Basel Markets 2025 Review: Everything You Need to Know

Summary

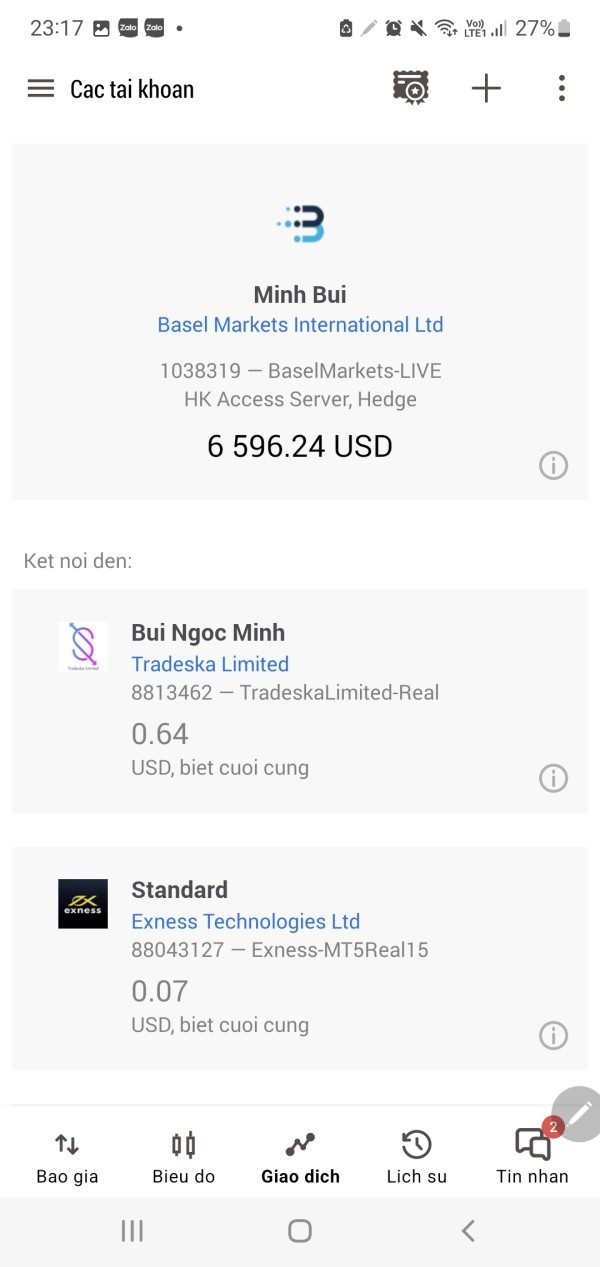

Basel Markets is a new forex broker that started in 2021. The company provides financial trading services for institutions and investors across more than 30 countries and economic zones. This basel markets review looks at a company that focuses on delivering deep liquidity through advanced data systems and open technology platforms to enhance trading performance, investment capabilities, and asset management solutions.

The platform has a user rating of 6/10. This rating shows moderate performance with room for improvement across various service areas. The rating reflects mixed user experiences and suggests that while the broker offers certain competitive advantages, particularly in liquidity provision and technological infrastructure, there are notable areas requiring enhancement.

Basel Markets targets small to medium-sized investors seeking high liquidity access and comprehensive trading support. The broker's emphasis on institutional-grade technology and multi-regional service coverage positions it as an option for traders who prioritize advanced trading infrastructure over traditional retail-focused features. However, potential clients should note that specific regulatory information and detailed service parameters are not readily available in public documentation. This may concern traders who prioritize transparency and regulatory oversight in their broker selection process.

Important Notice

Prospective investors should exercise caution when considering Basel Markets. The limited availability of regulatory information in publicly accessible sources raises concerns. The absence of clear regulatory disclosure raises questions about oversight and compliance standards that potential clients should carefully evaluate.

This review is based on available user feedback and accessible company information. The information may not comprehensively represent all user experiences or operational aspects of the broker. Given the limited public information, potential clients are advised to conduct thorough due diligence and directly verify regulatory status, terms of service, and operational procedures with the company before making investment decisions.

The cross-regional nature of Basel Markets' operations may involve different regulatory entities and service standards across various jurisdictions. This adds complexity to the evaluation process for international clients.

