Regarding the legitimacy of SuperFin forex brokers, it provides ASIC, FinCEN and WikiBit, .

Is SuperFin safe?

Pros

Cons

Is SuperFin markets regulated?

The regulatory license is the strongest proof.

ASIC Business Registration License (BR)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

ActiveLicense Type:

Business Registration License (BR)

Licensed Entity:

SUPERFIN CORP PTY LTD

Effective Date:

2025-05-21Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

BRISBANE CITY QLD 4000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FinCEN Currency Exchange License (MSB)

Financial Crimes Enforcement Network

Financial Crimes Enforcement Network

Current Status:

RegulatedLicense Type:

Currency Exchange License (MSB)

Licensed Entity:

Superfin Corp Limited

Effective Date:

2025-11-24Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

1312 17th St, Unit Num 2955, Denver, CO 80202Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is SuperForex A Scam?

Introduction

SuperForex is a forex broker that has positioned itself as a global player in the foreign exchange market since its establishment in 2013. With its headquarters in Belize, SuperForex offers a wide range of trading instruments, including currency pairs, CFDs, and cryptocurrencies, and operates on the popular MetaTrader 4 platform. However, as with any financial service provider, traders must exercise caution and conduct thorough due diligence before engaging with a broker. The forex market is rife with opportunities, but it also harbors risks, including fraud and scams. Therefore, evaluating the legitimacy and reliability of a broker like SuperForex is essential for protecting one's investments. This article aims to provide an objective analysis of SuperForex, utilizing data from various sources, including regulatory information, customer feedback, and industry reviews, to assess whether it is a safe and trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its credibility and safety. SuperForex operates under the jurisdiction of the International Financial Services Commission (IFSC) of Belize. While this regulatory body provides some level of oversight, it is considered a tier-3 regulator, which means that it imposes less stringent requirements compared to top-tier regulators such as the FCA (UK) or ASIC (Australia). The table below summarizes SuperForex's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | IFSC/60/292/TS/16 | Belize | Revoked |

Despite being regulated, the IFSC's oversight has faced criticism for its lack of rigorous enforcement and the absence of investor protection schemes. This raises concerns about the safety of client funds and the broker's accountability in case of disputes. Furthermore, reports indicate that SuperForex's license has been revoked, which significantly undermines its legitimacy as a broker. The lack of a robust regulatory framework could expose traders to higher risks, as they may have limited recourse in the event of financial misconduct or disputes.

Company Background Investigation

SuperForex is owned by Superfin Corp, which is registered in Belize. The company has been operational since 2013, and while it claims to have built a solid reputation in the forex industry, the reality is more complex. The management team behind SuperForex has not been widely publicized, leading to questions about their experience and expertise in the financial sector. Transparency regarding ownership and management is critical for establishing trust, and SuperForex's lack of detailed information in this area raises red flags.

In terms of company history, SuperForex has marketed itself aggressively, promoting various bonuses and trading contests to attract clients. However, the absence of a comprehensive track record or independent verification of its claims makes it challenging to assess its actual performance and reliability. Additionally, the company's communication practices have been scrutinized, with reports of unresponsive customer service and inadequate support for traders facing issues. This lack of transparency and accountability can deter potential clients from trusting the broker with their funds.

Trading Conditions Analysis

SuperForex offers competitive trading conditions, including a low minimum deposit requirement of just $1, which is attractive for new traders. However, the overall fee structure and trading costs warrant closer examination. The following table outlines the core trading costs associated with SuperForex:

| Cost Type | SuperForex | Industry Average |

|---|---|---|

| Spread on Major Pairs | 2 pips | 1.5 pips |

| Commission Model | $0 | $0 - $5 |

| Overnight Interest Range | Varies | Varies |

While SuperForex advertises zero commissions, the spreads on major currency pairs are higher than the industry average. This could lead to increased trading costs for clients, particularly for those who engage in frequent trading. Additionally, the broker's overnight interest rates can vary, which may affect long-term positions. Transparency regarding fees is crucial, as hidden costs can significantly impact profitability.

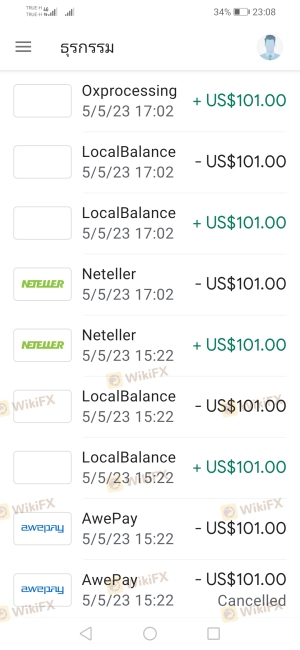

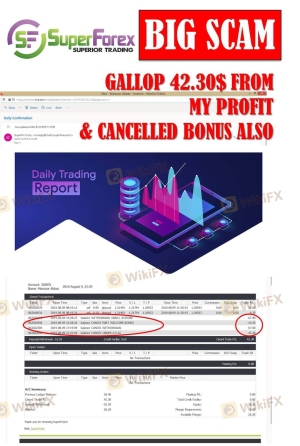

Moreover, SuperForex has been criticized for its bonus structures, which often come with stringent withdrawal conditions. Many traders have reported issues when attempting to withdraw bonus-related profits, leading to suspicions that the bonuses are designed to trap clients into trading more rather than genuinely enhance their trading experience.

