LBLV 2025 Review: Everything You Need to Know

Executive Summary

LBLV is a forex and CFD broker established in 2017. The company operates from the Seychelles and serves both beginner and professional traders through its online trading services. This lblv review shows that the broker offers flexible trading conditions, but concerns about its regulatory status may hurt investor confidence.

The broker's key features include leverage up to 500:1. LBLV also supports over 1400 trading instruments across various asset classes. The company uses the MetaTrader 5 platform and provides multilingual support including English, Russian, Spanish, Arabic, and several other languages. However, the minimum deposit requirement of $5,000 creates a high entry barrier for retail traders.

The primary user base consists of individual investors seeking to engage in forex and CFD trading. The broker offers a wide range of trading tools and instruments, but its unclear regulatory framework and lack of transparent licensing information present notable concerns for potential clients evaluating the platform's credibility and safety measures.

Important Disclaimer

Regulatory Concerns: LBLV's regulatory status remains unclear. No specific regulatory authority or license number appears in available documentation. This may present compliance variations across different jurisdictions and regions. Potential traders should exercise caution and conduct thorough research before engaging with this broker.

Review Methodology: This evaluation is based on publicly available information and user feedback. The review aims to provide a comprehensive understanding of LBLV's services, features, and potential limitations for prospective clients.

Rating Framework

Broker Overview

Company Background and Establishment

LBLV was founded in 2017. The company operates from its headquarters in the Seychelles and specializes in providing online trading services with a business model designed to serve both new traders and experienced professionals. The broker has positioned itself as a complete trading solution provider. It focuses on delivering access to global financial markets through its digital platform.

Platform and Asset Coverage

The broker uses MetaTrader 5 as its primary trading platform. This gives clients access to a sophisticated trading environment with advanced charting tools and analytical capabilities. LBLV provides trading opportunities across multiple asset classes, including foreign exchange pairs and contracts for difference covering various market sectors. The regulatory information remains unclear in available documentation, with no specific mention of authorizing regulatory bodies or compliance frameworks, which represents a significant consideration for potential clients in this lblv review.

Regulatory Jurisdiction: Available information does not specify detailed regulatory authorities. It also does not provide clear licensing documentation for verification purposes.

