esmond 2025 Review: Everything You Need to Know

Abstract

The esmond review shows a detailed look at Esmond International Markets Pty Ltd, a forex trading platform that started in 2023. Even though the Australian Securities and Investments Commission regulates this platform, it has built a bad reputation with many claims that it might be involved in fraud. User feedback shows an average rating of 3.26. Recent data shows that the platform got seven complaints in the past three months. Esmond targets individual investors who want to trade forex, but it lacks clear information about account conditions and trading tools, which creates big concerns. While ASIC oversight could be seen as good, the ongoing negative feelings and scam claims mean potential users should be careful. This esmond review gives an objective assessment based on public data and customer feedback. It highlights both the regulatory credentials and the major risks of using this platform.

Notice to Readers

Investors should know that Esmond's regulatory status may change across regions because of different local oversight rules. The way it operates in some areas might not match the strict regulatory environment that ASIC enforces, so investors should do their homework before putting money in. This review is mainly based on public data and recent user experiences. You should understand that while the esmond review uses current information from various sources, some parts of how the platform works—like how to withdraw funds and specific account details—are not clearly explained. Readers should check with regulatory bodies for the most current details and get professional advice when needed.

Score Framework

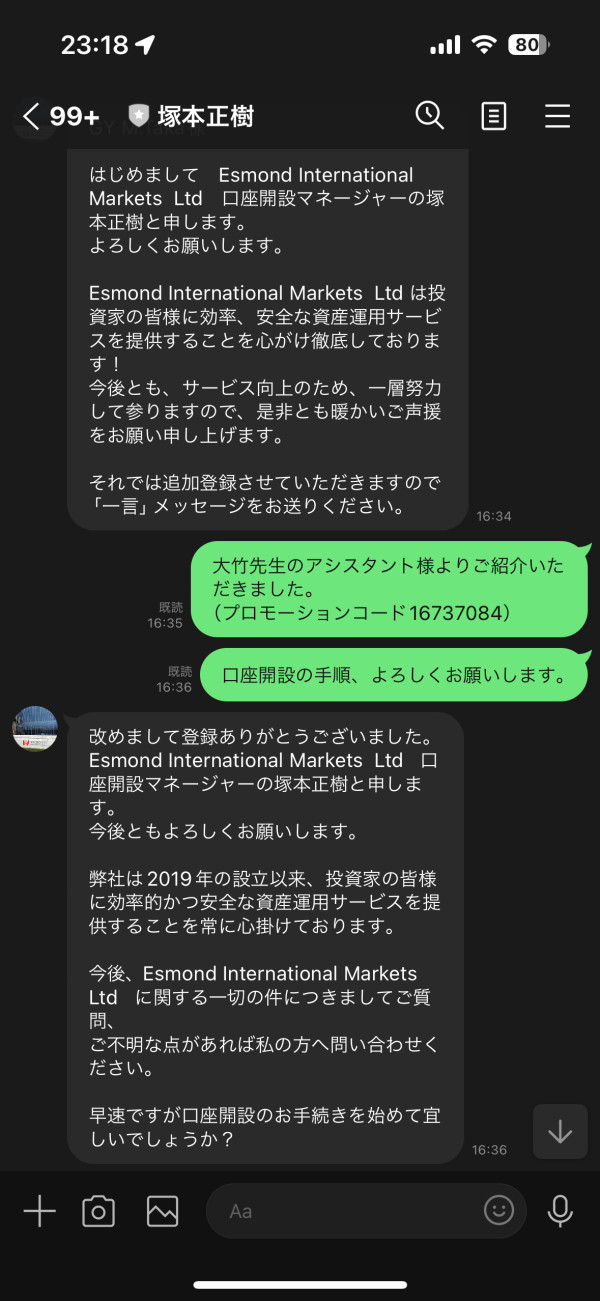

Broker Overview

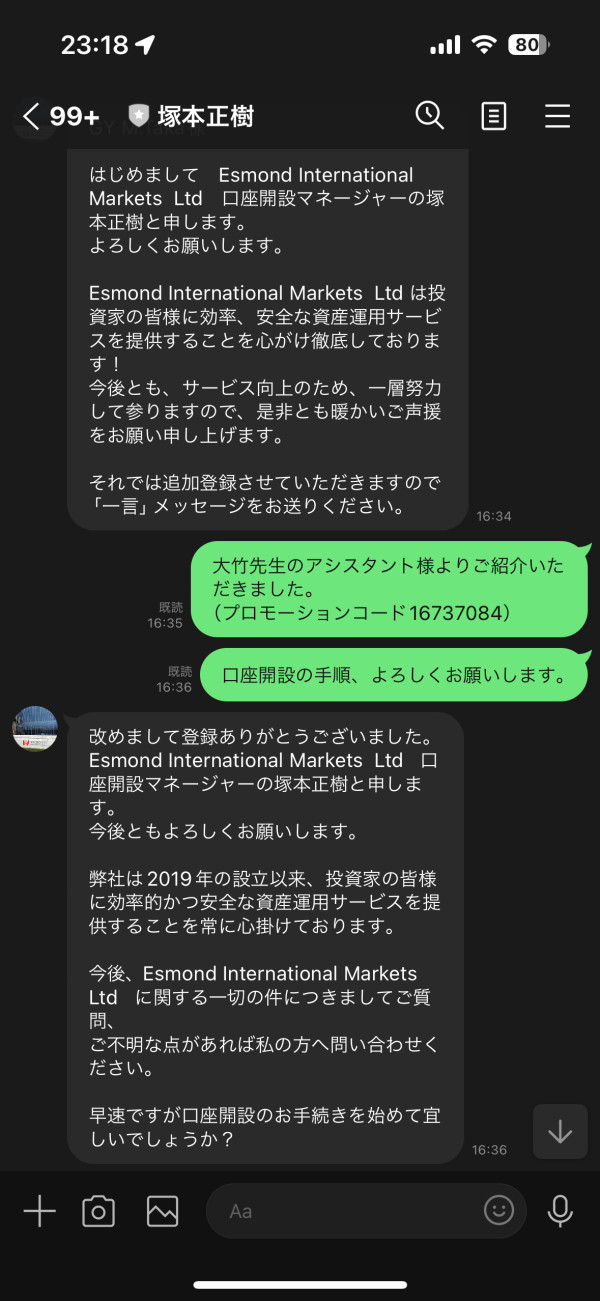

Esmond International Markets Pty Ltd started in 2023 and entered the competitive forex trading world with big goals. As a new company in the industry, it aimed to serve individual investors who want to trade in forex markets. But even early on, the platform faced a lot of criticism, with several people in the trading community worried about how it operates. The negative feedback shown in user ratings and documented complaints has raised questions about how transparent and reliable the service is. According to various sources, things like the account opening process and specific trading features are not well explained, which has led to a careful response from the market.