Rating Framework

Broker Overview

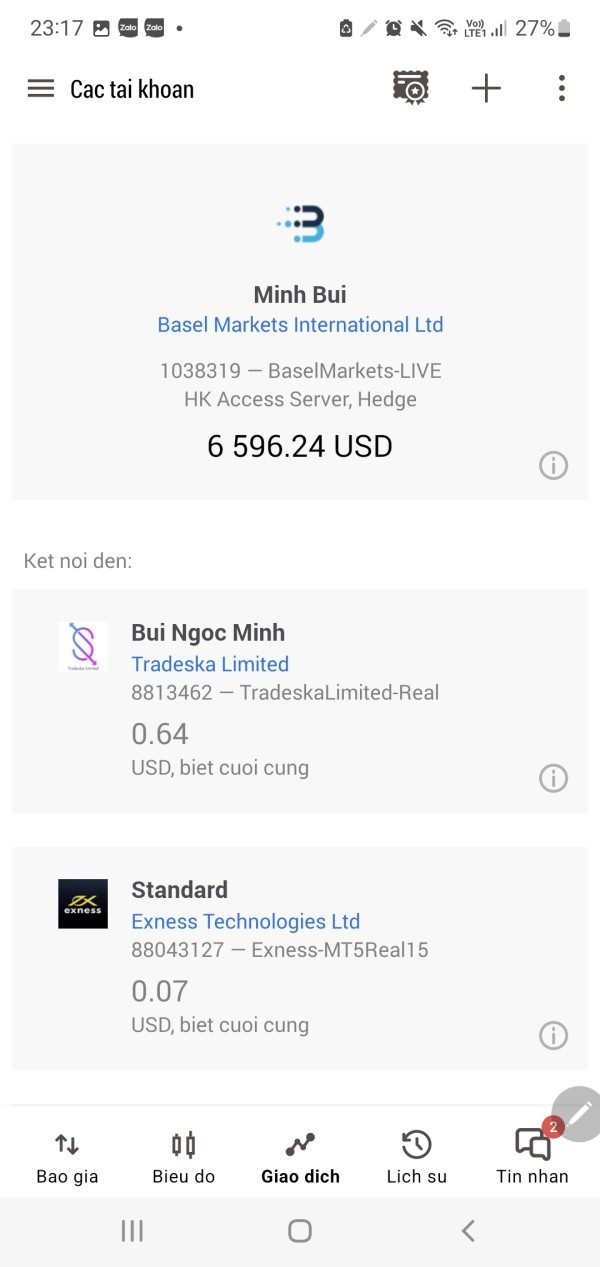

Basel Markets entered the financial services market in 2021. The company focuses on institutional-quality trading infrastructure and liquidity solutions. The company positions itself as a bridge between traditional institutional trading capabilities and the growing needs of individual and smaller institutional investors across global markets.

The broker's core business model centers on providing deep liquidity access through sophisticated data systems and open technology platforms. This approach aims to enhance trading performance, facilitate investment opportunities, and support asset management activities for clients operating in diverse international markets. Basel Markets serves clients across more than 30 countries and economic zones. This indicates a broad international reach despite its recent establishment.

However, this basel markets review must note that specific details regarding trading platforms, asset categories, and regulatory oversight are not comprehensively detailed in available public information. The company's website and accessible documentation do not provide extensive details about platform types, supported instruments, or primary regulatory jurisdictions. This represents a significant information gap for potential clients conducting due diligence.

The broker's emphasis on technology and liquidity suggests a focus on serving traders who prioritize execution quality and market access over traditional retail broker features such as educational resources or promotional offerings.

Regulatory Jurisdiction: Specific regulatory information is not clearly disclosed in available public sources. This represents a significant concern for potential clients seeking transparent regulatory oversight.