Client Fund Security

The safety of client funds is a paramount concern when selecting a forex broker. SuperForex claims to implement several measures to protect client funds, including the use of segregated accounts. This means that client deposits are kept separate from the company's operational funds, theoretically safeguarding them in the event of financial difficulties. However, the effectiveness of these measures is questionable, especially considering the broker's regulatory status.

Additionally, SuperForex does not offer a negative balance protection policy, which is a significant risk factor for traders, particularly those using high leverage. Without this protection, traders could lose more than their initial investment during volatile market conditions. Historical complaints have also surfaced regarding fund withdrawals, with numerous clients reporting difficulties in accessing their funds or having their withdrawal requests denied for various reasons. These issues raise serious concerns about the broker's commitment to safeguarding client assets.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of SuperForex reveal a mixed bag of experiences, with many clients expressing dissatisfaction with the broker's services. Common complaints include difficulties in withdrawing funds, unresponsive customer support, and issues related to the execution of trades. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support Quality | Medium | Inconsistent |

| Trade Execution Problems | High | Limited |

Several clients have reported that their withdrawal requests were canceled or delayed without adequate explanation, leading to accusations of fraudulent behavior. For instance, one trader claimed to have made a profit but was unable to withdraw their funds due to unexplained account restrictions. Such experiences contribute to a growing perception that SuperForex may not prioritize client satisfaction or transparency.

Platform and Trade Execution

SuperForex provides its clients with access to the MetaTrader 4 (MT4) platform, which is widely regarded for its user-friendly interface and robust trading tools. However, while MT4 is a reputable platform, concerns have been raised regarding the execution quality on SuperForex's platform. Traders have reported experiencing slippage and delays during high volatility periods, which can adversely affect trading outcomes.

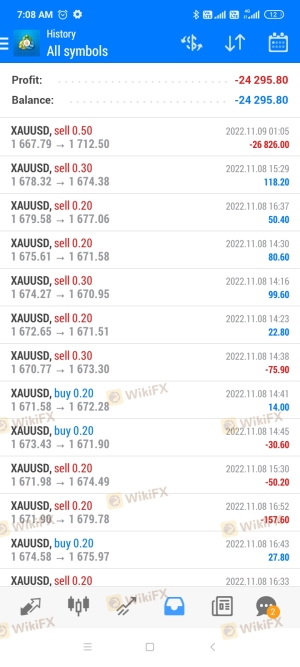

Additionally, there are allegations of potential platform manipulation, with some users claiming that profitable trades were canceled or altered without justification. This raises significant concerns about the integrity of the trading environment and whether clients can trust that their trades will be executed fairly and transparently.

Risk Assessment

Engaging with SuperForex entails several risks that traders should be aware of. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates under a revoked license from a tier-3 regulator. |

| Fund Safety Risk | High | Lack of negative balance protection and questionable fund security measures. |

| Customer Service Risk | Medium | Reports of unresponsive support and difficulty resolving issues. |

| Trade Execution Risk | High | Allegations of trade manipulation and poor execution quality. |

To mitigate these risks, potential clients should consider trading with well-regulated brokers that offer comprehensive investor protection and transparent policies. It is also advisable to start with a demo account or invest only a small amount initially to gauge the broker's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, while SuperForex presents itself as a legitimate forex broker, numerous red flags warrant caution. The broker's regulatory status is questionable, with a revoked license from a tier-3 regulator, which significantly undermines its credibility. Additionally, the lack of negative balance protection, combined with numerous client complaints regarding withdrawal issues and trade execution, raises serious concerns about the safety of client funds.

Traders should approach SuperForex with caution and consider alternative options that offer stronger regulatory oversight and better client protection. For those seeking reliable forex brokers, it is advisable to explore well-regulated alternatives such as FCA or ASIC regulated brokers, which provide a higher level of investor security and transparency. Ultimately, thorough research and careful consideration of the risks involved are essential for making informed trading decisions in the forex market.

Is SuperFin a scam, or is it legit?

The latest exposure and evaluation content of SuperFin brokers.

SuperFin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SuperFin latest industry rating score is 5.97, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.97 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.