Is WHIZFX safe?

Business

License

Is Whiz FX A Scam?

Introduction

Whiz FX is a relatively new entrant in the forex market, positioning itself as a broker offering various trading services, including forex, cryptocurrencies, and CFDs. Given the plethora of brokers available, traders must exercise caution when selecting a platform, as the landscape is rife with potential scams and unregulated entities. The importance of due diligence cannot be overstated; a broker's regulatory status, transparency, and customer feedback are critical factors that can significantly affect a trader's experience and financial safety. This article aims to provide a comprehensive analysis of Whiz FX, evaluating its legitimacy and safety through a structured framework that includes regulatory status, company background, trading conditions, customer experiences, and risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial for ensuring that it operates within legal guidelines and offers a level of protection to its clients. Whiz FX claims to be registered in Saint Vincent and the Grenadines (SVG), a jurisdiction known for its lack of stringent regulatory requirements for forex brokers. In fact, the local financial authority does not license or supervise brokers in any meaningful way, which raises significant concerns regarding the safety of traders' funds.

The following table summarizes the core regulatory information regarding Whiz FX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | 2546 | Saint Vincent and Grenadines | Unverified |

The absence of a legitimate regulatory license is a significant red flag. Whiz FX's claim of being regulated by the Australian Securities and Investments Commission (ASIC) has been called into question, as its appointed representative license was revoked. Such regulatory lapses indicate a lack of accountability and oversight, making it difficult for traders to hold the broker responsible for any misconduct.

Company Background Investigation

Whiz FX, operating under the name Whiz FX LLC, has a relatively short history, having been established in 2022. The company claims to serve clients from various regions, including Canada and Latin America, but the lack of transparency surrounding its ownership structure and management team raises further concerns.

The management team behind Whiz FX is not well-documented, and the absence of publicly available information about the individuals running the company makes it challenging to assess their qualifications and experience. This lack of transparency is concerning, especially when evaluating a broker's trustworthiness. A reputable broker typically provides detailed information about its management team, including their backgrounds and professional experiences, to build confidence among potential clients.

Trading Conditions Analysis

Whiz FX offers a range of trading conditions that might seem attractive at first glance. However, a closer inspection reveals potential pitfalls. The broker claims to provide low spreads and high leverage, which can appeal to traders looking to maximize their profits. Yet, these features often come with hidden costs or unfavorable policies that can erode any potential gains.

The following table compares Whiz FX's core trading costs with industry averages:

| Cost Type | Whiz FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not specified | 1.0 - 1.5 pips |

| Commission Structure | None specified | $5 - $10 per lot |

| Overnight Interest Range | Not specified | Varies by broker |

While the broker advertises ultra-low spreads, the lack of transparency regarding these figures is alarming. Additionally, the absence of clear information about commissions and overnight interest rates further complicates the evaluation of Whiz FX's trading conditions. Traders should be wary of brokers that do not provide explicit details about their fee structures, as this can lead to unexpected costs.

Client Fund Security

One of the most pressing concerns for any trader is the safety of their funds. Whiz FX has been criticized for its lack of investor protection measures, such as segregated accounts and negative balance protection. These features are essential for safeguarding client funds, especially in the volatile forex market.

The broker does not guarantee the safety of customer deposits, which is a significant concern. Without proper regulatory oversight, there is little recourse for clients in the event of a financial dispute or if the broker were to go bankrupt. Historical complaints and reports of fund mismanagement further exacerbate these concerns, as traders have reported difficulties in withdrawing their funds.

Customer Experience and Complaints

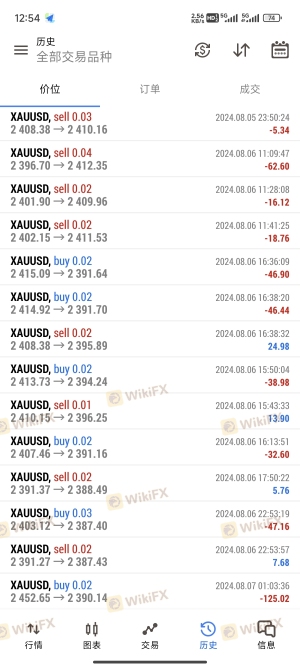

Customer feedback is an essential component in assessing the reliability of a broker. Whiz FX has received a mix of reviews, with many users expressing dissatisfaction with their experiences. Common complaints include difficulties in withdrawing funds, lack of effective customer support, and issues with order execution.

The following table summarizes the types of complaints received about Whiz FX and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Ineffective Customer Support | Medium | Average |

| Order Execution Problems | High | Poor |

Several users have reported that their withdrawal requests were either denied or excessively delayed, raising suspicions about the broker's operational integrity. In some cases, clients have alleged that the broker employs tactics to discourage withdrawals, such as imposing high fees or requiring additional trading volumes before releasing funds.

Platform and Execution

The trading platform offered by Whiz FX is the widely-used MetaTrader 5 (MT5). While MT5 is known for its robust features and user-friendly interface, the performance and reliability of the platform can vary significantly based on the broker's infrastructure.

Traders have reported issues with order execution, including slippage and rejections, which can significantly impact trading outcomes. Additionally, there are concerns about potential platform manipulation, as some users have noted discrepancies in price feeds during volatile market conditions.

Risk Assessment

Using Whiz FX carries inherent risks, primarily due to its unregulated status and questionable operational practices. The following risk assessment summarizes the key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation and oversight. |

| Financial Risk | High | No investor protection measures in place. |

| Operational Risk | Medium | Reports of poor customer service and execution issues. |

Given these risks, traders should approach Whiz FX with extreme caution. It is advisable to consider alternative brokers that offer better regulatory oversight and proven track records of customer satisfaction.

Conclusion and Recommendations

In conclusion, Whiz FX exhibits several characteristics that warrant serious concern regarding its legitimacy as a forex broker. The lack of regulatory oversight, transparency in company operations, and numerous customer complaints suggest that it may not be a safe choice for traders.

For those looking to trade forex, it is strongly recommended to consider regulated brokers with a proven history of reliability and customer support. Alternatives such as brokers licensed by the FCA, ASIC, or CySEC are advisable, as they provide a higher level of security for client funds and more robust consumer protection measures. Always conduct thorough research and due diligence before committing to any trading platform to safeguard your investments.

Is WHIZFX a scam, or is it legit?

The latest exposure and evaluation content of WHIZFX brokers.

WHIZFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WHIZFX latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.