Argus 2025 Review: Everything You Need to Know

Executive Summary

Argus represents a well-established presence in the financial services sector. Argus Research boasts over 90 years of experience in providing independent research for investors, making it a trusted name in the industry. This comprehensive argus review reveals a firm that has developed sophisticated analytical frameworks and maintains regulatory compliance across multiple jurisdictions with remarkable consistency. The company operates through different entities, with Argus Stockbrokers serving as a fully licensed member of both the Cyprus Stock Exchange and Athens Stock Exchange.

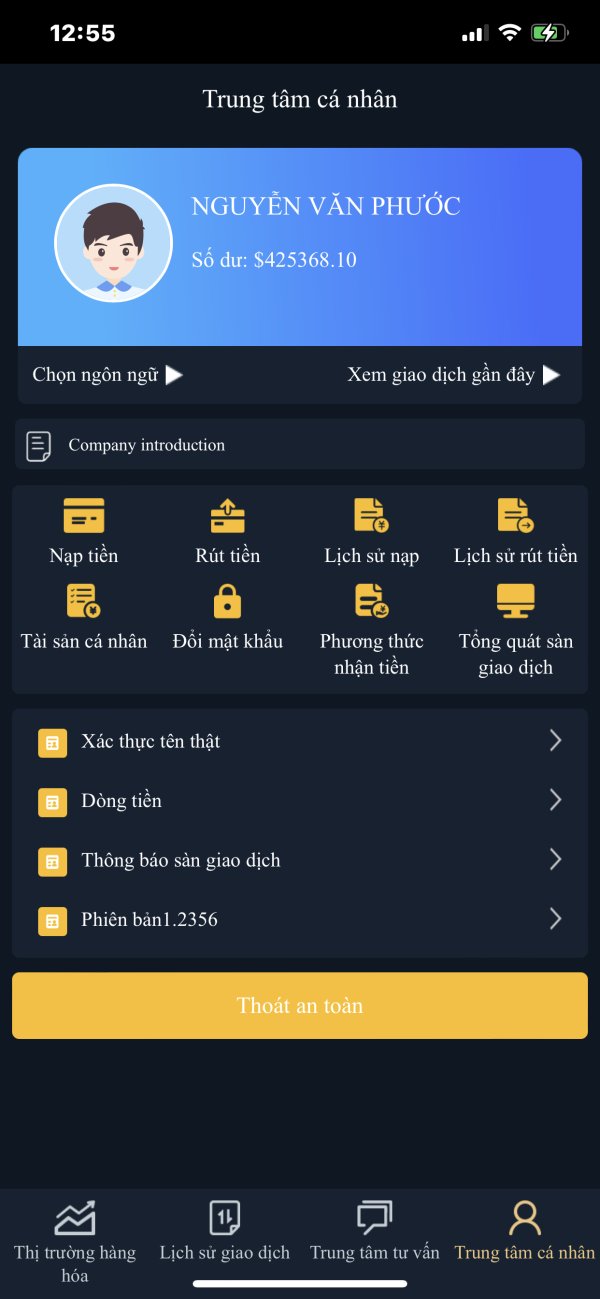

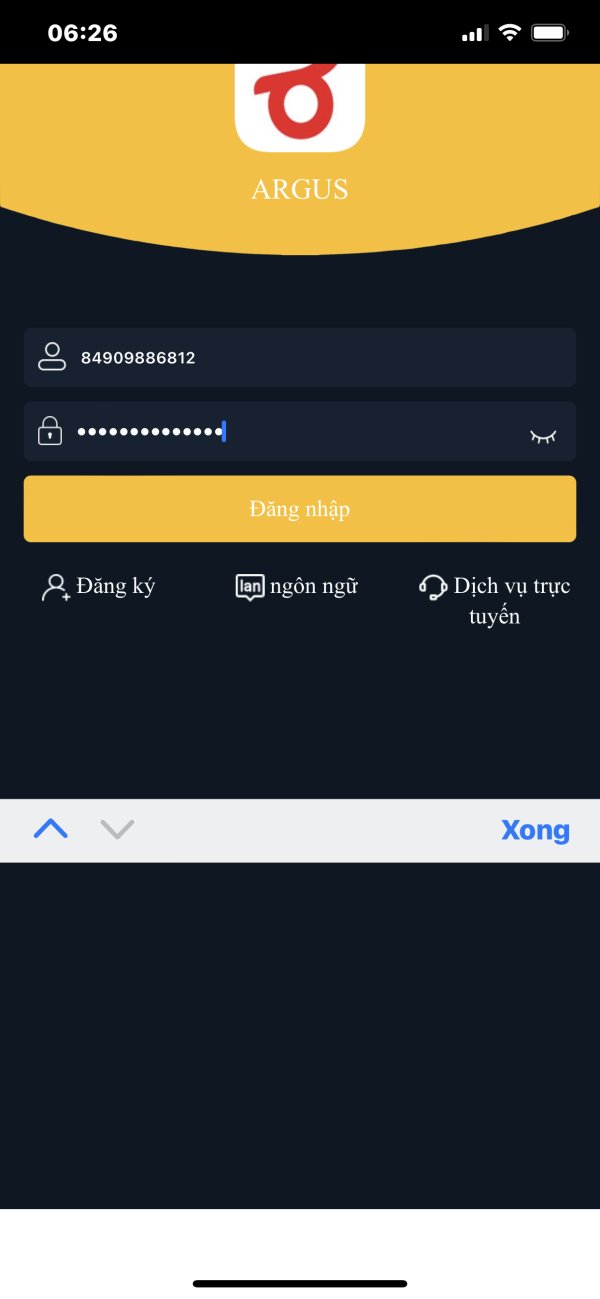

Key highlights include access to diverse asset classes through the ARGUS Global Trader Platform. This platform is powered by Saxo technology, a well-known provider in the trading industry. The broker offers trading in futures, equities, bonds, ETFs, and various CFD instruments covering stocks, ETPs, indices, futures, and forex markets with impressive breadth. Commission structures begin at 0.00% with a minimum fee of €5, making it accessible for traders seeking cost-effective solutions.

The platform primarily targets traders seeking diversified investment opportunities across multiple asset classes. With regulatory oversight from established European exchanges and a technology partnership with Saxo, Argus positions itself as a reliable option for investors requiring comprehensive market access and professional-grade research capabilities that meet modern trading demands.

Important Disclaimers

Traders should note that Argus operates through different entities across various jurisdictions. Regulatory frameworks vary by region, which means protection levels may differ depending on your location. Argus Stockbrokers specifically operates under Cyprus and Greek regulatory oversight through CSE and ASE memberships, providing established European regulatory protection. Users must verify the applicable regulations and protections available in their specific jurisdiction before opening accounts.

This review is based on publicly available information and aims to provide comprehensive analysis of the broker's offerings. Trading involves significant risk, and past performance does not guarantee future results in any market condition. Potential clients should carefully consider their risk tolerance and conduct independent research before making trading decisions that could affect their financial situation.

