Beirman Capital 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive beirmancapital review presents a balanced analysis of a broker that has generated mixed feedback from the trading community. Beirman Capital Ltd was established in 2021 and registered in Saint Lucia. The company positions itself as a multi-asset trading platform offering forex, CFDs, stocks, and cryptocurrency trading through the popular MT5 platform. The broker's overall user rating of 2.06 reflects a complex landscape of trader experiences. Some positive feedback exists regarding platform functionality, but this is balanced against concerns about transparency and service quality.

The broker's key strengths include its diverse asset offerings and the robust MT5 trading infrastructure. This makes it potentially suitable for traders seeking multi-asset exposure in a single platform. However, our analysis reveals significant areas for improvement, particularly in transparency, customer service responsiveness, and building trader trust. This beirmancapital review aims to provide prospective traders with a comprehensive understanding of what to expect from this relatively new market entrant. It helps them make informed decisions about whether Beirman Capital aligns with their trading objectives and risk tolerance.

Important Notice

This beirmancapital review is based on publicly available information and user feedback collected from various sources as of 2024. Given that Beirman Capital is registered in Saint Lucia and operates under FinCEN regulation in the United States, traders should be aware that regulatory protections may differ significantly from those offered by brokers in major financial centers such as the UK, EU, or Australia. The regulatory environment in Saint Lucia may provide different levels of investor protection and dispute resolution mechanisms compared to more established financial jurisdictions. Our evaluation methodology combines user testimonials, publicly disclosed company information, and industry standard assessment criteria. This provides a balanced perspective on the broker's services and reliability.

Rating Framework

Broker Overview

Beirman Capital Ltd emerged in the competitive online trading landscape in 2021. The company established its headquarters in Saint Lucia while seeking to serve international traders through a comprehensive multi-asset platform. The company has positioned itself as a technology-forward broker, leveraging the widely respected MetaTrader 5 platform to deliver trading services across multiple asset classes. Despite its relatively recent establishment, Beirman Capital has attempted to differentiate itself through its diverse offering that spans traditional forex pairs, contracts for difference (CFDs), equity instruments, and the increasingly popular cryptocurrency markets.

The broker operates under a business model that emphasizes accessibility and variety. It targets traders who prefer to manage diverse portfolios through a single platform rather than maintaining multiple brokerage relationships. According to available information, Beirman Capital maintains regulatory compliance through FinCEN registration in the United States, which provides a framework for anti-money laundering and financial transparency requirements. The company's approach appears to focus on serving intermediate to experienced traders who appreciate the advanced functionality of the MT5 platform. They seek exposure to both traditional and emerging financial markets through their beirmancapital review of available services.

Regulatory Environment

Beirman Capital operates under registration in Saint Lucia with regulatory oversight provided by FinCEN (Financial Crimes Enforcement Network) in the United States. This regulatory structure focuses primarily on anti-money laundering compliance and financial reporting requirements rather than comprehensive investor protection mechanisms.

