Acer 2025 Review: Everything You Need to Know

Executive Summary

Based on available information and user feedback, this acer review reveals significant concerns about Acer Finance as a trading platform. Spanish financial regulators have flagged the broker for fraudulent activities and it lacks proper licensing documentation. Unlike established financial institutions, Acer Finance operates without transparent company registration details or regulatory oversight, making it a high-risk choice for traders.

The platform claims to offer trading services across multiple asset classes including forex, stocks, commodities, and cryptocurrencies. However, user testimonials consistently report negative experiences, including financial losses and poor customer support. The lack of regulatory compliance and transparency raises serious questions about fund security and operational legitimacy.

This review targets traders who may be considering Acer Finance, particularly those interested in high-risk investments. However, based on current evidence, the platform appears unsuitable for both novice and experienced traders seeking reliable trading conditions and regulatory protection.

Important Notice

This review is based on publicly available information and user feedback as of 2025. Readers should note that Acer Finance may operate under different regulatory frameworks in various jurisdictions, and the information presented here may not reflect all regional variations. The evaluation methodology relies on verified user experiences, regulatory warnings, and available documentation from official sources.

Due to the limited transparency of Acer Finance's operations, some standard broker information remains unavailable for comprehensive analysis. Potential users are strongly advised to conduct independent research and verify regulatory status before engaging with this platform.

Rating Framework

Broker Overview

Acer Finance presents itself as a multi-asset trading platform, though its establishment date and corporate background remain unclear in available documentation. Spanish financial authorities have attracted attention due to allegations of fraudulent operations and lack of proper licensing. Unlike legitimate brokers that maintain transparent corporate structures, Acer Finance operates without clear company registration numbers or verifiable business addresses.

The platform's business model centers around offering trading access to various financial instruments including foreign exchange, equity markets, commodities, and cryptocurrency assets. However, the specific mechanisms of trade execution, pricing models, and operational infrastructure remain largely undisclosed, raising concerns about transparency and professional standards.

From a regulatory perspective, Acer Finance faces scrutiny from Spanish financial supervisors who have issued warnings about its operations. The absence of recognized regulatory licenses from major financial authorities such as the FCA, CySEC, or ASIC significantly impacts the platform's credibility. This acer review emphasizes that regulatory compliance remains a fundamental concern for potential users considering this broker.

The platform's target market appears to focus on traders willing to accept higher risk levels, though the lack of educational resources and transparent risk disclosures suggests limited suitability for retail investors seeking comprehensive trading education and support.

Regulatory Status: Acer Finance currently lacks authorization from recognized financial regulators, with Spanish authorities specifically flagging the entity for potential fraudulent activities. No valid regulatory licenses have been identified.

