CFD 2025 Review: Everything You Need to Know

Executive Summary

Contract for Difference trading has changed a lot in 2025. It now offers traders easy access to many types of investments like forex, shares, and digital currencies. This complete cfd review looks at how CFD trading works today by studying popular platforms such as Plus500, eToro, IG, and CMC Markets. CFDs are still trading tools that follow the price of other investments, giving chances to both regular people and big companies who trade.

The CFD market keeps bringing in traders who want different investment choices without actually owning the real investments. New market studies show that CFD brokers have made their services better with improved technology, smaller price differences, and more helpful learning materials. But rule changes in different countries have also created new requirements that change how brokers work and help their customers.

This review helps traders who want many investment choices and those who like trading with borrowed money. The study shows that CFD trading gives a lot of flexibility and access to markets around the world, but traders must think carefully about choosing platforms, following rules, and managing risks when picking their favorite broker.

Important Notice

This review comes from detailed study of user reviews, how platforms work, and market feedback available in January 2025. CFD trading rules are very different in various countries, so traders should check that their chosen broker has proper licenses in their area.

The study method uses information from many places including broker comparisons, user stories, and official rule documents. Readers should know that CFD trading has big risks, and past success does not promise future results. All information shown comes from public data and should be added to with personal research before making trading choices.

Rating Framework

Broker Overview

Contract for Difference is a smart financial tool that lets traders bet on price changes without owning the real investment. Market reports show that CFDs have become more popular because they are flexible and easy to use across many types of investments. The tool lets traders make money from both rising and falling markets, which makes it very attractive when markets change a lot.

The CFD market works through agreements between traders and brokers to exchange the difference in an investment's value between when the contract opens and closes. This system gives leverage chances while keeping capital needs relatively low compared to traditional investment ownership. Recent market studies show that CFD trading amounts have grown a lot, driven by more regular people joining and technology getting better in trading platforms.

Top CFD platforms including Plus500, eToro, IG, and CMC Markets have become market leaders by offering many investments and easy-to-use interfaces. These platforms usually give access to forex pairs, individual stocks, market indexes, raw materials, and digital currencies through one trading account. Competition has gotten stronger, with brokers focusing on smaller price differences, faster trade completion, and better mobile trading abilities.

Rule oversight changes a lot across countries, with major financial authorities making specific rules for CFD providers. The rule environment keeps changing, especially about leverage limits, protection from negative balances, and marketing restrictions. This rule framework aims to protect regular traders while keeping market honesty and fair competition among service providers.

Regulatory Regions: CFD regulation covers many areas including the UK's FCA, Cyprus' CySEC, Australia's ASIC, and various European authorities under MiFID II. Specific rule requirements change by region, affecting leverage limits and what products are available.

