulation raise significant concerns. Traders should prioritize brokers that offer proven, reliable platforms with transparent execution practices.

Risk Assessment

Using Citi Fx as a trading platform presents several inherent risks that potential clients should consider. The lack of regulation, transparency, and customer protection measures raises the overall risk profile associated with this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or accountability. |

| Financial Risk | High | Lack of fund segregation and protection. |

| Operational Risk | Medium | Reports of execution issues and complaints. |

| Customer Service Risk | High | Poor response to user inquiries and complaints. |

To mitigate these risks, it is crucial for traders to conduct thorough research before engaging with any broker. Seeking out well-regulated alternatives that offer transparent practices, robust customer support, and proven track records can significantly reduce the likelihood of encountering issues.

In conclusion, the risks associated with trading through Citi Fx are substantial. Potential clients should exercise extreme caution and consider alternative brokers that prioritize regulatory compliance and customer safety.

Conclusion and Recommendations

In light of the evidence presented, it is clear that Citi Fx raises significant concerns regarding its legitimacy and safety. The lack of regulatory oversight, transparency issues, and numerous customer complaints point towards a high likelihood of it being a scam broker. Traders are advised to approach Citi Fx with caution and consider the potential risks involved.

For those seeking reliable trading options, it is recommended to explore brokers that are well-regulated by reputable authorities, such as the FCA or ASIC, and that demonstrate a commitment to transparency and customer service. Brokers like OANDA, IG Markets, and Forex.com are examples of reputable alternatives that provide a safer trading environment.

In conclusion, Citi Fx is not considered a safe trading option, and potential clients should prioritize their financial security by choosing brokers with proven track records and regulatory compliance.

Is Citi Fx a scam, or is it legit?

The latest exposure and evaluation content of Citi Fx brokers.

Citi Fx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Citi Fx latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.