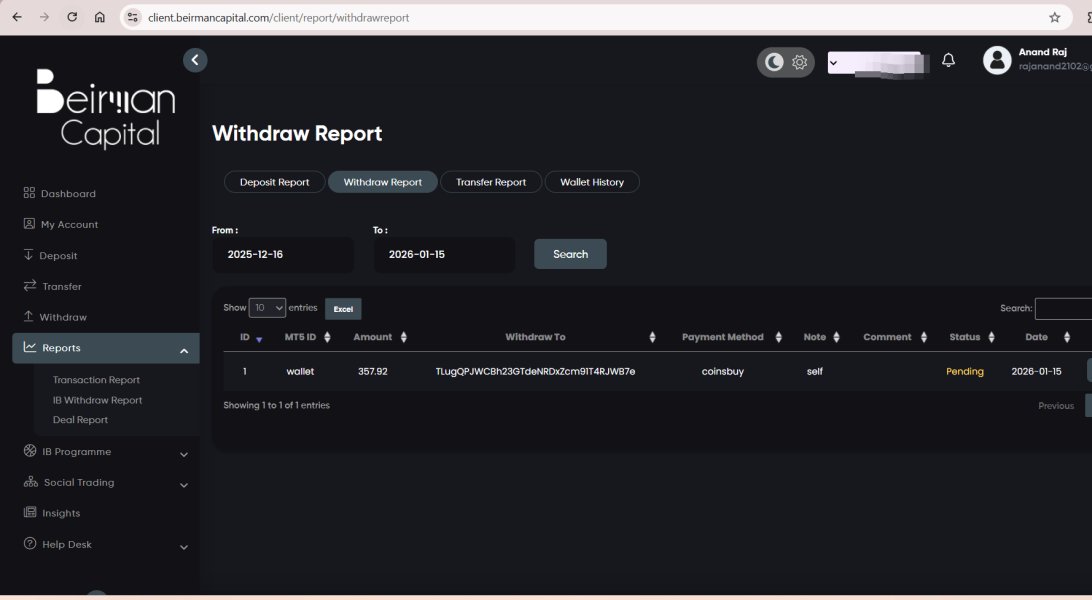

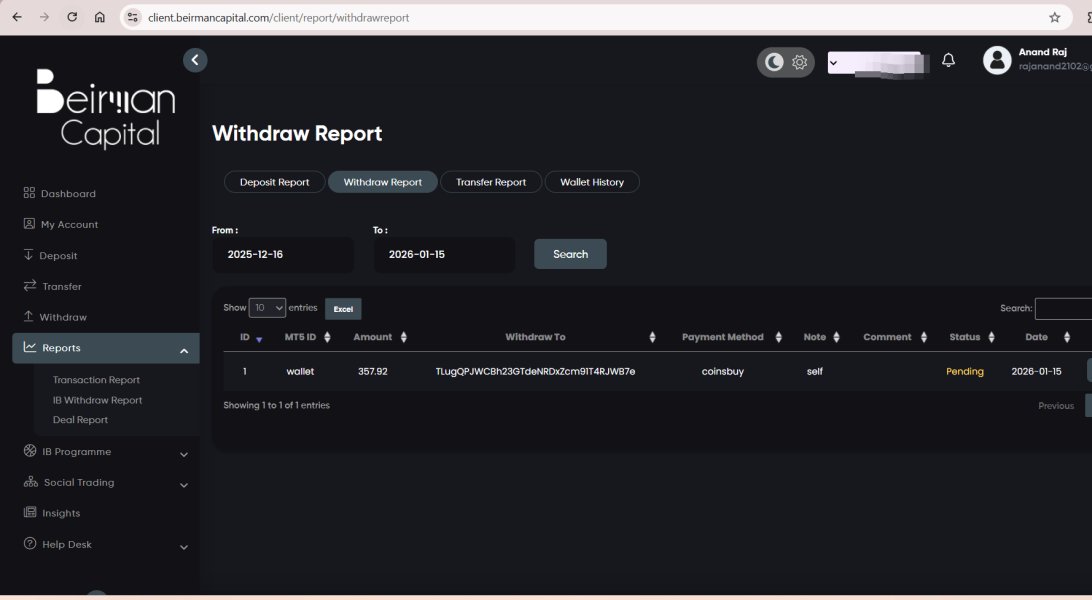

Funding Methods

Specific information regarding deposit and withdrawal methods was not detailed in available materials. This requires traders to contact the broker directly for comprehensive funding options and processing timeframes.

Minimum Deposit Requirements

The exact minimum deposit amount required to open an account with Beirman Capital was not specified in available documentation. This represents a transparency gap that prospective traders should clarify before account opening.

Details regarding welcome bonuses, promotional campaigns, or trading incentives were not mentioned in available materials. This suggests either limited promotional activity or insufficient public disclosure of such programs.

Available Trading Assets

Beirman Capital provides access to foreign exchange pairs, contracts for difference (CFDs), stock instruments, and cryptocurrency trading. This offers a comprehensive multi-asset trading environment for diversified portfolio management.

Cost Structure

Specific information about spreads, commissions, overnight financing costs, and other trading fees was not detailed in available sources. This requires direct inquiry with the broker for complete pricing transparency.

Leverage Options

Maximum leverage ratios and margin requirements were not specified in available materials. This represents important information that traders must obtain directly from Beirman Capital before engaging in leveraged trading activities.

The broker utilizes the MetaTrader 5 (MT5) platform. This provides traders with advanced charting capabilities, algorithmic trading support, and comprehensive market analysis tools through this industry-standard trading infrastructure.

Geographic Restrictions

Specific information about restricted countries or regional limitations was not provided in available documentation. This requires verification based on individual circumstances and local regulations.

Customer Support Languages

The range of supported languages for customer service was not specified in available materials. However, support contact information suggests English-language assistance through support@beirmancapital.com.

This beirmancapital review highlights significant information gaps that prospective traders should address through direct communication with the broker before making account opening decisions.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The account conditions offered by Beirman Capital present a mixed picture that reflects both the broker's relatively recent market entry and apparent gaps in public transparency. Based on available information, the specific details regarding account types, minimum balance requirements, and account-specific features remain largely undisclosed. This significantly impacts our ability to provide a comprehensive assessment. This lack of transparency represents a notable concern for potential traders who require clear understanding of terms and conditions before committing funds.