Rating Framework

Broker Overview

Argus Research has established itself as a significant player in the financial research sector. The company has maintained operations for 90 years, building a reputation for quality and reliability in the process. The company distinguishes itself by focusing exclusively on independent research production for investors, deliberately avoiding activities such as bringing companies public, advising on mergers and acquisitions, or making markets in stocks. This focused approach has allowed Argus to develop sophisticated analytical methodologies, including their proprietary six-point system for stock analysis that provides consistent evaluation criteria.

The firm's commitment to analytical rigor is demonstrated through their Investment Policy Committee approval process. Each potential rating change undergoes thorough review before implementation, ensuring quality control at every step. This systematic approach reflects the company's dedication to maintaining research quality and independence throughout their extensive operational history, which spans nearly a century of market cycles.

The trading arm, Argus Stockbrokers, operates through the ARGUS Global Trader Platform. This platform leverages technology partnerships with established providers like Saxo, bringing institutional-grade capabilities to individual traders. The platform provides access to comprehensive asset classes including futures, equities, bonds, ETFs, and CFDs covering stocks, ETPs, indices, futures, and forex markets with competitive execution. Regulatory oversight comes through full licensing with the Cyprus Stock Exchange and Athens Stock Exchange, providing European regulatory framework compliance. This argus review confirms the broker's positioning within established regulatory environments while offering diverse trading opportunities that meet modern investor needs.

Regulatory Jurisdictions: Argus Stockbrokers operates as a fully licensed member of both the Cyprus Stock Exchange and Athens Stock Exchange. This dual licensing provides regulatory oversight under European frameworks, ensuring compliance with established financial standards.