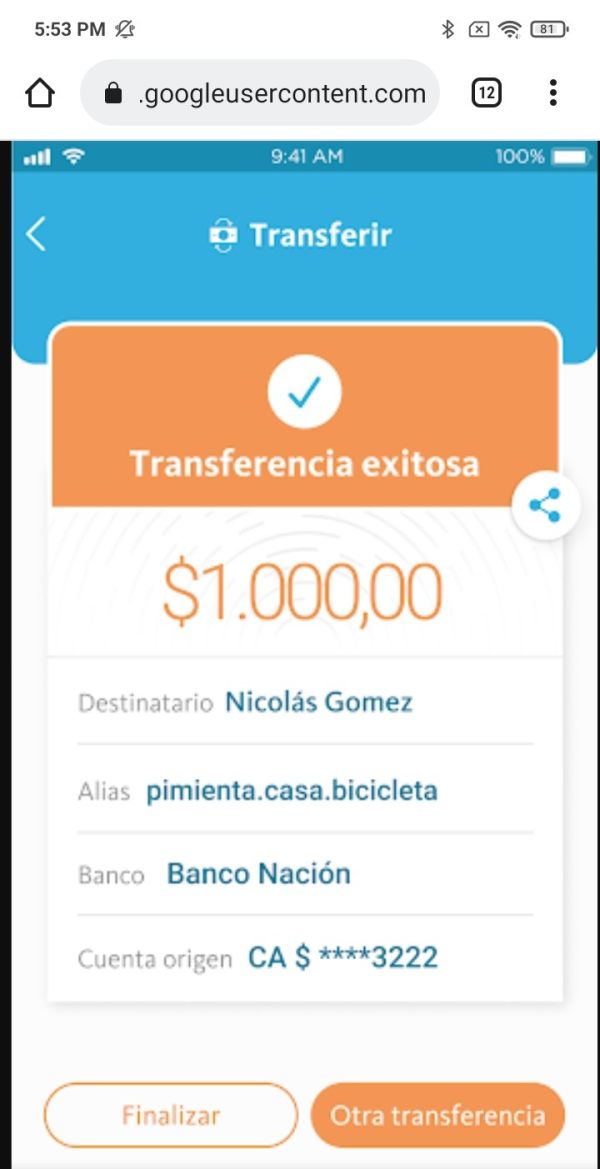

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and withdrawal procedures has not been disclosed in available documentation, creating uncertainty about transaction capabilities.

Minimum Deposit Requirements: The platform has not published clear minimum deposit thresholds, making it difficult for potential users to assess entry-level investment requirements.

Promotional Offers: Details about bonus structures, promotional campaigns, or incentive programs remain unspecified in current available information.