User feedback suggests that while basic account opening procedures appear functional, many traders have expressed frustration with the limited availability of detailed account specifications. The absence of clearly defined account tiers, benefits structures, or special features such as Islamic accounts creates uncertainty for traders with specific requirements. Industry standards typically expect brokers to provide comprehensive account documentation. This makes this beirmancapital review particularly relevant for highlighting these transparency gaps.

Compared to established brokers in the market, Beirman Capital's account condition disclosure falls below industry expectations. The lack of detailed information about account maintenance fees, inactivity charges, or account upgrade pathways suggests either inadequate marketing communication or deliberate opacity in terms presentation. Prospective traders should prioritize obtaining complete account documentation before proceeding with any financial commitments. This ensures alignment with their trading objectives and risk management requirements.

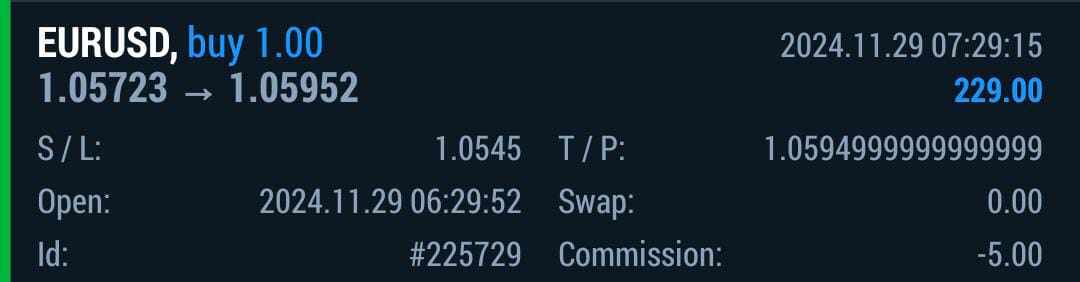

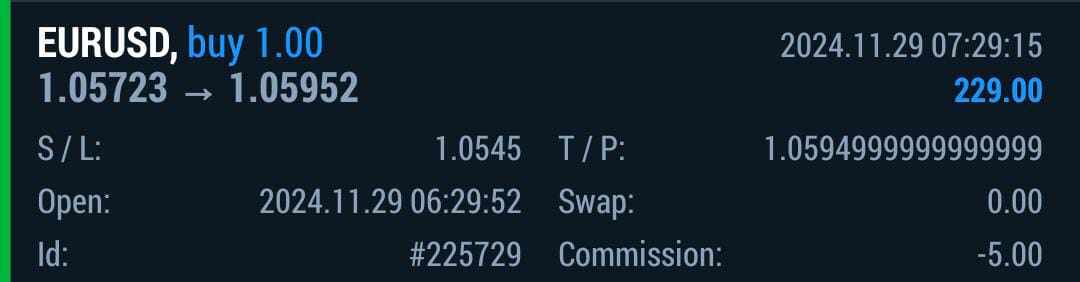

Beirman Capital's strength lies primarily in its adoption of the MetaTrader 5 platform, which represents a significant positive aspect of their service offering. The MT5 platform provides traders with institutional-grade trading tools, including advanced charting capabilities, algorithmic trading support through Expert Advisors, and comprehensive market analysis features. User feedback generally acknowledges the platform's reliability and functionality. Many traders appreciate the familiar interface and robust technical analysis capabilities that MT5 provides.

However, this beirmancapital review identifies notable gaps in educational resources and research support that typically accompany professional trading platforms. Available information does not indicate comprehensive market research, daily analysis, economic calendar integration, or educational materials that help traders develop their skills and market understanding. This absence of value-added resources places Beirman Capital at a disadvantage compared to full-service brokers who provide comprehensive trader education and market insight.

The broker's tool offering appears to focus primarily on execution rather than trader development, which may limit its appeal to less experienced traders who benefit from educational support and market guidance. While the MT5 platform itself offers extensive analytical capabilities, the lack of broker-provided research and educational content suggests that traders must rely on third-party resources or their own market analysis capabilities to make informed trading decisions.

Customer Service and Support Analysis (Score: 6/10)

Customer service represents a critical area where Beirman Capital shows both promise and significant room for improvement. Available feedback indicates that while some traders have received satisfactory support responses, others have experienced delays and inadequate resolution of their concerns. The primary support channel appears to be email-based through support@beirmancapital.com. However, comprehensive information about support hours, response timeframes, and escalation procedures remains unclear.