When it comes to how it operates, Esmond has not given detailed information about its trading platform technology or the range of assets that investors can trade. The main and only noted regulatory oversight comes from the Australian Securities and Investments Commission , which is the key regulatory authority for the firm. Even with regulatory backing, the lack of complete details about the platform's trading environment, account conditions, and technology has resulted in a lukewarm market response. This esmond review shows that while regulatory compliance is there, the overall execution and transparency of the platform need a lot of work, which means potential investors should be extra careful when thinking about this broker.

Regulatory Region:

Esmond is regulated by the Australian Securities and Investments Commission , which oversees and enforces strict rules in the Australian financial market. This oversight is seen as a key sign of regulatory compliance, but it does not fully address the concerns raised by the platform's overall transparency and user feedback. ASIC's involvement is often cited by industry watchers as a main endorsement for legitimacy, but other operational aspects remain unclear.

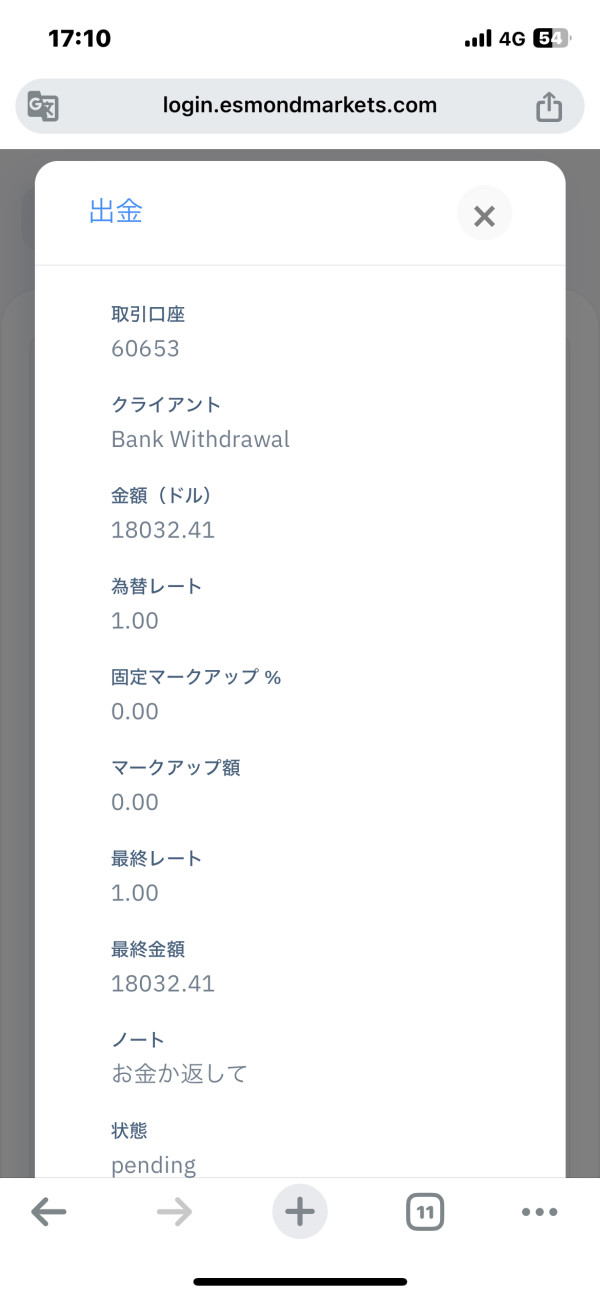

