Citi Fx 2025 Review: Everything You Need to Know

Citi Fx has garnered a mixed reputation in the forex trading community, with numerous reviews highlighting both its potential benefits and significant drawbacks. While some users praise the platform for its user-friendly interface and extensive asset offerings, others raise serious concerns about its regulatory status and withdrawal issues.

Note: It's essential to recognize that Citi Fx operates under various entities in different regions, which may lead to discrepancies in user experiences and regulatory compliance. This review aims to provide a fair and balanced overview based on the latest information available.

Rating Overview

We evaluate brokers based on user feedback, expert opinions, and factual data.

Broker Overview

Citi Fx, claiming to have been established within the last few years, presents itself as a forex broker offering a range of trading services. The broker primarily operates through the MetaTrader 5 platform, which is a popular choice among traders for its advanced analytical tools and user-friendly interface. The platform allows trading in various asset classes, including forex, commodities, and indices. However, it is crucial to note that Citi Fx lacks proper regulatory oversight, which raises red flags regarding its legitimacy and safety for traders.

Detailed Section

Regulatory Regions:

Citi Fx claims to be based in the UK and suggests it is regulated by the Financial Conduct Authority (FCA). However, multiple sources indicate that this is misleading, as no record of Citi Fx exists in the FCA register. This lack of regulation is a significant concern for potential traders, as it implies that the broker operates without the necessary oversight to protect client funds.