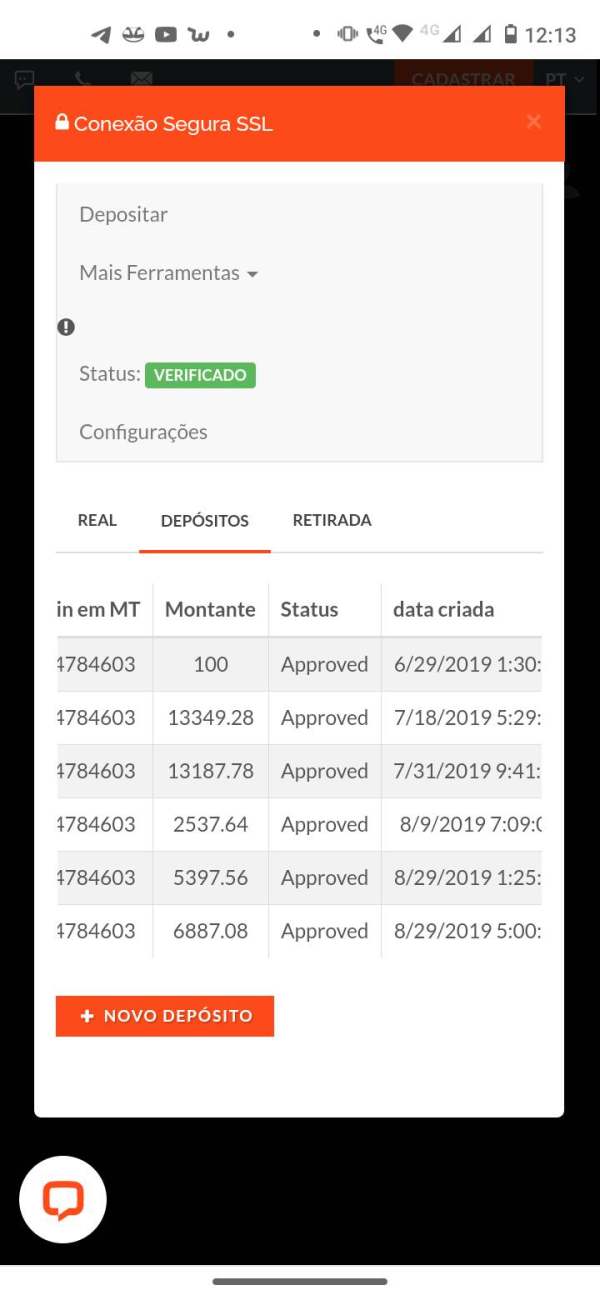

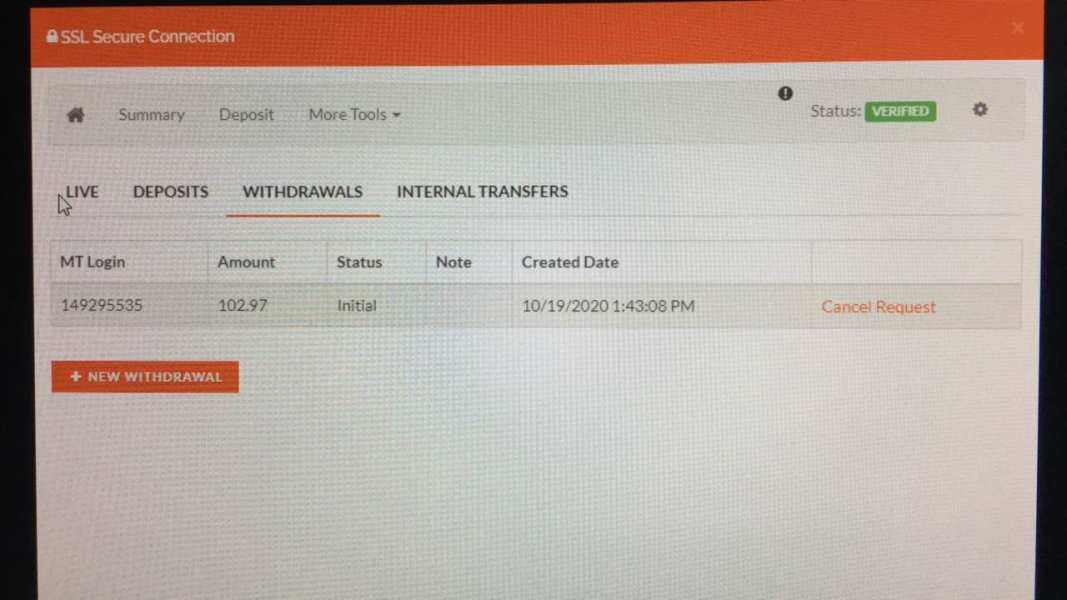

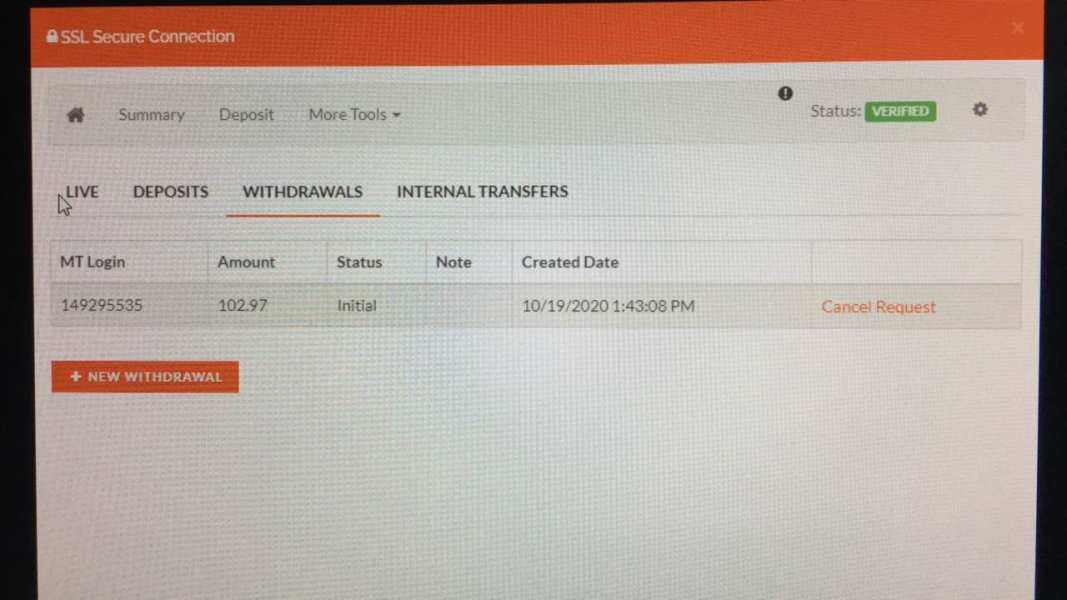

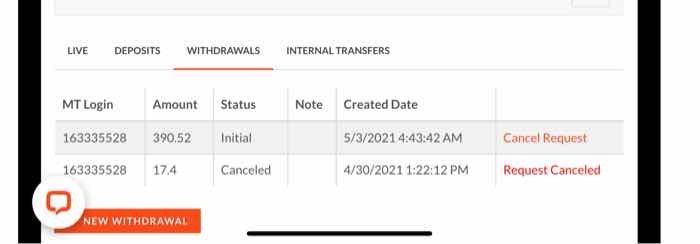

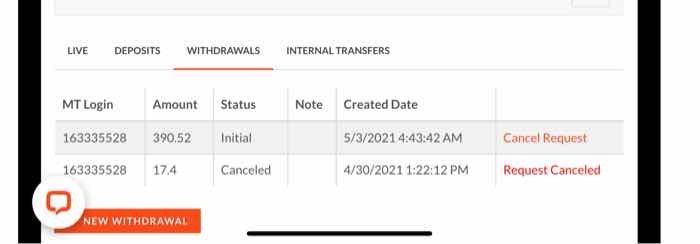

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options is not detailed in current documentation.

Minimum Deposit Requirements: The broker requires a minimum deposit of $5,000 to begin real trading activities. This represents a relatively high entry threshold.

Bonus and Promotional Offers: Current promotional activities or bonus structures are not specified in available information sources.

