Is TakeProfitTrader safe?

Pros

Cons

Is TakeProfitTrader Safe or a Scam?

Introduction

TakeProfitTrader is a proprietary trading firm that specializes in providing funding for traders in the futures market. With its headquarters in Orlando, Florida, TakeProfitTrader aims to empower traders by offering them the opportunity to trade with the firm's capital rather than their own. This model appeals to both novice and experienced traders looking to enhance their trading potential without risking personal funds. However, as the trading landscape is fraught with risks and potential scams, it is crucial for traders to conduct thorough evaluations of any trading firm before engaging. This article aims to explore the legitimacy and safety of TakeProfitTrader by examining its regulatory status, company background, trading conditions, customer experiences, and overall risks involved in trading with this firm.

To ensure a comprehensive analysis, this investigation utilizes a combination of qualitative assessments and quantitative data drawn from reputable sources, user reviews, and industry benchmarks. By employing a structured evaluation framework, we aim to provide a balanced perspective on whether TakeProfitTrader is a safe trading partner or a potential scam.

Regulation and Legitimacy

The regulatory status of a trading firm is a critical aspect that influences its credibility and safety. Regulatory bodies impose strict guidelines and oversight to protect traders and ensure fair trading practices. Unfortunately, TakeProfitTrader operates without a prominent regulatory license, which raises questions about its legitimacy and the safety of traders' funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that TakeProfitTrader is not subject to the same level of scrutiny as regulated firms, which may expose traders to higher risks. Proprietary trading firms like TakeProfitTrader often operate in a less regulated environment compared to traditional brokerage firms, leading to concerns about transparency and accountability. Furthermore, the lack of a robust regulatory framework can make it challenging for traders to seek recourse in case of disputes or issues with withdrawals.

While TakeProfitTrader claims to prioritize trader education and support, the regulatory gap is a significant factor that potential users should consider. The firm does not provide any historical compliance records or evidence of adherence to regulatory standards, which further complicates its legitimacy. Therefore, when evaluating the question, "Is TakeProfitTrader safe?" it is essential to recognize that the lack of regulation may serve as a red flag for prospective traders.

Company Background Investigation

TakeProfitTrader was founded in 2021 by James Sixsmith, a former professional athlete turned trading enthusiast. The firm aims to provide a platform that democratizes access to trading capital, focusing on empowering traders to enhance their skills and achieve sustainable profits. However, the rapid establishment of the company raises questions about its operational history and long-term stability.

The management team, led by Sixsmith, has a background that combines sports and trading, but it lacks the extensive experience typically associated with established financial firms. While the founder's journey from novice to successful trader is commendable, the absence of seasoned professionals in the management team may impact the firm's credibility.

Transparency is vital in building trust with users, and TakeProfitTrader's website provides limited information about its operations, financial health, and internal policies. The lack of detailed disclosures regarding ownership structure and company performance can hinder potential traders' ability to make informed decisions. As such, the question, "Is TakeProfitTrader safe?" becomes more pressing, given the company's relatively short history and limited transparency regarding its operational framework.

Trading Conditions Analysis

TakeProfitTrader offers a variety of account sizes and trading conditions for its users, primarily focusing on futures trading. The firm utilizes a subscription model, requiring traders to pay monthly fees based on their chosen account size. However, the overall fee structure may be perceived as relatively high compared to industry standards.

| Fee Type | TakeProfitTrader | Industry Average |

|---|---|---|

| Spread on Major Pairs | Variable | 1-2 pips |

| Commission Model | $5 per lot | $3 per lot |

| Overnight Interest Range | N/A | 0.5% - 1.5% |

The commission structure, particularly the $5 per round trip per contract, is notably higher than the industry average, which could significantly affect traders' profitability. Furthermore, the absence of overnight interest rates may limit trading strategies for those looking to hold positions longer.

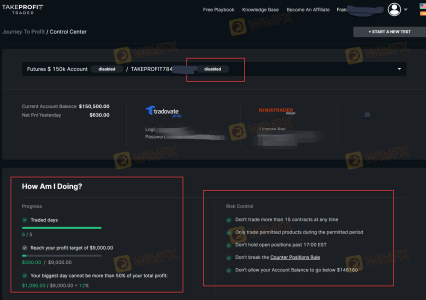

Additionally, the requirement for traders to achieve specific profit targets while adhering to strict risk management rules can be daunting. The firm imposes daily loss limits and drawdown restrictions, which, while intended to promote responsible trading, may hinder traders' ability to execute their strategies effectively. This raises concerns about the overall flexibility and trader-friendliness of TakeProfitTrader's trading conditions.

Given these factors, it is essential for potential users to carefully consider the trading conditions before engaging with the firm. The question of whether "Is TakeProfitTrader safe?" is further complicated by the firm's fee structure and the potential impact on traders' bottom lines.

