4t 2025 Review: Everything You Need to Know

Executive Summary

This 4t review looks at a broker that has gotten attention in the MENA (Middle East and North Africa) region for its commission-free CFD trading approach. 4t works as an online broker that offers various asset classes including forex, commodities, indices, and stocks, based on information from multiple sources. The platform stands out by providing spreads starting from 0 pips with no commission structure on CFD trades. It also offers a maximum leverage of 1:100.

The broker mainly targets traders in the Middle East and North Africa regions, especially those who want to reduce trading costs. 4t holds regulatory authorization from the Financial Conduct Authority (FCA), which provides a basic level of regulatory oversight, according to various broker review platforms. However, several reviews note that the broker operates in what some analysts call "gray zone licenses." This suggests that while legitimate in their registered areas, the regulatory framework may change across different operational territories.

Our assessment shows a mixed picture - while the cost structure looks competitive and the regulatory status provides some confidence, the limited availability of detailed user feedback and operational information creates challenges for a complete evaluation.

Important Notice

Regional Entity Variations: You must understand that 4t may operate through different legal entities across various jurisdictions. Broker analysis reports highlight that regulatory requirements and market access conditions can significantly impact user experience depending on your geographical location. The FCA regulation mentioned applies to specific operational aspects. However, local regulations in your jurisdiction may impose additional restrictions or requirements.

Review Methodology Disclaimer: This evaluation uses publicly available information from broker review websites, regulatory databases, and industry reports available as of 2025. Some assessments reflect industry standard comparisons rather than extensive user testimonials due to limited direct user feedback availability in our research. Potential traders should do their own research and verify current terms and conditions directly with the broker.

Rating Framework

Broker Overview

4t works as an online brokerage firm that specializes in commission-free CFD trading services across multiple asset classes. The company has positioned itself as a cost-effective solution for traders who want to reduce transaction expenses while maintaining access to diverse financial markets, according to broker review platforms. The broker's business model focuses on providing competitive spreads starting from 0 pips without imposing commission charges on CFD transactions. This represents a significant value proposition in the current brokerage landscape.

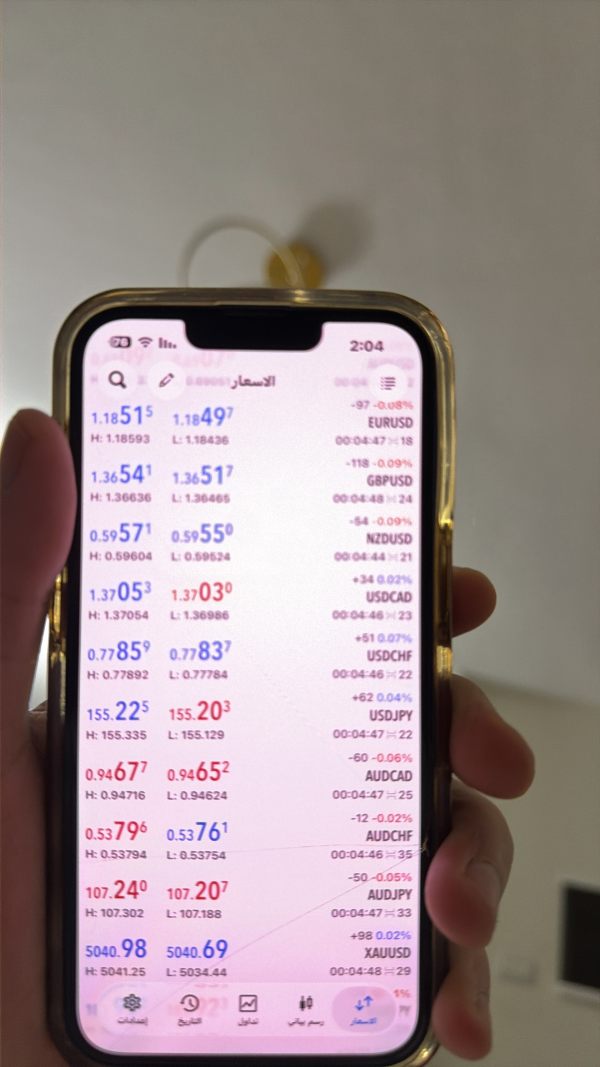

The company's operational focus appears concentrated in the Middle East and North Africa regions, where it has established its primary market presence. This 4t review shows that the broker offers trading access to forex pairs, commodities, stock indices, and individual equity instruments through CFD structures. The platform's approach to market access emphasizes reducing barriers for retail traders. It also maintains regulatory compliance within its operational jurisdictions.