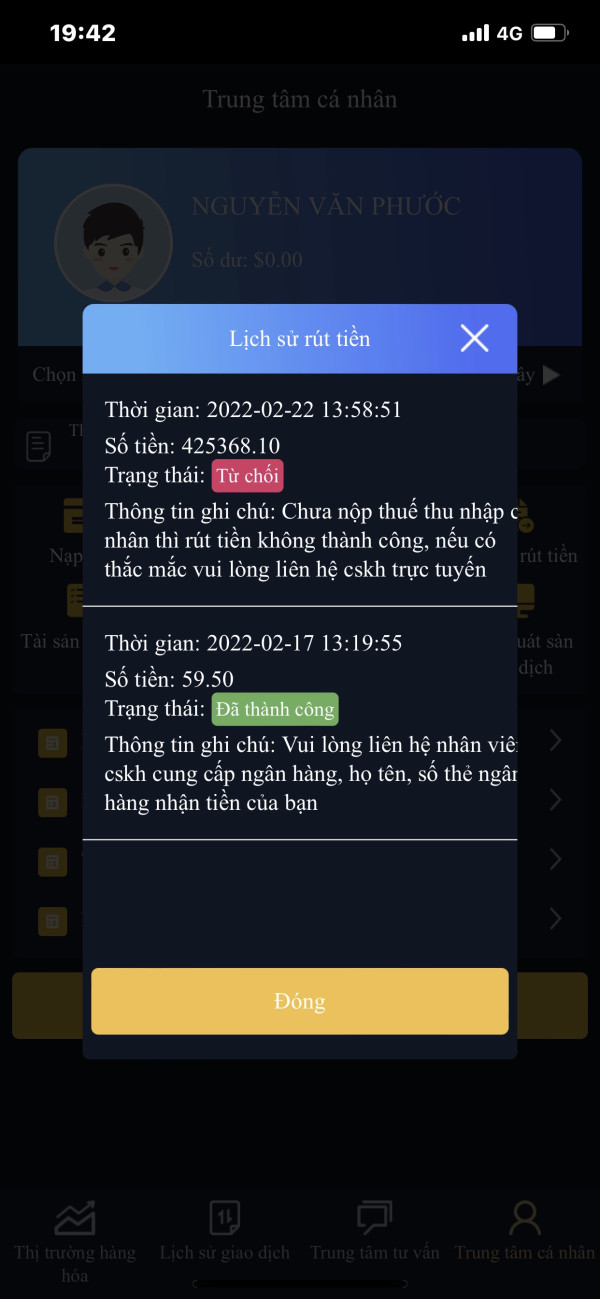

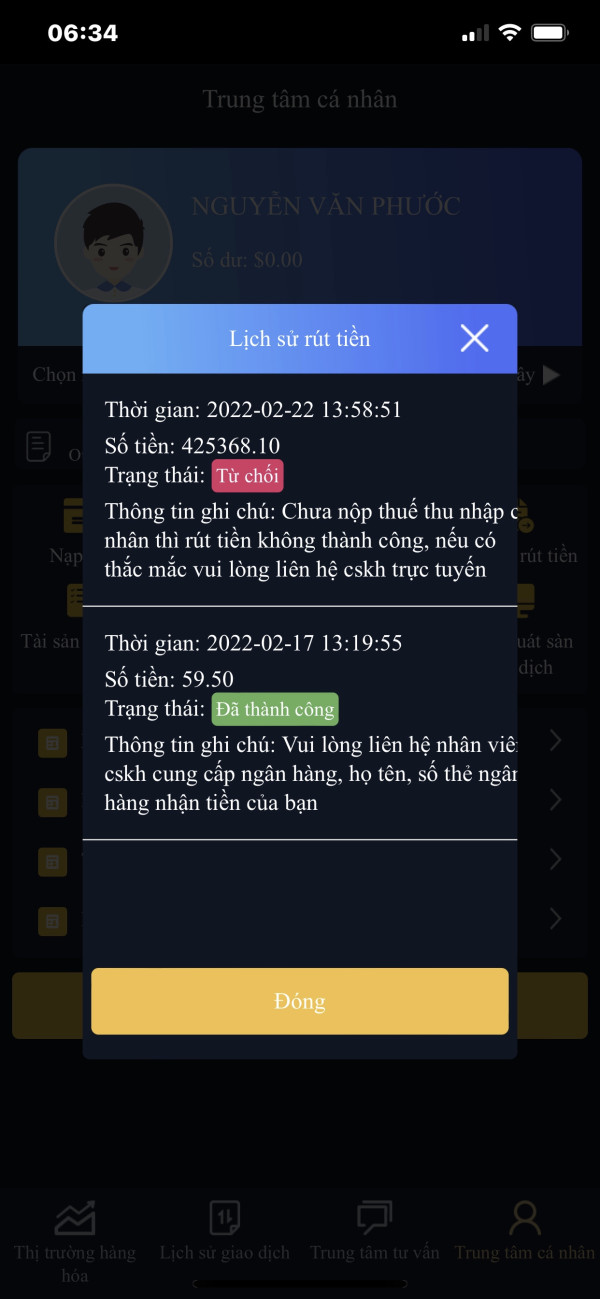

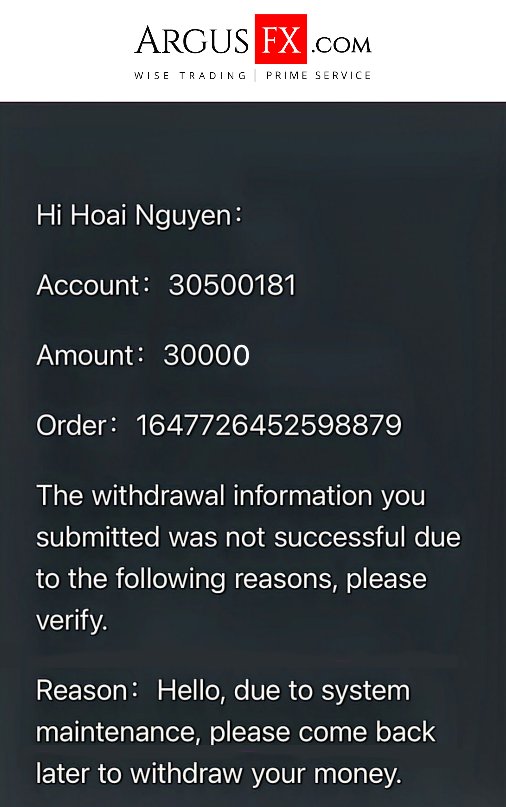

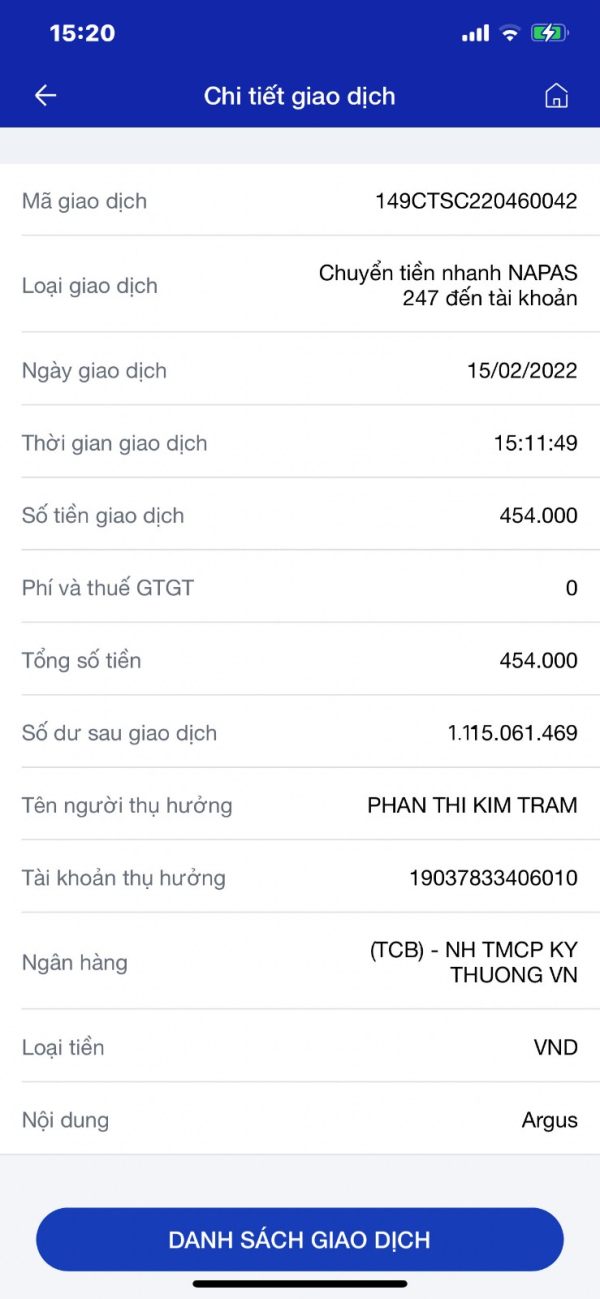

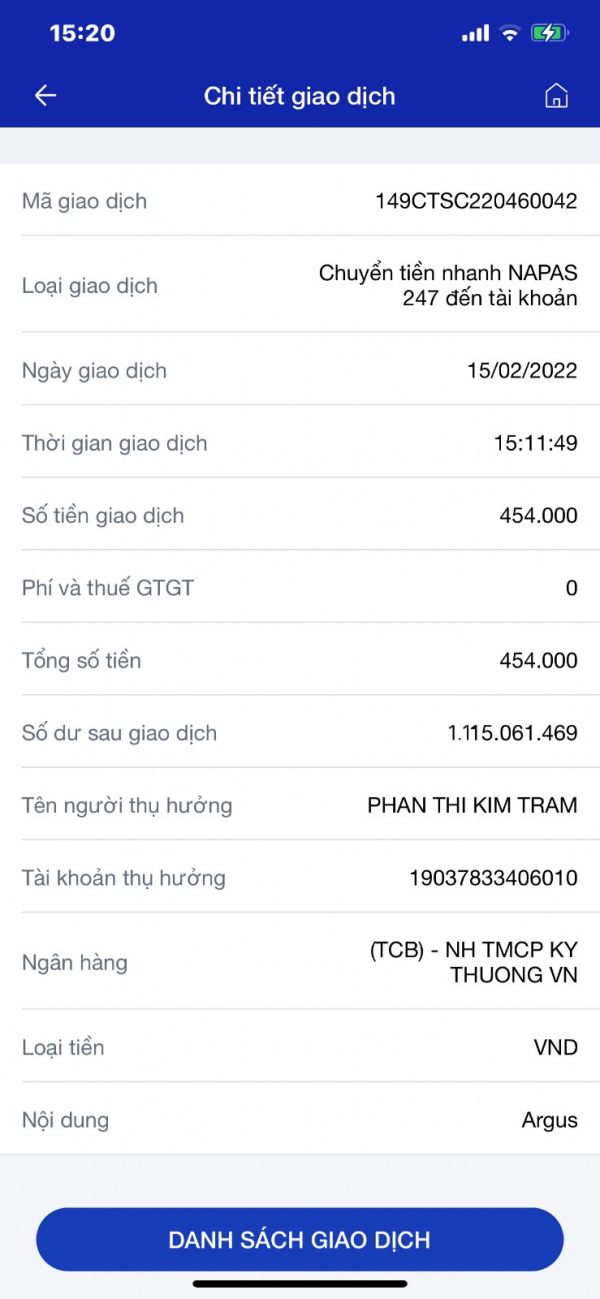

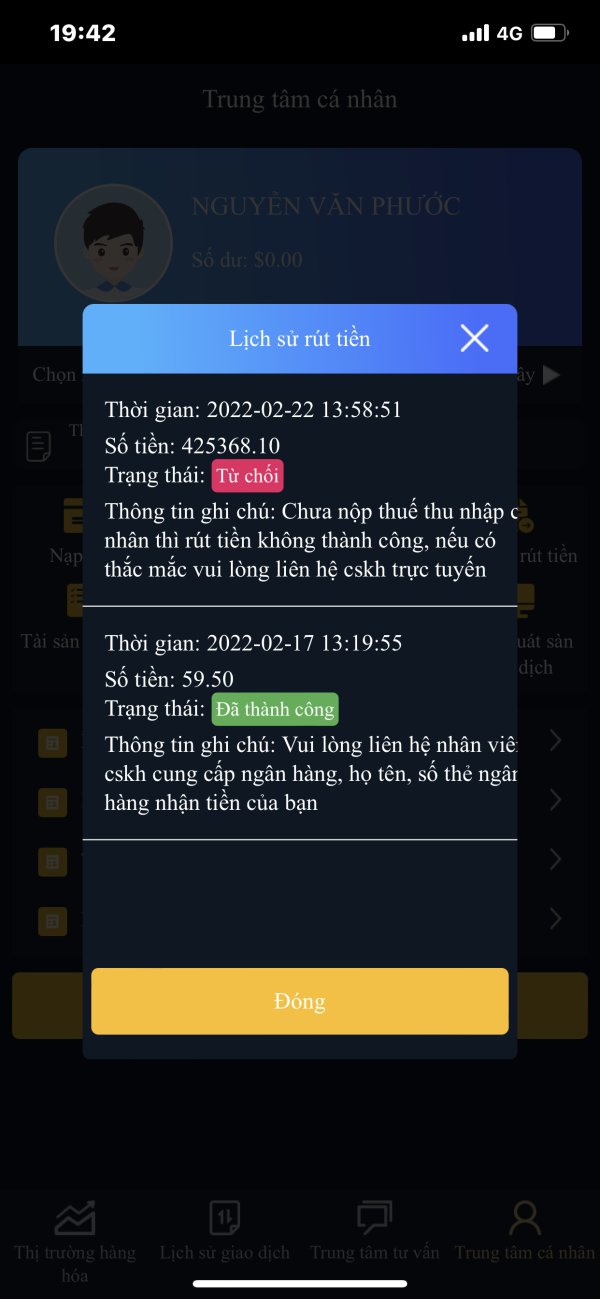

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods was not detailed in available materials. Potential clients should contact the broker directly for comprehensive payment option details and processing times.

Minimum Deposit Requirements: Minimum deposit requirements are not specified in available documentation. Prospective traders should inquire directly with the broker for account opening thresholds and any tier-specific requirements.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not detailed in available materials. Potential clients should inquire directly about available incentives and any terms or conditions that may apply.

Tradeable Assets: The platform offers comprehensive asset coverage including futures, equities, bonds, ETFs, and CFD instruments. These instruments span stocks, ETPs, indices, futures, and forex markets, providing diversified trading opportunities across multiple asset classes.

