WhizFX 2025 Review: Everything You Need to Know

Executive Summary

WhizFX is a new forex broker. The company registered its website domain in late 2022 and positions itself as a multi-asset trading platform. This detailed whizfx review shows a broker that raises big concerns for potential traders. The company is registered in multiple places including Australia (as WHIZ FX PTY LTD, formerly PINE FX MARKETS PTY LTD) and Canada (as WHIZFX LIMITED since March 18, 2022), but it works without proper regulatory oversight. This raises major red flags about trader protection and fund security.

The broker offers different CFD trading services across forex, energy, stocks, futures, and indices. However, user feedback shows a troubling picture, with a Trustpilot rating of 3.8 stars that hides serious complaints about severe slippage, withdrawal difficulties, and platform accessibility issues. Multiple industry sources have flagged WhizFX as a high-risk platform. Some categorize it as conducting illegal business operations.

This broker may only work for traders with very high risk tolerance who fully understand they could lose all their money. The lack of proper regulatory protection, combined with many user complaints about fund withdrawals, makes WhizFX a questionable choice for most retail traders seeking reliable trading conditions.

Important Notice

Regional Entity Differences: WhizFX operates through different registrations across jurisdictions. While registered in Australia and Canada, the regulatory status varies a lot between regions, which could affect trader protections and legal recourse. The Australian entity operates as WHIZ FX PTY LTD (formerly PINE FX MARKETS PTY LTD), while the Canadian operation is registered as WHIZFX LIMITED. However, neither registration appears to provide complete financial services regulation like major regulatory bodies offer.

Review Methodology: This evaluation uses publicly available information, user feedback from multiple platforms including Trustpilot, and industry reports from financial monitoring services. Given the limited transparency from the broker itself, this assessment relies heavily on third-party sources and user experiences.

Rating Framework

Broker Overview

WhizFX appeared in the forex trading world in 2022. The company established its web presence and corporate structure across multiple jurisdictions. The company's corporate history shows it started as PINE FX MARKETS PTY LTD before changing to its current identity as WHIZ FX PTY LTD in Australia. This rebranding, combined with its recent establishment, raises questions about the company's operational history and track record in financial services.

The broker positions itself as a complete CFD trading provider. It focuses mainly on forex markets while expanding into energy commodities, stock indices, individual equities, and futures contracts. According to available information, WhizFX operates from Saint Vincent and the Grenadines as its primary base, with additional registrations in Australia and Canada to expand its operational reach.

The business model appears to center on providing leveraged trading access across multiple asset classes through CFD instruments. However, specific details about the trading platform technology, execution methods, and operational infrastructure are notably missing from public disclosures. This lack of transparency, particularly for a broker handling client funds, represents a significant concern highlighted throughout this whizfx review. The company's rapid establishment and limited operational transparency suggest traders should use extreme caution when considering this platform for their trading activities.

Regulatory Status: WhizFX maintains registrations in Australia and Canada but lacks authorization from major financial regulatory bodies. The Australian registration as WHIZ FX PTY LTD and Canadian registration as WHIZFX LIMITED do not appear to include complete financial services licenses, leaving traders without traditional regulatory protections.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available public information. This itself represents a transparency concern for potential clients seeking clarity about fund management procedures.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit requirements. This makes it difficult for traders to assess accessibility and account opening costs.

Promotional Offers: Available information does not mention any specific bonus or promotional programs. This may reflect the broker's limited marketing transparency rather than absence of such offers.

Trading Assets: WhizFX provides access to multiple asset classes including forex currency pairs, energy commodities (likely crude oil and natural gas), stock CFDs covering major global markets, futures contracts, and major stock indices. The diversity of offerings suggests an attempt to cater to various trading preferences.

Cost Structure: Specific details about spreads, commissions, overnight financing charges, and other trading costs are not publicly available. This makes it impossible for traders to accurately assess the total cost of trading with this broker.

Leverage Ratios: Information about maximum leverage offerings across different asset classes has not been disclosed in available public materials.

Platform Options: The specific trading platforms offered by WhizFX are not detailed in public information. The broker presumably provides some form of electronic trading interface.