4t operates under Financial Conduct Authority (FCA) oversight from a regulatory standpoint, which provides a foundational level of supervisory framework. However, industry analysts note that the broker's multi-jurisdictional approach means that regulatory coverage may vary depending on the specific services offered in different territories. The maximum leverage offering of 1:100 aligns with regulatory requirements in many jurisdictions while providing traders with enhanced capital efficiency opportunities.

Regulatory Jurisdictions: 4t operates primarily under FCA regulation, providing traders with regulatory protection and oversight. This regulatory framework ensures compliance with financial services standards, though the specific protections may vary based on your location and the entity through which you trade, according to broker analysis reports.

Deposit and Withdrawal Methods: Current available information does not provide detailed information regarding funding options. Prospective traders should verify available payment methods directly with the broker to ensure compatibility with their preferred banking arrangements.

Minimum Deposit Requirements: Specific minimum deposit thresholds are not detailed in available sources. This information gap represents a significant consideration for potential account holders who need to plan their initial investment accordingly.

Promotional Offerings: Available research does not indicate specific bonus or promotional structures currently offered by the platform. The absence of promotional information suggests the broker may focus on competitive trading conditions rather than introductory incentives.

Tradeable Assets: The platform provides access to multiple asset classes including forex currency pairs, commodity CFDs, stock index instruments, and individual equity CFDs. This diversification allows traders to implement varied strategies across different market sectors.

Cost Structure: The broker's primary competitive advantage lies in its commission-free CFD trading model combined with spreads beginning at 0 pips. This pricing structure can significantly reduce transaction costs compared to traditional commission-based brokers. It particularly benefits high-frequency traders.

Leverage Ratios: Maximum leverage is capped at 1:100, which balances trading flexibility with risk management requirements. This leverage level complies with regulatory standards while providing meaningful capital efficiency for experienced traders.

Platform Options: Specific trading platform information is not detailed in current sources, representing an area where potential users should seek additional clarification directly from the broker.

Geographic Restrictions: Primary focus on Middle East and North Africa regions suggests potential limitations for traders in other jurisdictions. Regulatory compliance requirements may restrict access from certain countries.

Customer Support Languages: Language support details are not specified in available documentation, though regional focus suggests Arabic and English support may be prioritized.

This 4t review highlights that while certain operational aspects show promise, the limited availability of detailed information requires prospective traders to conduct thorough research before account opening.

Account Conditions Analysis

The account structure offered by 4t presents a mixed evaluation when assessed against industry standards. The broker's commission-free approach to CFD trading represents a significant advantage, particularly for traders who execute frequent transactions or work with smaller account balances where commission costs can substantially impact profitability. The spreads starting from 0 pips indicate competitive pricing in optimal market conditions. However, the consistency and availability of these tight spreads across different market sessions and volatility periods requires further investigation.

The lack of detailed information regarding account types, minimum deposit requirements, and specific account features creates uncertainty for potential traders. Industry-standard offerings typically include multiple account tiers with varying benefits, minimum deposit levels, and specialized features such as Islamic accounts for Sharia-compliant trading. The absence of clear account structure information in available sources suggests that prospective traders need to engage directly with the broker to understand their options fully.

4t's cost structure appears competitive when compared to other commission-free brokers in the market, but the overall account conditions evaluation is limited by information gaps. The regulatory framework provided by FCA oversight does offer some assurance regarding account protection and operational standards. However, the specific investor protection schemes and compensation arrangements are not detailed in current sources.

The account opening process, verification requirements, and ongoing account maintenance procedures are not documented in available materials. This lack of transparency regarding practical account management aspects represents a significant consideration for traders who value clear, upfront information about their trading relationship.