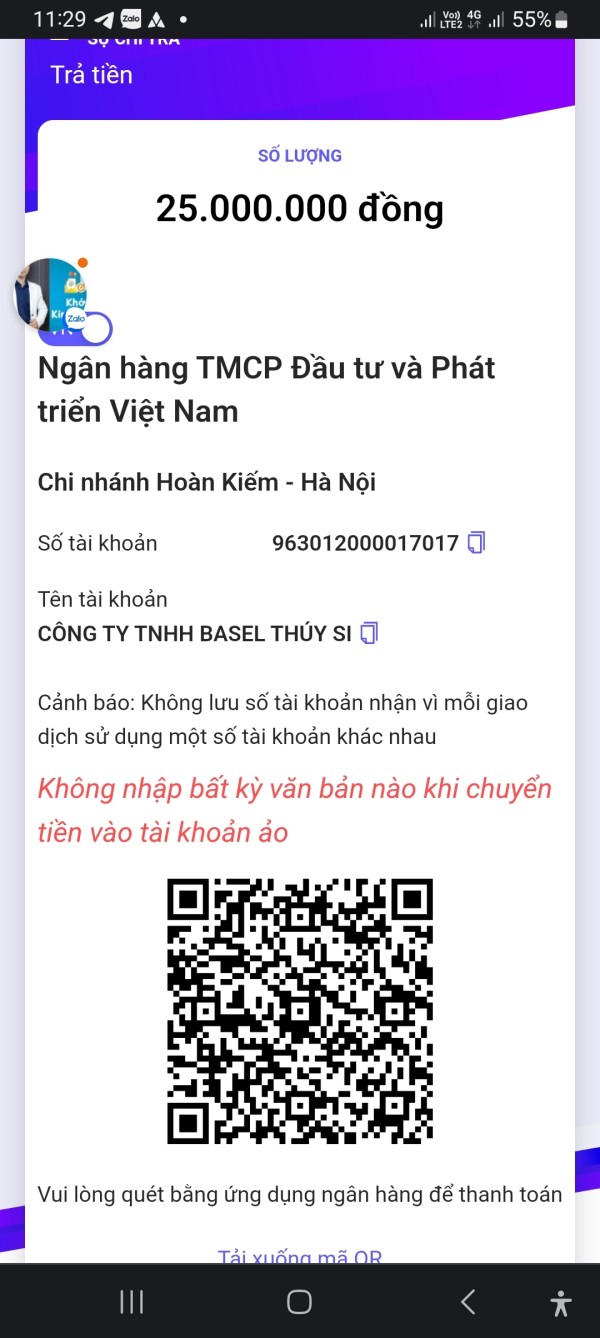

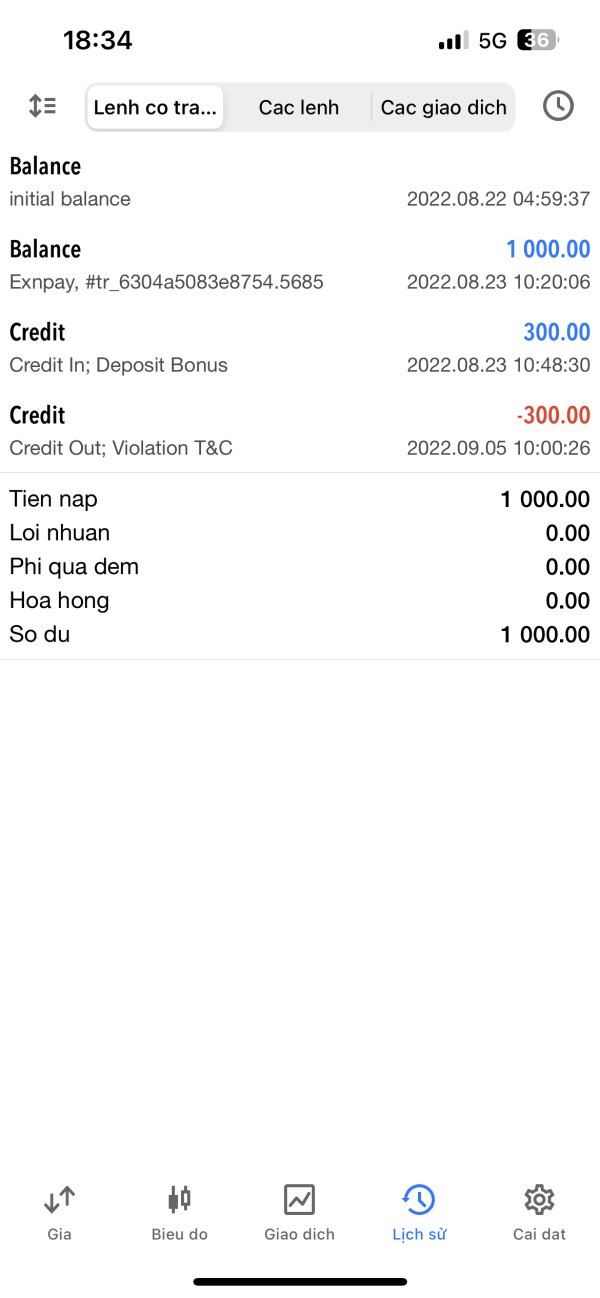

Deposit and Withdrawal Methods: Details regarding supported payment methods and processing procedures are not specified in accessible documentation.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in available public information.

Bonuses and Promotions: No information about promotional offerings or bonus structures is available in current documentation.

Tradeable Assets: The range of available trading instruments and asset classes is not detailed in accessible sources. The focus appears to be on providing liquidity across multiple markets.

Cost Structure: Specific information about spreads, commissions, and fee structures is not provided in available documentation. This makes cost comparison difficult.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in accessible sources.

Platform Options: Details about trading platform availability and features are not comprehensively outlined in public information.

Geographic Restrictions: Specific country limitations or service restrictions are not clearly detailed in available documentation.

Customer Support Languages: Supported languages for customer service are not specified in accessible sources.

This basel markets review highlights the significant information gaps that potential clients must consider when evaluating this broker option.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Basel Markets' account conditions faces significant limitations. The absence of detailed information in publicly accessible sources creates problems. Without specific data on account types, minimum deposit requirements, or special features, it becomes impossible to provide a meaningful assessment of how the broker's account offerings compare to industry standards.

Traditional forex brokers typically offer multiple account tiers with varying minimum deposits, spread structures, and additional features such as Islamic accounts for Shariah-compliant trading. However, Basel Markets has not made such information readily available. This may indicate either a simplified account structure or a lack of transparency in service disclosure.

The absence of detailed account information particularly affects potential clients who need to understand specific terms before committing funds. Professional traders and institutions typically require clear documentation of account features, margin requirements, and any special conditions that might apply to their trading activities. This basel markets review cannot provide a comprehensive account conditions rating due to insufficient publicly available information. This highlights the importance of direct communication with the broker for clients seeking detailed account specifications.

Assessment of Basel Markets' trading tools and resources is severely limited. The lack of detailed information in accessible documentation creates evaluation problems. While the company emphasizes its use of leading data systems and open technology platforms, specific details about available trading tools, research resources, or educational materials are not provided.

Modern forex brokers typically offer comprehensive suites including advanced charting tools, technical analysis indicators, economic calendars, market research, and educational resources. The absence of detailed tool descriptions makes it impossible to evaluate whether Basel Markets provides competitive resources for trader development and market analysis. The company's focus on institutional-grade technology suggests potential strength in execution tools and market access capabilities. However, without specific information about platform features, automated trading support, or analytical tools, potential clients cannot make informed comparisons with other brokers.