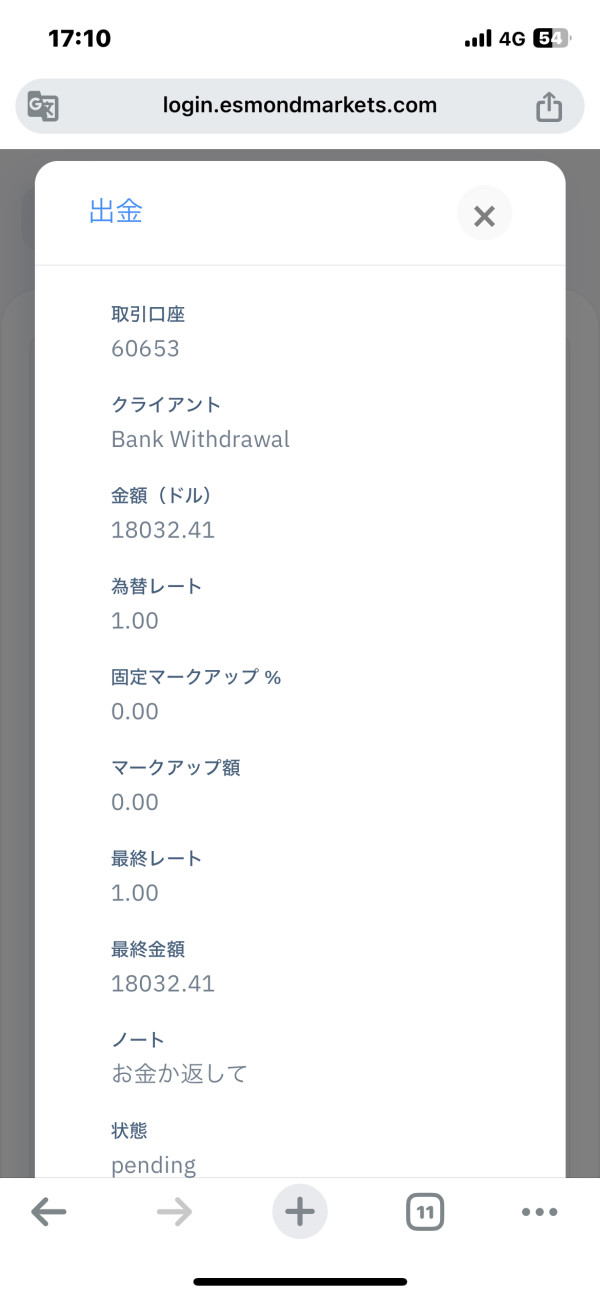

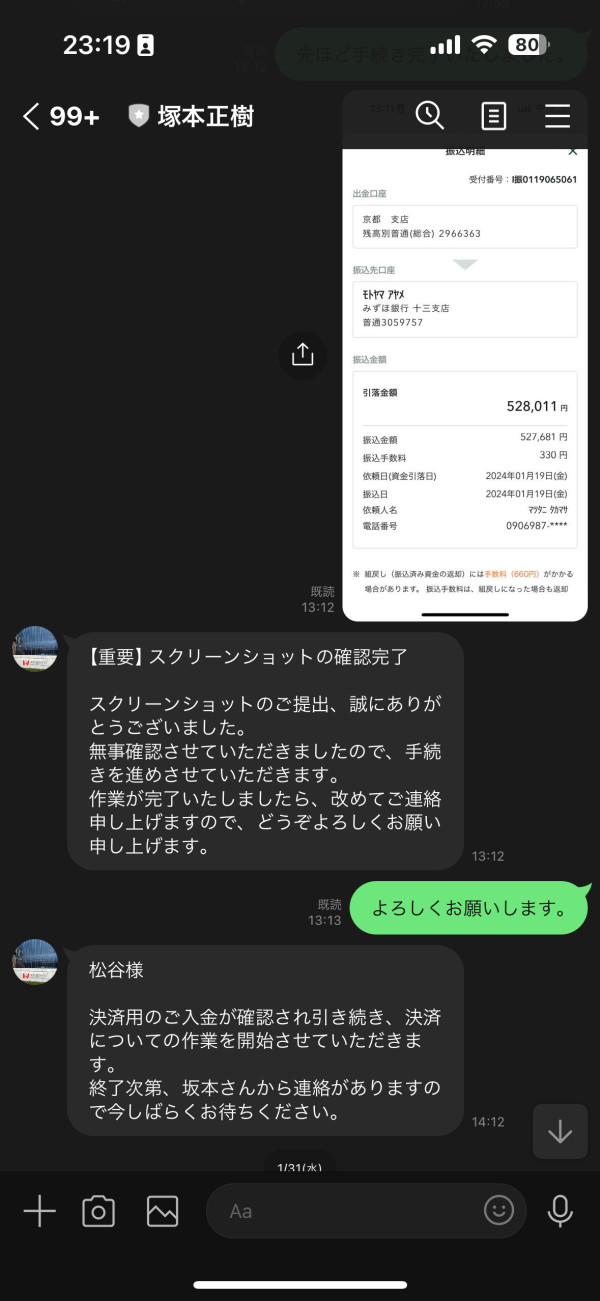

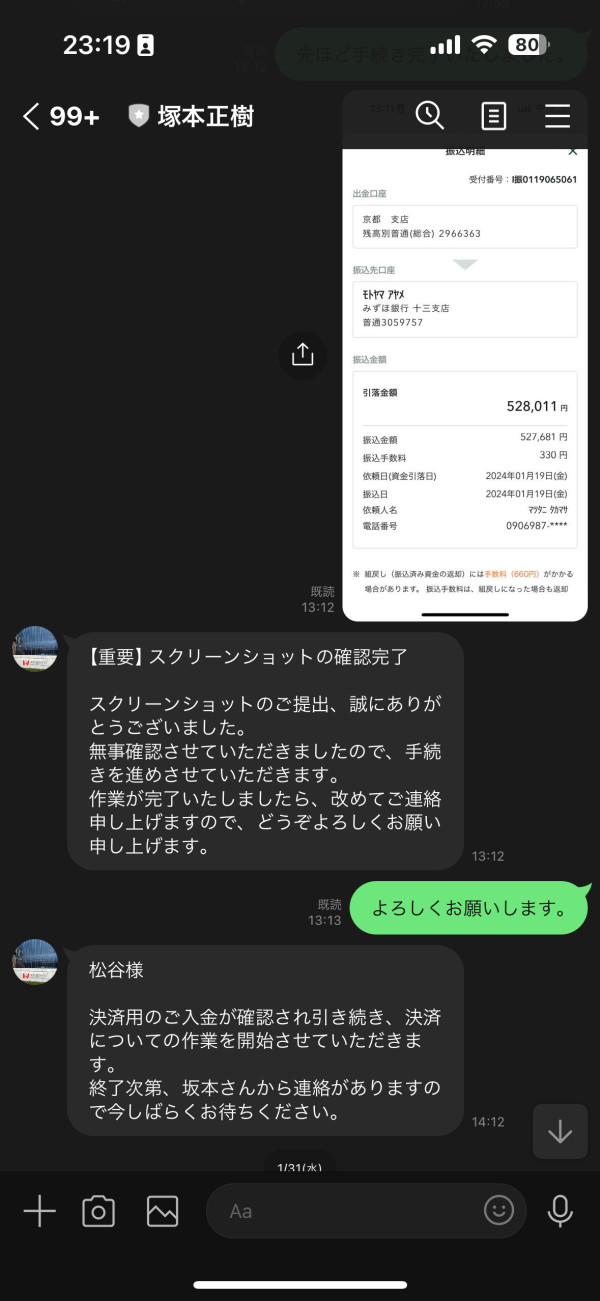

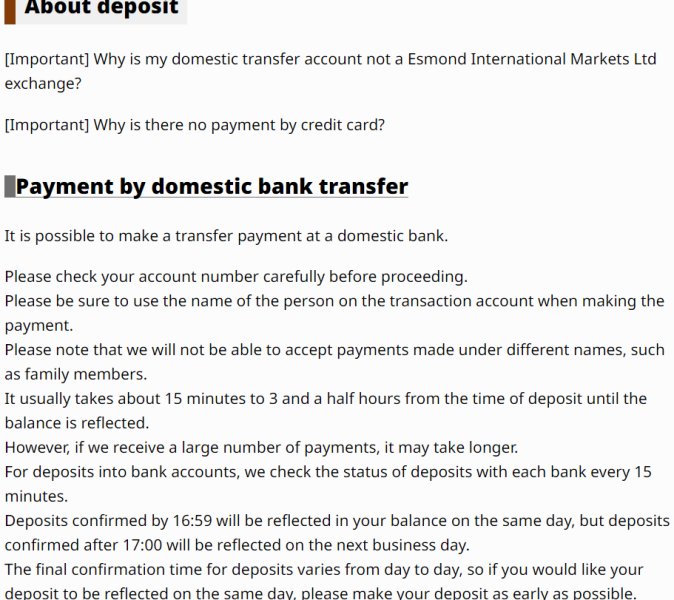

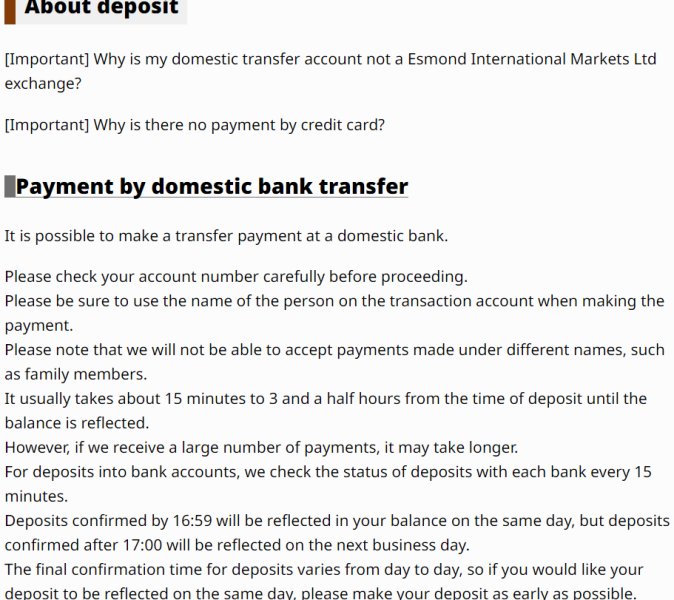

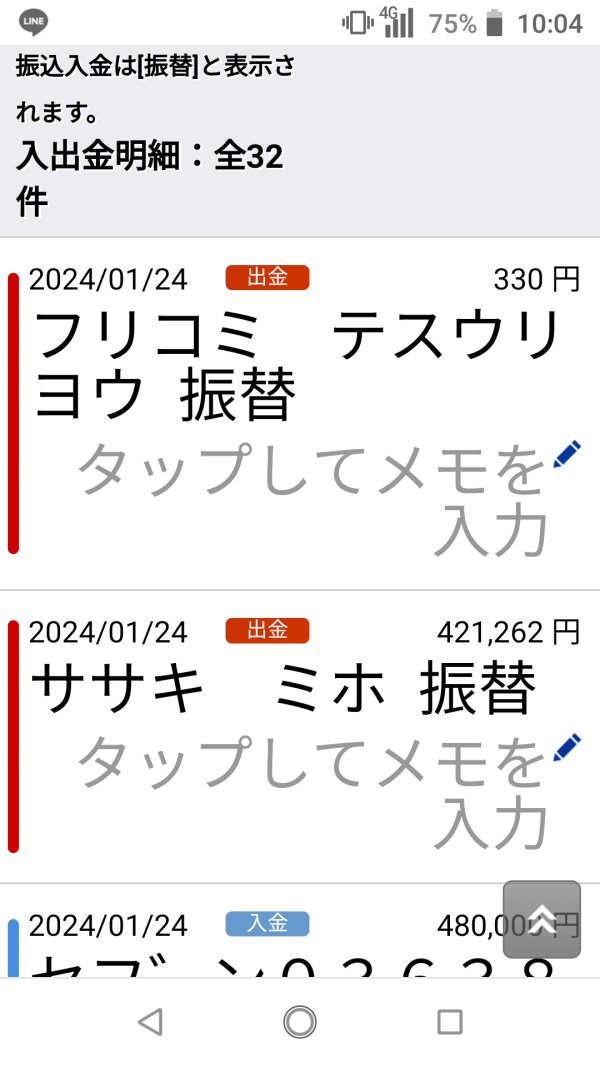

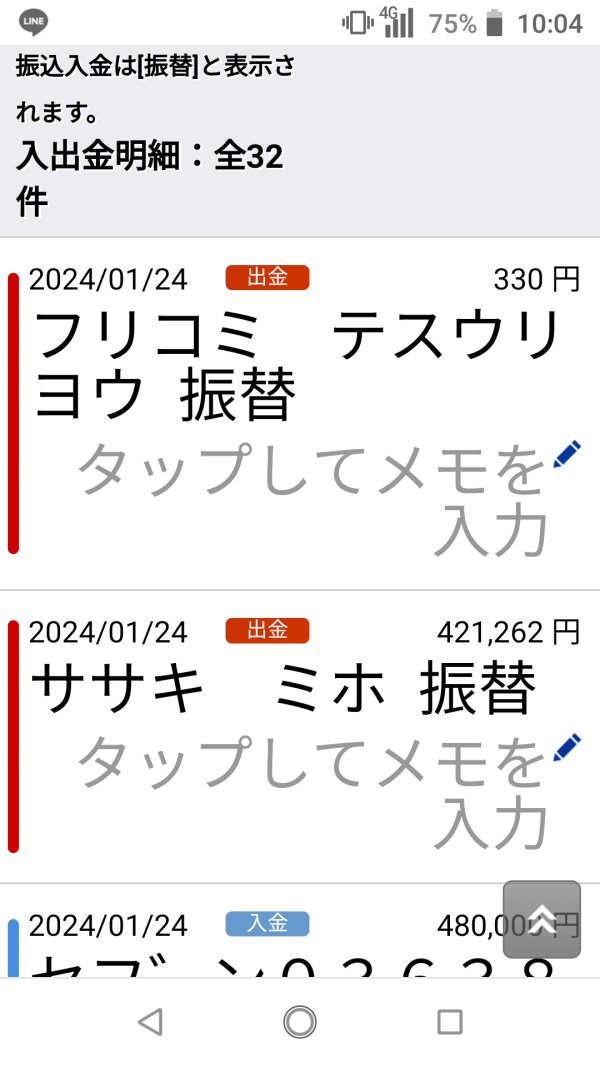

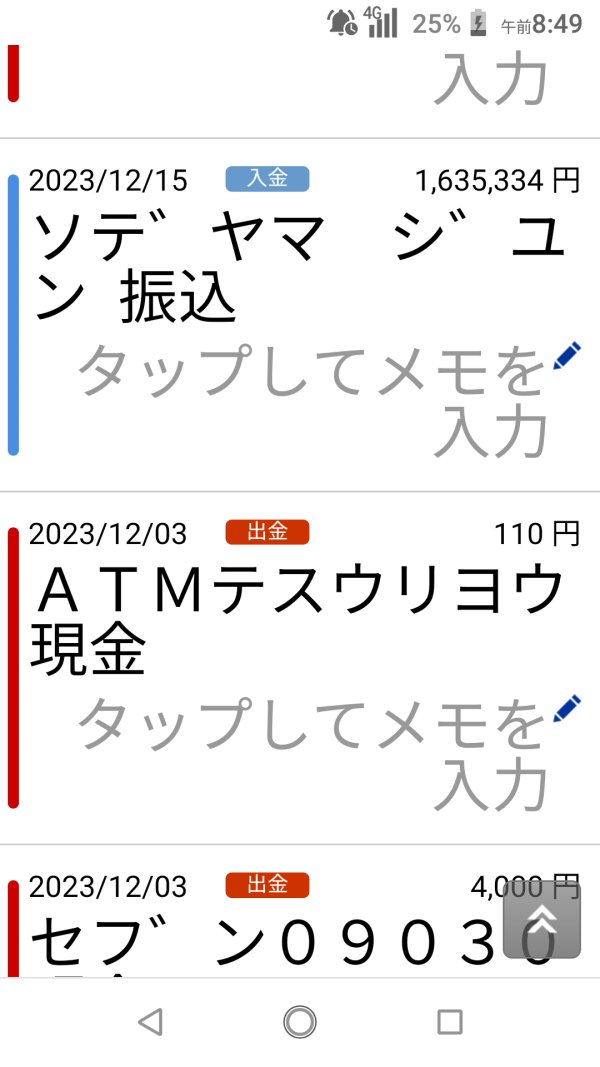

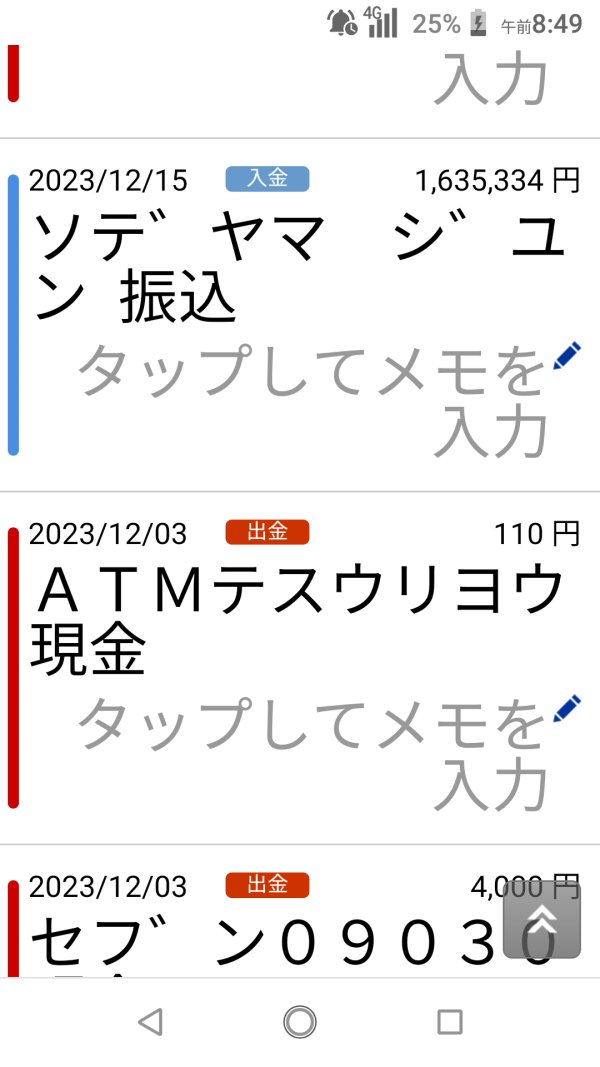

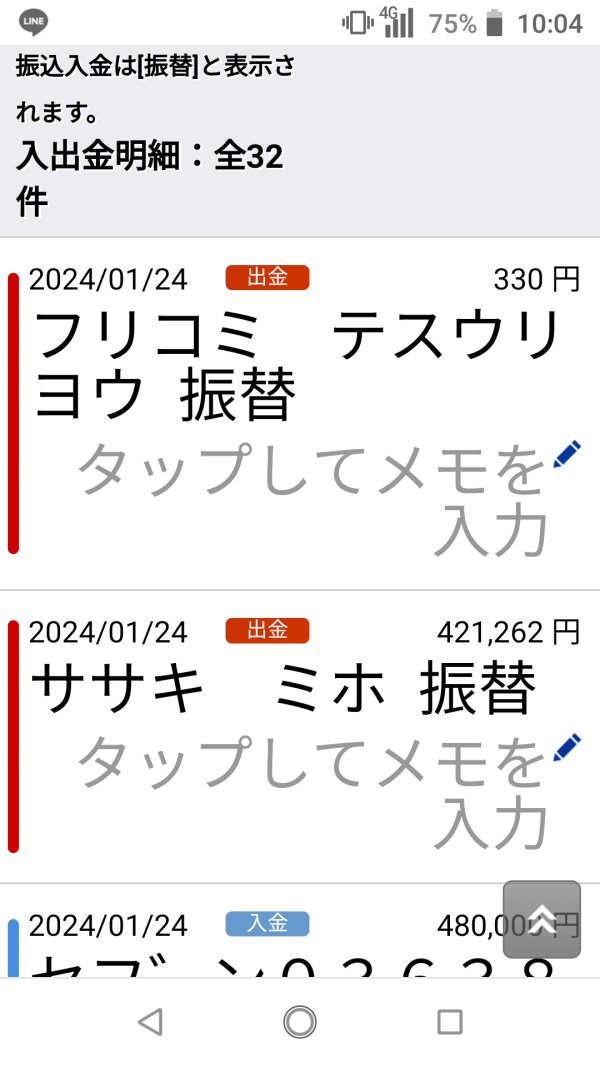

Deposits and Withdrawals:

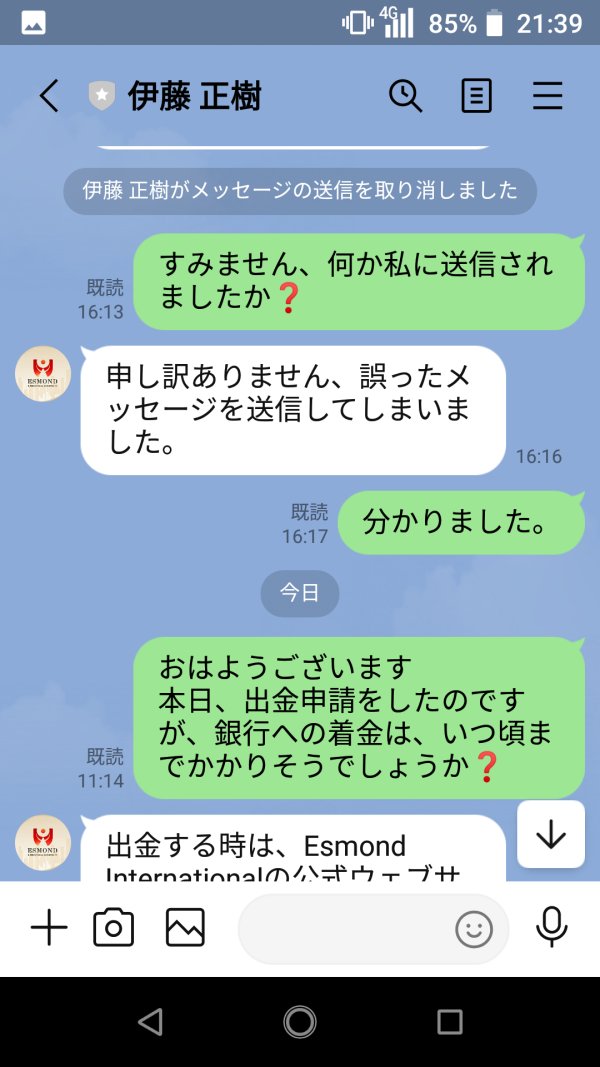

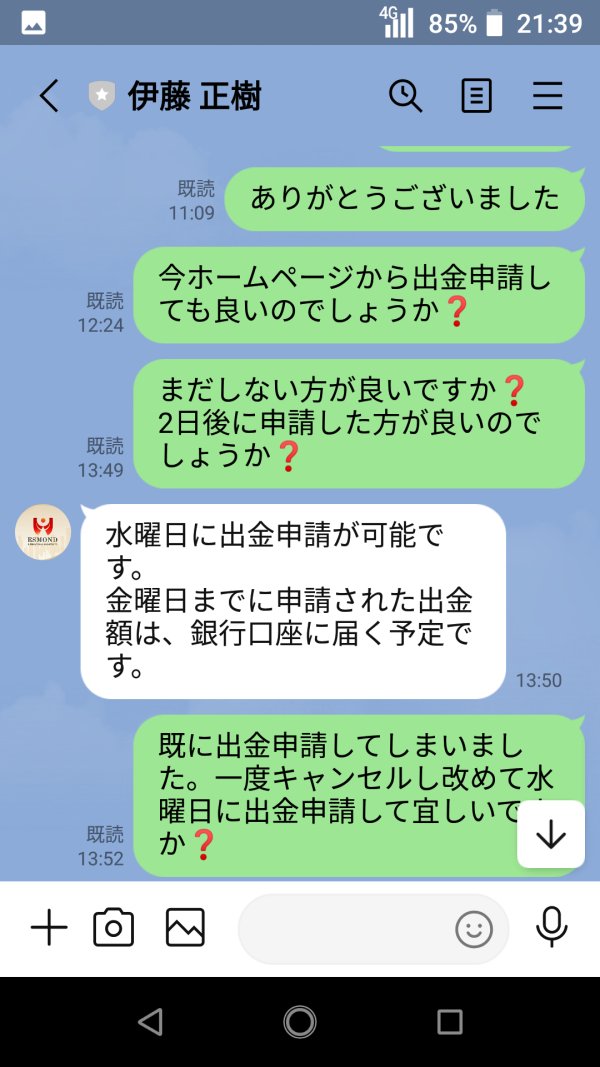

Information about deposit and withdrawal methods is not detailed in the available data. There is no clear explanation about the specific channels or timelines that clients can expect, leaving many potential investors without information about the fund management process.

Minimum Deposit Requirements:

The review did not find any exact details on the minimum deposit needed to open an account. This lack of information stops potential clients from making fully informed decisions about capital allocation and risk exposure.

Bonus and Promotional Offers:

There are no clear signs or detailed explanations about bonus or promotional offers on the platform. The absence of such information makes it harder for investors to assess the potential added value or hidden costs of introductory promotions.

Tradable Assets:

The range and variety of tradable assets are not specifically outlined in the reviewed materials. Without clarity on available instruments—whether forex pairs, commodities, or indices—investors are left guessing which asset classes the platform supports.

Cost Structure:

Key cost parts such as spreads, commissions, and any associated fees are not detailed in the available data. The lack of a transparent cost structure creates uncertainties, as investors have no clear view of the true cost of executing trades. This lack of clarity is troubling for those who prioritize cost-efficiency and transparency in their trading operations.

Leverage Options:

Information about the maximum or variable leverage offered by the platform is missing. Without clear disclosure about leverage ratios, investors cannot easily assess the risk profile associated with their trading strategies.

Platform Selection:

There is no specific information about the different trading platforms available to clients. The lack of detail on whether Esmond offers desktop, web-based, or mobile platforms, as well as the technological capabilities of these interfaces, leaves a significant gap in understanding the trading experience.

Regional Restrictions:

Details on any geographic restrictions or limitations for investors are not provided. This leaves open the possibility that the platform might not be accessible or may operate under different conditions in certain regions.

Customer Support Languages:

While customer support is mentioned in the overall concerns about service quality, there are no specifics about the languages available for client support. This omission adds to the confusion for non-English speaking or international investors.

This esmond review shows the importance of transparency and detailed operational information, which currently seems to be lacking in critical areas.

Detailed Score Analysis

1. Account Conditions Analysis

A detailed look at Esmond's account conditions shows several problems. The available data does not specify the types or features of the accounts offered, leaving potential investors unsure about options such as standard, mini, or specialized accounts. There is no clear explanation of the account opening process or any streamlined features like an Islamic account option. Also, the absence of guidelines about minimum deposit requirements makes the decision-making process harder for investors with different capital levels. The reported lack of transparency has led to unfavorable comparisons with established brokers who provide complete details on account types and benefits. User reviews also suggest that the process might involve hidden constraints or unclear terms, which adds to the risk profile. According to industry reports, such lack of clarity about account conditions is a significant risk factor. Overall, this aspect of the platform gets a low score, and investors should be careful, as insufficient account information can result in unexpected issues during the trading experience. This assessment contributes to a critical perspective within this esmond review.

The analysis of Esmond's trading tools and resources shows a significant gap in the information provided to investors. There is no detailed description of the tools available for market analysis, automated trading, or any other features that support a strong trading strategy. Research and educational resources are notably absent, which could have been a vital asset for both new and experienced traders seeking to better understand market dynamics. There is also no indication that the broker provides any advanced charting software, technical analysis tools, or real-time market data feeds—elements that are standard among leading forex platforms. The limited availability of such resources may be a result of the short operational history of the firm, which can negatively influence the overall trading environment and investor confidence. Expert reviews often stress that reliable tools and comprehensive educational content are essential for a positive trading experience. In this context, the clear lack of these features further reduces the platform's value proposition. This esmond review, therefore, suggests that prospective users might need to seek additional external resources to make up for these shortcomings.