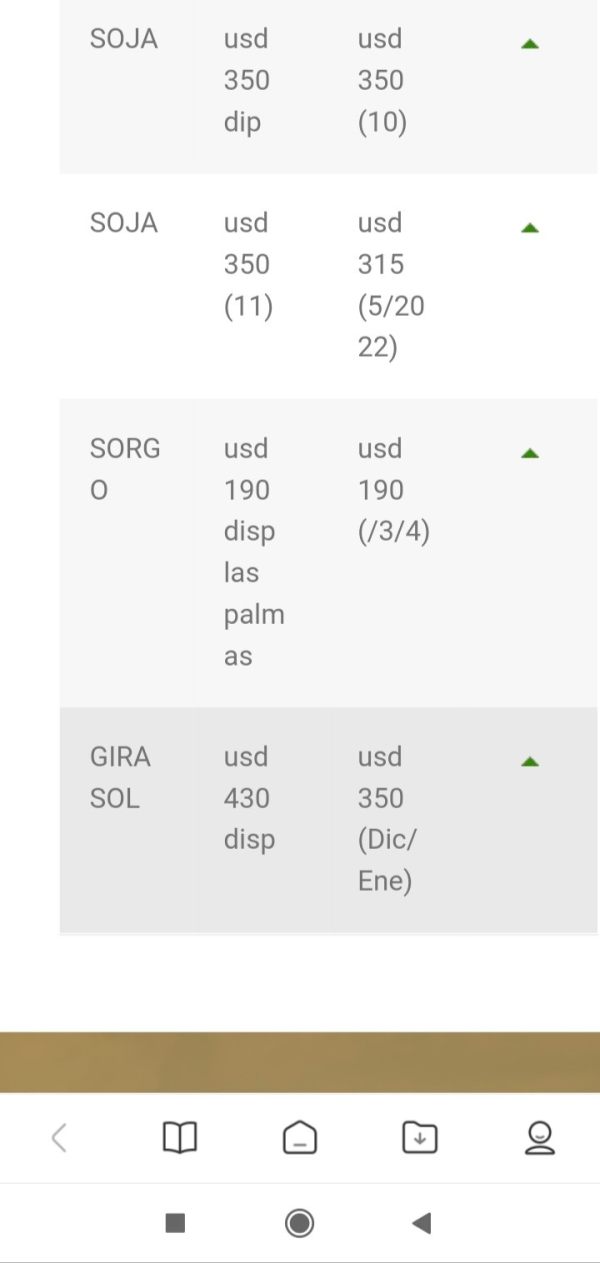

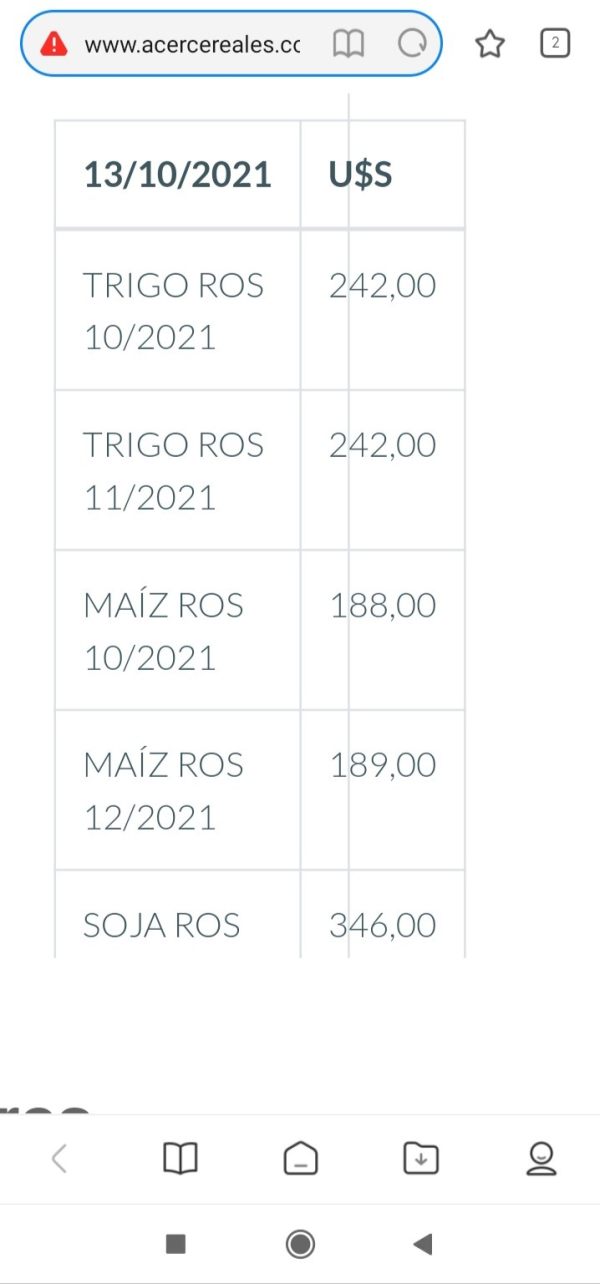

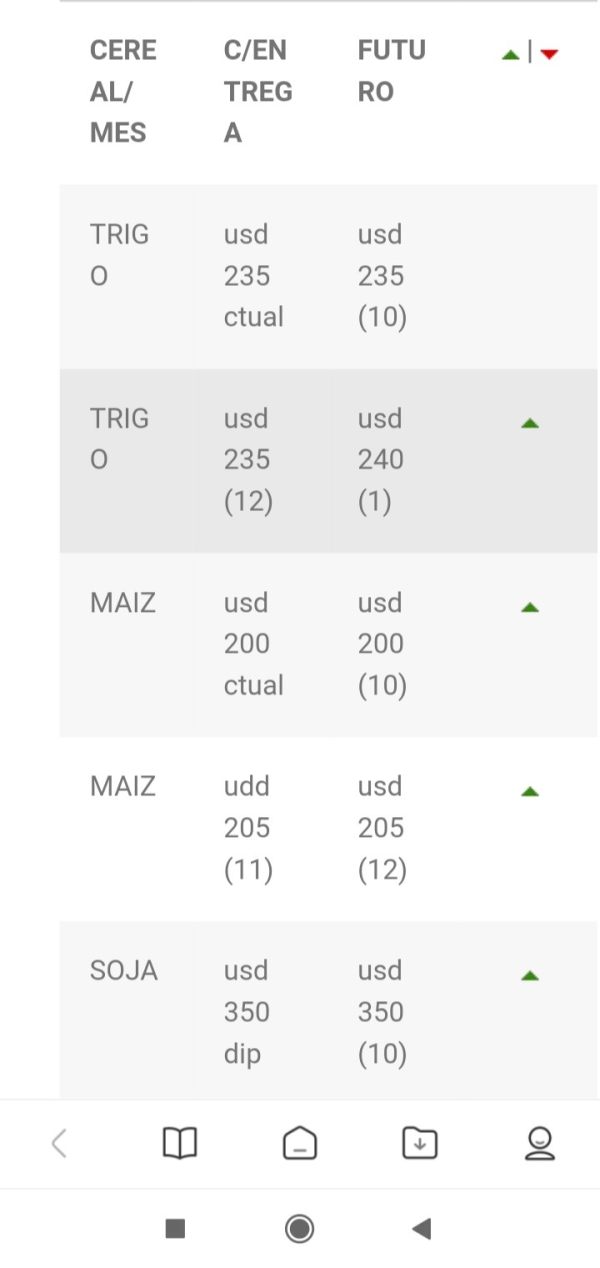

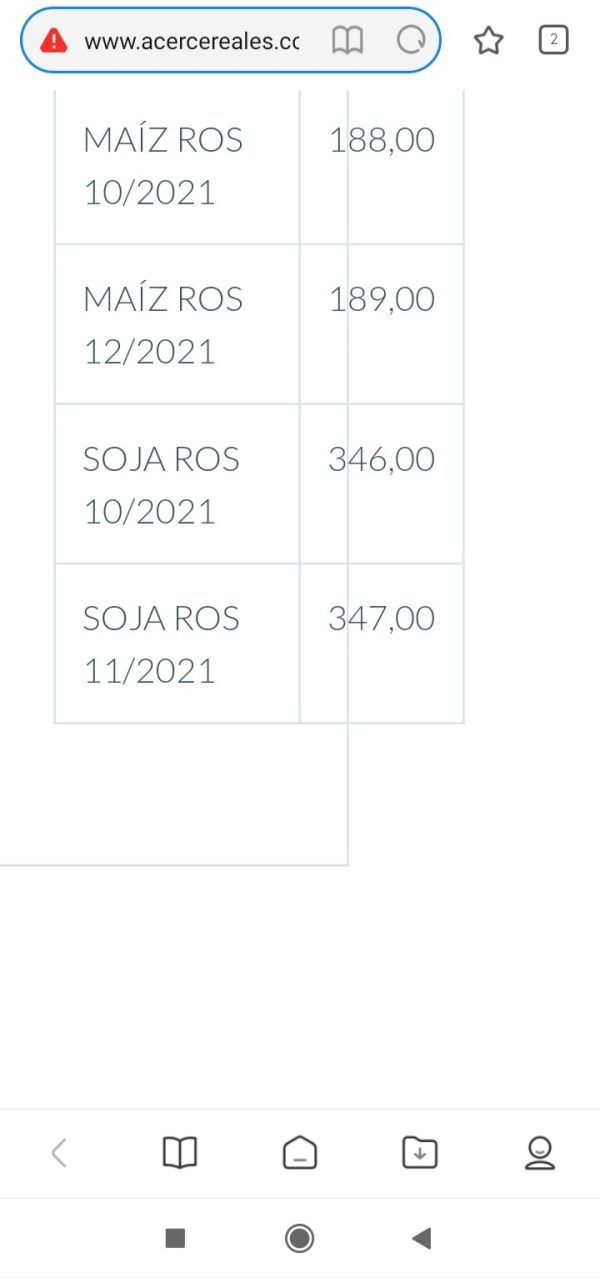

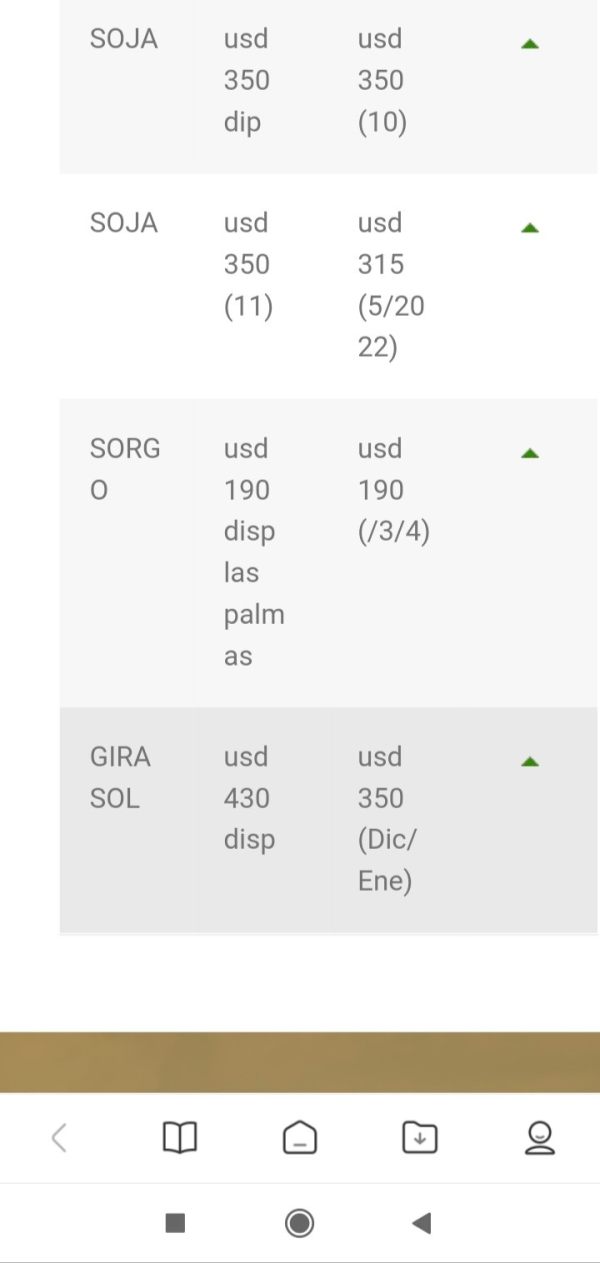

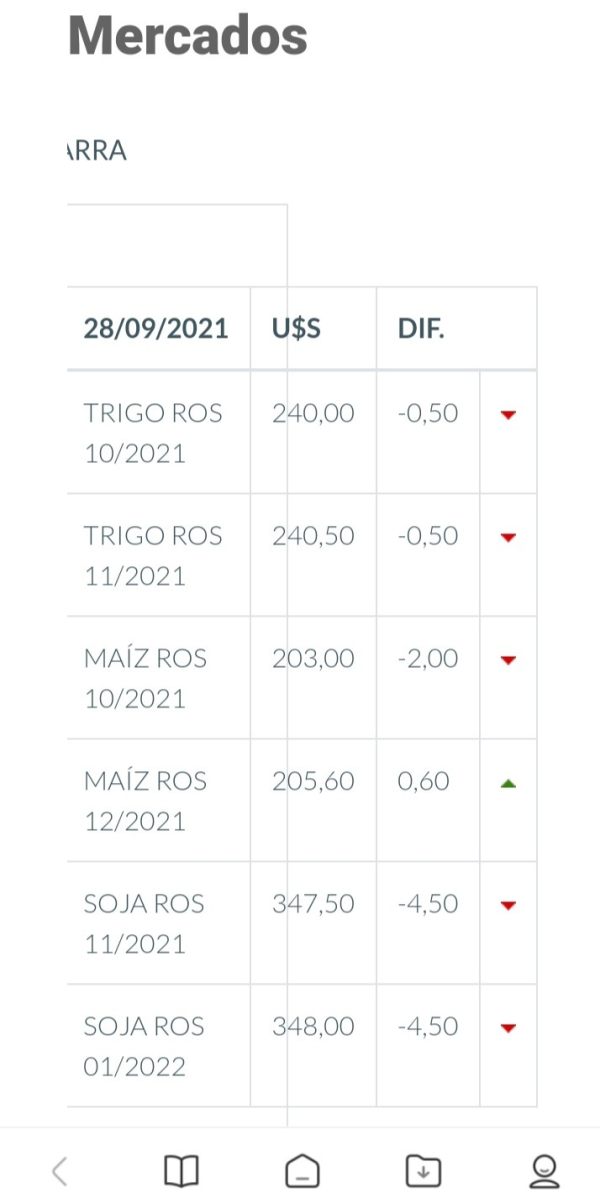

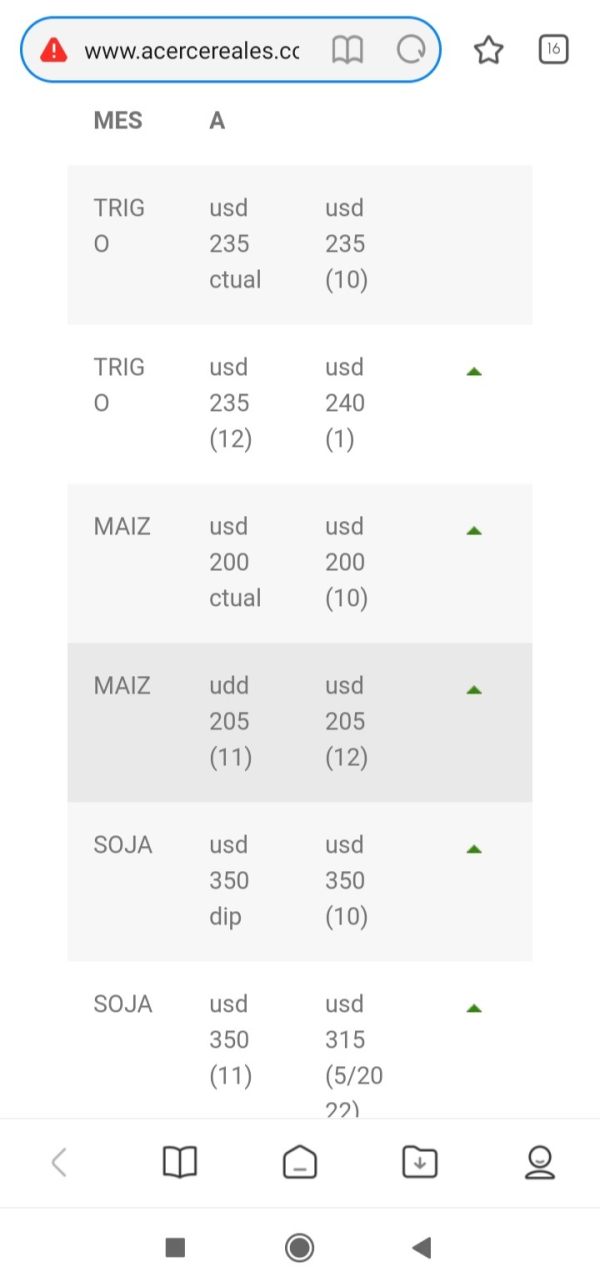

Tradeable Assets: The broker claims to provide access to forex pairs, stock indices, commodity markets, and cryptocurrency instruments, though specific asset counts and market coverage details are not comprehensively documented.

Cost Structure: Information regarding spreads, commission rates, overnight financing charges, and other trading costs has not been transparently disclosed, preventing accurate cost analysis for potential users.

Leverage Options: Specific leverage ratios and margin requirements across different asset classes remain undisclosed in available documentation.

Platform Selection: The trading platform technology, software providers, and available trading interfaces have not been clearly specified in accessible materials.

Geographic Restrictions: Specific country limitations and regional availability constraints are not detailed in current documentation.