Educational resources, which are crucial for developing traders, are not mentioned in available documentation. This potentially limits the broker's appeal to less experienced market participants who require learning support alongside trading access.

Customer Service and Support Analysis

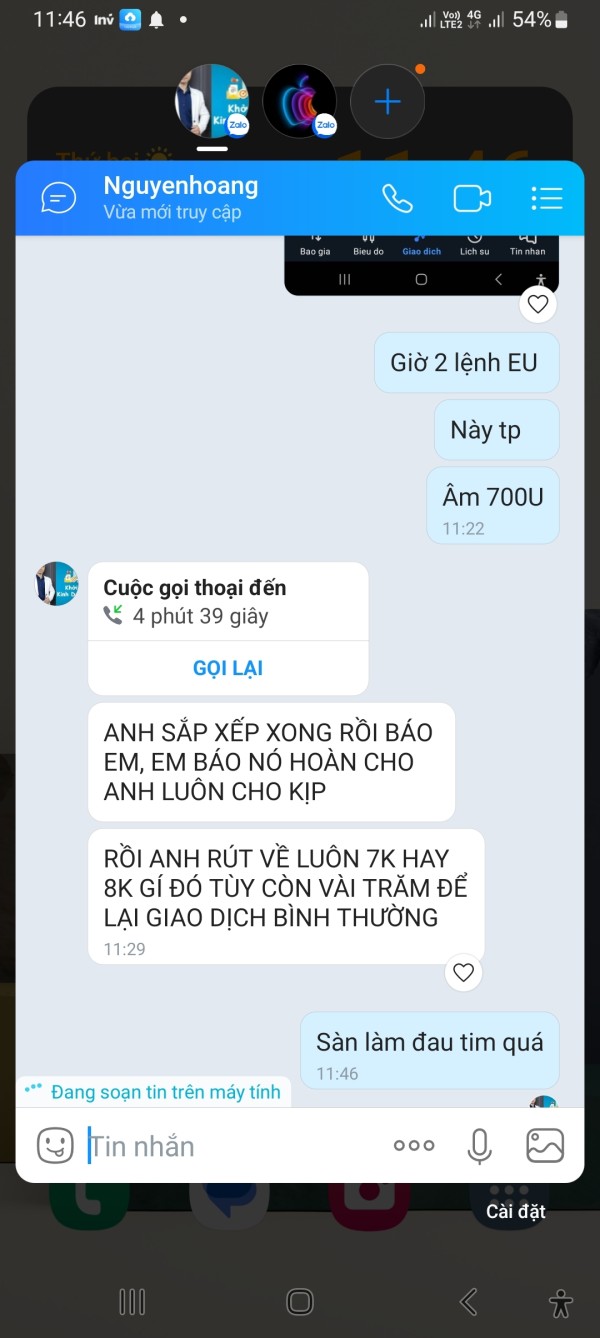

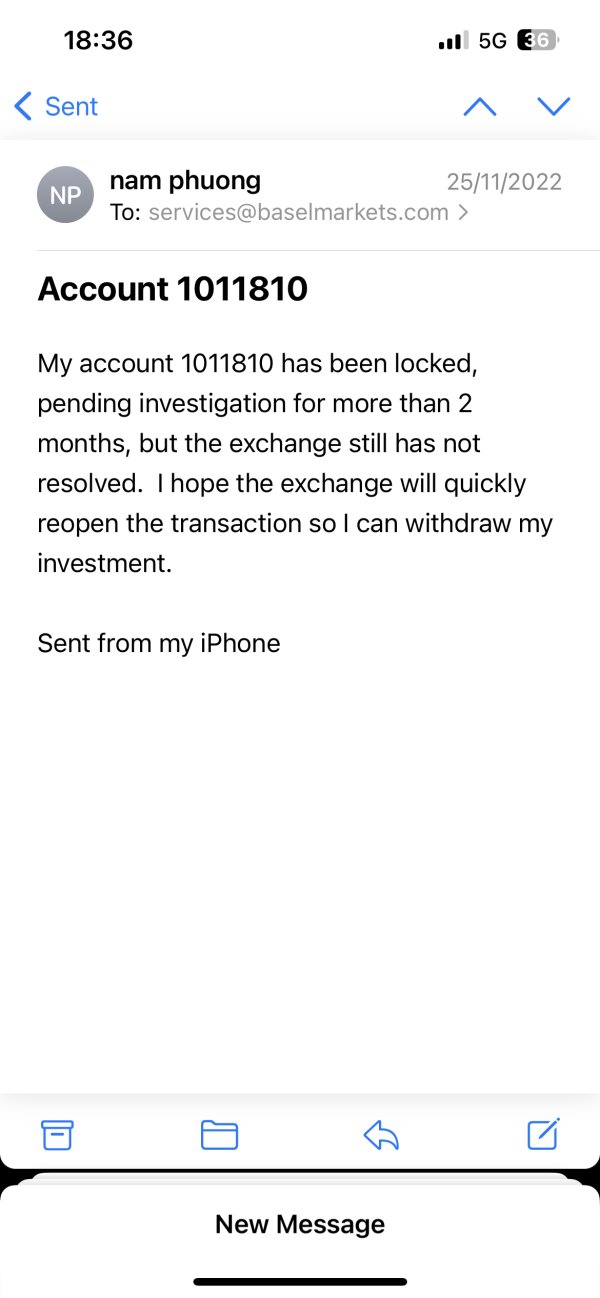

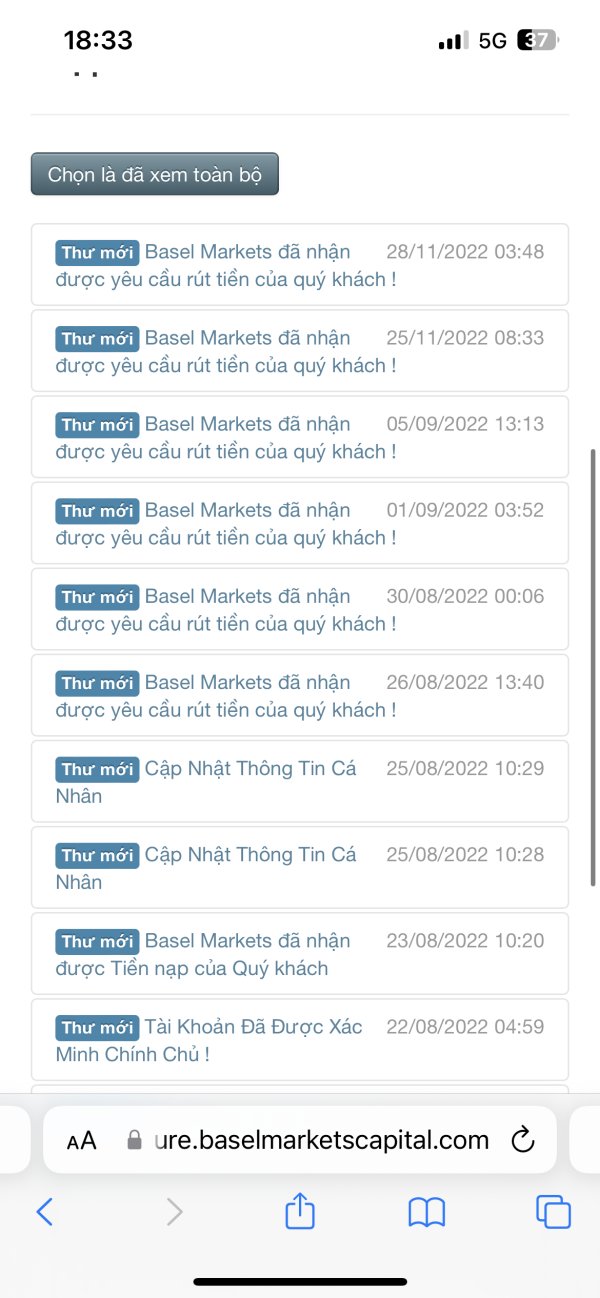

Customer service evaluation for Basel Markets is hampered by the absence of specific information. Support channels, availability hours, response times, or service quality metrics are not detailed in publicly accessible sources. This lack of transparency regarding customer support infrastructure raises concerns about the level of assistance clients can expect.

Professional trading environments require reliable, responsive customer support, particularly for technical issues, account management, and urgent trading-related inquiries. Without details about available communication channels such as phone support, live chat, email response times, or multilingual capabilities, potential clients cannot assess whether the broker meets their support requirements. The international scope of Basel Markets' operations across 30+ countries suggests a need for comprehensive multilingual support and extended service hours to accommodate different time zones. However, no information about such capabilities is available in current documentation.

The absence of customer service information is particularly concerning for institutional clients and active traders. These users require immediate assistance for time-sensitive trading situations or technical issues that could impact trading performance.