Geographic Restrictions: While the broker operates internationally, specific geographic restrictions and compliance limitations are not clearly outlined in available information.

Customer Support Languages: Available information does not specify the languages supported by customer service teams or the hours of operation for client support services.

This whizfx review finds the lack of detailed operational information particularly concerning for a financial services provider handling client funds and executing trades.

Account Conditions Analysis

WhizFX's account structure and conditions present big transparency challenges that potential traders must carefully consider. The broker has not provided complete public information about its account types, tier structures, or the specific features available to different client categories. This lack of clarity makes it extremely difficult for traders to understand what they can expect when opening an account.

The absence of clear minimum deposit requirements represents a fundamental transparency issue. Most reputable brokers prominently display their account opening requirements, fee structures, and trading conditions. WhizFX's failure to provide this basic information suggests either poor marketing practices or intentional opacity that could hide unfavorable terms.

Account opening procedures and verification requirements remain undisclosed in available public information. This creates uncertainty about the onboarding process, documentation requirements, and time frames for account activation. Professional traders typically require clear understanding of these processes for business planning purposes.

Special account features such as Islamic accounts, professional trader classifications, or institutional account options are not mentioned in available materials. The absence of information about these standard industry offerings suggests either a limited service range or poor communication of available services.

User feedback available through this whizfx review indicates big concerns about account management, particularly regarding fund withdrawals and account access. Multiple users report difficulties accessing their accounts and retrieving funds, which represents the most serious possible account condition issue. These reports suggest that regardless of the specific account terms offered, the practical experience of account management may be severely compromised.

WhizFX's trading tools and educational resources remain largely undocumented in publicly available information. This represents a big gap for traders seeking complete market analysis and learning materials. The broker claims to offer diversified CFD trading services across multiple asset classes, but specific details about the analytical tools, charting capabilities, and research resources are notably absent.

The lack of information about trading platforms is particularly concerning. The platform represents the primary interface between traders and markets. Most established brokers provide detailed specifications about their platform features, including charting tools, technical indicators, automated trading capabilities, and order management systems. WhizFX's failure to provide this fundamental information makes it impossible for traders to assess whether the platform meets their technical requirements.

Research and market analysis resources appear to be either non-existent or poorly communicated. Professional traders typically rely on broker-provided market commentary, economic calendars, news feeds, and analytical reports to inform their trading decisions. The absence of clear information about these resources suggests WhizFX may not provide the research support that serious traders require.

Educational materials and trader development resources are not mentioned in available public information. Most reputable brokers invest a lot in trader education through webinars, tutorials, market analysis training, and educational content libraries. The apparent absence of these resources suggests either a limited commitment to trader development or poor communication of available educational support.

Automated trading support, including Expert Advisor compatibility, algorithmic trading interfaces, and API access, remains unspecified. Modern traders increasingly rely on automated trading strategies, making platform compatibility with these tools essential for many trading approaches.

Customer Service and Support Analysis

Customer service quality represents one of the most concerning aspects revealed in this whizfx review. Multiple user reports indicate serious deficiencies in support responsiveness and problem resolution. The available feedback suggests that WhizFX's customer service fails to meet basic industry standards for financial services providers.

User reports consistently highlight difficulties in reaching customer support representatives and obtaining meaningful assistance with account issues. The most serious complaints involve traders unable to access their accounts or withdraw funds, with customer service apparently unable or unwilling to resolve these critical issues. These reports suggest either inadequate staffing, poor training, or potentially more serious operational problems.

Response time issues appear to be systemic rather than isolated incidents. Multiple user accounts describe extended delays in receiving responses to support inquiries, with some traders reporting complete lack of response to urgent account access requests. This pattern indicates either severe operational deficiencies or intentional avoidance of customer concerns.

Service quality complaints extend beyond response times to include the substance of support interactions. Users report receiving unhelpful responses, being transferred between representatives without resolution, and experiencing apparent disconnection between customer service claims and actual account functionality. These issues suggest either poor training of support staff or systemic problems with account management systems.

The availability of multiple communication channels (phone, email, live chat) is not clearly documented in available information. Most professional brokers provide 24/5 support during market hours through multiple channels, with clear escalation procedures for urgent issues. WhizFX's support infrastructure appears to fall well short of these industry standards.

