BTC Review 1

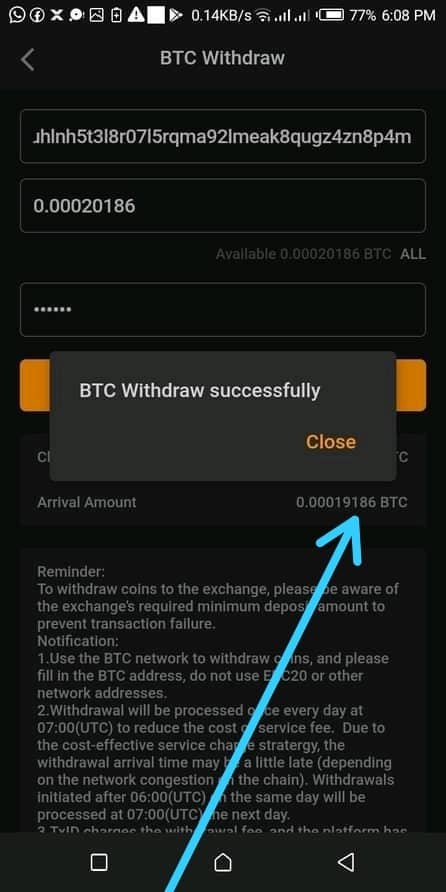

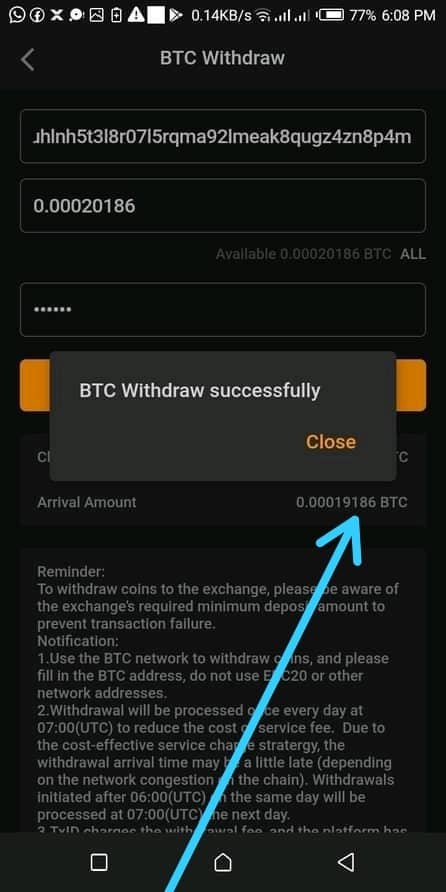

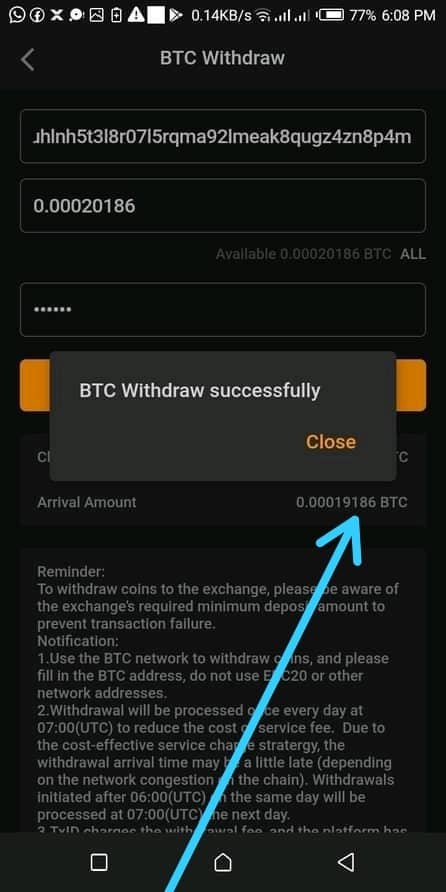

EVER SINCE I PLACED WITHDRAWAL ON THIS BROKER, IT HAS BEEN PENDING, DON'T KNOW WHAT TO DO ANYMORE

BTC Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

EVER SINCE I PLACED WITHDRAWAL ON THIS BROKER, IT HAS BEEN PENDING, DON'T KNOW WHAT TO DO ANYMORE

This comprehensive btc review examines Bitcoin trading opportunities in 2025. It focuses on available platforms and trading conditions for cryptocurrency enthusiasts. Bitcoin has reached unprecedented heights based on recent market data. Prices broke to new all-time highs of $112,000 in May 2025. Traders seeking exposure to Bitcoin and other cryptocurrencies need to understand available trading platforms and their offerings.

