Regarding the legitimacy of CXM Prime forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is CXM Prime safe?

Business

Risk Control

Is CXM Prime markets regulated?

The regulatory license is the strongest proof.

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Inst Market Making (MM)

Licensed Entity:

CXM Prime Ltd

Effective Date:

2022-12-20Email Address of Licensed Institution:

info@cxmprime.co.uk, compliance@cxmprime.co.ukSharing Status:

Website of Licensed Institution:

https://www.cxmprime.co.ukExpiration Time:

--Address of Licensed Institution:

Office 3043, Level 30 The Leadenhall Building 122 Leadenhall Street London City Of London EC3V 4AB UNITED KINGDOMPhone Number of Licensed Institution:

+4402037535373Licensed Institution Certified Documents:

Is CXM Prime Safe or Scam?

Introduction

CXM Prime is a forex broker that has made a name for itself in the competitive landscape of online trading. With claims of providing quality liquidity solutions and a robust trading experience, it positions itself as a viable option for both institutional and retail traders. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The importance of due diligence cannot be overstated, as the consequences of choosing an unreliable broker can be detrimental to one's financial health. This article aims to evaluate the safety and legitimacy of CXM Prime by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a broker is crucial for assessing its reliability. CXM Prime claims to be regulated by the Financial Conduct Authority (FCA) in the UK, which is a reputable regulatory body known for its stringent oversight of financial institutions. However, it is essential to verify these claims, as unregulated brokers often operate with little accountability. The following table summarizes the core regulatory information for CXM Prime:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 966753 | United Kingdom | Verified |

While CXM Prime is indeed listed under the FCA, it is important to note that this regulation primarily applies to institutional clients and does not extend to retail traders. This raises questions about the broker's commitment to protecting individual investors. The FCA's stringent requirements for client fund segregation and negative balance protection are critical features that many traders seek in a reliable broker. However, the lack of clear information regarding CXM Prime's adherence to these regulations for retail clients is a cause for concern.

Company Background Investigation

CXM Prime was established in recent years and is part of a larger group of companies focused on providing liquidity solutions and trading services. The ownership structure and management team play a significant role in a broker's credibility. CXM Prime's management comprises individuals with extensive experience in the forex industry, which lends some credibility to its operations. However, the company's transparency regarding its ownership structure and operational history is lacking.

A thorough background investigation reveals that CXM Prime operates in a complex corporate landscape, often intertwined with other entities that may not have the same regulatory oversight. This lack of clarity can lead to confusion for potential clients trying to ascertain the broker's legitimacy. The company's website offers limited information about its history and operational practices, which further complicates the assessment of its reliability.

Trading Conditions Analysis

When evaluating a broker, it is essential to consider the trading conditions they offer. CXM Prime has a variety of account types and claims to provide competitive spreads and leverage options. However, potential clients should be aware of any hidden fees or unusual cost structures that could impact their trading experience. Below is a comparison of core trading costs:

| Cost Type | CXM Prime | Industry Average |

|---|---|---|

| Spread on Major Pairs | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of clear information regarding spreads and commissions on CXM Prime's website can be troubling. Potential clients should be cautious of brokers that lack transparency in their fee structures, as this can lead to unexpected costs that erode trading profits. It is advisable for traders to conduct thorough research and seek out reviews or testimonials that provide insight into the true cost of trading with CXM Prime.

Client Fund Security

One of the most critical aspects of any trading platform is the safety of client funds. CXM Prime claims to implement various measures to protect client deposits, including segregated accounts and negative balance protection. However, the effectiveness of these measures is contingent upon the broker's adherence to regulatory standards.

Historically, there have been instances where brokers have failed to safeguard client funds adequately, leading to significant financial losses for traders. CXM Prime's lack of a comprehensive history regarding fund security practices raises concerns. Traders should inquire about the specific security protocols in place and whether the broker has faced any historical disputes or issues related to client funds.

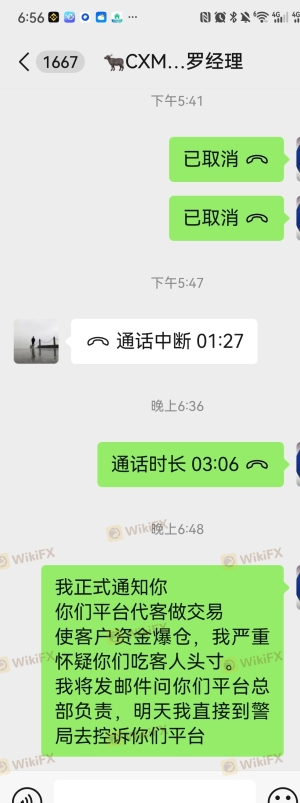

Customer Experience and Complaints

Customer feedback is invaluable when assessing a broker's reliability. A review of user experiences with CXM Prime reveals a mixed bag of opinions. While some traders report positive experiences, others have raised significant complaints regarding withdrawal issues and account management. The following table outlines the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Account Freezing | Medium | Inconsistent |

| Slippage Issues | Low | Average |

Typical complaints include difficulties in withdrawing funds, with some users reporting that their accounts were frozen without clear justification. Such issues can be alarming, especially for traders who prioritize liquidity and access to their funds. The responsiveness of CXM Prime to these complaints also varies, which could indicate underlying operational challenges.

Platform and Trade Execution

The quality of the trading platform is another crucial factor in evaluating a broker's reliability. CXM Prime offers the popular MetaTrader 4 platform, known for its user-friendly interface and robust trading tools. However, issues related to order execution, such as slippage and rejections, have been reported by some users.

A stable and efficient trading platform is essential for executing trades effectively, and any signs of manipulation or performance issues should be closely scrutinized. Traders should be aware of the potential risks associated with using a broker that may not prioritize platform stability and execution quality.

Risk Assessment

Engaging with any broker comes with inherent risks, and CXM Prime is no exception. A comprehensive risk assessment reveals several areas of concern that potential clients should consider:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Limited oversight for retail clients. |

| Fund Security | Medium | Lack of transparency in fund protection measures. |

| Customer Service | Medium | Mixed reviews regarding responsiveness. |

To mitigate these risks, traders are encouraged to perform thorough due diligence, seek out alternative brokers with established reputations, and consider starting with smaller investments until they are comfortable with the broker's practices.

Conclusion and Recommendations

In conclusion, the question of Is CXM Prime safe? remains somewhat ambiguous. While the broker is regulated by the FCA, its focus on institutional clients raises concerns for retail traders. The lack of transparency regarding trading conditions, fund security measures, and customer experiences suggests that potential clients should approach with caution.

For traders seeking reliable alternatives, it may be prudent to consider brokers with a proven track record of regulatory compliance and positive customer feedback. Ultimately, the decision to engage with CXM Prime should be made after careful consideration of the risks and a thorough evaluation of the broker's practices.

Is CXM Prime a scam, or is it legit?

The latest exposure and evaluation content of CXM Prime brokers.

CXM Prime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CXM Prime latest industry rating score is 5.05, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.05 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.