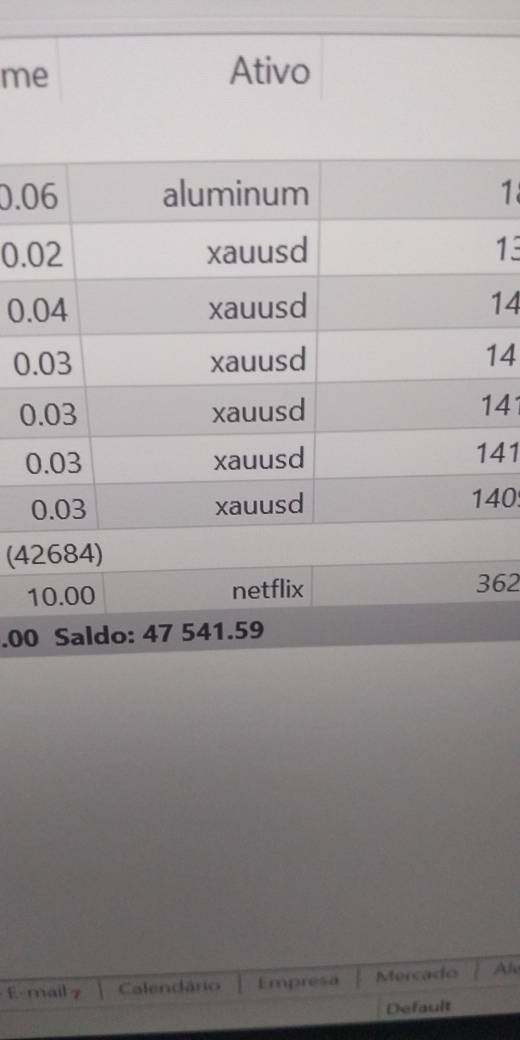

Tradeable Assets: LBLV offers access to over 1400 trading instruments. These include foreign exchange pairs and CFD products across multiple asset categories including indices, commodities, and shares.

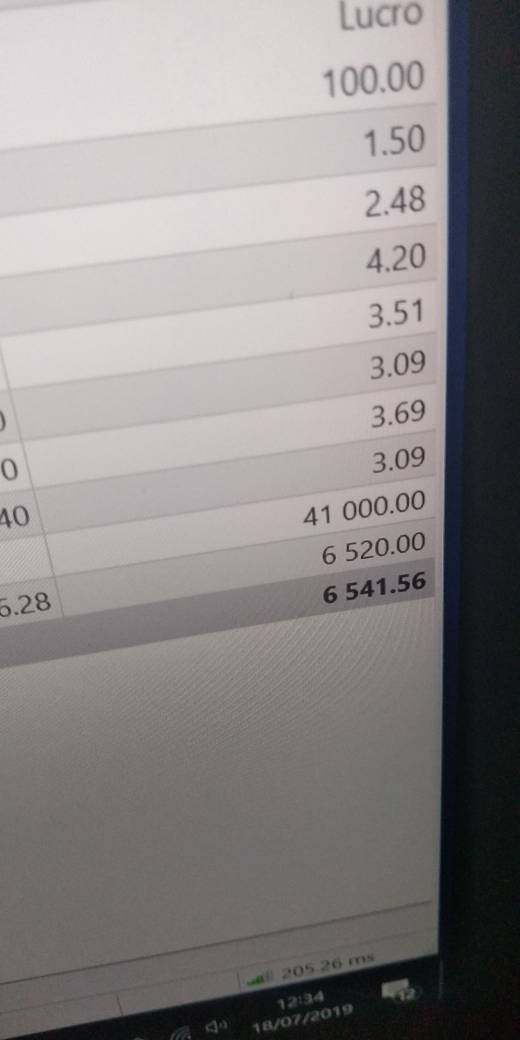

Cost Structure: Specific commission rates and spread information are not detailed in available documentation. This limits transparency regarding trading costs.

Leverage Ratios: The broker provides leverage up to 500:1. This offers significant position sizing flexibility for qualified traders.

Platform Options: MetaTrader 5 serves as the primary trading platform. It provides comprehensive trading functionality and analytical tools.

Geographic Restrictions: Specific regional limitations or restricted jurisdictions are not detailed in current information.

Customer Support Languages: The platform supports multiple languages including English, Russian, Spanish, Arabic, Azerbaijani, and Brazilian Portuguese. This facilitates international client accessibility. This lblv review notes the broker's commitment to multilingual support for diverse trading communities.

Account Conditions Analysis

LBLV's account structure presents a mixed proposition for potential traders. The broker offers various account types, though specific details regarding the characteristics and features of each tier are not extensively documented in available materials. The most notable aspect of the account conditions is the $5,000 minimum deposit requirement, which significantly exceeds industry standards.

This relatively high threshold suggests the broker may be targeting more wealthy individual traders. It may also target those with substantial trading capital. While this approach may indicate a focus on serious traders, it simultaneously excludes a significant portion of the retail trading market. The account opening process details are not specified in current documentation.

