Is BTC safe?

Pros

Cons

Is BTC Safe or Scam?

Introduction

BTC is a brokerage firm that positions itself within the forex and cryptocurrency markets, offering traders a platform to engage in various financial instruments. As the digital trading landscape continues to evolve, it is crucial for traders to exercise caution when selecting a broker. The rise of scams and unregulated entities in the forex market necessitates a thorough evaluation of any potential trading partner. This article aims to investigate the credibility of BTC by examining its regulatory status, company background, trading conditions, customer fund security, and user experiences. Our analysis is based on a comprehensive review of available data, including user reviews, regulatory records, and expert opinions.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety and legitimacy of any brokerage. A well-regulated broker is typically subject to stringent oversight, which helps protect traders' interests. In the case of BTC, it is essential to assess its regulatory status and compliance history.

| Regulatory Body | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| Not Available | N/A | N/A | Not Verified |

As evident from the table, BTC lacks regulation from recognized authorities. The absence of a regulatory framework raises significant concerns regarding the legitimacy of BTC as a trading platform. Without oversight from a reputable regulator, traders may find themselves exposed to various risks, including unfair trading practices and potential fraud. Furthermore, the lack of historical compliance records makes it challenging to ascertain the broker's commitment to ethical trading practices.

Company Background Investigation

Understanding the history and ownership structure of a brokerage can provide insight into its reliability. BTC appears to have a limited public profile, which raises questions about its transparency and operational history.

The companys management team is not well-documented, making it difficult to evaluate their professional backgrounds and experience in the financial sector. Transparency is vital for building trust, and the lack of accessible information about BTC's leadership could deter potential clients. Moreover, if a brokerage does not provide clear information about its operations, it may indicate a lack of accountability, which is a red flag for traders.

Trading Conditions Analysis

Examining the trading conditions offered by BTC is crucial in determining whether it is a viable option for traders. A fair and transparent fee structure is essential for any brokerage to maintain credibility.

| Fee Type | BTC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5%-1% |

The table indicates that BTC does not provide clear information regarding its fees and commissions. The absence of this data is concerning, as traders rely on transparent fee structures to make informed decisions. Hidden fees or unfavorable commission models can significantly impact trading profitability, and the lack of clarity raises doubts about BTC's integrity as a broker.

Customer Fund Security

The safety of customer funds is paramount when choosing a broker. Traders need assurance that their investments are protected against potential risks.

BTC's security measures regarding customer funds remain unclear. It is essential for brokers to implement fund segregation practices, investor protection mechanisms, and negative balance protection policies to safeguard clients' assets. Without these protective measures, traders may face significant financial risks. Historical issues regarding fund security, if any, could further exacerbate concerns about BTC's reliability.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's performance and reliability. Analyzing user experiences can help identify common issues and the broker's responsiveness to complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Service | Medium | Slow to respond |

| Lack of Transparency | High | Ignored concerns |

The table outlines some of the major complaints associated with BTC. Users have reported significant delays in withdrawals and poor customer service, indicating a lack of support when issues arise. The severity of these complaints suggests that BTC may not prioritize customer satisfaction, which is a concerning factor for potential traders. A few cases of unresolved issues highlight the need for better communication and responsiveness from the brokerage.

Platform and Execution

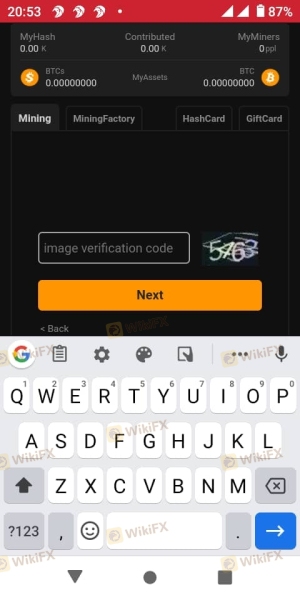

The performance and reliability of the trading platform are crucial for effective trading. A robust platform should provide seamless execution, minimal slippage, and a user-friendly interface.

BTCs platform performance is difficult to assess due to limited user feedback. However, any signs of execution issues, such as high slippage or frequent rejections of orders, could indicate potential manipulation or inefficiencies within the trading system. Traders should be wary of platforms that do not provide a transparent trading environment, as this can lead to significant financial losses.

Risk Assessment

Using BTC as a trading partner carries inherent risks that traders must consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight and regulation |

| Fund Security Risk | High | Unclear security measures |

| Customer Support Risk | Medium | Poor response to complaints |

The risk assessment indicates a high level of concern regarding regulatory and fund security risks. The absence of regulatory oversight places traders at a higher risk of encountering fraudulent practices. Furthermore, the lack of clarity about fund security measures could jeopardize client investments. Traders should carefully consider these risks before engaging with BTC.

Conclusion and Recommendations

In conclusion, the investigation into BTC raises several red flags regarding its legitimacy as a trading broker. The lack of regulation, transparency, and customer support indicates that BTC may not be a safe choice for traders. If you are considering trading with BTC, it is crucial to proceed with caution.

For traders seeking reliable alternatives, consider brokers with robust regulatory oversight, transparent fee structures, and positive customer feedback. Reputable options include brokers like eToro, Interactive Brokers, and Capital.com, which have established themselves as trustworthy entities in the trading landscape. Always prioritize safety and conduct thorough research before committing to any broker.

In summary, is BTC safe? The evidence suggests that traders should be wary and consider other more reputable options in the market.

Is BTC a scam, or is it legit?

The latest exposure and evaluation content of BTC brokers.

BTC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BTC latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.