Is Basel Markets safe?

Pros

Cons

Is Basel Markets Safe or Scam?

Introduction

Basel Markets is a forex broker that emerged in 2021, positioning itself as a platform for traders seeking access to a wide array of financial instruments, including currency pairs, commodities, and indices. As the online trading landscape continues to expand, the importance of thorough evaluations of brokers like Basel Markets cannot be overstated. Traders must navigate a complex environment filled with both legitimate opportunities and potential scams. This article aims to provide an objective assessment of Basel Markets, analyzing its regulatory status, company background, trading conditions, customer safety, and user experiences. Our investigation incorporates data from various sources, including user reviews and regulatory databases, to present a comprehensive overview of whether Basel Markets is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory framework within which a broker operates is crucial for ensuring the safety and security of traders' funds. Basel Markets operates without formal regulatory oversight from recognized authorities, which raises significant concerns about its legitimacy. The broker claims to be affiliated with the National Futures Association (NFA), but it is labeled as unauthorized, indicating a lack of adherence to regulatory standards.

Here is a summary of Basel Markets' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | N/A | United States | Unauthorized |

| Seychelles FSA | N/A | Seychelles | Unregulated |

The absence of a valid regulatory license means that Basel Markets is not subject to the same protocols and safeguards that protect consumers in regulated environments. This lack of oversight can lead to higher risks related to security, transparency, and overall reliability. Additionally, the broker's operations in offshore jurisdictions, such as Saint Vincent and the Grenadines, further complicate the assessment of its legitimacy. Traders should approach this broker with caution, as the absence of regulation raises red flags regarding its credibility.

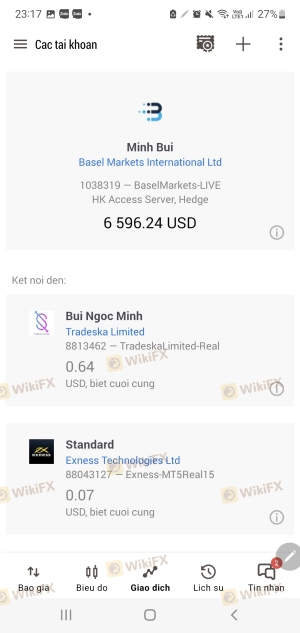

Company Background Investigation

Basel Markets was established in 2021 and is registered in Saint Vincent and the Grenadines. Despite its relatively recent inception, the broker claims to offer a diverse range of trading services. However, the lack of transparency regarding its ownership structure and management team is concerning. There is minimal information available about the individuals leading the company, which raises questions about the broker's accountability and operational integrity.

The company's website does not provide comprehensive details about its history, management, or operational practices, which is a common characteristic of less reputable brokers. The absence of clear information can be a significant red flag for potential traders, as it indicates a lack of transparency. Furthermore, the broker's marketing strategies often highlight features such as high leverage and low spreads, which can be enticing but also point to a potential risk of over-promising and under-delivering.

Trading Conditions Analysis

The trading conditions offered by Basel Markets include high leverage options (up to 1:500) and varying spreads depending on the account type. While these features may appear attractive, it is essential to scrutinize the overall fee structure and any potentially hidden costs associated with trading on this platform.

Heres a comparison of Basel Markets' core trading costs:

| Fee Type | Basel Markets | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 2.0 pips | 1.5 pips |

| Commission Model | Varies | Fixed or Tiered |

| Overnight Interest Range | High | Moderate |

The spreads offered by Basel Markets are relatively high compared to industry averages, which could impact overall profitability for traders. Additionally, the commission structure lacks clarity, potentially leading to unexpected charges. Traders should be aware of these costs and consider how they may affect their trading strategies. The presence of unusually high overnight interest rates may also deter some traders, particularly those engaging in longer-term positions.