The trading landscape for Bitcoin presents mixed opportunities. Some brokers offer impressive leverage ratios up to 1:400 for BTC/USD pairs, while others provide more conservative approaches. Leading platforms like IC Markets offer trading in 23 cryptocurrency CFDs according to FXEmpire reports. This includes BTC/USD and BCH/USD pairs. However, regulatory restrictions vary significantly across jurisdictions. US clients often have limited cryptocurrency options compared to international traders.

This review targets high-risk tolerance traders and Bitcoin investors who seek leveraged exposure to cryptocurrency markets. The analysis reveals that opportunities exist for substantial returns. However, traders must navigate varying regulatory environments and platform limitations that could impact their trading strategies.

Regional Entity Differences: Trading conditions and available services may vary significantly between different regional entities. Traders should carefully verify the specific regulations and offerings available in their jurisdiction before making any trading decisions.

Review Methodology: This evaluation is based on publicly available information from multiple industry sources. These include broker websites, regulatory filings, and market data providers. The assessment does not include direct user feedback collection or proprietary testing. Traders should conduct their own due diligence before selecting a trading platform.

| Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | 6/10 | Maximum leverage of 1:400 available, but specific account details not comprehensively detailed |

| Tools and Resources | 7/10 | Supports BTC/USD and BCH/USD trading with established platforms |

| Customer Service | N/A | Insufficient information available in source materials |

| Trading Experience | 7/10 | Based on established platform infrastructure and cryptocurrency offerings |

| Trust and Regulation | 4/10 | Limited regulatory information available in reviewed sources |

| User Experience | N/A | Specific user experience data not detailed in available materials |

The Bitcoin trading landscape in 2025 presents a complex environment where traditional brokers increasingly offer cryptocurrency exposure alongside conventional forex and CFD products. Industry reports show that the integration of Bitcoin trading into mainstream brokerage platforms has accelerated. This is driven by institutional adoption and growing retail demand for cryptocurrency investment vehicles.

The business model for Bitcoin trading typically revolves around CFD products. These allow traders to speculate on Bitcoin price movements without actually owning the underlying cryptocurrency. This approach provides several advantages including the ability to use leverage, go short on Bitcoin prices, and integrate cryptocurrency trading with existing forex trading strategies.

Platform infrastructure varies considerably across providers. Some brokers use established trading platforms while others develop proprietary solutions. The asset coverage typically extends beyond Bitcoin to include other major cryptocurrencies. However, the specific selection depends on regulatory constraints and the broker's risk management policies. Regulatory oversight remains fragmented across different jurisdictions, creating varying levels of protection and trading conditions for clients based on their geographic location.

Market makers and liquidity providers play crucial roles in determining the quality of Bitcoin trading execution. Spreads and execution speeds vary significantly between different platforms. The volatility inherent in cryptocurrency markets requires robust risk management systems and appropriate position sizing tools to help traders manage their exposure effectively.

Regulatory Landscape: The regulatory environment for Bitcoin trading remains complex and jurisdiction-dependent. Specific regulatory information was not detailed in the available source materials. This indicates potential variations in oversight and client protection across different regions.