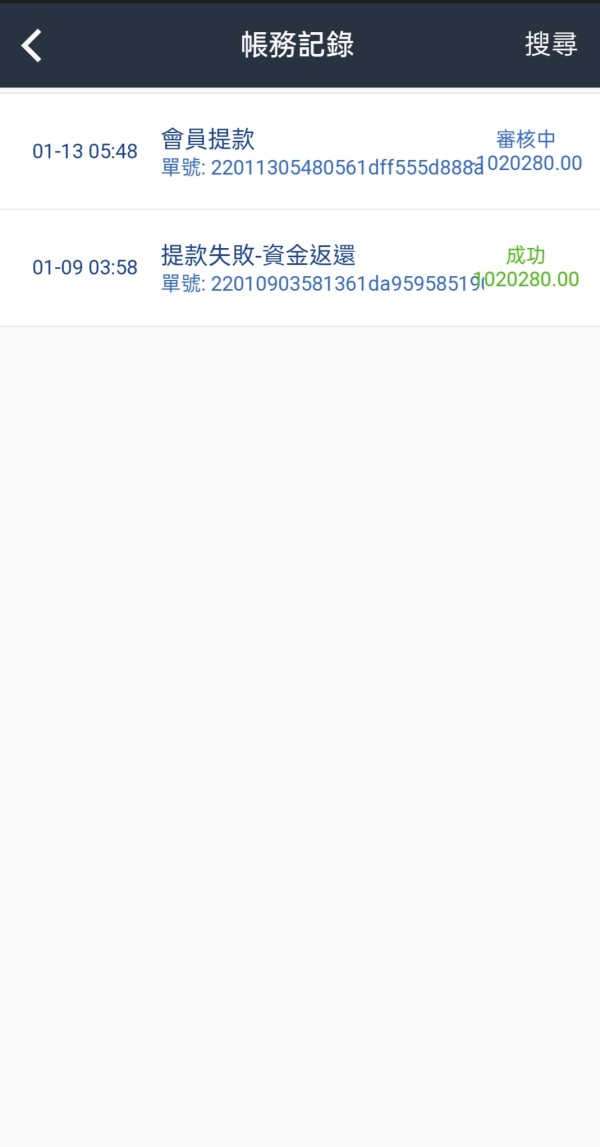

Deposit and Withdrawal Methods: Most CFD brokers accept bank transfers, credit cards, debit cards, and electronic wallets. Processing times usually range from instant for electronic methods to 3-5 business days for bank transfers.

Minimum Deposit Requirements: Starting requirements change a lot among providers, with some platforms offering accounts from as little as $100 while others need $500 or more for full access. Entry costs vary based on the broker and account type chosen.

Promotional Offers: Bonus structures have become less common due to rule restrictions, though some brokers still offer welcome bonuses, reduced spreads, or educational rewards for new clients.

Tradeable Assets: CFDs give access to forex pairs, individual stocks from major exchanges, market indexes, raw materials including precious metals and energy, and digital currency pairs. What investments are available depends on rule area and broker licensing.

Cost Structure: Trading costs usually include spreads, overnight financing charges, and possible commission fees. Competitive spreads range from 0.6 pips on major forex pairs to wider spreads on unusual investments and digital currencies.

Leverage Ratios: Leverage limits are controlled by area, with regular clients in Europe limited to 30:1 on major forex pairs and lower ratios for other investments. Professional clients may access higher leverage levels.

Platform Options: Popular platforms include Plus500, eToro, IG, and CMC Markets, each offering their own trading software with mobile apps and web-based access.

Geographic Restrictions: Service availability changes by country due to rule restrictions, with some regions having limited access to CFD trading. Some areas cannot use certain CFD services at all.

Customer Support Languages: Most major brokers provide support in many languages, though specific language availability depends on the provider and target markets.

This complete cfd review shows how complex it is to choose the right CFD services in today's regulated world.

Detailed Rating Analysis

Account Conditions Analysis

Account structure information stays limited across many CFD providers, making complete evaluation challenging for potential traders. Available information suggests that most brokers offer layered account structures, though specific details about minimum deposits, account benefits, and upgrade requirements are not consistently shared across platforms.

The account opening process usually involves online application, identity checking, and financial suitability review. However, the time needed for account approval changes a lot among providers, with some offering instant approval while others need several business days for verification completion. This inconsistency affects trader experience, especially for those wanting immediate market access.

Special account features such as Islamic accounts for religious trading rules are available from select brokers, though availability and terms change considerably. Professional account types offer enhanced leverage and reduced rule restrictions, but qualification requirements differ among areas and providers.

Account maintenance fees and inactivity charges are not uniformly applied across the industry, creating additional complexity for traders comparing options. Some providers charge monthly fees for inactive accounts, while others impose withdrawal fees or minimum trading requirements. This cfd review identifies account condition transparency as an area needing improvement across the industry.

The quality and variety of trading tools represent a significant strength in the current CFD landscape. Leading platforms like Plus500, eToro, IG, and CMC Markets have invested heavily in advanced charting abilities, technical analysis tools, and market research resources. These platforms usually offer complete chart packages with multiple timeframes, technical indicators, and drawing tools essential for modern trading strategies.

Research abilities change a lot among providers, with some offering institutional-grade market analysis while others focus mainly on basic price data and news feeds. Economic calendars, earnings schedules, and market sentiment indicators are commonly available, though depth and accuracy differ among platforms.

Educational resources have become increasingly sophisticated, with many brokers providing webinars, trading courses, and market tutorials. However, the quality and completeness of educational content changes considerably, with some providers offering extensive learning libraries while others provide minimal educational support.

Automated trading support through Expert Advisors or copy trading features has gained popularity, especially on platforms like eToro which emphasizes social trading abilities. These features appeal to both new traders seeking guidance and experienced traders looking to diversify their strategies through automation.