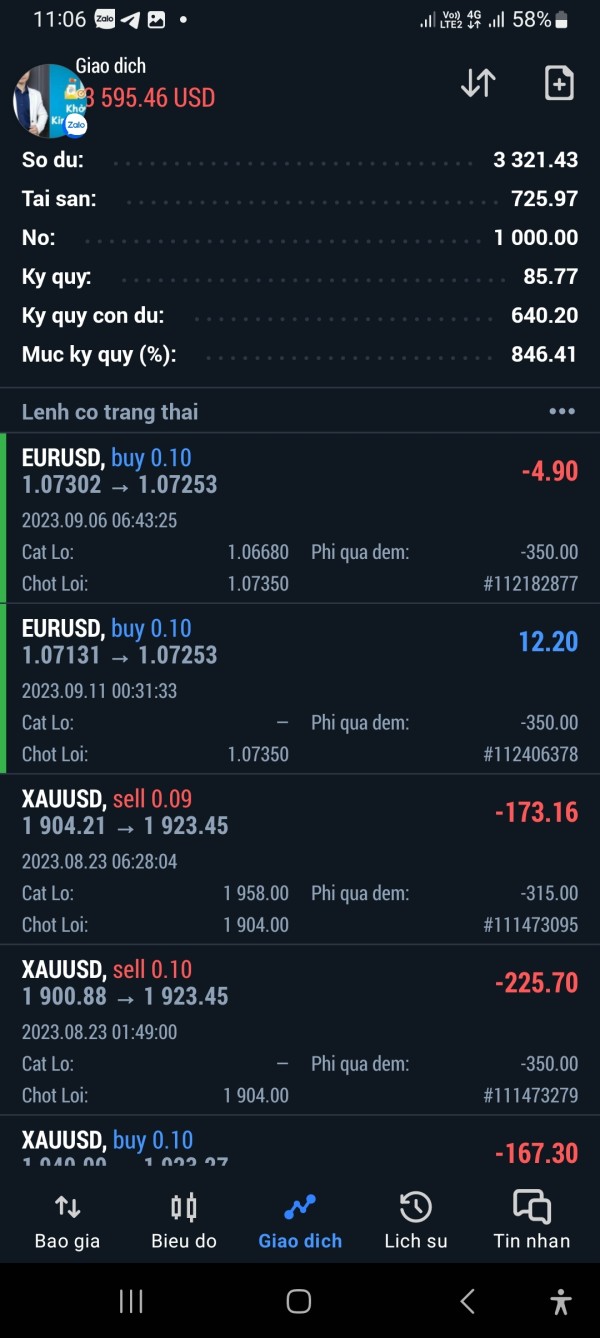

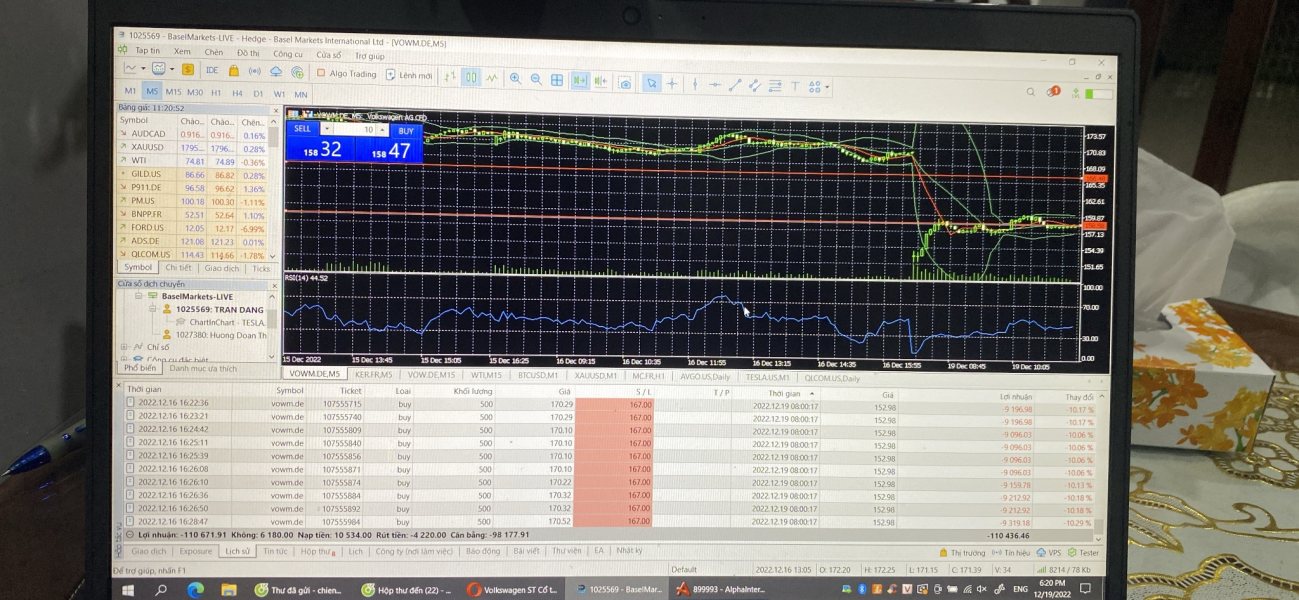

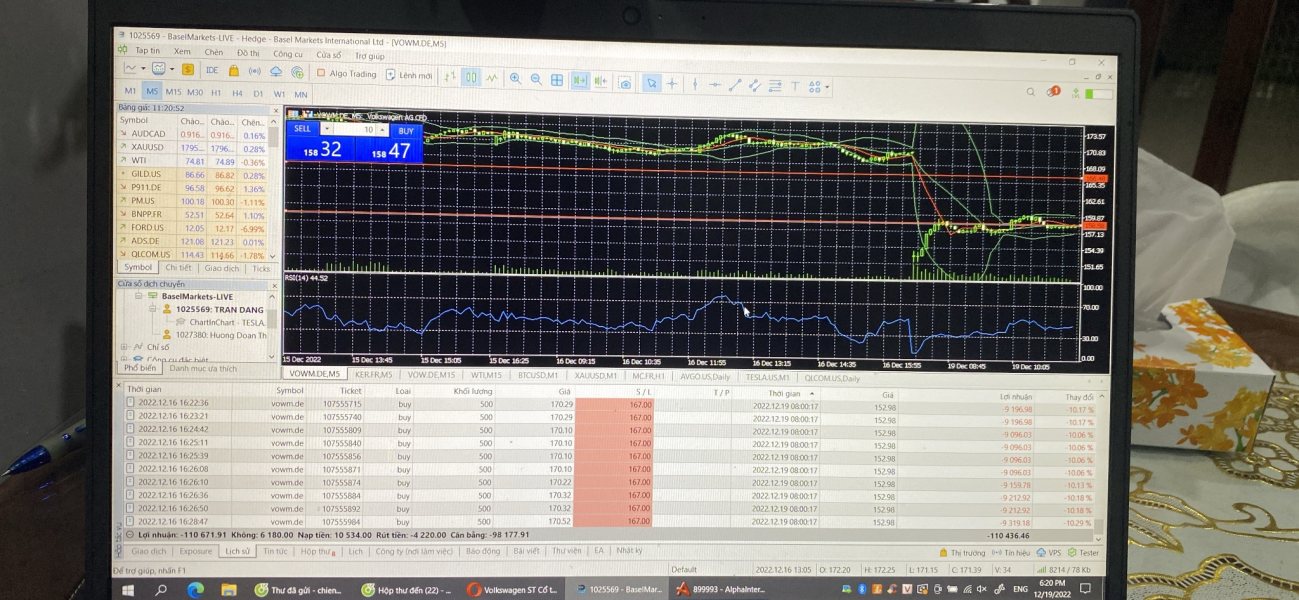

Trading Experience Analysis

Evaluating the trading experience at Basel Markets proves challenging. Limited specific information about platform performance, execution quality, and user interface design creates assessment difficulties. While the company emphasizes deep liquidity and advanced technology, concrete details about trading conditions and platform functionality are not readily available.

Key trading experience factors such as order execution speed, slippage rates, platform stability, and mobile trading capabilities require specific data that is not provided in accessible sources. The emphasis on institutional-grade infrastructure suggests potential strengths in execution quality. However, without user feedback or performance metrics, this cannot be verified.

Platform usability, which significantly impacts daily trading operations, cannot be assessed without specific information about interface design, customization options, or mobile app functionality. The absence of detailed platform descriptions makes it difficult for potential clients to understand what trading environment they would encounter. This basel markets review cannot provide a comprehensive trading experience rating due to insufficient publicly available information about actual trading conditions and platform performance metrics.

