Regarding the legitimacy of ARGUS forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is ARGUS safe?

Pros

Cons

Is ARGUS markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP) 18

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Argus Stockbrokers Ltd

Effective Date:

2003-05-12Email Address of Licensed Institution:

argus@argus.com.cySharing Status:

No SharingWebsite of Licensed Institution:

http://www.argus.com.cy/, www.argusglobaltrader.comExpiration Time:

--Address of Licensed Institution:

25 Demostheni Severi Avenue, Metropolis Tower, 1st & 2nd floor, CY-1080 NicosiaPhone Number of Licensed Institution:

35722717000Licensed Institution Certified Documents:

Is Argus Safe or a Scam?

Introduction

Argus is a financial brokerage firm that has made its mark in the forex trading market, claiming to offer a range of investment opportunities across various asset classes. As traders increasingly turn to online platforms for trading, it becomes essential to evaluate the credibility and safety of these brokers before committing funds. The forex market is rife with both reputable and unscrupulous entities, making it crucial for traders to conduct thorough due diligence. This article aims to provide a comprehensive analysis of Argus, assessing its regulatory status, company background, trading conditions, customer experience, and overall safety. The evaluation is based on a thorough examination of multiple sources, including regulatory databases, customer reviews, and expert analyses.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in determining its safety. Argus operates under the oversight of the Cyprus Securities and Exchange Commission (CySEC), which is known for its relatively robust regulatory framework. However, it is important to note that while CySEC provides a level of oversight, it does not carry the same weight as top-tier regulators like the U.S. Securities and Exchange Commission (SEC) or the UK's Financial Conduct Authority (FCA).

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 010/03 | Cyprus | Verified |

Despite being regulated, the quality of oversight can vary. CySEC has been criticized for having less stringent requirements compared to other regulatory bodies. While Argus is compliant with CySEC regulations, there have been concerns regarding its transparency and the overall level of investor protection. Historical compliance records indicate that Argus has faced scrutiny, prompting traders to question its reliability. Therefore, while Argus is technically regulated, the quality of this regulation and its implications for investor safety should be carefully considered.

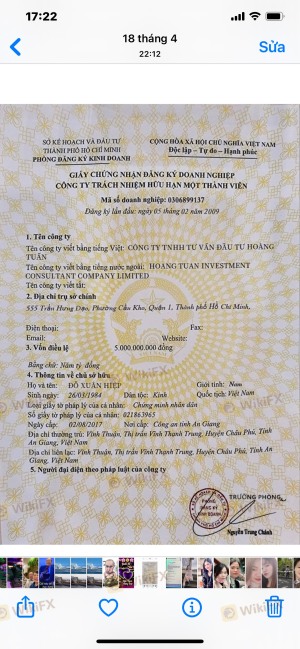

Company Background Investigation

Argus was established in 2003 and has since positioned itself as a player in the forex and CFD trading markets. The company's ownership structure is not extensively disclosed, leading to concerns about transparency. A thorough background check on the management team reveals limited information about their qualifications and experience in the financial sector. This lack of transparency raises red flags for potential investors who seek clarity on who is behind the brokerage.

In terms of operational transparency, Argus provides basic information on its website, including contact details and a brief overview of its services. However, the absence of detailed disclosures regarding the company's financial health, ownership, and management team can deter potential clients. The overall lack of transparency may contribute to the perception that Argus is not fully committed to maintaining the trust of its clients.

Trading Conditions Analysis

When evaluating whether Argus is safe, it is crucial to consider its trading conditions, including fees and costs. The brokerage offers a low minimum deposit requirement of $100, which is appealing for novice traders. However, the trading costs associated with various instruments can vary significantly.

| Cost Type | Argus | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 pips |

| Commission Model | None for standard accounts | $5 per lot |

| Overnight Interest Range | Variable | 0.5% - 1.5% |

While the absence of commissions for standard accounts may seem attractive, the variable spreads can lead to higher costs in volatile market conditions. Additionally, the lack of a clear commission structure for other account types may create confusion for traders. It is essential for potential users to fully understand these costs before engaging with the platform, as hidden fees can significantly impact profitability.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Argus claims to implement measures for fund security, including segregated accounts for client funds, ensuring that they are kept separate from the company's operating funds. However, the effectiveness of these measures remains a point of contention.

Investors should also inquire about investor protection schemes, which can provide additional safety nets in case of broker insolvency. CySEC does offer some level of investor protection, but it is not as comprehensive as schemes in other jurisdictions. Historical accounts of fund security issues or disputes involving Argus can further complicate the picture, as any past incidents may serve as a warning for potential clients.

Customer Experience and Complaints

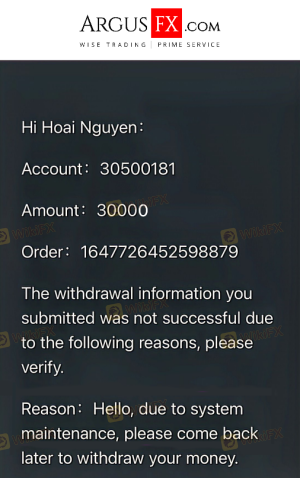

Customer feedback is a valuable resource when assessing the reliability of a broker. Reviews for Argus are mixed, with some users praising the platform's ease of use and customer support, while others report issues with fund withdrawals and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor customer support | Medium | Mixed responses |

Common complaints include difficulties in withdrawing funds, which is a significant concern for many traders. Reports of accounts being locked or delayed withdrawal processes have led to frustrations among users. In some cases, the company's response has been inadequate, further exacerbating the situation. These patterns of complaints raise questions about whether Argus is truly safe for traders.

Platform and Execution

The trading platform provided by Argus is designed to facilitate a smooth trading experience. However, user experiences vary, with some reporting issues related to platform stability and order execution quality. Concerns about slippage and order rejections have been raised, indicating that the trading environment may not be as reliable as advertised.

A thorough evaluation of execution quality is essential, particularly in a market where timing can significantly impact profitability. If traders experience frequent slippage or rejected orders, it can lead to substantial financial losses. Therefore, assessing the platform's performance is crucial when determining whether Argus is a safe option for trading.

Risk Assessment

Using Argus for trading carries inherent risks that need to be acknowledged. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | CySEC regulation is not as stringent as other jurisdictions. |

| Fund Safety Risk | High | Historical issues with fund withdrawals and transparency. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, potential traders should conduct thorough research, utilize demo accounts to test the platform, and consider diversifying their investments across multiple brokers.

Conclusion and Recommendations

In conclusion, while Argus is a regulated brokerage, there are several areas of concern that potential traders should consider. The lack of transparency regarding its management, mixed customer feedback, and issues with fund withdrawals raise questions about whether Argus is truly safe.

For traders seeking reliability, it may be prudent to explore alternatives with stronger regulatory oversight and a proven track record of customer satisfaction. Brokers regulated by top-tier authorities like the FCA or ASIC may offer a more secure trading environment. Ultimately, traders must weigh the risks and benefits before deciding whether to engage with Argus.

Is ARGUS a scam, or is it legit?

The latest exposure and evaluation content of ARGUS brokers.

ARGUS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ARGUS latest industry rating score is 5.08, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.08 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.