Is Acer safe?

Business

License

Is Acer Finance A Scam?

Introduction

Acer Finance has emerged as a player in the forex trading market, attracting traders with promises of high leverage and a variety of trading instruments. However, the importance of thoroughly vetting forex brokers cannot be overstated, as the financial landscape is rife with scams and unregulated entities. Traders must be vigilant to protect their investments and ensure they are dealing with reputable firms. This article aims to provide an objective assessment of Acer Finance, focusing on its regulatory status, operational history, trading conditions, and customer experiences. Our investigation is based on a comprehensive review of available online resources, including user feedback, regulatory databases, and expert analyses.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is crucial for ensuring the safety of traders' funds. Acer Finance claims to operate in various markets, but its regulatory status raises significant concerns.

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

Acer Finance operates without any regulatory oversight, which is a red flag for potential investors. The absence of a license from reputable regulatory bodies such as the FCA (UK), ASIC (Australia), or any European authority indicates a lack of accountability and consumer protection. Unregulated brokers can operate with impunity, making it difficult for traders to recover funds in cases of fraud or mismanagement. Given the high leverage offered by Acer Finance, which can reach up to 1:600, the risks associated with trading here are compounded. The lack of regulatory oversight raises serious questions about the safety of funds and the legitimacy of trading operations at Acer Finance.

Company Background Investigation

A thorough examination of Acer Finances company background reveals a lack of transparency and critical information. The broker is reportedly owned by Cynosure Consulting Ltd, a company registered in Dominica, a jurisdiction known for its lenient regulatory environment.

The management team of Acer Finance is not well-documented, and there is minimal information available regarding their professional backgrounds. This obscurity can be concerning for potential traders, as a knowledgeable and experienced management team is vital for the successful operation of a brokerage. Furthermore, the absence of clear ownership details and operational history suggests that the company may not prioritize transparency, which is essential for building trust with clients.

In summary, the lack of a solid company foundation and the ambiguous nature of its ownership structure contribute to the perception that Acer Finance may not be a trustworthy broker.

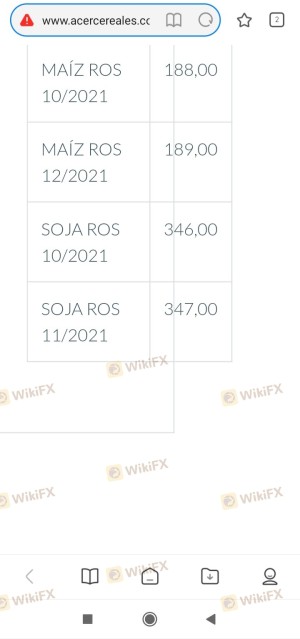

Trading Conditions Analysis

Acer Finance presents a range of trading conditions that may initially appear attractive to potential investors. However, a closer look reveals some concerning aspects of their fee structure.

| Fee Type | Acer Finance | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 3 pips | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by Acer Finance are significantly higher than the industry average, which could erode potential profits for traders. Additionally, while the broker claims not to charge commissions, the high spreads effectively serve as a hidden cost that traders must account for. Furthermore, the overnight interest rates are reportedly high, which can lead to additional costs for traders holding positions overnight.

These trading conditions suggest that while Acer Finance may attract traders with high leverage and no visible commissions, the underlying costs could be detrimental to overall profitability.

Client Fund Security

The security of client funds is paramount in the forex trading industry, and this is an area where Acer Finance raises several alarms. The broker does not provide clear information regarding the segregation of client funds or investor protection measures.

Acer Finance does not appear to offer negative balance protection, which is a critical feature that prevents traders from losing more money than they have deposited. Moreover, the lack of a compensation scheme in case of broker insolvency adds to the risks associated with trading with Acer Finance.

Historically, unregulated brokers like Acer Finance have been involved in disputes over fund security, often leading to significant losses for clients. The absence of robust security measures for client funds is a significant concern, making traders question: Is Acer safe?

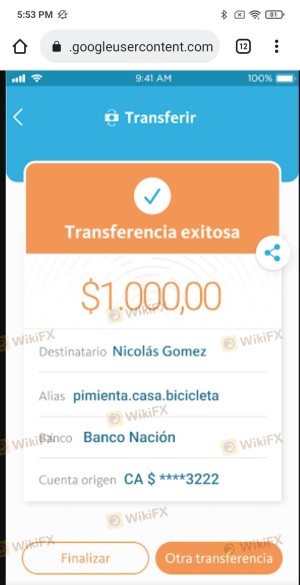

Customer Experience and Complaints

Customer feedback is a vital component in evaluating a broker's reliability, and Acer Finance has received a mixture of reviews, predominantly negative. Many users report difficulties in withdrawing funds, which is a common complaint among unregulated brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

Typical complaints include users being unable to access their funds after making a deposit and experiencing unresponsive customer service. In some cases, traders have reported being pressured to invest more money or to meet unrealistic trading volume requirements before they could withdraw their initial investment.

These patterns of complaints suggest a troubling operational ethos at Acer Finance, leading many to question whether it is a scam broker.

Platform and Trade Execution

The trading platform offered by Acer Finance is another area of concern. Users report that the platform is basic and lacks the advanced features commonly found in reputable trading software like MetaTrader 4 or 5.

Issues with order execution, including slippage and high rejection rates, have also been reported by traders. Such problems can significantly impact trading performance and raise suspicions of platform manipulation.

In conclusion, the lack of a robust trading platform and the reported execution issues further contribute to the skepticism surrounding Acer Finance.

Risk Assessment

Trading with Acer Finance presents several risks that traders should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Fund Security Risk | High | Lack of fund segregation and compensation. |

| Trading Condition Risk | Medium | High spreads and potential hidden fees. |

| Customer Service Risk | High | Poor response to complaints and issues. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with any broker, particularly those that lack regulatory oversight. It is also advisable to start with a small investment and test the withdrawal process before committing larger sums.

Conclusion and Recommendations

In light of the evidence presented, it is clear that Acer Finance raises several red flags that suggest it may not be a safe or legitimate trading option. The lack of regulation, poor customer feedback, and questionable trading conditions all point towards a potentially risky trading environment.

For traders seeking reliable alternatives, it is recommended to consider brokers that are regulated by reputable authorities, offer transparent trading conditions, and have a history of positive customer experiences. Some reputable options include brokers regulated by the FCA, ASIC, or other recognized financial authorities.

In conclusion, while Acer Finance may present itself as an attractive option for forex trading, the risks associated with using this broker far outweigh any potential benefits. Traders should exercise caution and conduct thorough due diligence before deciding to engage with Acer Finance.

Is Acer a scam, or is it legit?

The latest exposure and evaluation content of Acer brokers.

Acer Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Acer latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.