Multilingual support capabilities and service hours remain unspecified. This creates additional uncertainty for international traders who may require assistance in their native languages or during specific time zones.

Trading Experience Analysis

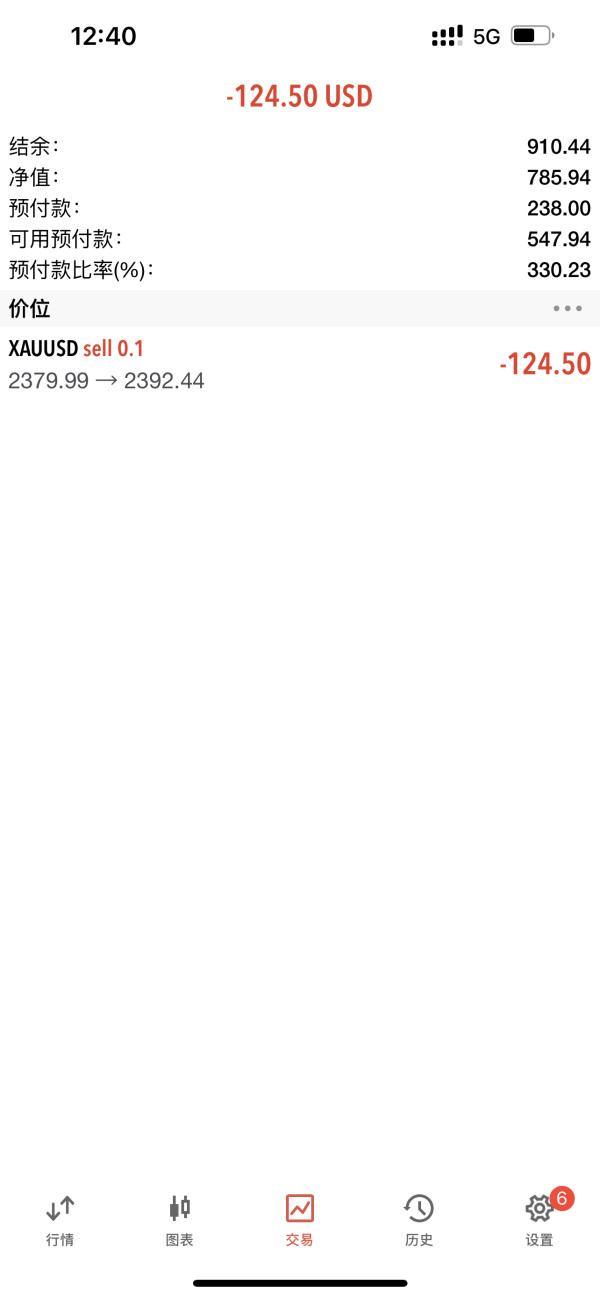

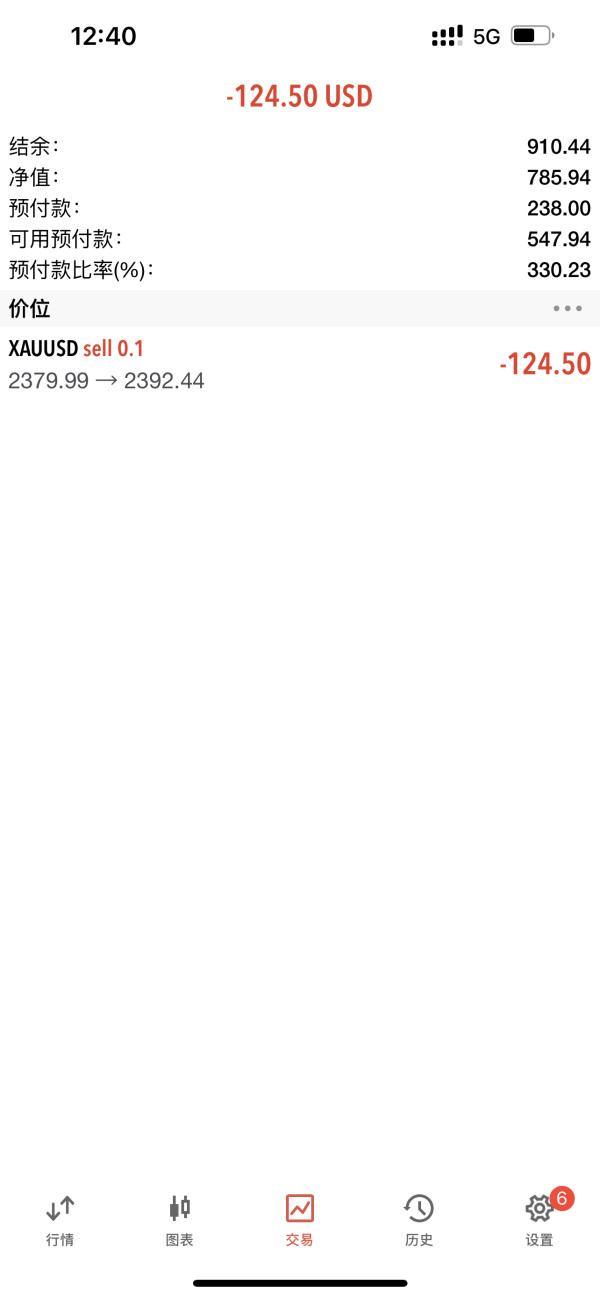

The trading experience offered by WhizFX presents serious concerns based on available user feedback and operational indicators. Multiple traders report big platform stability issues that directly impact their ability to execute trades effectively and manage positions properly. These technical problems appear to be systemic rather than isolated incidents.

Platform stability problems include reports of traders being unable to log into their accounts, particularly during critical trading periods. These access issues represent one of the most serious problems a trader can face, as they prevent position management and can lead to big losses during volatile market conditions. The frequency of these reports suggests underlying technical infrastructure problems.

Order execution quality has drawn substantial criticism from users, with multiple reports of severe slippage that significantly impacts trade profitability. Slippage occurs when trades execute at prices different from those requested, and while some slippage is normal during volatile markets, excessive slippage can indicate poor liquidity management or unfair execution practices. The consistent reports of severe slippage suggest serious execution quality issues.

Requoting problems have been reported by multiple users, indicating that initial price quotes are frequently unavailable when traders attempt to execute orders. Excessive requoting can prevent traders from entering positions at desired price levels and suggests either poor liquidity access or potentially manipulative pricing practices.

The trading environment regarding spreads and liquidity remains poorly documented, making it difficult to assess competitiveness compared to other brokers. However, user complaints about execution quality suggest that even if spreads are competitive on paper, the actual trading costs may be much higher due to slippage and execution problems.