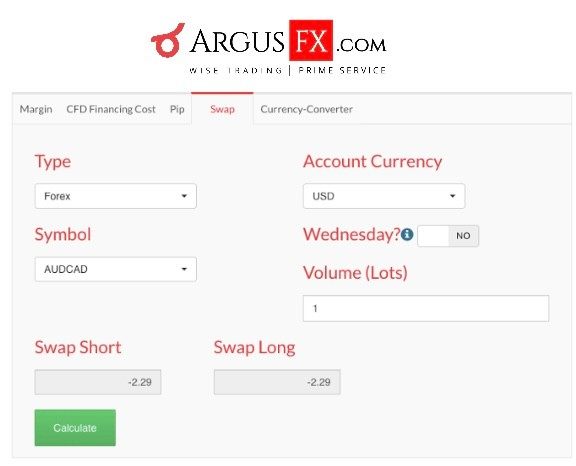

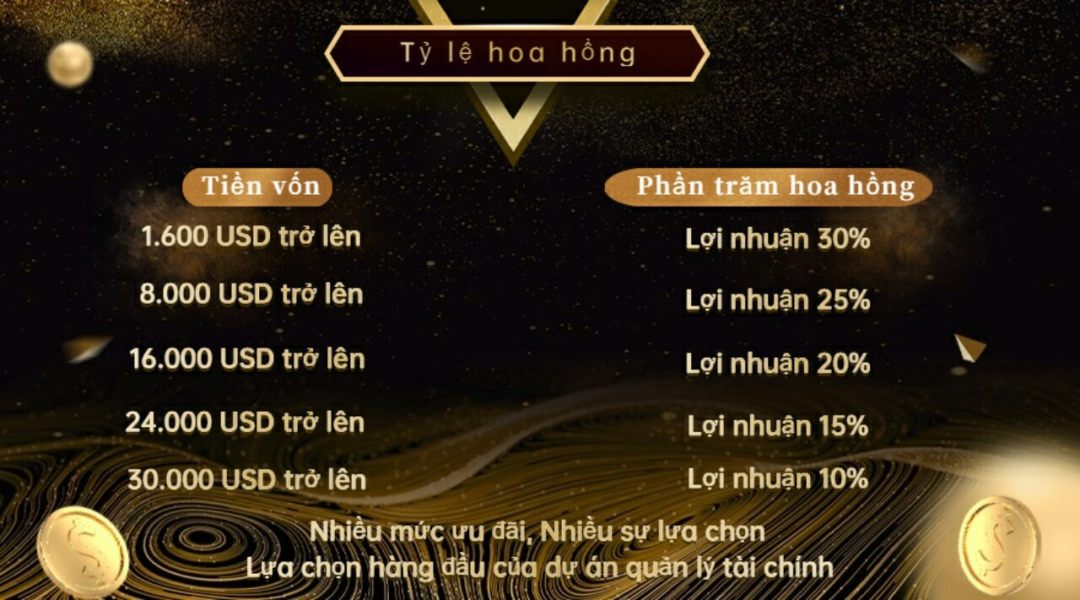

Cost Structure: Commission rates begin at 0.00% with a minimum fee of €5 per transaction. Additional costs including subscription fees, custody charges, and settlement fees may apply depending on trading activity and account type. Detailed fee schedules are available through the broker's official channels for complete transparency.

Leverage Ratios: Specific leverage ratios and margin requirements are not detailed in available materials. Traders should consult directly with the broker for trading condition specifics and risk management requirements.

Platform Options: Trading is conducted through the ARGUS Global Trader Platform. This platform utilizes Saxo technology to provide secure and intuitive access to multiple asset classes with professional-grade functionality. This argus review notes the platform's focus on delivering institutional-quality tools to individual traders.

Geographic Restrictions: Specific geographic restrictions and availability limitations are not detailed in available documentation. Potential clients should verify service availability in their jurisdiction before proceeding with account opening.

Customer Service Languages: Available customer service languages and support options require direct verification with the broker. Multilingual support capabilities may vary by region and service level.

Account Conditions Analysis

Account conditions represent a crucial factor for trader decision-making in today's competitive market. Argus presents a competitive structure with commission rates starting at 0.00% and minimum fees of €5, making the platform accessible to traders across different capital levels. This pricing approach maintains cost-effectiveness for frequent trading activities while remaining competitive with industry standards.

However, comprehensive details about account types, minimum deposit requirements, and specific account features remain limited in available materials. The absence of detailed account tier information suggests that potential clients should engage directly with the broker to understand available options and their respective benefits fully. Different account types may offer varying features and pricing structures that could significantly impact trading costs.

Account opening procedures and verification processes are not extensively documented in available sources. Prospective traders will need to contact Argus directly for specific requirements and timelines to ensure smooth account setup. Special account features, such as Islamic-compliant accounts or institutional arrangements, require direct inquiry to determine availability and conditions that may apply.

The commission structure's transparency, with clearly stated minimum fees, demonstrates the broker's commitment to upfront pricing. However, the complete fee schedule, including potential additional charges for specific services or asset classes, necessitates thorough review during the account opening process to avoid unexpected costs. This argus review emphasizes the importance of understanding all applicable costs before committing to the platform for long-term trading activities.