The trading tools and resources evaluation for 4t faces significant limitations due to insufficient detailed information in available sources. The broker confirms CFD trading availability across multiple asset classes, but the specific quality, sophistication, and comprehensiveness of trading tools remain unclear. Modern traders typically expect access to advanced charting packages, technical analysis indicators, economic calendars, and market research resources as standard platform features.

The absence of detailed platform specifications raises questions about whether 4t provides proprietary trading software, third-party platforms like MetaTrader, or web-based trading interfaces. Each platform type offers different advantages - proprietary platforms can provide unique features and integration, MetaTrader offers familiar functionality and expert advisor support, while web-based platforms ensure accessibility across devices without software installation requirements.

Research and analysis resources represent another area where information gaps limit evaluation. Competitive brokers typically provide market commentary, economic analysis, trading signals, and educational content to support trader decision-making. The lack of documented research offerings suggests either limited provision of such services or inadequate marketing of available resources.

Educational resources and trader development programs are not mentioned in current sources, which could indicate a focus on experienced traders rather than comprehensive support for developing trading skills. Automated trading support, copy trading features, and social trading integration are increasingly important for modern traders but are not addressed in available documentation.

The overall tools and resources assessment must remain conservative given these information limitations, suggesting that potential users should thoroughly investigate platform capabilities before committing to the broker.

Customer Service and Support Analysis

Customer service evaluation for 4t cannot be assessed due to insufficient information in available sources regarding support channels, availability, and service quality. Modern broker selection increasingly depends on reliable, responsive customer support, making this information gap particularly significant for potential traders.

Industry standards typically include multiple communication channels such as live chat, email support, telephone assistance, and sometimes social media engagement. The availability of these channels during different time zones becomes crucial for international traders, particularly given 4t's focus on the Middle East and North Africa regions where trading activity may span multiple time zones.

Response time expectations vary by communication channel, with live chat typically providing immediate assistance, email support offering detailed responses within 24 hours, and telephone support providing real-time problem resolution. Potential traders cannot assess whether 4t's support structure aligns with their needs and expectations without documented service level commitments.

Multilingual support capabilities represent another critical consideration, especially for a broker operating across diverse regional markets. The linguistic diversity of the MENA region suggests that Arabic and English support would be essential. Additional language requirements may exist depending on specific market focus.

The absence of documented customer service information prevents evaluation of support quality, staff expertise, and problem resolution effectiveness. User testimonials and service reviews, which typically provide insight into real-world support experiences, are not available in current sources. This limitation significantly impacts the ability to assess this crucial aspect of the broker's service offering.

Trading Experience Analysis

The trading experience evaluation for 4t centers primarily on the broker's commission-free structure and competitive spread offerings, which can significantly enhance trading economics, particularly for active traders. The absence of commission charges on CFD trades eliminates a major cost component that can accumulate substantially over time. This especially benefits traders executing multiple daily transactions or working with smaller position sizes where commission costs represent a higher percentage of potential profits.