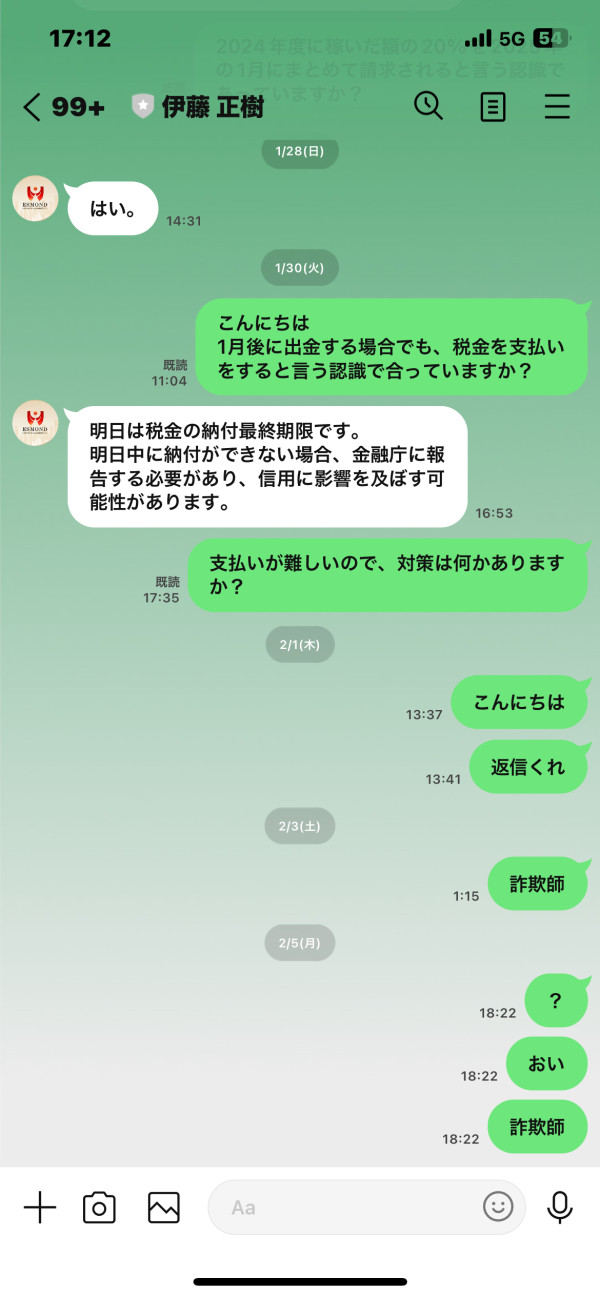

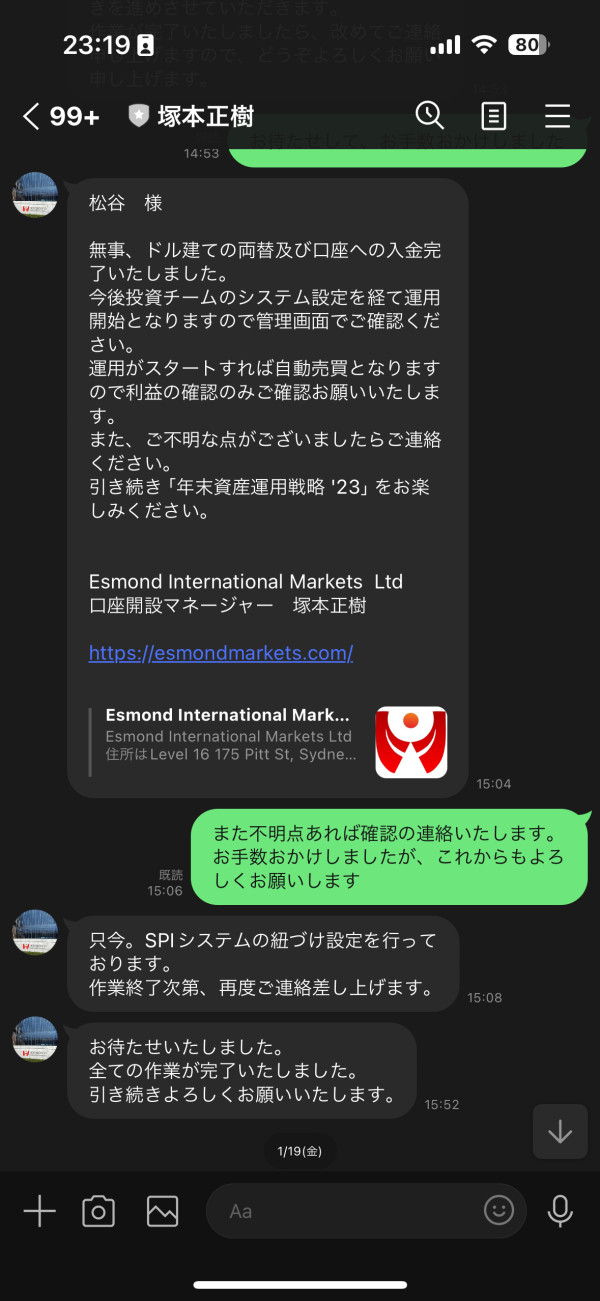

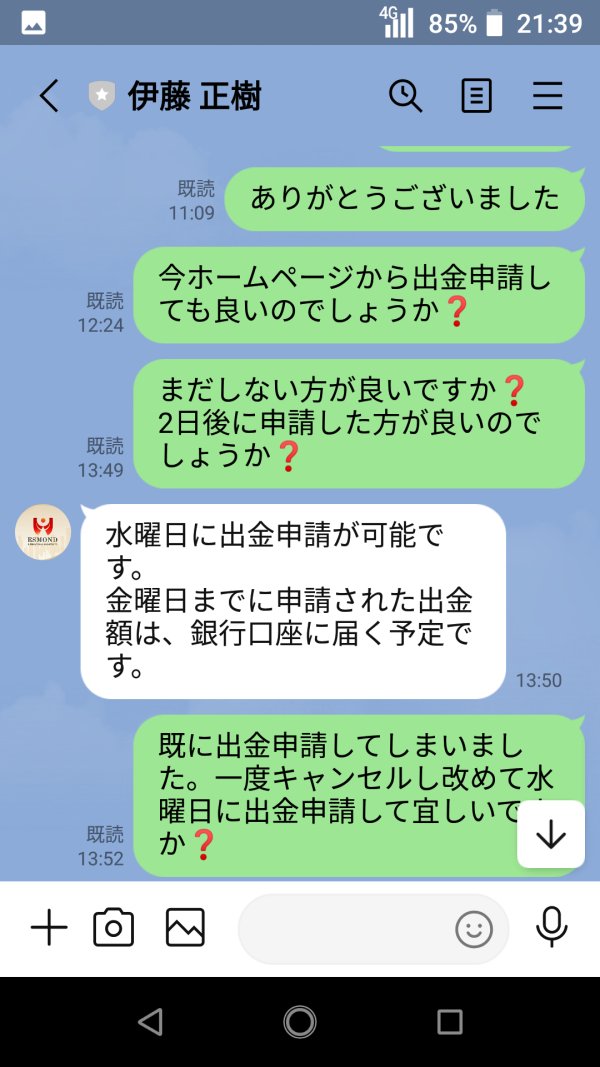

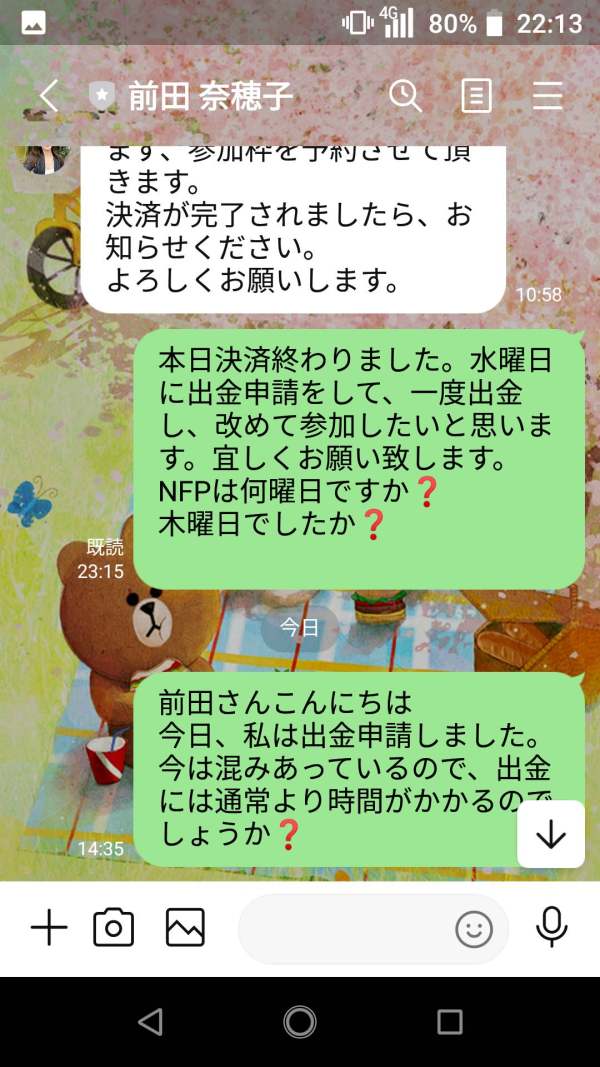

3. Customer Service and Support Analysis

Customer service and support at Esmond appear to be below industry standards. The platform has earned a user rating of 3.26, which shows a generally unsatisfactory service level. There are also reports of seven complaints over a recent three-month period, which further highlights potential issues in responsiveness and overall service quality. The data does not reveal the specific customer support channels available—whether live chat, email, or telephone—and there is no information about the availability of support outside of normal business hours or in multiple languages. This lack of detailed information around customer support may lead to delays in resolving technical issues or account-related questions, which can be particularly problematic for forex traders who need prompt assistance due to the fast pace of market developments. According to several user testimonials, slow response times and insufficient problem resolution make the overall dissatisfaction worse. Without clear communication channels or strong support infrastructure, clients may face additional risks during periods of market volatility. This section of the esmond review points to significant areas for improvement, especially when compared to industry leaders who emphasize round-the-clock, multilingual, and multi-channel support.