The absence of information regarding specialized account features represents a notable gap in the available documentation. This includes Islamic accounts for clients requiring Sharia-compliant trading conditions. This lblv review finds that while the high minimum deposit may appeal to well-funded traders, the lack of detailed account information limits the ability to make fully informed decisions regarding account selection and suitability.

LBLV demonstrates considerable strength in its trading instrument offerings. The broker provides access to over 1400 trading tools across multiple asset categories. This extensive selection includes foreign exchange pairs, CFDs on shares, indices, and commodities, offering traders significant diversification opportunities within a single platform environment.

The MetaTrader 5 platform serves as the foundation for the broker's trading infrastructure. MT5 typically provides robust analytical tools, advanced charting capabilities, and support for automated trading strategies. This platform choice indicates a commitment to professional-grade trading technology, as MT5 is widely recognized for its sophisticated features and reliability in institutional trading environments.

However, specific information regarding proprietary research resources, market analysis materials, or educational content is not detailed in available documentation. The platform's support for Expert Advisors and algorithmic trading strategies through MT5 represents a significant advantage for traders employing automated systems or requiring advanced order management capabilities.

Customer Service and Support Analysis

The customer service framework at LBLV demonstrates commitment to international accessibility. The broker provides assistance in multiple languages including English, Russian, Spanish, Arabic, Azerbaijani, and Brazilian Portuguese, indicating an effort to serve a diverse global client base effectively.

However, specific details regarding customer service channels are not comprehensively documented in available information. This includes live chat availability, telephone support hours, or email response protocols. This limitation makes it challenging to assess the practical accessibility and responsiveness of the support infrastructure during critical trading periods or urgent account-related inquiries.

The quality of customer service interactions, average response times, and problem resolution effectiveness remain unclear. This is due to limited user feedback documentation. Without detailed information about support team expertise, availability schedules, or escalation procedures, potential clients cannot fully evaluate the reliability of assistance during technical difficulties or account management needs.

The absence of comprehensive customer service information represents a notable gap in transparency. This is particularly important for international clients who may require support across different time zones or during volatile market conditions when immediate assistance becomes crucial for trading operations.

Trading Experience Analysis

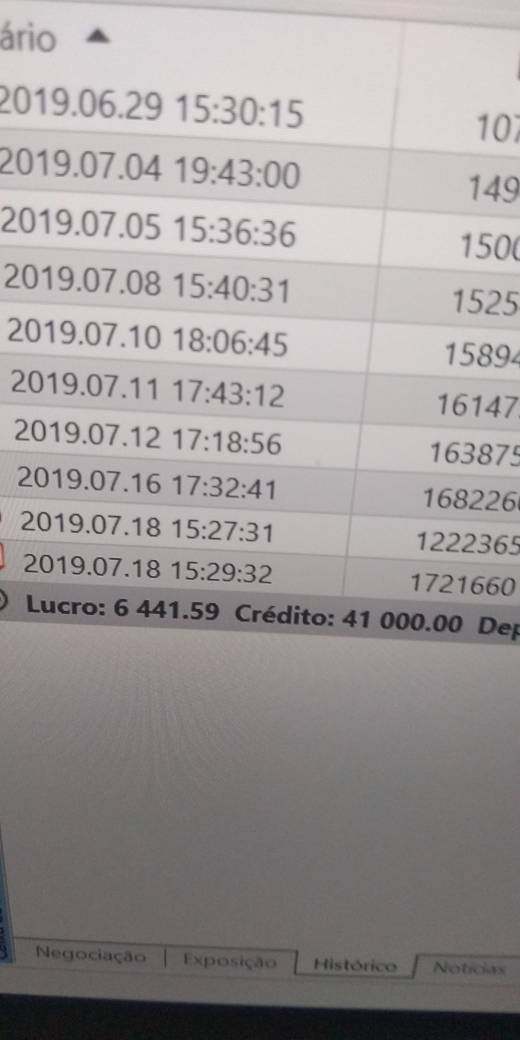

The trading experience at LBLV centers around the MetaTrader 5 platform. MT5 typically provides robust stability and comprehensive functionality for forex and CFD trading activities. MT5's reputation for reliable order execution and advanced analytical capabilities suggests a solid foundation for the trading environment, though specific performance metrics or user experience data are not detailed in available documentation.