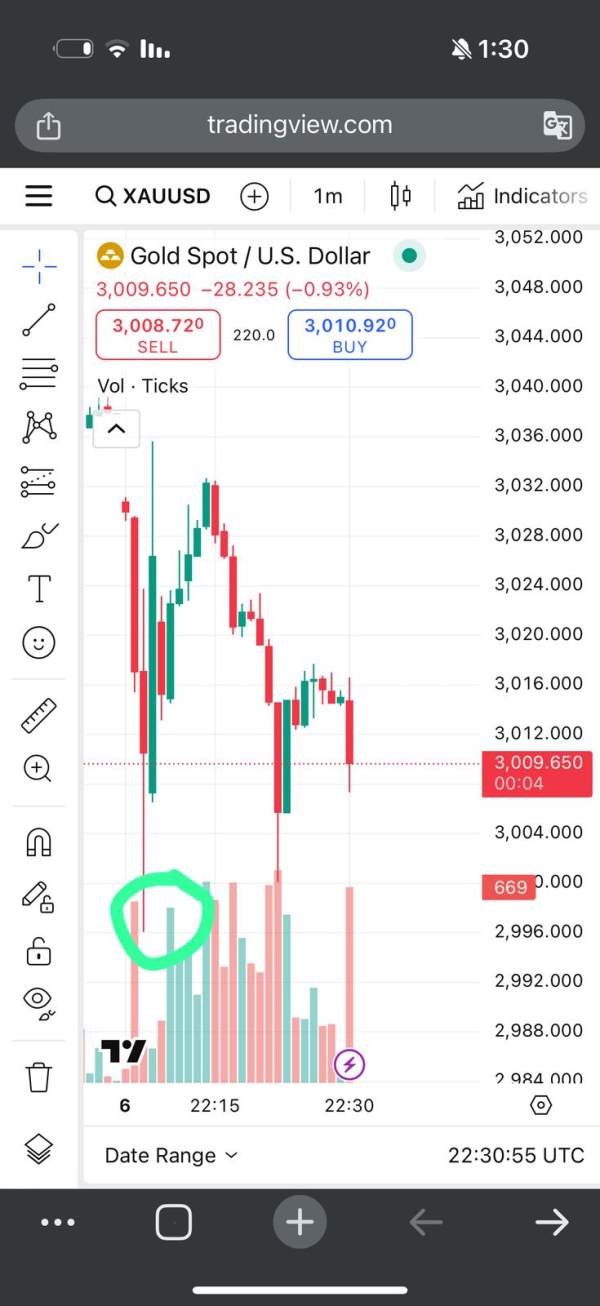

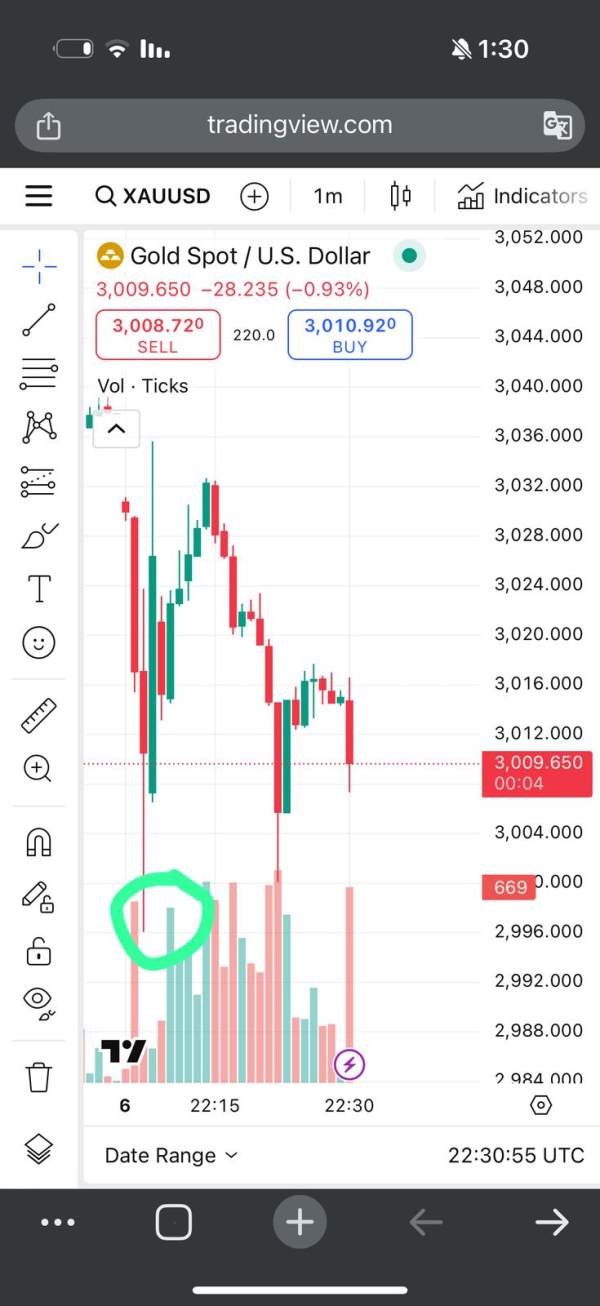

The spread structure beginning at 0 pips suggests favorable trading conditions during optimal market periods, though the consistency of these tight spreads across different market sessions, volatility conditions, and asset classes requires further investigation. Real-world trading experience often depends on spread stability and execution quality during both calm and volatile market periods.