Argus demonstrates strength in providing diverse trading instruments across multiple asset classes. The platform offers access to futures, equities, bonds, ETFs, and comprehensive CFD options covering stocks, ETPs, indices, futures, and forex markets with impressive scope. This breadth of available instruments positions Argus favorably for traders seeking portfolio diversification and cross-asset strategies that require multiple market access.

The ARGUS Global Trader Platform, powered by Saxo technology, suggests access to professional-grade trading tools and analytical capabilities. Saxo's reputation for robust trading infrastructure indicates that users likely benefit from advanced charting, order management, and market analysis features that meet institutional standards. However, specific tool details require direct platform evaluation to assess functionality and user interface quality.

Research capabilities represent a significant strength given Argus Research's 90-year history in independent analysis. The firm's proprietary six-point stock analysis system and Investment Policy Committee oversight suggest access to high-quality research resources that could enhance trading decisions. However, the extent of research availability to trading clients requires clarification through direct broker contact.

Educational resources and automated trading support details are not extensively covered in available materials. Traders interested in learning resources or algorithmic trading capabilities should inquire directly about available options and any associated costs or requirements that may apply to their account type.

Customer Service and Support Analysis

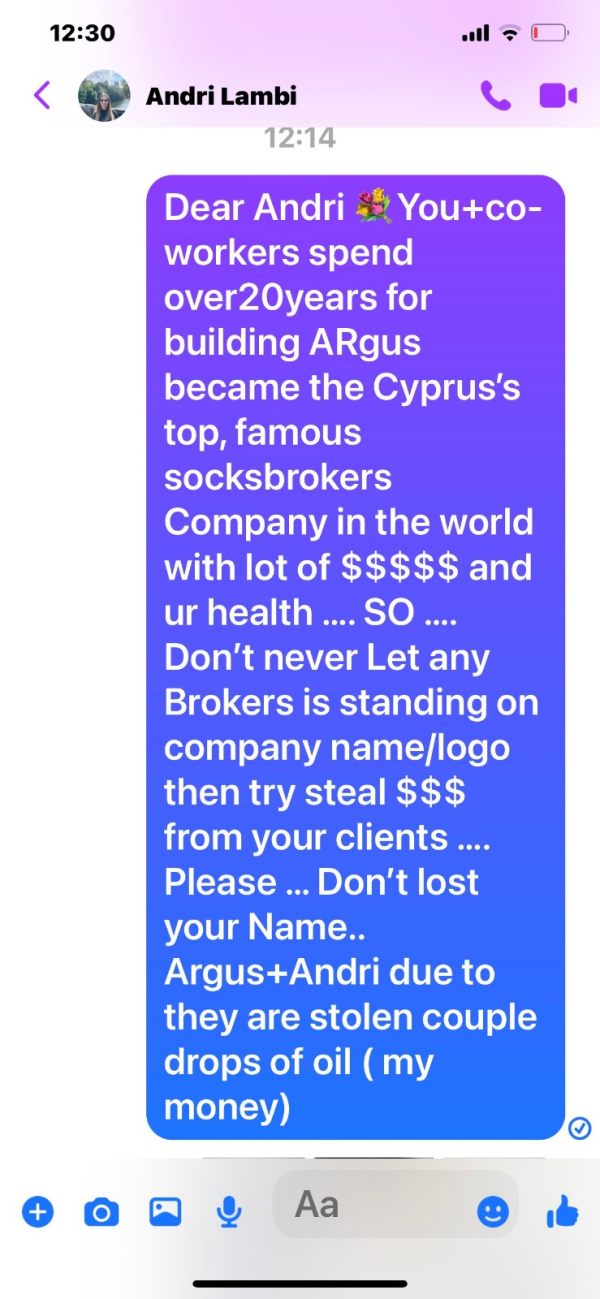

Customer service information represents a significant gap in available documentation about Argus. Specific details about support channels, availability hours, response times, and service quality metrics are not readily available in current materials, making comprehensive evaluation challenging for prospective clients. This lack of transparency may concern traders who prioritize responsive customer support.

The absence of detailed customer service information suggests that potential clients should prioritize direct contact with the broker to assess support quality and availability. Key factors to evaluate include response times across different communication channels, technical support capabilities, and the availability of dedicated account management services that could enhance the trading experience. Quality customer service becomes crucial during market volatility when quick resolution of issues can impact trading performance.

Multilingual support capabilities and regional service variations require direct verification. This verification becomes particularly important given the broker's operations across Cyprus and Greek markets where language preferences may vary. Understanding available languages and regional support structures becomes crucial for international clients considering the platform for their trading activities.