Trust and Reliability Analysis

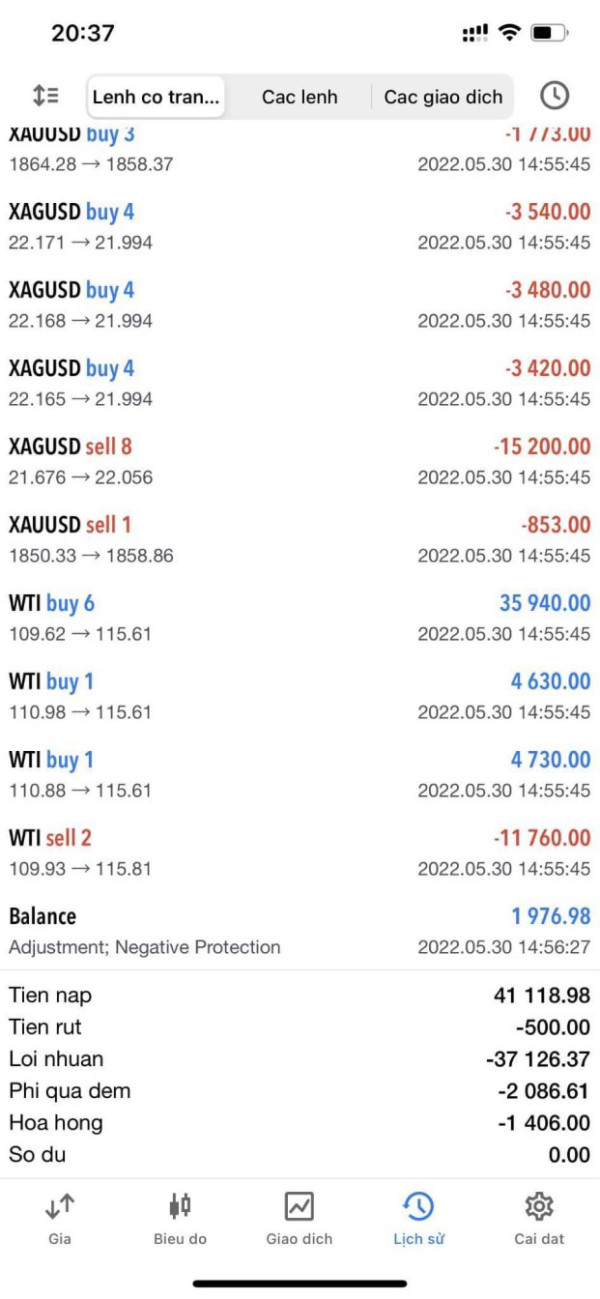

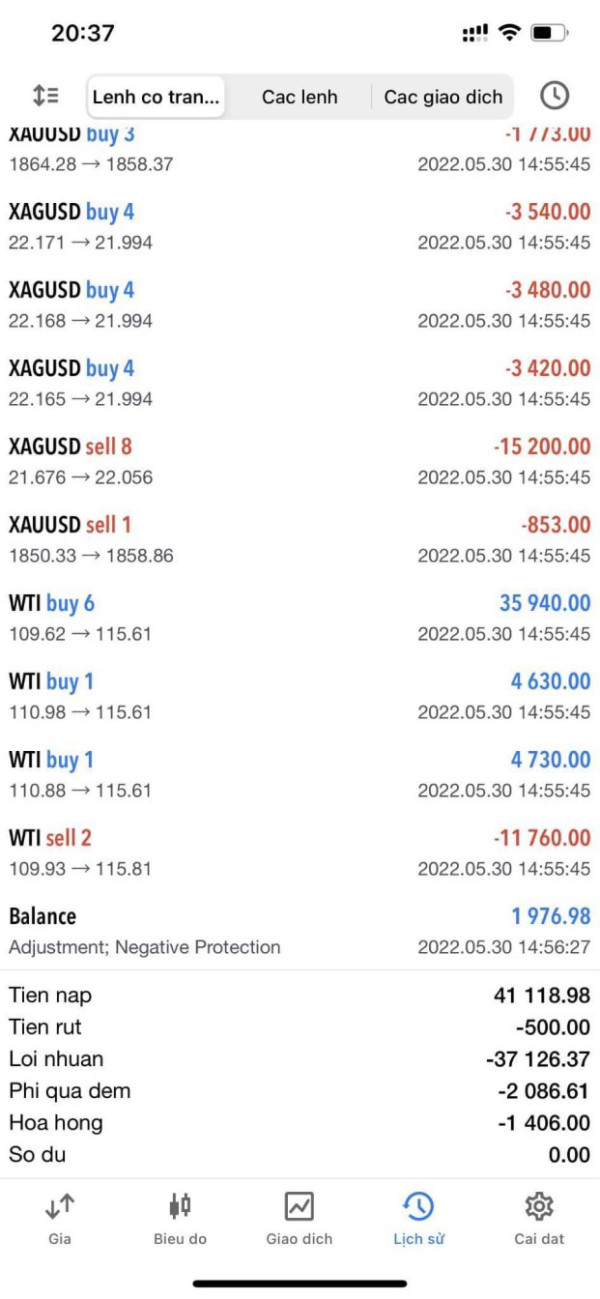

Trust and reliability assessment for Basel Markets reveals significant concerns. Limited regulatory transparency and company disclosure create evaluation problems. The absence of clearly stated regulatory information in publicly accessible sources represents a major red flag for potential clients prioritizing safety and oversight.

Reputable forex brokers typically provide comprehensive regulatory information including license numbers, regulatory body names, and compliance documentation. The lack of such transparency at Basel Markets raises questions about regulatory oversight and client protection measures that may be in place. Fund safety measures, segregation policies, and insurance coverage details are not specified in available documentation. This leaves potential clients without crucial information about asset protection.

This lack of transparency particularly affects institutional clients and larger investors who require clear understanding of fund security protocols. The company's relatively recent establishment in 2021, combined with limited public information about management, regulatory status, and operational transparency, contributes to reduced trust scores. Without third-party verification of regulatory compliance or independent audits, potential clients must rely on limited available information for trust assessment.

User Experience Analysis

User experience evaluation is based primarily on the reported 6/10 user rating. This indicates moderate satisfaction levels with room for improvement across various service areas. This rating suggests that while some clients find value in Basel Markets' services, there are notable areas where user expectations are not fully met.

The moderate rating may reflect the challenges associated with limited information transparency. This can create frustration for users seeking detailed service information. Interface design and ease of use cannot be assessed without specific user feedback about platform navigation and functionality.

Registration and verification processes, which significantly impact initial user experience, are not detailed in available documentation. Streamlined onboarding is crucial for user satisfaction. However, without specific information about account opening procedures, this aspect cannot be evaluated.

The absence of detailed user feedback about specific strengths and weaknesses makes it difficult to identify particular areas where Basel Markets excels or needs improvement. The 6/10 rating suggests mixed experiences that potential clients should investigate further through direct contact with existing users or the broker itself.

Conclusion

This basel markets review reveals a broker with potential strengths in liquidity provision and technological infrastructure. However, the broker shows significant weaknesses in transparency and information disclosure. While Basel Markets positions itself as a provider of institutional-grade trading solutions across 30+ countries, the lack of detailed regulatory, operational, and service information creates substantial barriers for potential client evaluation.

The 6/10 user rating indicates moderate performance levels. This suggests that while some clients find value in the broker's services, there are notable areas requiring improvement. The emphasis on deep liquidity and advanced technology platforms may appeal to traders prioritizing execution quality and market access.

However, the absence of clear regulatory information, detailed service specifications, and comprehensive customer support documentation makes Basel Markets suitable primarily for experienced traders. These traders must be willing to conduct extensive due diligence and accept higher uncertainty levels regarding regulatory oversight and operational transparency.