Is ESMOND safe?

Pros

Cons

Is Esmond A Scam?

Introduction

Esmond is a relatively new player in the forex trading market, having been established in 2023. As a forex broker, it offers various trading services and products, including foreign exchange, commodities, and indices. With the rapid growth of the forex market, it is essential for traders to exercise caution and conduct thorough evaluations of brokers before investing their hard-earned money. This article aims to provide a comprehensive assessment of Esmond, focusing on its regulatory status, company background, trading conditions, client safety, customer experience, platform performance, and associated risks. The analysis is based on a review of various online sources and user feedback, ensuring an objective and balanced perspective.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its legitimacy and reliability. A well-regulated broker is typically subject to strict oversight, which helps protect investors' interests. Esmond claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, recent reports indicate that its regulatory license has been revoked, raising concerns about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001307462 | Australia | Revoked |

The revocation of Esmond's license is a significant red flag, as it suggests potential non-compliance with regulatory standards. ASIC is known for its stringent regulations, aimed at safeguarding traders and ensuring fair practices in the financial markets. The revocation of Esmond's license indicates a failure to meet these standards, which could expose traders to increased risks, including the potential for fraud or mismanagement of funds.

Company Background Investigation

Esmond International Markets Pty Ltd, the entity behind the Esmond brand, was founded in Australia in 2023. It operates from its headquarters located at Level 16, 175 Pitt St, Sydney, NSW 2000. The management team, while not extensively detailed in available sources, appears to lack significant experience in the forex industry, which could be a concern for potential investors.

Transparency is a critical factor for any financial institution. Unfortunately, Esmond's website does not provide comprehensive information regarding its ownership structure or the backgrounds of its management team. This lack of transparency may lead to doubts about the broker's credibility and operational integrity. A reputable broker typically provides clear and accessible information about its management and corporate structure to instill confidence among its clients.

Trading Conditions Analysis

Esmond offers a variety of trading conditions, which are essential for traders to consider when selecting a broker. The broker's fee structure includes spreads, commissions, and overnight interest rates. However, the lack of clarity in its fee policies raises concerns.

| Fee Type | Esmond | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.7-1.2 pips | 1.0-2.0 pips |

| Commission Model | $11 per lot | $5-10 per lot |

| Overnight Interest Range | Varies | Varies |

While Esmond's spreads appear competitive, the commission structure is relatively high compared to industry averages. Additionally, the broker does not provide clear information regarding overnight interest rates, which can significantly impact trading costs. This lack of transparency in fees may lead to unexpected costs for traders, making it essential to clarify these terms before opening an account.

Client Funds Security

The safety of client funds is paramount when choosing a forex broker. Esmond claims to implement various safety measures, including fund segregation and negative balance protection. However, the effectiveness of these measures is questionable given the revocation of its regulatory license.

Esmond does not provide detailed information about its fund segregation practices or investor protection schemes. Without proper regulatory oversight, there are no guarantees that client funds are adequately protected. Additionally, the absence of a clear history regarding any past security issues raises further concerns about the broker's reliability.

Customer Experience and Complaints

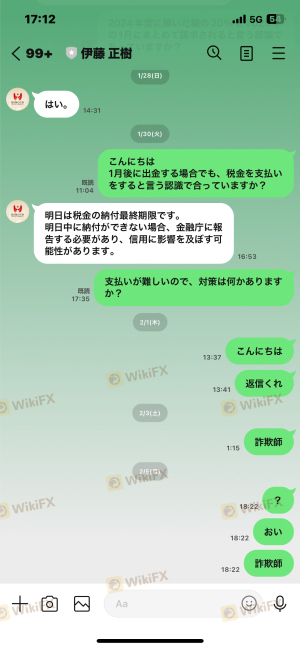

Customer feedback is a vital aspect of evaluating a broker's performance. Reviews of Esmond indicate mixed experiences among users. While some users report a smooth account setup process, others have raised serious concerns about withdrawal issues and difficulty contacting customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Average |

Several complaints highlight the inability to withdraw funds, with users claiming that their withdrawal requests went unanswered for extended periods. Such issues can indicate deeper systemic problems within the broker's operations and may suggest a lack of commitment to customer service.

Platform and Execution

Esmond utilizes the MetaTrader 4 (MT4) platform, known for its user-friendly interface and powerful trading tools. However, users have reported mixed experiences regarding platform stability and execution quality. Some traders have experienced slippage and rejected orders, which can significantly impact trading performance.

The quality of order execution is critical for traders, especially in the fast-paced forex market. Reports of slippage and rejected orders could indicate potential manipulation or technical issues within the platform, further raising concerns about the broker's integrity.

Risk Assessment

Using Esmond as a forex broker presents several risks that potential investors should consider. The revocation of its regulatory license, lack of transparency, and mixed customer feedback contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | License revoked |

| Fund Security | High | Lack of clear protection |

| Customer Support | Medium | Mixed feedback on support |

To mitigate these risks, traders should approach Esmond with caution. It is advisable to start with a small investment or explore alternative brokers with a solid regulatory framework and positive customer reviews.

Conclusion and Recommendations

In conclusion, Esmond raises several red flags that warrant caution. The revocation of its regulatory license, lack of transparency regarding its management and operations, and mixed feedback from customers suggest that potential investors should be wary. While Esmond may offer competitive trading conditions, the associated risks make it a less favorable choice for traders seeking a reliable and secure trading environment.

For traders looking for more secure alternatives, consider brokers that are well-regulated by reputable authorities, such as the FCA or ASIC, and have a proven track record of positive customer experiences. Some recommended alternatives include brokers like HFM, Black Bull Markets, or FP Markets, which offer robust regulatory protections and transparent trading conditions. Always conduct thorough research and consider your risk tolerance before choosing a forex broker.

Is ESMOND a scam, or is it legit?

The latest exposure and evaluation content of ESMOND brokers.

ESMOND Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ESMOND latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.