Mobile trading capabilities and cross-platform functionality are not detailed in available information. Given the reported problems with the primary platform, mobile trading reliability remains questionable. This whizfx review finds the overall trading experience to be substantially below industry standards based on available user feedback.

Trust and Reliability Analysis

Trust and reliability represent the most critical concerns identified in this complete whizfx review. Multiple serious red flags exist that potential traders must carefully consider. WhizFX operates without meaningful regulatory oversight from established financial authorities, leaving traders without the protections typically associated with licensed financial services providers.

The regulatory status reveals big gaps in oversight and trader protection. While the company maintains registrations in Australia and Canada, these registrations do not appear to include complete financial services licenses equivalent to those required by major regulatory bodies such as the FCA, ASIC, or CySEC. This regulatory gap means traders lack access to compensation schemes, regulatory complaint procedures, and the operational oversight that licensed brokers must maintain.

Multiple industry sources have flagged WhizFX as a high-risk platform, with some financial monitoring services categorizing it as conducting potentially illegal business operations. These warnings come from independent financial watchdog organizations that monitor broker operations and alert traders to potential risks. The consistency of these warnings across multiple sources suggests serious underlying concerns about the broker's operations.

Fund security measures and client money protection protocols are not disclosed in available public information. Reputable brokers typically maintain segregated client accounts, provide detailed information about fund security measures, and submit to regular audits of their client money handling procedures. WhizFX's failure to provide this fundamental information represents a serious transparency gap.