Customer Service and Support Analysis

Customer service quality assessment proves challenging due to limited publicly available information about response times, support channels, and service quality measures. Most major CFD brokers offer multiple contact methods including live chat, email, and telephone support, though availability hours and response efficiency change a lot.

Multilingual support abilities are generally strong among established brokers, reflecting their international client base and rule requirements. However, the quality of non-English support and cultural sensitivity in customer interactions are not consistently documented across providers.

Technical support for platform issues, account problems, and trading disputes represents a critical service area where broker performance directly impacts trader satisfaction. Unfortunately, detailed information about problem resolution procedures and escalation processes is rarely shared publicly, making comparative assessment difficult.

The availability of dedicated account managers for higher-tier clients changes among providers, with some offering personalized service while others rely mainly on general support channels. This difference in service levels can significantly impact the trading experience for active or high-volume traders.

Trading Experience Analysis

Platform stability and execution speed represent fundamental aspects of CFD trading experience. Popular platforms including Plus500, eToro, IG, and CMC Markets generally receive positive feedback regarding system reliability and order execution quality. However, performance can change during high-volatility periods when server loads increase significantly.

Order execution quality includes factors such as slippage, requotes, and fill rates, which directly impact trading profitability. While specific execution statistics are rarely published by brokers, user feedback suggests that established platforms generally provide competitive execution standards, though performance may change by investment class and market conditions.

Mobile trading abilities have become essential for modern CFD trading, with most leading brokers offering complete mobile applications. These apps usually provide full trading functionality, real-time pricing, and account management features, though user interface quality and feature completeness change among providers.

The overall trading environment includes factors such as available order types, risk management tools, and platform customization options. Advanced order types like stop-loss, take-profit, and trailing stops are standard features, though implementation and reliability can differ among platforms. This cfd review emphasizes the importance of testing platform functionality through demo accounts before committing capital.

Trust and Security Analysis

Rule compliance represents the foundation of broker trustworthiness in CFD trading. However, complete rule information is not consistently available across all providers, making thorough evaluation challenging for potential clients. Major brokers usually hold licenses from respected authorities, though the quality and scope of rule oversight changes by area.

Fund security measures including separated client accounts, deposit protection schemes, and negative balance protection are critical for trader safety. While most regulated brokers implement these protections, specific details about coverage limits and claim procedures are not always clearly shared with clients.

Company transparency regarding ownership structure, financial statements, and rule status changes a lot among CFD providers. Some brokers provide complete corporate information while others offer minimal disclosure, affecting trader ability to assess counterparty risk accurately.

Industry reputation and track record provide important indicators of broker reliability, though historical performance does not guarantee future behavior. The handling of negative events, rule actions, and client disputes offers insight into broker integrity and operational standards.

User Experience Analysis

Overall user satisfaction appears positive for leading CFD platforms based on available feedback, with traders especially appreciating the variety of available investments and platform functionality. However, satisfaction levels change a lot based on trader experience level, trading style, and specific platform features utilized.

Interface design and usability represent important factors affecting trader productivity and satisfaction. Modern CFD platforms generally emphasize clean, intuitive designs with customizable layouts, though learning curves can be significant for complex platforms offering extensive functionality.

Registration and verification processes have been streamlined by most major brokers, though completion times and documentation requirements change by area and client classification. Some providers offer instant account opening while others require extensive verification procedures that can delay trading access.

Common user complaints often relate to withdrawal processing times, customer service responsiveness, and platform stability during volatile market conditions. However, specific feedback patterns are not consistently documented across different broker review platforms, limiting complete assessment abilities.

Conclusion

This complete CFD review reveals a mature but diverse market offering significant opportunities for traders seeking access to multiple investment classes through leveraged instruments. The overall assessment remains neutral, reflecting both the strengths and limitations identified across different evaluation criteria.

CFD trading appears most suitable for traders seeking diversified investment options, those comfortable with leveraged products, and individuals preferring flexible trading approaches across multiple markets. The availability of popular platforms like Plus500, eToro, IG, and CMC Markets provides traders with established options backed by rule oversight.

The primary advantages include investment diversity, platform variety, and generally positive user experiences with leading providers. However, significant disadvantages include limited transparency regarding account conditions, inconsistent rule information disclosure, and variable customer service quality. Traders should conduct thorough research and consider their specific needs, risk tolerance, and rule requirements when selecting CFD providers.