Order execution quality is not specifically addressed in current information sources. This includes potential issues with slippage or requotes. This absence of execution quality data limits the ability to assess the practical trading conditions that clients might experience during active market periods or high volatility situations.

The platform's mobile compatibility through MT5's mobile applications should provide traders with flexibility. Users can manage positions and monitor markets while away from desktop environments. However, specific user feedback regarding mobile platform performance or feature accessibility is not documented in available sources.

Trading environment factors such as spread stability, liquidity provision, and server performance during peak trading hours remain unspecified. This lblv review notes that while the MT5 platform foundation suggests professional-grade capabilities, the lack of specific performance data and user experience feedback limits comprehensive assessment of the actual trading conditions clients might encounter.

Trust and Reliability Analysis

The trust and reliability assessment of LBLV reveals significant concerns. Potential clients must carefully consider these issues. The most prominent issue is the unclear regulatory status, with no specific regulatory authority or license number mentioned in available documentation.

This regulatory uncertainty raises fundamental questions about oversight, client protection measures, and compliance frameworks. Without clear regulatory oversight, clients may face increased risks regarding fund security and limited recourse options in case of operational difficulties or disputes with the broker.

Company transparency appears limited. There is insufficient public information about corporate governance, financial reporting, or operational procedures. The lack of detailed regulatory disclosure and limited transparency regarding business operations contribute to reduced confidence in the broker's reliability and accountability standards.

Industry reputation and third-party verification sources are not extensively documented. This makes it difficult to assess the broker's standing within the professional trading community or among regulatory bodies. User trust feedback indicates concerns about the regulatory status, which significantly impacts overall confidence in the platform's reliability and long-term operational stability.

User Experience Analysis

The overall user experience at LBLV presents a mixed picture. The platform has both positive features and notable limitations. The MetaTrader 5 platform typically offers an intuitive interface design that facilitates efficient navigation and trading operations, though specific user feedback regarding interface customization or usability is not detailed in available documentation.

The registration and account verification processes are not comprehensively described. This makes it difficult to assess the convenience and efficiency of client onboarding procedures. The high minimum deposit requirement of $5,000 may create barriers for many potential users seeking to evaluate the platform with smaller initial investments.

Fund management operations lack detailed documentation regarding available methods, processing times, or potential fees. This includes deposit and withdrawal procedures. This information gap significantly impacts the user experience assessment, as efficient fund management is crucial for active trading operations.

Common user concerns appear to focus on the regulatory status uncertainty. This may create anxiety among clients regarding fund safety and operational reliability. The absence of comprehensive user feedback and satisfaction surveys limits the ability to identify specific areas of user satisfaction or dissatisfaction with the platform's services and features.

Conclusion

LBLV presents itself as a broker offering extensive trading instruments and flexible leverage options. The broker operates through the professional MetaTrader 5 platform. The broker's strength lies in providing access to over 1400 trading tools across multiple asset classes, coupled with multilingual support that caters to an international client base.

However, significant concerns regarding the unclear regulatory status and lack of transparent licensing information pose substantial risks for potential investors. The high minimum deposit requirement of $5,000 further limits accessibility for many retail traders seeking entry-level opportunities.

Suitable User Types: LBLV may appeal to well-funded individual investors seeking extensive instrument variety and high leverage options. This is particularly true for those comfortable with regulatory uncertainty.

Key Advantages: Comprehensive instrument selection, high leverage availability, MT5 platform capabilities, and multilingual support.

Primary Disadvantages: Unclear regulatory framework, high minimum deposit requirements, limited transparency regarding costs and operational procedures, and insufficient user feedback documentation for comprehensive evaluation.