Client Fund Security

When evaluating whether Basel Markets is safe, the security of client funds is a paramount concern. The broker claims to implement various safety measures, but without regulatory oversight, these claims must be taken with caution. There is no clear information on whether client funds are held in segregated accounts, a critical practice that protects traders' capital in the event of the broker's insolvency.

Furthermore, the absence of investor protection schemes, such as those provided by regulated brokers in jurisdictions like the UK or the EU, poses additional risks. Traders should consider the historical context of Basel Markets and whether there have been any past incidents of fund mismanagement or security breaches. The lack of transparency regarding these issues further complicates the assessment of the broker's safety.

Customer Experience and Complaints

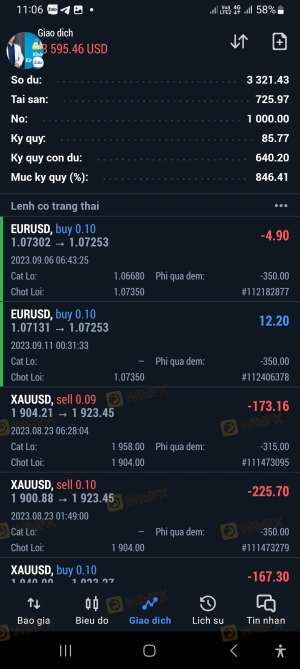

User feedback is a valuable resource for understanding a broker's reliability. A review of customer experiences with Basel Markets reveals a mix of satisfaction and dissatisfaction. Common complaints include difficulties in withdrawal processes, lack of responsive customer service, and issues with account management.

Heres a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Delays | Medium | Inconsistent |

| Account Management Problems | High | No Resolution |

Several users have reported being unable to withdraw their funds, which is a significant concern for any trader considering whether Basel Markets is safe. In some cases, users have described lengthy delays and unhelpful responses from customer support. These issues highlight the potential risks of trading with a broker that lacks robust operational practices and customer service protocols.

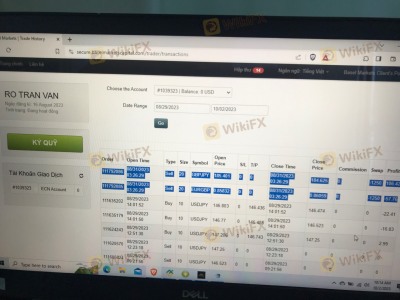

Platform and Execution

Basel Markets exclusively offers the MetaTrader 5 (MT5) platform, a widely recognized trading tool known for its advanced features. However, the overall performance of the platform, including execution speed and reliability, is crucial for traders. Reports of slippage and order rejections have surfaced, raising concerns about the quality of trade execution.

Traders should be cautious of any signs of platform manipulation or excessive slippage, which can significantly impact trading outcomes. The absence of a robust support system for addressing these issues further complicates the trading experience on this platform.

Risk Assessment

Engaging with Basel Markets involves several risks that potential traders should consider carefully. The lack of regulation, high trading costs, and mixed customer feedback contribute to an overall risk profile that leans towards the high side.

Heres a risk scorecard summarizing the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No formal oversight |

| Financial Risk | Medium | High trading costs |

| Operational Risk | High | Poor customer service |

To mitigate these risks, traders are advised to conduct thorough research, avoid investing large sums initially, and consider using demo accounts to test the platform before committing real funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Basel Markets presents several red flags that warrant caution. The lack of regulatory oversight, high trading costs, and mixed customer experiences indicate that traders should be vigilant when considering this broker.

While some traders may find the features appealing, the potential for issues related to fund withdrawals and customer service should not be overlooked. For traders seeking safer alternatives, it is advisable to consider brokers regulated by reputable authorities, such as the FCA or ASIC, which offer better protections for client funds and more transparent operations.

Ultimately, whether you are a novice or an experienced trader, it is crucial to prioritize safety and reliability in your trading choices.

Is Basel Markets a scam, or is it legit?

The latest exposure and evaluation content of Basel Markets brokers.

Basel Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Basel Markets latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.