Regarding the legitimacy of 4T forex brokers, it provides FCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is 4T safe?

Pros

Cons

Is 4T markets regulated?

The regulatory license is the strongest proof.

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

4T Markets Limited

Effective Date: Change Record

2015-01-30Email Address of Licensed Institution:

finance@4t.co.uk, complaints@4t.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.4t.co.ukExpiration Time:

--Address of Licensed Institution:

Office 4.03 80 Coleman Street London EC2R 5BJ UNITED KINGDOMPhone Number of Licensed Institution:

+44 2038193100Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

4T Limited

Effective Date:

--Email Address of Licensed Institution:

hamzeh.ajjour@4t.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.4t.comExpiration Time:

--Address of Licensed Institution:

1st floor, Olivier Maradan Building, Victoria, Mahe, SeychellesPhone Number of Licensed Institution:

+2484322955Licensed Institution Certified Documents:

Is 4t A Scam?

Introduction

In recent years, the forex trading landscape has expanded significantly, with numerous brokers emerging to cater to the growing demand for currency trading. One such broker is 4t, which positions itself as a platform for both retail and institutional traders. However, as the market becomes increasingly saturated, it is crucial for traders to carefully evaluate the legitimacy and reliability of forex brokers before committing their funds. This article aims to provide an objective assessment of 4t, exploring its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. Our evaluation is based on a comprehensive review of available data, including regulatory disclosures, user reviews, and industry analyses.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is a critical factor in determining its reliability. A well-regulated broker is typically seen as safer due to the oversight it undergoes, which can protect traders from potential fraud or malpractice. 4t claims to be regulated by the Seychelles Financial Services Authority (FSA) and the UK's Financial Conduct Authority (FCA). Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 058 | Seychelles | Active |

| UK FCA | 624225 | United Kingdom | Active |

The FCA is known for its stringent regulatory standards, which include requirements for client fund protection and transparency in operations. Conversely, the FSA in Seychelles is considered a more lenient regulator, often associated with offshore brokers. While 4t's FCA license adds a layer of credibility, the presence of its Seychelles license raises questions about the overall regulatory environment in which it operates. The dual-regulation setup indicates that while it may comply with some high standards, the offshore aspect introduces potential risks often associated with less stringent oversight.

Company Background Investigation

4t was established in 2015 and operates under the name 4t Limited, with its headquarters located in Seychelles and a representative office in the UK. The companys ownership structure is not extensively detailed in public records, which can be a concern for potential investors seeking transparency. The management team appears to have a mix of experience in financial services, but specific profiles of key personnel are not readily available, limiting insight into their expertise and track record.

The level of transparency regarding company operations and ownership is a significant factor for traders. A broker that openly shares information about its management team and business practices tends to inspire more confidence among its clients. In 4t's case, while it does provide basic information about its services and regulatory status, the lack of detailed disclosures about its management and operational history may raise concerns for some traders.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its competitiveness and fairness. 4t offers a minimum deposit requirement of $100, which is relatively low compared to industry standards. The broker claims to provide variable spreads starting from 1 pip, with no commission on trades. Below is a comparison of core trading costs:

| Cost Type | 4t | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1 pip | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While the spread offered by 4t is competitive, the absence of commissions may be a red flag. Brokers that do not charge commissions often have wider spreads or hidden fees that can affect overall trading costs. Furthermore, the leverage offered by 4t can go up to 1:300, which, while attractive for experienced traders, poses significant risks, especially for novice investors.

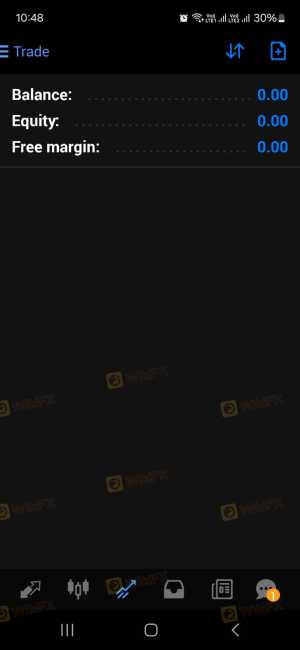

Client Fund Security

The security of client funds is paramount in the forex trading industry. 4t claims to implement several measures to protect client funds, such as segregating client accounts from company funds and maintaining them in reputable banks. However, it is essential to scrutinize the specifics of these claims.

4t does not provide detailed information regarding investor protection schemes, such as negative balance protection or compensation funds, which are often critical in safeguarding traders' investments. The absence of such measures can leave clients vulnerable in the event of a broker insolvency or operational issues. Historical reviews have raised concerns regarding fund withdrawals and the overall safety of investments, which traders should consider before depositing significant amounts.

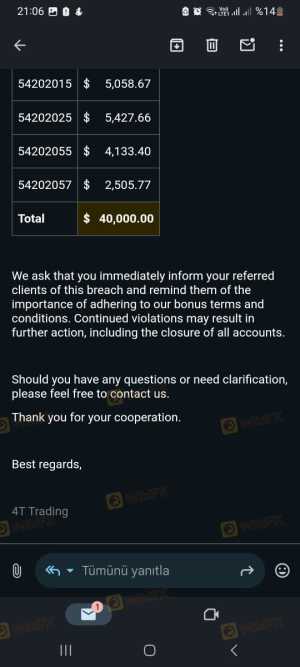

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. Reviews of 4t reveal a mixed bag of experiences. Some users praise the platform for its user-friendly interface and efficient customer support, while others report issues related to withdrawal delays and inadequate responses to complaints. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Customer Support Issues | Medium | Varies |

| Platform Stability | Low | Generally positive |

One notable case involved a trader who experienced significant delays in processing withdrawal requests, leading to frustration and a loss of trust in the broker. While 4t's customer support has been described as generally helpful, the inconsistency in response times may deter potential clients who prioritize timely assistance.

Platform and Execution

The trading platform provided by 4t is based on the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) systems, which are well-regarded for their functionality and user experience. Users report that the platforms are stable and feature-rich, allowing for effective trade execution and analysis. However, concerns have been raised regarding order execution quality, with some users citing instances of slippage and order rejections.

The potential for platform manipulation, while not explicitly reported, is always a concern in the trading industry. Traders should remain vigilant and monitor their trades closely to ensure that execution aligns with market conditions.

Risk Assessment

Engaging with any forex broker carries inherent risks, and 4t is no exception. The following risk assessment summarizes the key risk areas associated with trading through 4t:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation may lead to inconsistencies in client protection. |

| Withdrawal Risk | High | Reports of delayed withdrawals raise concerns about fund access. |

| Trading Risk | High | High leverage can amplify losses significantly. |

To mitigate these risks, it is advisable for traders to start with a demo account, thoroughly understand the trading conditions, and ensure they are comfortable with the broker's policies before committing significant funds.

Conclusion and Recommendations

In conclusion, while 4t presents itself as a legitimate forex broker with regulatory oversight, potential traders should approach with caution. The mixed reviews regarding customer experiences, coupled with the risks associated with high leverage and withdrawal issues, suggest that there are areas of concern that merit careful consideration.

For traders who are risk-averse or new to forex trading, it may be prudent to explore alternative brokers with stronger reputations for reliability, transparency, and customer support. Recommended alternatives include brokers that are strictly regulated by tier-1 authorities and have a proven track record of positive customer feedback.

Ultimately, traders should conduct thorough research and consider their individual trading needs before selecting a broker.

Is 4T a scam, or is it legit?

The latest exposure and evaluation content of 4T brokers.

4T Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

4T latest industry rating score is 3.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.