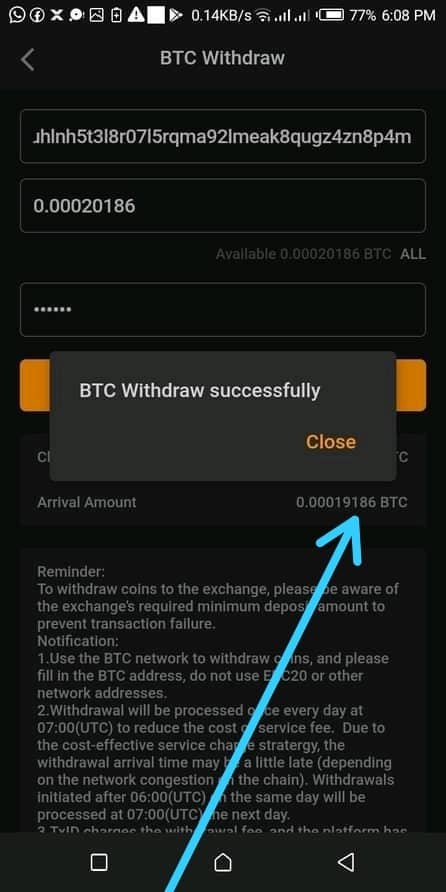

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options was not comprehensively detailed in the reviewed materials. Traders should verify available funding methods directly with their chosen platform.

Minimum Deposit Requirements: Minimum deposit thresholds were not specified in the available source materials. This suggests these may vary between different account types and regional offerings.

Promotional Offers: Current bonus and promotional information was not detailed in the reviewed materials. Traders should check directly with platforms for any available incentives.

Tradeable Assets: Trading is available in 23 cryptocurrency CFDs according to IC Markets data. This includes BTC/USD and BCH/USD pairs. However, US clients face restrictions with access limited to just 3 cryptocurrencies. BTC, BCH, and ETH are available to residents of 47 states.

Cost Structure: Trading costs vary across platforms. Some reports indicate higher fee structures. Specific spread and commission details require direct verification with individual brokers.

Leverage Options: Maximum leverage ratios reach 1:400 for BTC/USD pairs on certain platforms. However, these high leverage options may not be available to all client categories or jurisdictions.

Platform Selection: Various platforms serve Bitcoin traders. Established names in the industry provide cryptocurrency CFD access alongside traditional forex offerings.

Geographic Restrictions: Significant limitations exist for US-based traders. They typically have access to fewer cryptocurrency options compared to international clients.

Customer Support Languages: Specific language support information was not detailed in the available review materials.

The account conditions for Bitcoin trading in 2025 present a mixed landscape that reflects both opportunities and limitations within the current regulatory environment. Some platforms offer attractive leverage ratios of up to 1:400 for BTC/USD trading. However, the specific details regarding account types, minimum balance requirements, and tier-based benefits remain unclear from available sources.

The lack of comprehensive account structure information poses challenges for traders attempting to evaluate the full cost-benefit analysis of different platforms. This btc review finds that while high leverage options exist, the absence of detailed account opening procedures and specific feature comparisons limits the ability to provide definitive recommendations.

Account verification processes and documentation requirements likely vary between platforms and jurisdictions. However, specific information was not available in the reviewed materials. The regulatory compliance requirements for cryptocurrency trading may impose additional verification steps compared to traditional forex accounts.

Special account features were not specifically addressed in the available information. These include Islamic-compliant trading options or professional trader classifications. This indicates a need for direct platform consultation to understand the full range of available account options.

The tools and resources available for Bitcoin trading have evolved significantly. Platforms now offer comprehensive cryptocurrency CFD trading alongside traditional forex instruments. Major platforms provide access to 23 cryptocurrency CFDs according to industry reports. This includes popular pairs like BTC/USD and BCH/USD, indicating robust asset coverage for cryptocurrency traders.

The integration of Bitcoin trading into established trading platforms suggests access to professional-grade charting tools, technical analysis indicators, and real-time market data feeds. However, specific details regarding proprietary research resources, educational materials, or advanced analytical tools were not comprehensively covered in the available source materials.

Automated trading support and algorithmic trading capabilities for cryptocurrency markets remain unclear from the reviewed information. However, the integration with established platforms suggests these features may be available. The quality and depth of market analysis resources require direct platform evaluation. This includes fundamental analysis tools specific to cryptocurrency markets.

The technological infrastructure supporting Bitcoin trading appears robust given the involvement of established brokers. However, specific performance metrics and tool availability details were not provided in the source materials.

Customer service and support information was not adequately detailed in the available source materials. This prevents a comprehensive evaluation of this crucial aspect of the trading experience. The absence of specific information regarding support channels, response times, and service quality represents a significant gap in the available data.

