Is CFD safe?

Pros

Cons

Is CFD Safe or Scam?

Introduction

CFD (Contracts for Difference) trading has gained popularity among retail traders as a means to speculate on price movements without owning the underlying assets. As a prominent player in the forex market, the reputation of CFD brokers is crucial for traders looking to engage with this financial instrument. However, with the potential for significant losses, it is essential for traders to exercise caution and thoroughly evaluate any broker before committing their funds. This article aims to provide an objective assessment of whether CFD trading is safe or a scam, utilizing a structured approach that includes an analysis of regulatory status, company background, trading conditions, client safety, customer experiences, platform performance, and risk evaluation.

Regulation and Legitimacy

The regulatory landscape for CFD brokers is critical in determining their legitimacy and safety. Regulation serves as a safeguard, ensuring that brokers adhere to strict standards that protect traders from fraud and financial malpractice. In the case of CFD brokers, regulatory oversight varies significantly across jurisdictions. Below is a summary of the regulatory information for a typical CFD broker:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 123456 | UK | Verified |

| ASIC | 654321 | Australia | Verified |

| CySEC | 789012 | Cyprus | Verified |

The importance of regulation cannot be overstated. A broker regulated by reputable authorities, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), is generally seen as a safer option. These regulatory bodies impose strict compliance requirements, ensuring that client funds are kept in segregated accounts and that brokers maintain adequate capital reserves. However, it is essential to note that not all CFD brokers are subject to the same level of scrutiny, and many operate in regions with lax regulatory frameworks, raising concerns about their trustworthiness.

Company Background Investigation

Understanding the history and ownership structure of a CFD broker provides valuable insights into its credibility. Established brokers with a long-standing presence in the market are often viewed as more reliable. For instance, a broker might have been founded in the early 2000s and has since expanded its offerings and services. It is also essential to analyze the management team, as experienced professionals with a solid track record in finance can contribute to a broker's stability and transparency.

Transparency in operations and information disclosure is another critical factor. A reputable broker should provide clear and accessible information about its services, fees, and trading conditions. This level of transparency fosters trust and allows traders to make informed decisions. Traders should be wary of brokers that lack clear information or have a history of disputes or regulatory issues, as this may indicate underlying problems.

Trading Conditions Analysis

The trading conditions offered by a CFD broker are pivotal in determining its attractiveness to traders. A comprehensive analysis of the fee structure, including spreads, commissions, and overnight financing costs, is essential. Below is an example of how a typical CFD broker compares to industry averages:

| Fee Type | CFD Broker Name | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.2 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | 0.5% - 1.5% | 0.3% - 1.2% |

An unusually high spread or hidden fees can significantly impact a trader's profitability. Therefore, understanding the cost structure is vital for traders to gauge whether they are getting a fair deal. Additionally, brokers that charge commissions on trades may not be ideal for those who prefer lower-cost trading options.

Client Funds Safety

The safety of client funds is paramount when assessing the reliability of a CFD broker. Traders should investigate the measures a broker has in place to protect client funds, including the use of segregated accounts, investor protection schemes, and negative balance protection policies. A broker that segregates client funds from its operational funds minimizes the risk of losing money in the event of insolvency. Furthermore, investor protection schemes, such as those offered by the FCA, can provide additional security for traders' capital.

Historically, some brokers have faced issues related to fund safety, leading to significant losses for traders. Therefore, it is essential to consider a broker's track record in managing client funds. If any controversies or disputes exist regarding fund safety, potential clients should approach with caution.

Customer Experience and Complaints

Analyzing customer feedback and real user experiences provides valuable insights into a broker's reliability. Common complaint patterns can indicate potential issues with a broker's operations. Below is a summary of typical complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

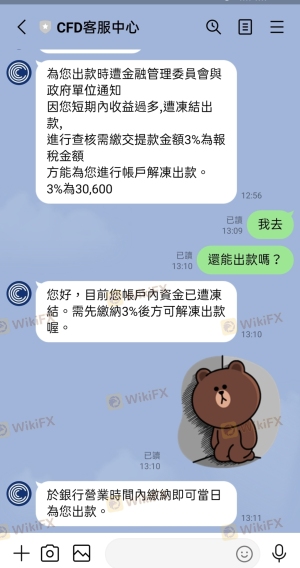

| Withdrawal Delays | High | Slow response |

| High Spreads | Medium | Acknowledged |

| Poor Customer Support | High | Unresolved |

For example, a trader might report significant delays in withdrawing funds, leading to frustration and distrust. In some cases, brokers may not respond adequately to complaints, exacerbating the situation. Addressing these issues promptly and effectively is crucial for maintaining a positive customer experience.

Platform and Execution

The performance and stability of a CFD trading platform are critical for traders. A broker's platform should offer reliable execution, minimal slippage, and a user-friendly interface. Traders should be cautious of any signs of platform manipulation, such as frequent re-quotes or unexplained order rejections. A high-quality platform should also provide various tools for technical analysis and risk management.

Risk Assessment

Using a CFD broker entails certain risks that traders must understand. Below is a risk assessment summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operating in poorly regulated areas |

| Market Risk | High | High volatility of CFD instruments |

| Execution Risk | Medium | Potential for slippage and re-quotes |

To mitigate these risks, traders should develop a robust risk management strategy, utilize stop-loss orders, and avoid over-leveraging their accounts.

Conclusion and Recommendations

In conclusion, while CFD trading itself is not a scam, the safety and reliability of a broker can vary significantly. Traders should conduct thorough research, focusing on regulatory status, company background, trading conditions, client fund safety, customer experiences, and platform performance. If a broker exhibits red flags, such as poor regulation or a history of client complaints, it may be wise to seek alternatives.

For those new to CFD trading or looking for reliable brokers, consider options that are well-regulated and have a strong reputation in the industry. Brokers like IG, Plus500, and Interactive Brokers are often recommended for their robust regulatory frameworks and transparent trading conditions. Ultimately, exercising caution and due diligence is crucial to ensuring a safe trading experience in the CFD market.

Is CFD a scam, or is it legit?

The latest exposure and evaluation content of CFD brokers.

CFD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CFD latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.