Maximum leverage of 1:100 provides reasonable capital efficiency while maintaining compliance with regulatory requirements in many jurisdictions. This leverage level offers meaningful position sizing flexibility without the extreme risk exposure associated with higher leverage ratios that some brokers offer in less regulated environments.

However, critical trading experience factors remain unclear due to information limitations. Platform stability, execution speed, slippage characteristics, and order fill quality are fundamental aspects that significantly impact trading success but are not documented in available sources. The absence of user feedback regarding platform performance during high-volatility periods or market opening sessions represents a significant information gap.

Mobile trading capabilities, which have become essential for modern traders who need market access while away from desktop platforms, are not detailed in current sources. The quality and functionality of mobile applications can significantly impact overall trading experience and operational flexibility.

Trust and Safety Analysis

The trust and safety evaluation for 4t benefits from the broker's FCA regulatory authorization, which provides a foundational level of oversight and operational standards. The Financial Conduct Authority maintains rigorous requirements for authorized firms, including capital adequacy standards, operational procedures, and client protection measures. This regulatory framework offers some assurance regarding the broker's legitimacy and adherence to financial services standards.

However, industry analysis notes that 4t operates in what are described as "gray zone licenses," suggesting that while the broker maintains legitimate regulatory authorization in its registered jurisdictions, the regulatory framework may vary across different operational territories. This multi-jurisdictional approach can create complexity regarding which specific protections apply to individual traders based on their location and the entity through which they trade.

The absence of detailed information regarding client fund protection measures, segregation procedures, and compensation scheme participation represents a significant gap in safety assessment. Modern regulatory frameworks typically require client fund segregation from operational capital, participation in investor compensation schemes, and clear procedures for fund protection in various scenarios.

Company transparency regarding ownership structure, financial statements, and operational procedures is not well-documented in available sources. Transparent disclosure of company information typically enhances trust and allows traders to make informed decisions about their broker selection.

The limited availability of third-party evaluations, industry awards, or independent assessments restricts the ability to gauge broader industry recognition and peer evaluation of the broker's operations and reputation.

User Experience Analysis

User experience assessment for 4t faces significant limitations due to the scarcity of user feedback and testimonials in available sources. This information gap prevents detailed evaluation of real-world user satisfaction, common challenges, and overall platform usability from the perspective of active traders.

The broker's focus on commission-free trading and competitive spreads suggests an orientation toward cost-conscious traders who prioritize transaction economics over premium features or services. This positioning may appeal to experienced traders who value straightforward, cost-effective trading conditions but could potentially limit appeal for traders seeking educational resources, research services, or premium platform features.

Interface design, navigation intuitiveness, and platform usability cannot be assessed without direct user feedback or detailed platform documentation. Modern trading success increasingly depends on efficient platform interaction, particularly for traders implementing time-sensitive strategies or managing multiple positions simultaneously.

The registration and account verification process efficiency, which significantly impacts initial user experience, is not documented in available sources. Streamlined onboarding procedures with clear requirements and reasonable processing times represent important factors in overall user satisfaction.

Fund management experience, including deposit and withdrawal procedures, processing times, and fee structures, remains unclear due to information limitations. These operational aspects significantly impact ongoing user experience and satisfaction with broker services.

Identifying common concerns, frequently requested improvements, or areas of particular user satisfaction becomes impossible without user feedback, limiting the ability to provide meaningful user experience guidance.

Conclusion

This 4t review reveals a broker with potentially competitive offerings in specific areas, particularly regarding commission-free CFD trading and tight spread structures, but significant information gaps limit evaluation. The FCA regulatory authorization provides foundational credibility, while the focus on Middle East and North Africa markets suggests regional specialization that may benefit local traders.

The broker appears most suitable for cost-conscious traders in the MENA region who prioritize low transaction costs and straightforward CFD trading access. However, the limited availability of detailed operational information, user feedback, and platform specifications requires prospective traders to conduct thorough direct investigation before account opening.

Primary advantages include the commission-free trading model, competitive spread offerings, and regulatory oversight. Key limitations involve insufficient documentation of platform features, customer service capabilities, and real-world user experiences. Potential traders should verify current terms, conditions, and service offerings directly with the broker while carefully considering their specific trading requirements and geographic location.