Problem resolution procedures and escalation processes are not documented in available materials. Prospective clients should understand support frameworks before account opening to ensure adequate assistance when needed. The quality of customer service can significantly impact trading experience, particularly during market volatility or technical issues that require immediate attention.

Trading Experience Analysis

The trading experience centers around the ARGUS Global Trader Platform, which utilizes Saxo technology infrastructure. This partnership suggests access to institutional-grade trading capabilities that could enhance execution quality and platform reliability. However, specific performance metrics such as execution speeds, platform stability, and order fill quality require direct evaluation through platform testing to assess actual performance.

Platform functionality appears comprehensive given the diverse asset classes available. The system supports futures, equities, bonds, ETFs, and CFD instruments across multiple markets, suggesting sophisticated platform capabilities that can handle complex trading strategies. However, user interface design and ease of navigation require hands-on assessment to evaluate fully and determine suitability for different trading styles.

Mobile trading capabilities and cross-device synchronization features are not detailed in available materials. Modern traders increasingly require seamless mobile access for managing positions and monitoring markets on the go. Prospective users should verify mobile platform availability and functionality during their assessment process to ensure compatibility with their trading workflow.

Order execution quality and market access represent critical factors for trading success. While the Saxo technology partnership suggests professional-grade infrastructure, specific execution statistics and market access details require direct verification with the broker to understand actual performance capabilities. This argus review recommends thorough platform testing before committing significant capital to ensure the platform meets individual trading requirements.

Trust and Regulation Analysis

Regulatory oversight represents a significant strength for Argus in the current financial landscape. Argus Stockbrokers maintains full licensing with both the Cyprus Stock Exchange and Athens Stock Exchange, providing dual regulatory framework protection. This European-standard oversight enhances trader protection and operational transparency through established compliance requirements.

The 90-year operational history of Argus Research demonstrates institutional stability and market longevity. This extensive track record suggests established operational procedures and market experience that span multiple economic cycles and market conditions. However, specific financial stability metrics and capital adequacy information require verification through regulatory filings to assess current financial strength.

Fund safety measures and client asset protection protocols are not extensively detailed in available materials. Given the regulatory framework, standard European client asset segregation requirements likely apply to protect trader funds from company operational risks. However, specific protection measures should be verified directly with the broker to understand the full scope of client protections available.

Company transparency regarding ownership structure, financial performance, and operational metrics requires additional investigation. While regulatory oversight provides baseline protection, comprehensive due diligence should include reviewing available financial disclosures and regulatory filings to assess company stability. This transparency becomes particularly important for traders planning to maintain significant account balances.

User Experience Analysis

User experience evaluation is limited by the absence of comprehensive user feedback and interface documentation. The platform's integration with Saxo technology suggests professional-grade functionality that could enhance trading efficiency and user satisfaction. However, actual user satisfaction metrics require direct assessment through user communities and review platforms to gain realistic expectations.

Interface design and platform usability represent crucial factors for trading efficiency. The ARGUS Global Trader Platform's specific design philosophy and user experience approach require hands-on evaluation to assess properly and determine fit for individual preferences. Key factors include navigation intuitiveness, customization options, and workflow efficiency for different trading styles that may vary significantly between users.

Registration and account verification processes are not detailed in available documentation. This lack of information makes it difficult to assess onboarding experience quality and potential complications that new users might encounter. Prospective clients should inquire about required documentation, verification timelines, and any potential complications in the account opening process to set appropriate expectations.

The target user profile appears to focus on traders seeking diversified investment opportunities across multiple asset classes. This positioning suggests the platform may be optimized for sophisticated traders rather than beginners who might need more educational support and simplified interfaces. However, specific user experience accommodations for different skill levels require direct verification to determine platform suitability.

Conclusion

This argus review reveals a broker with solid regulatory foundations and comprehensive asset class coverage. However, significant information gaps limit complete evaluation of the platform's full capabilities and user experience quality. Argus demonstrates strength through its 90-year research heritage, dual exchange licensing, and technology partnership with Saxo that brings institutional-grade capabilities to individual traders. The commission structure starting at 0.00% with €5 minimum fees presents competitive pricing for cost-conscious traders seeking efficient market access.

The platform appears well-suited for traders seeking diversified investment opportunities across futures, equities, bonds, ETFs, and CFD markets. However, the absence of detailed information about customer service, specific platform features, and user experience metrics necessitates direct engagement with the broker for comprehensive evaluation before making account opening decisions. Prospective clients should conduct thorough due diligence to ensure platform compatibility with their trading requirements.

Primary advantages include established regulatory oversight, competitive commission structure, and access to diverse asset classes through professional-grade technology infrastructure. Key limitations involve insufficient publicly available information about customer service quality, platform-specific features, and user experience metrics that could impact daily trading activities. This situation requires prospective clients to conduct thorough due diligence before account opening to ensure the platform meets their specific trading needs and expectations.