Customer Funds Security

The security of customer funds is paramount when evaluating any trading firm. TakeProfitTrader claims to implement several measures to protect user funds; however, the lack of regulation raises concerns about the effectiveness and reliability of these measures.

The firm does not provide clear information regarding fund segregation, investor protection, or negative balance protection policies. Without regulatory oversight, it is challenging to ascertain the level of security provided to clients. Moreover, there have been no reported incidents or controversies regarding the safety of customer funds, but the absence of such information does not guarantee safety.

In conclusion, while TakeProfitTrader may present itself as a secure platform, the lack of regulatory backing and transparency regarding its security measures prompts skepticism about the safety of traders' funds. Thus, the question of "Is TakeProfitTrader safe?" remains a critical consideration for prospective users.

Customer Experience and Complaints

Customer feedback is a vital indicator of a trading firm's reliability and service quality. Reviews of TakeProfitTrader reveal a mixed bag of experiences, with many users praising the firm's customer support and prompt withdrawal processes. However, some complaints have surfaced regarding the high fees and strict trading rules.

| Complaint Type | Severity | Company Response |

|---|---|---|

| High Fees | Moderate | Addressed in FAQs |

| Slow Withdrawal Processing | High | Improved over time |

| Rigid Trading Rules | Moderate | Clarified in support |

Common complaints include the $5 commission per contract, which many traders find excessive. Additionally, the strict trading rules can be frustrating for users who prefer more flexibility in their strategies. While the company has made efforts to address these issues through improved communication and support, the recurring nature of these complaints suggests underlying concerns about the firm's policies.

For example, one user reported a delay in receiving their withdrawal, which took longer than expected despite the firm's claims of immediate payouts. In contrast, another user highlighted the efficiency of the customer support team in resolving issues quickly, indicating a positive aspect of the firm's service.

Overall, while many users have had positive experiences with TakeProfitTrader, the recurring complaints raise questions about the firm's commitment to customer satisfaction. This leads to the pressing question: "Is TakeProfitTrader safe?" The mixed feedback suggests that potential users should proceed with caution and conduct thorough research before engaging.

Platform and Trade Execution

The performance of the trading platform is crucial for a seamless trading experience. TakeProfitTrader offers access to various trading platforms, including NinjaTrader and TradingView, which are popular among traders. However, the quality of execution, order fills, and potential slippage are vital factors that can significantly impact trading outcomes.

User reviews indicate that while the platforms are generally stable, some traders have experienced issues with slippage and order rejections during high-volatility periods. These issues can lead to missed opportunities and reduced profitability, raising concerns about the reliability of the execution process.

The absence of evidence suggesting platform manipulation is a positive aspect; however, the reported experiences of slippage and rejected orders warrant attention. As such, potential users should consider whether the trading environment aligns with their trading strategies and risk tolerance.

Given these factors, the question, "Is TakeProfitTrader safe?" becomes increasingly relevant as traders assess the overall reliability of the trading platform and execution quality.

Risk Assessment

Trading with any firm involves inherent risks, and TakeProfitTrader is no exception. Evaluating the risks associated with this proprietary trading firm is crucial for potential users to make informed decisions.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated firm with no oversight |

| Financial Risk | Medium | High fees may impact profitability |

| Operational Risk | Medium | Platform issues and slippage reported |

| Withdrawal Risk | Medium | Complaints about withdrawal delays |

The absence of regulation poses a significant risk, as traders may have limited recourse in case of disputes or issues with withdrawals. Additionally, the high fee structure can erode profitability, particularly for those employing strategies that require frequent trading.

To mitigate these risks, traders should carefully assess their trading strategies, maintain strict risk management practices, and consider diversifying their trading activities across multiple platforms. Engaging with a well-regulated firm may also provide an additional layer of security and peace of mind.

Conclusion and Recommendations

In conclusion, the evidence surrounding TakeProfitTrader presents a complex picture. While the firm offers a unique opportunity for traders to access funded accounts and emphasizes education and support, the lack of regulation and transparency raises significant concerns about its safety and legitimacy.

The question, "Is TakeProfitTrader safe?" does not have a straightforward answer. Potential users should be cautious and weigh the risks against the potential rewards. For traders seeking reliable alternatives, firms with robust regulatory oversight and transparent practices may be more suitable. Options such as FTMO and Apex Trader Funding could provide safer environments for traders looking to thrive in the competitive landscape of proprietary trading.

Ultimately, conducting thorough research and understanding the intricacies of any trading firm is essential for safeguarding one's financial interests.

Is TakeProfitTrader a scam, or is it legit?

The latest exposure and evaluation content of TakeProfitTrader brokers.

TakeProfitTrader Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TakeProfitTrader latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.