4. Trading Experience Analysis

The trading experience offered by Esmond has several significant gaps that hurt user satisfaction. There is minimal disclosure about key performance indicators such as platform stability, execution speed, and the overall reliability of order processing. The absence of detailed information about the technological infrastructure leaves many traders uncertain about potential issues like frequent downtimes or delayed trade executions. There are also no specifics about the mobile trading experience, which is an essential part for modern traders requiring on-the-go access. In addition, the platform's functionality—such as the availability of customizable interfaces or integrated trading indicators—is not discussed in the source materials. Given the rapid pace of the forex markets, any latency or lack of essential trading features could result in significant financial losses. Trading experience is a critical factor in a platform's overall appeal, and the shortcomings identified here are deeply concerning. This segment of the esmond review suggests that the broker's technological and functional aspects fall short when compared with industry benchmarks, thereby casting doubts on the platform's ability to deliver a competitive trading environment. It is recommended that potential investors consider these limitations before engaging in live trading.

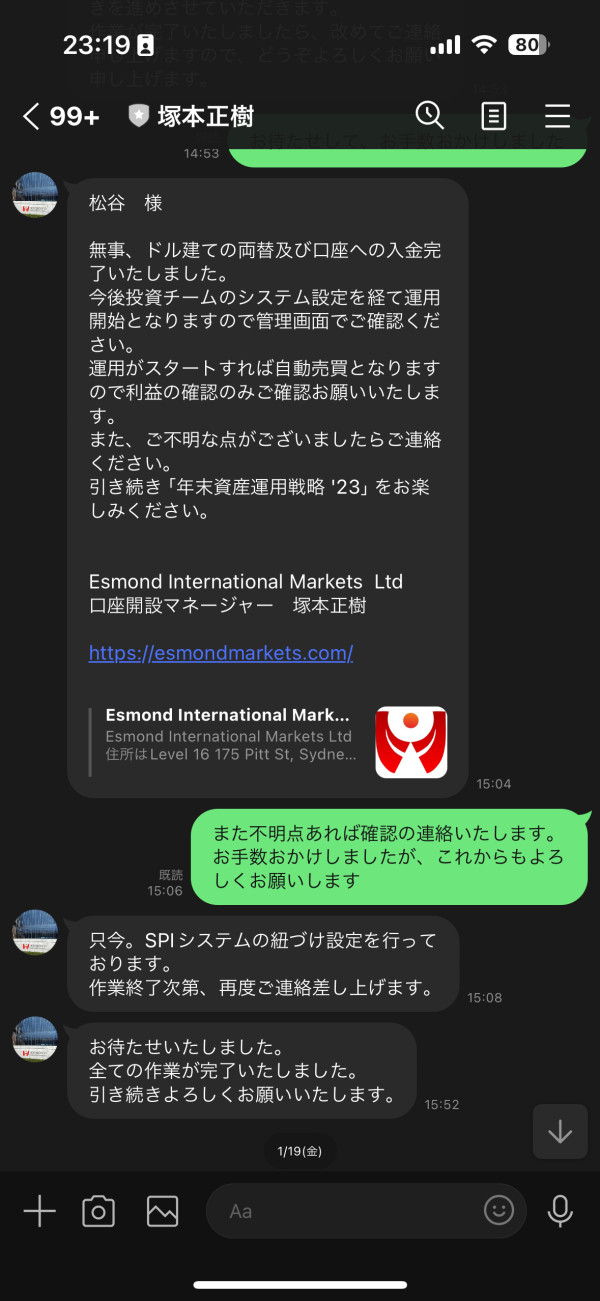

5. Trust Analysis

Trust remains the most critical issue facing Esmond. Despite being regulated by ASIC—a factor that normally adds a layer of credibility—the platform is plagued by allegations of engaging in fraudulent practices. Multiple reports and user feedback show that there are significant doubts about the overall integrity and transparency of the broker. The absence of detailed disclosures about fund security measures, company background information, and operational transparency further makes these concerns worse. The negative reputation and the fact that several users have reported unsatisfactory outcomes amplify the doubts related to the firm's reliability. Third-party reviews often emphasize that trust in a broker is built not only through regulatory compliance but also through consistent, transparent practices and prompt resolution of client issues. In the case of Esmond, the combination of limited information and the observed history of user complaints leads to a very low trust score. Industry experts warn that a suspected scam can have long-lasting effects on investor confidence and financial security. As such, this esmond review strongly advises potential investors to consider alternative brokers with a more established reputation and a transparent operational record.

6. User Experience Analysis

The overall user experience with Esmond is hurt by several critical shortcomings that have caused widespread dissatisfaction among its clients. User feedback emphasizes a low overall satisfaction level, mainly driven by the platform's unclear registration process, confusing verification requirements, and problematic fund operations. The website and trading interface do not offer the ease-of-use typically associated with more seasoned competitors. Many users have reported difficulties navigating the platform, which could discourage both new and experienced traders alike. Recurring complaints have specifically mentioned issues with user support responsiveness and the perception of unaddressed concerns about fraudulent practices. While some aspects of the design aesthetics might appear adequate, the lack of strong functionality and supportive customer engagement significantly hurts the overall user experience. These user-reported issues align with the low scores assigned across various dimensions. As highlighted in this esmond review, investors should be cautious as the prevailing user sentiment reflects an overall disappointment, which may influence trading performance and client satisfaction adversely. Recommendations for improvement include streamlining the registration process, enhancing support channels, and increasing overall transparency to rebuild user trust.

Conclusion

In summary, Esmond International Markets Pty Ltd is a newly established forex broker that comes with considerable risks and uncertainties. While the platform is regulated by ASIC, significant concerns remain about its transparency, account conditions, and overall trading experience. Negative user feedback, a low trust score, and unresolved issues related to customer support further reduce its appeal. As a result, this esmond review advises that Esmond is not recommended for the average investor seeking reliability, transparency, and strong functionality. Potential investors should exercise caution and consider more established alternatives in the competitive forex market.