Corporate transparency issues extend beyond regulatory status to include limited disclosure of company ownership, management structure, and operational procedures. The company's recent establishment combined with rebranding from its previous identity raises questions about operational continuity and management experience in financial services.

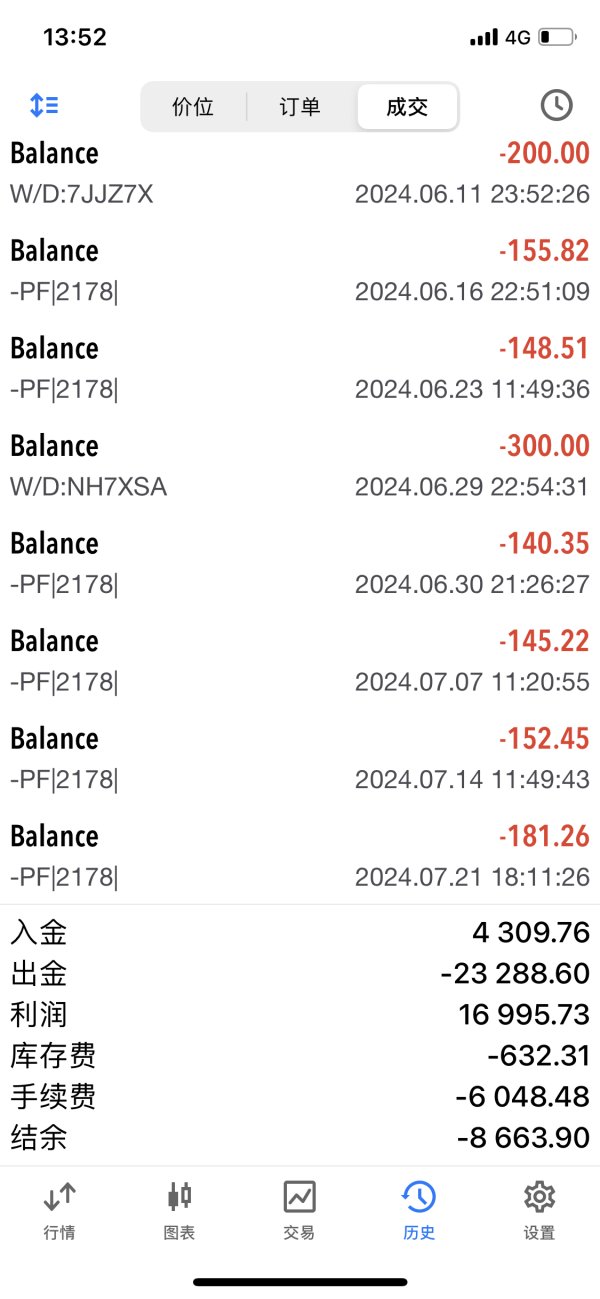

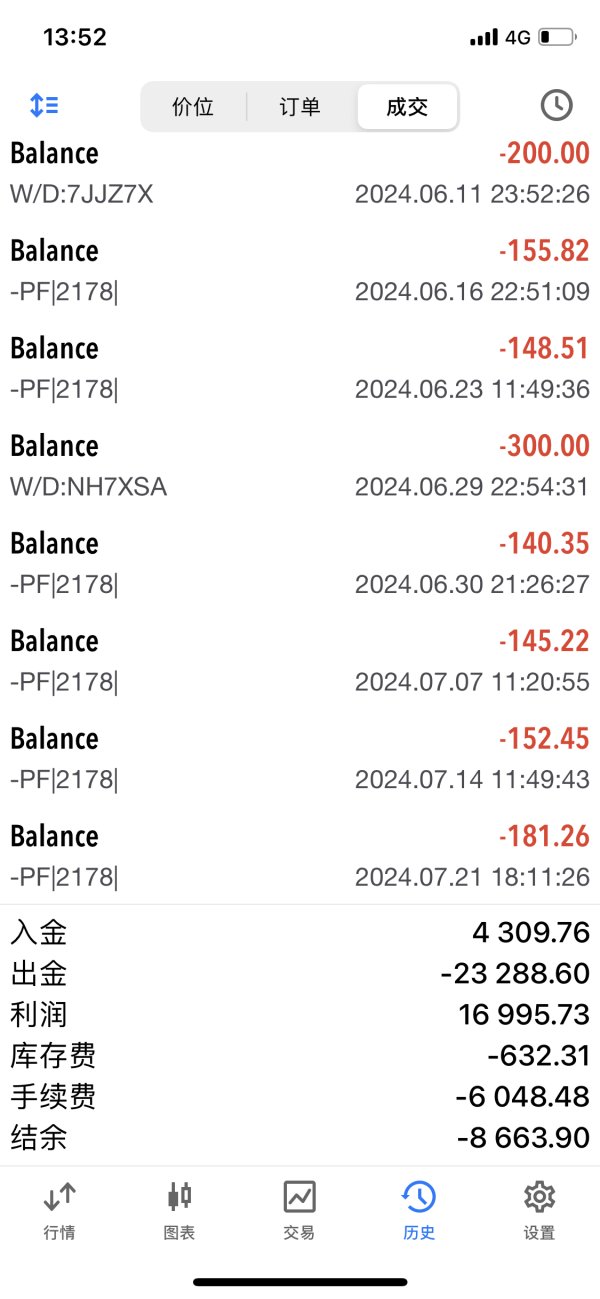

User reports of withdrawal difficulties represent the most serious trust concern, with multiple traders reporting inability to access their funds. These reports, combined with the lack of regulatory protection, suggest that traders face big risk of capital loss beyond normal trading risks.

User Experience Analysis

User experience analysis reveals a troubling pattern of dissatisfaction and operational problems that significantly impact trader satisfaction with WhizFX services. The broker's 3.8-star rating on Trustpilot, while appearing moderate, masks serious underlying issues revealed in detailed user feedback and complaint patterns.

Overall user satisfaction appears to be severely impacted by fundamental operational problems rather than minor service issues. The most serious complaints involve traders' inability to access their funds, which represents a complete breakdown of the basic broker-client relationship. These withdrawal difficulties create extreme stress for affected traders and suggest serious operational or liquidity problems.

Interface design and platform usability information is limited in available user feedback, though the reported login difficulties suggest big problems with basic platform functionality. Traders expect reliable access to their accounts and trading platforms, making access problems a fundamental user experience failure.

The registration and account verification process remains poorly documented, though user complaints about subsequent account access suggest that even successfully opened accounts may become inaccessible. This pattern indicates either poor system design or potentially intentional restrictions on account access.

Fund management experience represents the most critical user experience failure, with multiple reports of withdrawal difficulties and account access problems. These issues go beyond normal processing delays to suggest systematic problems with fund management and client money handling procedures.