Customer Support Languages: Available customer service languages and communication channels are not specified in accessible information. This comprehensive acer review highlights the significant information gaps that potential users should consider.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by Acer Finance present significant concerns for potential traders. Available documentation fails to specify different account types, tier structures, or the specific features associated with various membership levels. This lack of transparency makes it impossible for traders to understand what services they would receive at different investment levels.

Minimum deposit requirements remain unspecified, creating uncertainty about the financial commitment required to begin trading. Most legitimate brokers clearly outline their account opening procedures, required documentation, and verification processes, but Acer Finance provides limited information about these fundamental aspects of account establishment.

The absence of information about specialized account features, such as Islamic accounts for Sharia-compliant trading or professional accounts for experienced traders, suggests a limited service offering. User feedback consistently indicates confusion about account terms and conditions, with many reporting unexpected restrictions or limitations discovered only after attempting to use the platform.

Account opening procedures appear to lack the robust verification and compliance measures typically required by regulated brokers. This raises questions about the platform's commitment to anti-money laundering and know-your-customer requirements that are standard in the financial services industry. The overall account conditions framework appears inadequate for serious trading activities, contributing to the low rating in this acer review category.

Acer Finance claims to provide access to multiple asset classes including forex, stocks, commodities, and cryptocurrencies, though the actual quality and depth of these trading instruments remain unclear. The platform's tool offering appears limited compared to established brokers who typically provide comprehensive charting packages, technical analysis tools, and market research resources.

Research and analytical resources appear to be minimal or non-existent based on available information. Most professional trading platforms offer daily market analysis, economic calendars, and expert commentary to support trader decision-making, but Acer Finance does not appear to provide these standard resources.

Educational materials and learning resources are notably absent from the platform's offerings. Legitimate brokers typically invest significantly in trader education through webinars, tutorials, and comprehensive learning centers, but user feedback suggests Acer Finance lacks these supportive elements.

Automated trading capabilities and algorithmic trading support have not been documented, limiting options for traders who rely on systematic trading strategies. The absence of API access or third-party integration capabilities further restricts the platform's utility for advanced trading applications.

While the claimed asset variety might seem attractive, user experiences suggest that the actual execution quality and market access may not meet professional trading standards, resulting in a moderate rating for this evaluation category.

Customer Service and Support Analysis (Score: 3/10)

Customer service quality represents one of the most significant weaknesses identified in user feedback about Acer Finance. Available communication channels appear limited, with users reporting difficulty in reaching support representatives when assistance is needed.