Multi-language support capabilities were not specified in the reviewed materials. These are particularly important for international cryptocurrency traders. The availability of 24/7 support remains unclear from the available information. This is essential for cryptocurrency markets that operate continuously.

Response time expectations and escalation procedures for account issues or technical problems were not detailed in the source materials. The quality of support staff training could not be assessed based on available information. This particularly applies to cryptocurrency-specific issues and market dynamics.

Without specific user feedback or documented support experiences, it is impossible to provide a meaningful evaluation of the customer service quality. Traders should directly verify support capabilities and test responsiveness before committing to any platform for Bitcoin trading activities.

The trading experience for Bitcoin in 2025 appears to benefit from established platform infrastructure and growing institutional support for cryptocurrency markets. Bitcoin reached new all-time highs of $112,000 in May 2025 according to industry reports. The trading environment has matured considerably compared to earlier years.

Platform stability and execution quality likely vary between different providers. However, specific performance metrics were not detailed in the available source materials. The integration of cryptocurrency trading into established forex platforms suggests access to professional-grade execution engines and order management systems.

Order execution quality for Bitcoin CFDs depends heavily on underlying liquidity providers and market making arrangements. This btc review notes that execution quality metrics were not specifically provided in the reviewed materials. These include slippage statistics and fill rates, making it difficult to assess comparative performance.

Mobile trading capabilities and cross-platform synchronization features are likely available given the modern platform infrastructure. However, specific mobile app features and functionality were not detailed in the source materials. The trading environment appears to support both retail and professional traders. However, specific feature differentiation was not comprehensively covered.

The trust and regulatory landscape for Bitcoin trading presents significant challenges in evaluation due to limited regulatory information available in the source materials. The absence of specific regulatory authority details, license numbers, and compliance frameworks creates uncertainty regarding client protection and operational oversight.

Regulatory compliance varies dramatically across jurisdictions. US clients face notable restrictions compared to international traders. US residents have access to only 3 cryptocurrencies according to available information. BTC, BCH, and ETH are available across 47 states, highlighting the complex regulatory environment affecting Bitcoin trading access.

Fund security measures, segregation policies, and compensation schemes were not detailed in the available materials. This prevents assessment of client asset protection standards. The lack of specific regulatory authority oversight information raises questions about dispute resolution mechanisms and regulatory recourse options.

Company transparency regarding ownership structure, financial backing, and operational history was not adequately covered in the reviewed materials. Without access to regulatory filings, audit reports, or third-party verification data, establishing trust levels becomes challenging for potential clients.

User experience evaluation is significantly hampered by the absence of specific user feedback, satisfaction surveys, or documented user journey analysis in the available source materials. The lack of comprehensive user experience data prevents meaningful assessment of interface design quality, navigation efficiency, and overall platform usability.

Registration and account verification processes were not detailed in the reviewed materials. This makes it impossible to evaluate the onboarding experience for new Bitcoin traders. The complexity of cryptocurrency trading requires intuitive interface design and clear educational resources. However, specific platform features were not comprehensively covered.

Funding operation experiences were not detailed in the available information. These include deposit processing times, withdrawal procedures, and payment method integration. These operational aspects significantly impact user satisfaction but cannot be properly evaluated without specific platform data.

Common user complaints, feature requests, and satisfaction metrics were not available in the source materials. This prevents identification of potential pain points or areas of excellence in the user experience. Direct platform testing and user community research would be necessary to provide meaningful user experience insights.

This btc review reveals a complex trading environment where opportunities exist alongside significant information gaps and regulatory uncertainties. Platforms offer attractive features such as high leverage ratios up to 1:400 and access to multiple cryptocurrency CFDs. However, the lack of comprehensive regulatory information and user feedback data presents challenges for definitive recommendations.

The Bitcoin trading landscape appears most suitable for experienced traders with high risk tolerance who can navigate regulatory complexities and platform variations independently. The significant restrictions facing US traders compared to international clients highlight the importance of verifying specific regional offerings before making platform selections.

The primary advantages include access to leveraged Bitcoin exposure and integration with established trading platforms. The main drawbacks center on limited transparency regarding regulatory oversight and insufficient user experience documentation. Traders should conduct thorough due diligence and consider starting with smaller positions while evaluating platform performance and support quality.

FX Broker Capital Trading Markets Review