Common user complaints center on slippage during trade execution, platform stability problems, and most seriously, inability to withdraw funds. The pattern of complaints suggests that traders who deposit funds with WhizFX face big risk of being unable to recover their capital, regardless of trading performance.

The user demographic appears to include traders seeking diverse asset access, but the negative experiences reported suggest that even traders with high risk tolerance may find the operational problems unacceptable. User feedback consistently recommends extreme caution, with many reviewers advising other traders to avoid the platform entirely.

This whizfx review finds that user experience falls well below acceptable standards for financial services. Fundamental operational failures create serious risks for trader capital and trading success.

Conclusion

This complete whizfx review reveals a broker that presents big risks and operational concerns that potential traders must carefully consider. WhizFX operates without meaningful regulatory oversight, lacks transparency in its operational procedures, and has generated concerning user feedback regarding fund security and platform reliability.

The broker may only be suitable for traders with extremely high risk tolerance who fully understand they could lose all their money. The combination of regulatory gaps, user complaints about withdrawal difficulties, and warnings from industry monitoring services suggests that most retail traders should seek alternative brokers with established regulatory protection and proven operational track records.

The primary advantages of asset diversity and international accessibility are overshadowed by fundamental concerns about fund security, platform reliability, and customer service quality. The lack of effective regulatory oversight means traders have limited recourse if problems arise, making WhizFX a questionable choice for serious trading activities. Potential clients should prioritize brokers with complete regulatory licenses, transparent operational procedures, and positive user feedback regarding fund security and withdrawal processes.