Regarding the legitimacy of Beirman Capital forex brokers, it provides FinCEN and WikiBit, .

Is Beirman Capital safe?

Risk Control

Regulation

Is Beirman Capital markets regulated?

The regulatory license is the strongest proof.

FinCEN Currency Exchange License (MSB)

Financial Crimes Enforcement Network

Financial Crimes Enforcement Network

Current Status:

RegulatedLicense Type:

Currency Exchange License (MSB)

Licensed Entity:

BEIRMAN CAPITAL LIMITED

Effective Date:

2024-08-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

1067 15th St, DenverPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Beirman Capital A Scam?

Introduction

Beirman Capital has positioned itself as a notable player in the forex market, offering a range of trading services and financial instruments. As more traders enter the foreign exchange landscape, the need for thorough evaluations of brokers becomes paramount. Traders must navigate a complex environment filled with potential risks, including scams and unreliable platforms. This article aims to provide an objective analysis of Beirman Capital, assessing its legitimacy, regulatory status, trading conditions, and overall safety for clients. The investigation draws from various sources, including user reviews, regulatory information, and expert evaluations to provide a comprehensive overview of Beirman Capital.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial for ensuring the safety of client funds and maintaining market integrity. Beirman Capital claims to be registered in Saint Lucia and holds a Money Services Business (MSB) license from the Financial Crimes Enforcement Network (FinCEN) in the United States. However, it is essential to note that this license does not equate to comprehensive financial regulation, particularly in the context of forex trading.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | MSB 31000278731692 | Saint Lucia | Limited Regulation |

The MSB license primarily focuses on compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, which means it does not provide the same level of oversight as regulatory bodies like the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC). This lack of stringent regulation raises concerns about the safety of client funds and the overall operational transparency of Beirman Capital. Without effective regulatory oversight, investors may face challenges in recovering funds or seeking redress in the event of disputes, increasing the operational risk associated with this broker.

Company Background Investigation

Beirman Capital was established in 2021 and operates under the jurisdiction of Saint Lucia. The company claims to have over ten years of experience in the financial services sector, suggesting a level of expertise in trading and investment. However, the lack of detailed information about its ownership structure and management team raises questions about transparency.

The management team‘s background is not extensively documented, making it difficult for potential clients to assess their qualifications and experience. A transparent organization typically provides information about its leadership and operational history, which helps build trust with clients. The absence of such disclosures may lead to skepticism about the company’s reliability and commitment to ethical business practices.

Overall, while Beirman Capital presents itself as a legitimate broker, the limited information regarding its management and operational history may warrant caution from potential investors.

Trading Conditions Analysis

Beirman Capital claims to offer competitive trading conditions, including low spreads and a variety of account types. However, a closer examination of its fee structure reveals potential areas of concern. The broker advertises spreads starting from 0.01 pips, which is attractive compared to industry averages. Yet, the lack of transparency regarding commissions and overnight interest rates raises red flags.

| Fee Type | Beirman Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.01 pips | 1-2 pips |

| Commission Structure | Not disclosed | Varies (typically $5 per lot) |

| Overnight Interest Range | Not disclosed | Varies widely |

The absence of clear information regarding commissions and overnight fees could lead to unexpected costs for traders, potentially impacting their profitability. Furthermore, brokers that do not disclose their complete fee structure may engage in practices that are not in the best interest of their clients. This lack of transparency is a significant concern for traders who rely on clear and upfront information to make informed decisions.

Client Fund Security

The safety of client funds is a primary concern for any trader. Beirman Capital claims to implement measures such as segregated accounts to protect client funds. Segregation of funds is crucial as it ensures that client deposits are kept separate from the broker's operating funds, reducing the risk of loss in case of financial difficulties faced by the broker.

However, despite these claims, there is little transparency regarding how these measures are implemented. The lack of detailed information on fund segregation practices and any historical issues related to fund security could raise alarms for potential investors. If client funds are not adequately protected, investors may find it challenging to recover their money in case of disputes or if the broker encounters financial difficulties.

Additionally, there is no information regarding investor protection schemes that are typically offered by regulated brokers. Without such protections, clients could be at significant risk, especially in the volatile forex market.

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's reliability. Reviews for Beirman Capital are mixed, with some users praising the broker for its competitive spreads and customer support, while others express concerns over the lack of educational resources and transparency.

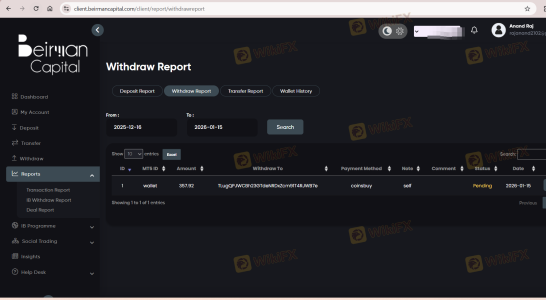

Common complaints include difficulties in withdrawing funds and a perceived lack of responsiveness from customer support. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Mixed responses |

| Lack of Transparency | Medium | Limited engagement |

| Inadequate Educational Resources | Medium | Acknowledged, not addressed |

One notable case involved a trader who reported significant delays in fund withdrawals, which the company reportedly addressed only after multiple inquiries. Such experiences can create a negative perception of the broker and deter potential clients from engaging with the platform.

Platform and Trade Execution

The trading platform offered by Beirman Capital is based on the popular MetaTrader 5 (MT5) software, which is known for its user-friendly interface and powerful trading tools. However, the quality of order execution and the potential for slippage are critical factors that can significantly impact a trader's experience.

User reviews indicate that while the platform is generally stable, there have been reports of slippage during high volatility periods, which can lead to unexpected losses. Additionally, any signs of platform manipulation, such as frequent re-quotes or rejected orders, could be indicative of deeper issues within the trading environment.

Risk Assessment

Engaging with Beirman Capital comes with inherent risks that potential investors should carefully consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Limited oversight and regulation. |

| Fund Safety | High | Unclear segregation practices. |

| Transparency | Medium | Lack of detailed fee disclosures. |

| Customer Support | Medium | Mixed reviews on responsiveness. |

To mitigate these risks, potential investors should conduct thorough research before committing funds. Opening a demo account can also provide insights into the broker's operations without risking real money.

Conclusion and Recommendations

In conclusion, while Beirman Capital presents itself as a legitimate forex broker offering competitive trading conditions, the lack of comprehensive regulation, transparency issues, and mixed customer feedback raise significant concerns. Potential investors should exercise caution and consider these factors carefully before deciding to engage with this broker.

For traders seeking a more secure trading environment, it may be wise to consider alternatives that are regulated by reputable authorities such as the FCA or ASIC. These brokers typically offer stronger investor protections and clearer fee structures, which can enhance the overall trading experience.

Is Beirman Capital a scam, or is it legit?

The latest exposure and evaluation content of Beirman Capital brokers.

Beirman Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Beirman Capital latest industry rating score is 6.63, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.63 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.