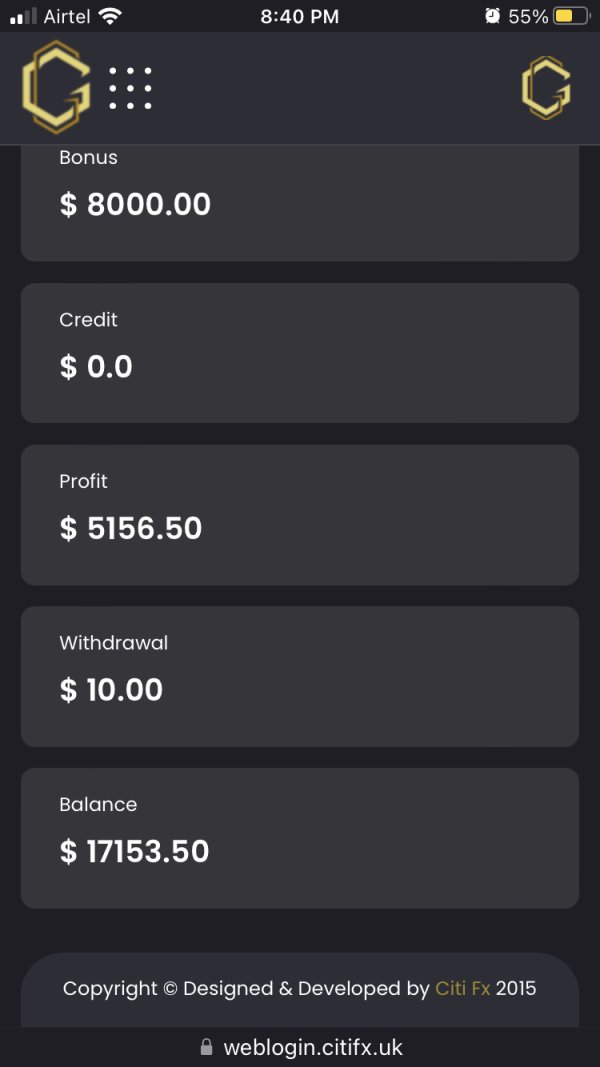

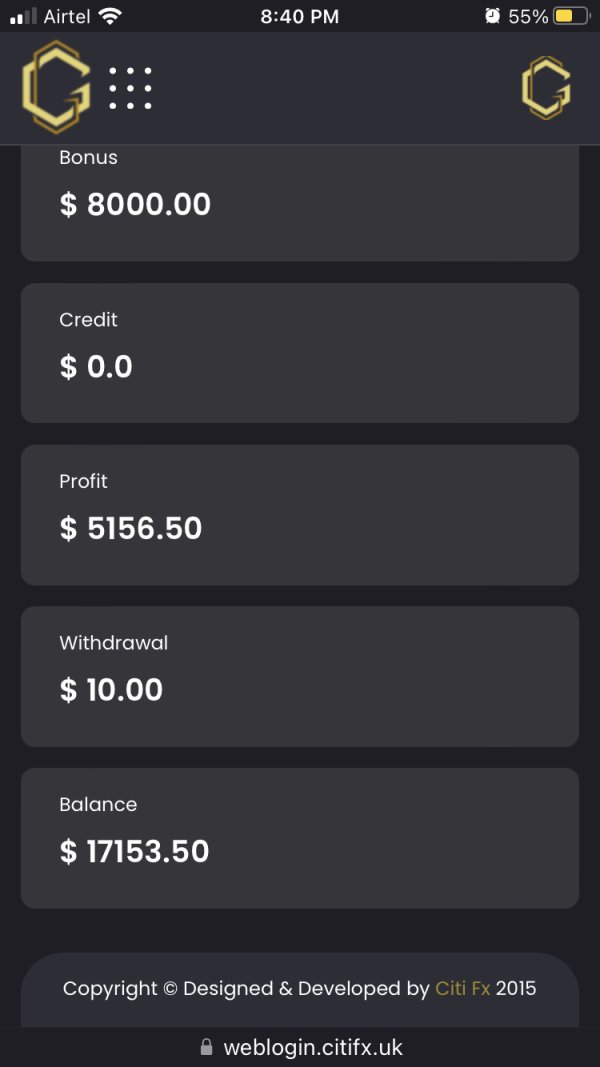

Deposit/Withdrawal Currencies:

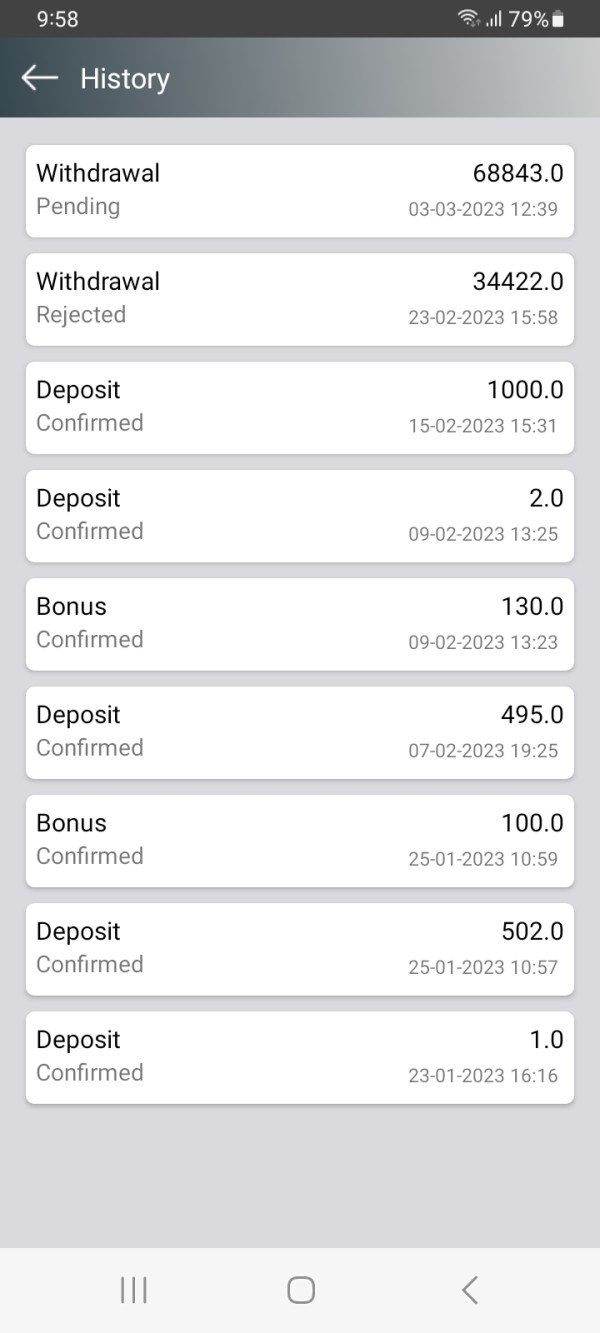

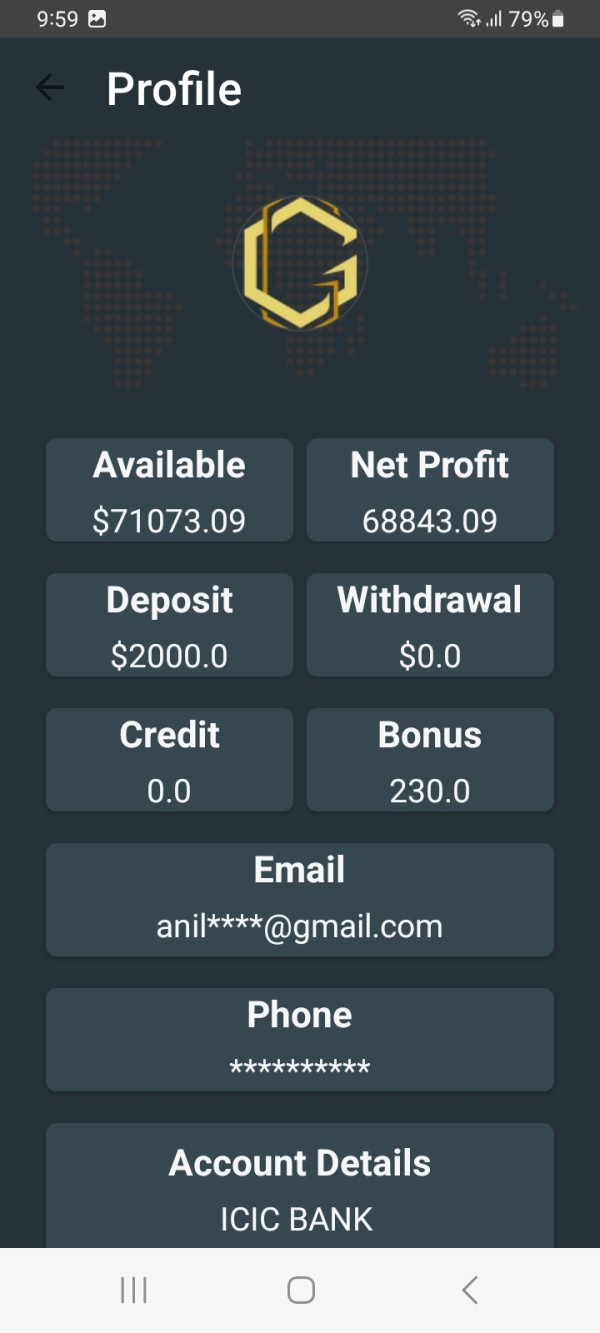

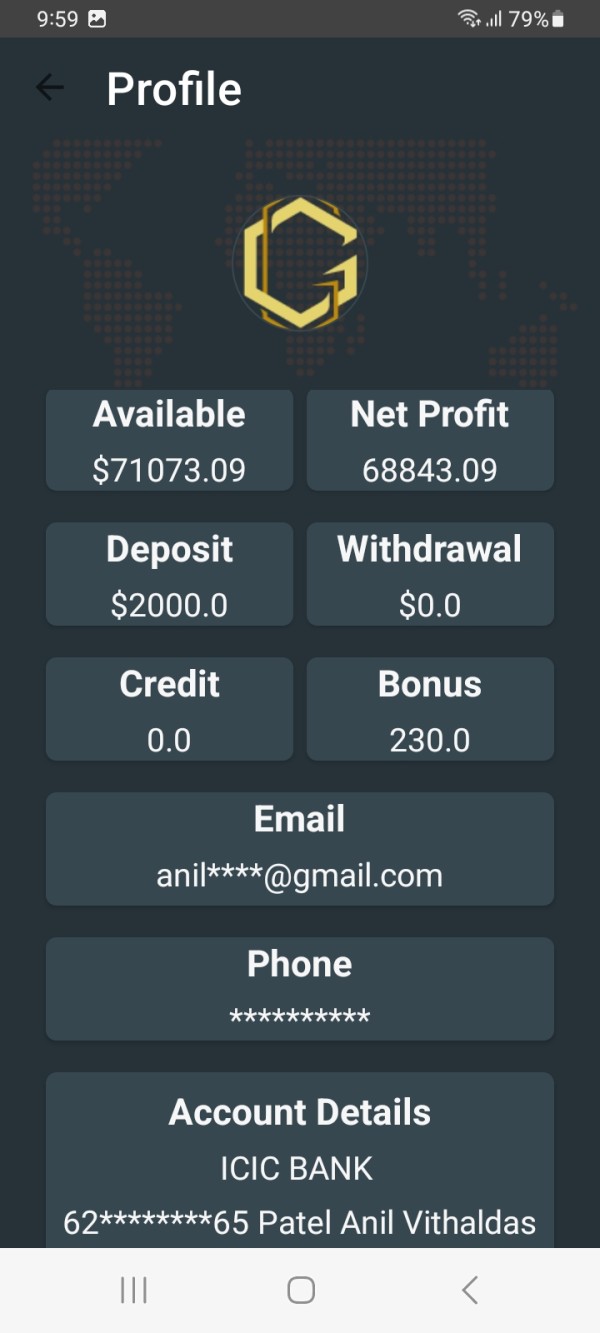

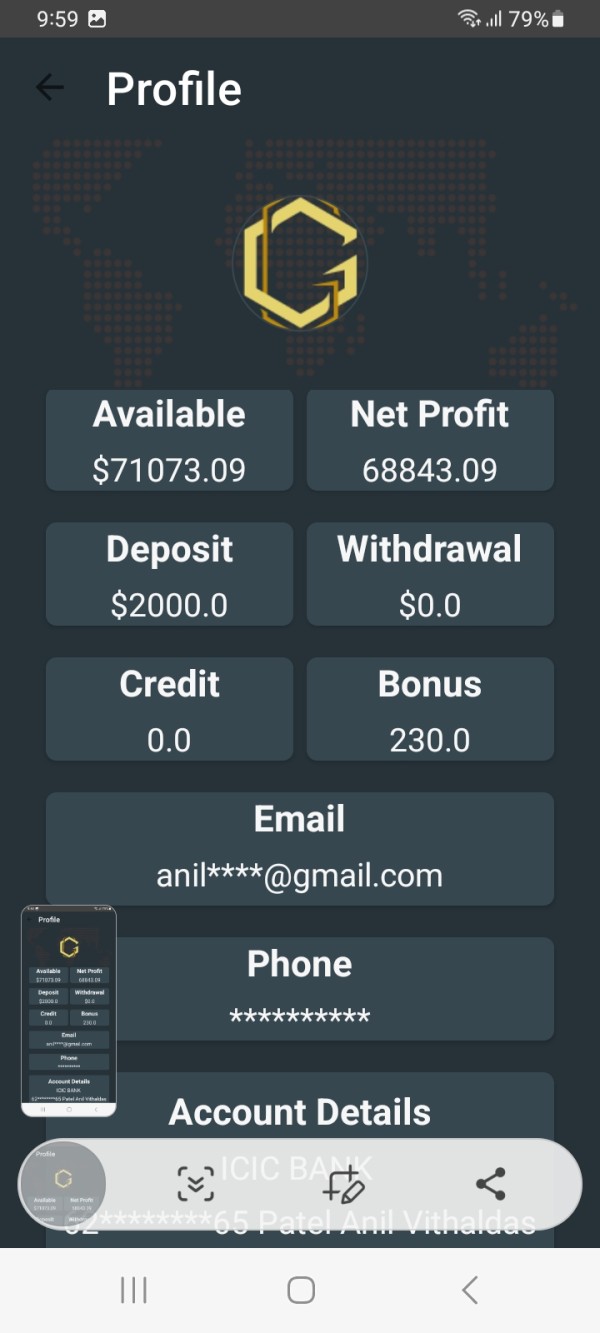

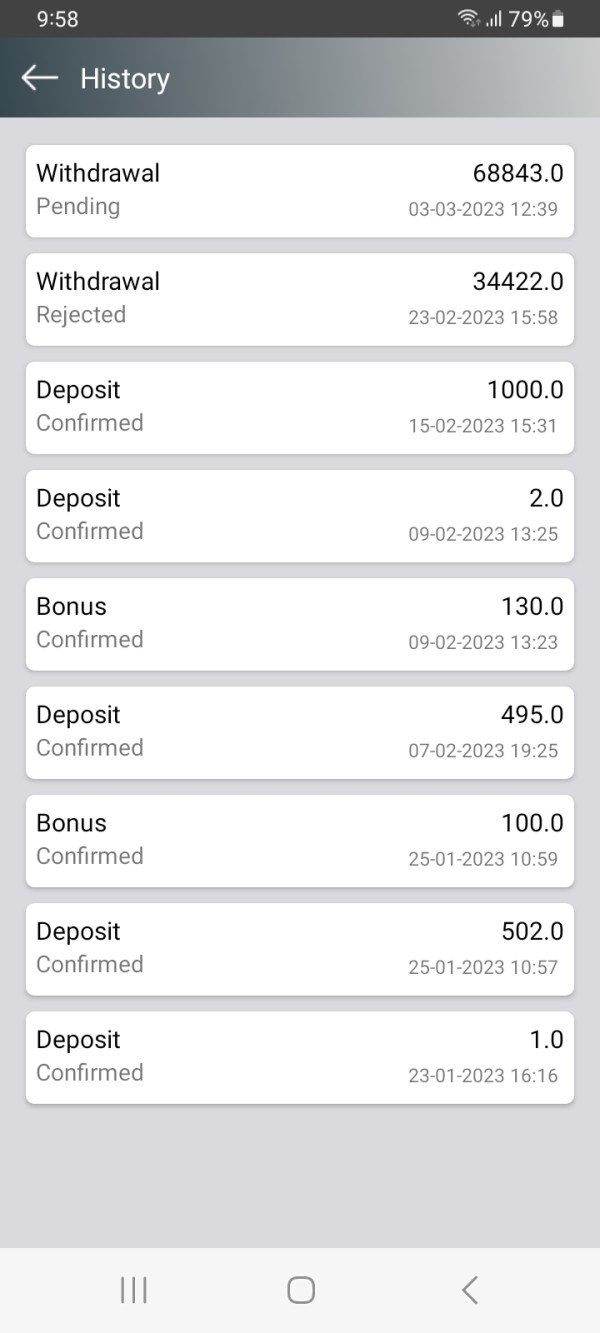

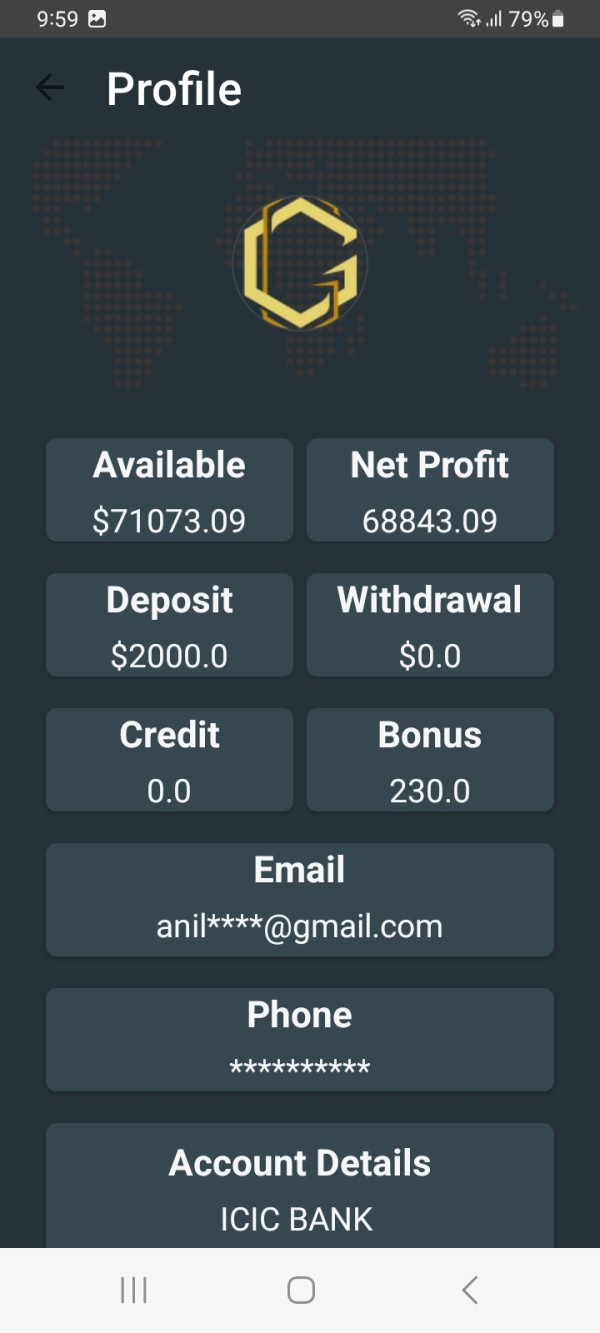

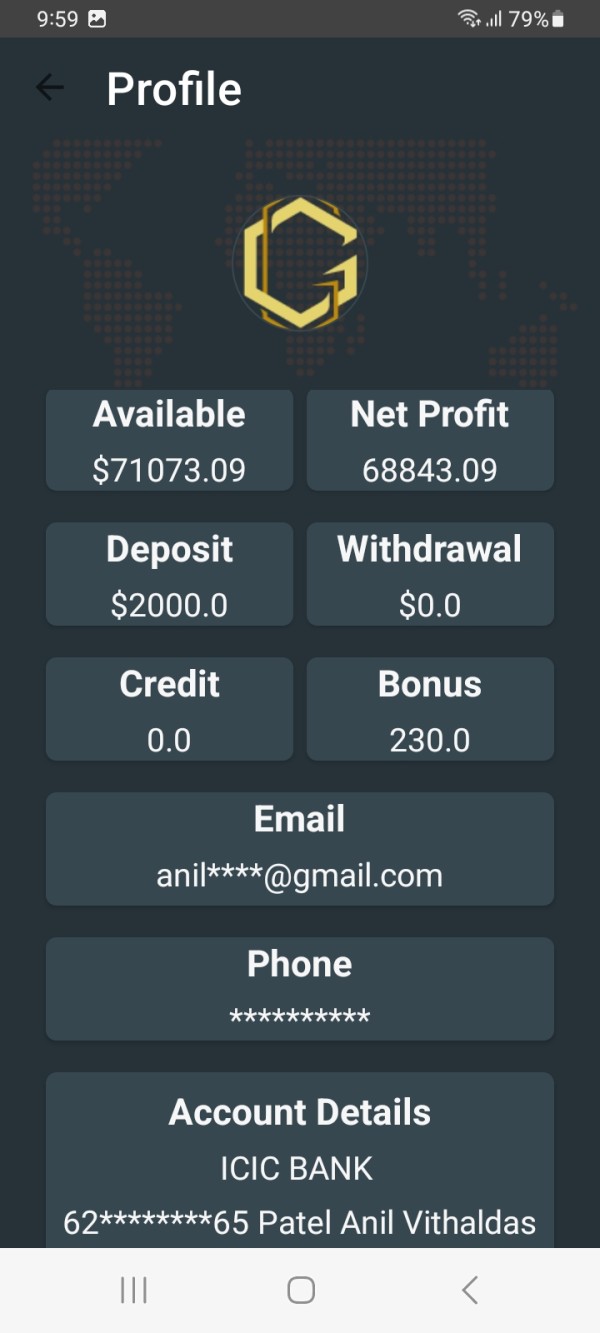

Citi Fx does not specify accepted deposit or withdrawal currencies on its website, which is a common red flag among unregulated brokers. Users have reported issues with withdrawals, including long processing times and outright denials, which further complicates the trading experience.

Minimum Deposit:

The minimum deposit requirement for opening an account with Citi Fx is reported to be around $1,000. This amount is relatively high compared to other legitimate brokers that often allow for much lower initial investments, making it less accessible for new traders.

Bonuses/Promotions:

Citi Fx does not appear to offer any bonuses or promotions, which is often a tactic used by scam brokers to attract new clients. The absence of these incentives can be seen as a positive aspect, as legitimate brokers tend to focus on transparent trading conditions rather than gimmicks.

Tradable Asset Classes:

Citi Fx claims to provide access to a variety of asset classes, including forex pairs, commodities, and indices. However, the lack of detailed information on specific instruments available for trading raises concerns about the broker's transparency.

Costs (Spreads, Fees, Commissions):

While specific information on spreads and commissions is not readily available, users have expressed dissatisfaction with the overall cost structure. Reports suggest that the fees associated with trading may be higher than average, particularly when considering the lack of regulatory oversight.

Leverage:

Citi Fx offers leverage as high as 1:5000, which is excessively risky and not compliant with regulations in many regions, including the UK, where the maximum allowable leverage is 1:30 for retail traders. Such high leverage can lead to significant losses, especially for inexperienced traders.

Allowed Trading Platforms:

Citi Fx primarily utilizes the MetaTrader 5 platform, which is well-regarded in the trading community for its robust features. However, the broker's claims about its proprietary trading software lack verification, raising doubts about its authenticity.

Restricted Regions:

The broker does not clearly outline any restricted regions, which could be a tactic to attract a broader range of clients without addressing the legal implications of operating in certain jurisdictions.

Available Customer Service Languages:

Citi Fx appears to offer limited customer support, with reports indicating that users often struggle to get timely responses. This lack of support can be particularly problematic for traders who may need assistance with their accounts or trading issues.

Rating Breakdown

Account Conditions:

Citi Fx's account conditions are deemed poor due to high minimum deposits and lack of clarity regarding account types. Users have reported feeling misled about the trading conditions offered.

Tools and Resources:

While the MetaTrader 5 platform provides essential trading tools, the overall resource offering from Citi Fx is limited, with no additional educational materials or market analysis available to traders.

Customer Service & Support:

Customer service has received significant criticism, with many users reporting unresponsive support and difficulties in resolving issues, particularly regarding withdrawals.

Trading Experience:

The trading experience with Citi Fx is marred by concerns over trustworthiness and transparency. Users have expressed frustration with withdrawal processes and the overall lack of support.

Trustworthiness:

Citi Fx scores poorly on trustworthiness, primarily due to its unregulated status and reported withdrawal issues. The misleading claims about regulatory compliance further exacerbate these concerns.

User Experience:

User experience varies, with some praising the platform's interface while others highlight significant issues with customer support and withdrawal processes.

In conclusion, Citi Fx review indicates that potential traders should exercise caution. The broker's lack of regulation, high minimum deposit requirements, and reported withdrawal issues suggest it may not be a safe choice for forex trading. Always consider opting for regulated brokers with a proven track record to ensure the safety of your funds.