Response times for customer inquiries appear to be substantially longer than industry standards. Professional brokers typically aim for same-day responses to customer concerns, but user reports suggest Acer Finance may take significantly longer to address issues, if responses are provided at all.

Service quality assessments based on user feedback indicate poor problem resolution capabilities. Many users report that their concerns remain unaddressed even after multiple contact attempts, suggesting inadequate customer support infrastructure or training.

Multi-language support capabilities are unclear, potentially limiting accessibility for international users who require assistance in their native languages. Operating hours for customer support have not been clearly communicated, creating uncertainty about when users can expect to receive assistance.

The overall customer support experience appears to fall well below industry standards, with users frequently expressing frustration about unresponsive or unhelpful service interactions. This poor support quality significantly impacts the overall user experience and contributes to negative platform perceptions.

Trading Experience Analysis (Score: 4/10)

The trading experience on Acer Finance appears to be problematic based on user feedback and available information. Platform stability issues have been reported, with users experiencing technical difficulties that can impact trading activities and potentially result in financial losses.

Order execution quality remains questionable, as specific information about execution speeds, slippage rates, and price improvement statistics has not been disclosed. Professional trading platforms typically provide detailed execution statistics to demonstrate their commitment to fair and efficient trade processing.

Platform functionality appears limited compared to industry-standard trading software. Users report that essential trading features may be missing or poorly implemented, reducing the effectiveness of trading strategies and market analysis capabilities.

Mobile trading experience details are not well documented, though mobile accessibility has become essential for modern traders who need to monitor and manage positions while away from their primary trading stations.

The overall trading environment appears to lack the professional features and reliability that serious traders require. User feedback consistently indicates disappointment with the platform's performance, suggesting that the trading infrastructure may not be suitable for active trading strategies. This acer review emphasizes that trading experience quality falls below acceptable standards for professional use.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent the most critical concerns regarding Acer Finance. The platform operates without proper regulatory authorization from recognized financial authorities, immediately raising red flags about its legitimacy and legal compliance.

Spanish financial regulators have specifically issued warnings about Acer Finance, citing concerns about fraudulent activities and unauthorized financial services provision. This regulatory attention indicates serious compliance failures that pose significant risks to potential users.

Fund safety measures appear to be non-existent or inadequately disclosed. Legitimate brokers typically maintain client funds in segregated accounts with major banking institutions and provide detailed information about fund protection measures, but Acer Finance lacks these transparency standards.

Corporate transparency is severely lacking, with no clear information about company registration, business addresses, or corporate governance structures. This opacity makes it impossible for users to verify the company's legitimacy or legal standing.

The platform's industry reputation is predominantly negative, with numerous user complaints and regulatory warnings contributing to a pattern of concerning behavior. The absence of positive third-party endorsements or industry recognition further undermines confidence in the platform's reliability.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Acer Finance appears to be consistently low based on available feedback and testimonials. Users frequently report experiences that fall far below their expectations for professional trading services.

Interface design and usability information is limited, though user comments suggest that the platform may lack the intuitive navigation and professional presentation that traders expect from modern trading software.

Registration and account verification processes appear to be problematic, with users reporting confusion about requirements and delays in account activation. These initial experience issues often set a negative tone for the entire user relationship.

Fund operation experiences receive particularly poor feedback, with users reporting difficulties in both depositing and withdrawing funds. These fundamental operational problems create significant stress and financial risk for platform users.

Common user complaints center around financial losses, poor customer service, platform technical issues, and difficulties with fund withdrawals. The consistency of these negative reports across multiple user testimonials suggests systemic problems rather than isolated incidents.

The user demographic appears to be primarily composed of individuals seeking high-risk investment opportunities, though the platform's limitations make it unsuitable for both novice traders seeking education and experienced traders requiring professional tools and support.

Conclusion

This comprehensive acer review reveals that Acer Finance presents significant risks and limitations that make it unsuitable for most traders. The platform's lack of regulatory authorization, combined with warnings from Spanish financial authorities, creates an unacceptable risk environment for potential users.

The broker appears to target traders interested in high-risk investments, but the absence of proper licensing, transparent operations, and adequate customer support makes it inappropriate for both novice and experienced traders. The consistent pattern of negative user feedback and regulatory concerns strongly suggests that potential users should seek alternative, properly regulated trading platforms.

Key disadvantages include regulatory non-compliance, poor customer service, limited transparency, and concerning user experiences. No significant advantages have been identified that would offset these substantial risks and operational deficiencies.