User testimonials present a mixed picture of service quality, with some traders reporting helpful and professional interactions while others express frustration with response times and problem resolution effectiveness. The absence of detailed information about live chat availability, phone support options, or multilingual assistance suggests potential limitations in support accessibility. This could impact trader satisfaction, particularly during volatile market conditions when immediate assistance may be required.

This beirmancapital review notes that customer service quality often correlates strongly with overall broker reliability, making the mixed feedback in this area particularly significant. The lack of transparent support policies, guaranteed response times, or comprehensive FAQ resources indicates that Beirman Capital may need to invest significantly in customer service infrastructure. This would help meet industry standards and improve trader confidence in their support capabilities.

Trading Experience Analysis (Score: 6/10)

The trading experience with Beirman Capital appears to center around the MT5 platform's capabilities, with user feedback suggesting generally stable performance and adequate order execution. Traders have reported that the platform functions reliably during normal market conditions. The familiar MT5 interface provides the analytical tools and execution capabilities that experienced traders expect. The multi-asset trading environment allows for portfolio diversification within a single platform, which many users find convenient for their trading strategies.

However, specific performance metrics such as average execution speeds, slippage rates, or uptime statistics were not available in public documentation. This represents important gaps in transparency that affect trader confidence. User feedback suggests that while basic trading functionality operates adequately, there may be limitations in advanced features or during high-volatility periods that could impact serious traders' performance.

The mobile trading experience and platform customization options were not detailed in available materials, though the MT5 platform generally provides robust mobile functionality. This beirmancapital review emphasizes that trading experience quality depends heavily on execution reliability, cost transparency, and platform stability. These are areas where Beirman Capital appears to perform adequately but without the excellence that distinguishes top-tier brokers from their competitors.

Trust and Reliability Analysis (Score: 4/10)

Trust and reliability represent perhaps the most concerning aspects of Beirman Capital's current market position, with several factors contributing to uncertainty about the broker's long-term credibility. The company's registration in Saint Lucia, while legally valid, provides limited regulatory protection compared to major financial centers. The FinCEN oversight focuses primarily on anti-money laundering compliance rather than comprehensive investor protection measures.

User feedback includes concerning allegations about transparency issues and potential fraudulent practices, though these claims require careful verification and may not represent the majority trader experience. The low overall user rating of 2.06 suggests significant dissatisfaction among some traders. However, the specific nature and validity of these concerns require individual assessment. The broker's relatively recent establishment in 2021 means limited track record for evaluation, making long-term reliability assessment challenging.

The absence of detailed information about fund segregation, investor compensation schemes, or dispute resolution procedures further impacts confidence in the broker's reliability. Industry best practices typically include clear disclosure of client fund protection measures and regulatory compliance procedures. These are areas where this beirmancapital review finds significant transparency gaps that potential traders should carefully consider before committing funds to the platform.

User Experience Analysis (Score: 5/10)

The overall user experience with Beirman Capital reflects the mixed nature of feedback received from the trading community, with the 2.06 user rating indicating significant room for improvement in trader satisfaction. While some users appreciate the MT5 platform's functionality and the broker's multi-asset offering, others have expressed concerns about various aspects of their trading experience. These range from account management to customer service interactions.

Interface design and platform usability appear adequate based on the MT5 foundation, though broker-specific enhancements or customizations were not detailed in available information. The account opening and verification processes lack clear documentation. This creates potential friction for new traders who prefer transparent onboarding procedures. User feedback suggests that while basic platform navigation functions properly, the overall service experience may not meet the expectations of traders accustomed to more comprehensive broker services.

Common user complaints appear to focus on transparency issues, service responsiveness, and communication clarity – areas that significantly impact overall satisfaction regardless of platform technical performance. The mixed feedback pattern suggests that while Beirman Capital may serve some traders adequately, significant improvements in service delivery, transparency, and user communication would be necessary. This would help achieve higher satisfaction levels and build stronger trader loyalty in the competitive online trading market.

Conclusion

This comprehensive beirmancapital review reveals a broker with both potential and significant challenges that prospective traders must carefully consider. While Beirman Capital offers appealing features such as multi-asset trading capabilities and the robust MT5 platform, concerns about transparency, customer service quality, and overall reliability create important considerations for potential users. The broker appears most suitable for experienced traders who can navigate potential service limitations while taking advantage of the diverse asset offerings and familiar trading infrastructure.

The mixed user feedback and low overall rating of 2.06 suggest that Beirman Capital requires substantial improvements in transparency, customer service, and trust-building measures to compete effectively with established market participants. Traders considering this broker should prioritize obtaining detailed information about account conditions, fees, and service policies before making any financial commitments. This ensures that their expectations align with the broker's current service capabilities and limitations.