CXM Prime 2025 Review: Everything You Need to Know

Executive Summary

CXM Prime is a forex and CFD broker regulated by the UK's Financial Conduct Authority. The company operates under proper regulatory oversight with FRN: 966753 and is incorporated in England and Wales with company number 13407617, but this cxm prime review reveals significant concerns alongside its regulatory credentials.

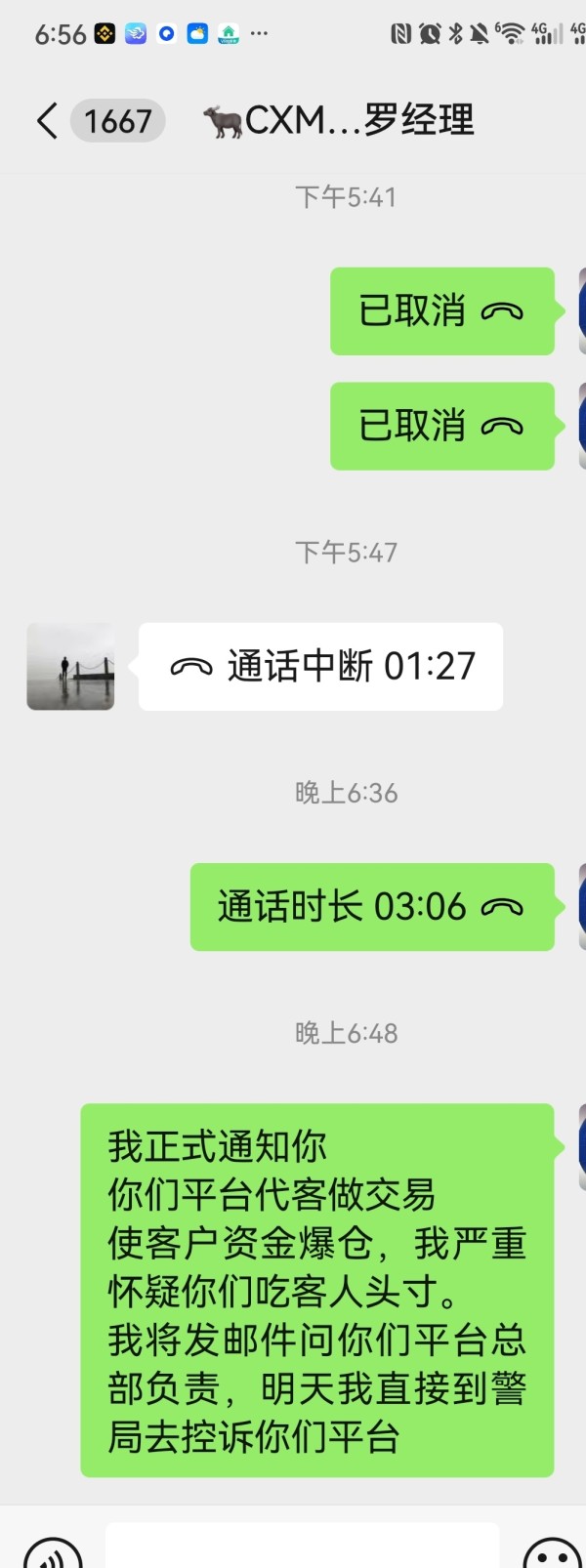

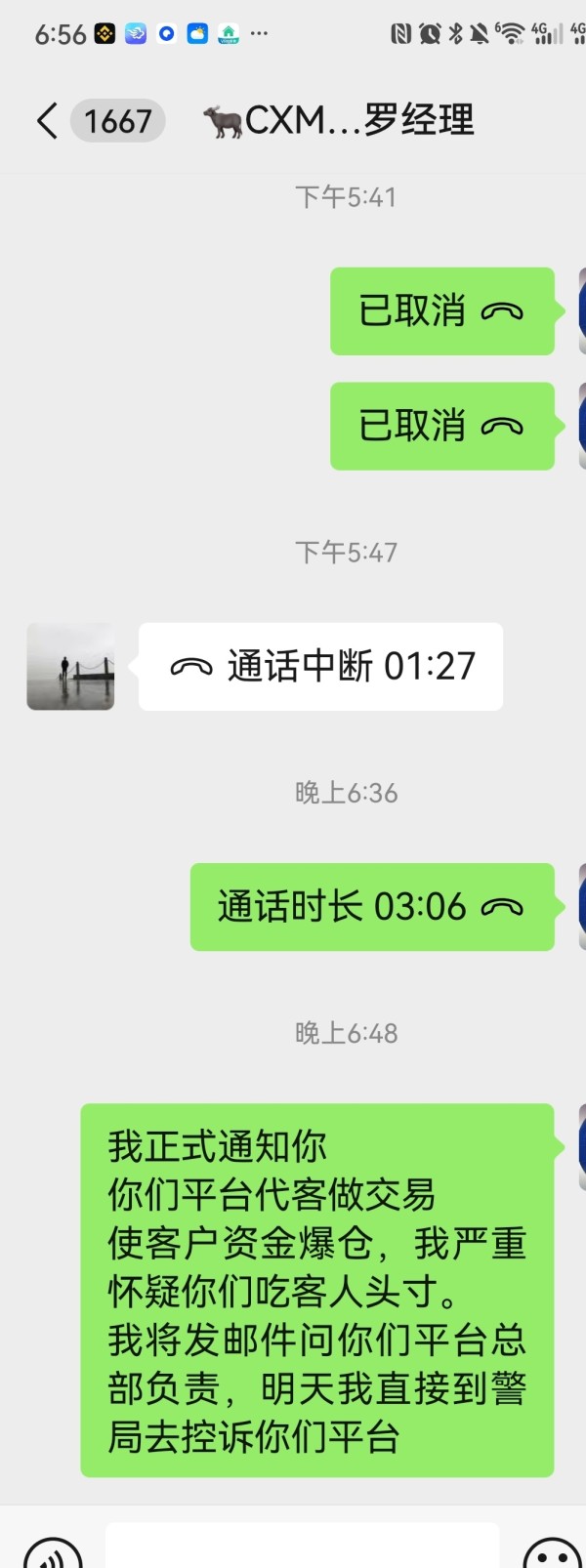

According to WikiFX monitor data, CXM Prime has received positive reviews from real users, but also faces serious allegations. The broker has been accused of employing deceptive technical practices through its business managers. These accusations allegedly guide clients in ways that lead to account failures, representing a major red flag for potential investors considering this platform.

The broker targets small to medium-sized investors interested in forex and CFD trading. It positions itself as a regulated entity that commits to following FX global standards, but the presence of negative exposure and trust concerns means traders should approach with considerable caution when evaluating CXM Prime as their trading partner.

Important Notice

This review focuses specifically on CXM Prime Ltd, which is registered and regulated solely in the United Kingdom under FCA supervision. Investors from other regions should exercise particular caution and verify whether services are legally available in their jurisdiction, as the regulatory protections discussed in this review may not extend to clients outside the UK.

This evaluation is based on publicly available information and user feedback collected from various sources. The assessment may not cover all aspects of user experience, and individual trading experiences may vary significantly from the general findings presented here.

Rating Framework

Broker Overview

CXM Prime Ltd operates as a UK-based forex and CFD broker. The company is incorporated in England and Wales under company number 13407617 and has established its registered office at a UK address, positioning itself within the competitive landscape of online trading platforms. While the exact founding year is not specified in available materials, the company operates under the regulatory framework established by the Financial Conduct Authority.

The broker's business model centers on providing forex and CFD trading services to retail clients. It operates as an intermediary in the foreign exchange and contract for difference markets, emphasizing its commitment to regulatory compliance and adherence to FX global standards, though recent allegations have raised questions about actual business practices versus stated commitments.

According to available information, CXM Prime offers trading in forex and CFD instruments. Specific details about trading platforms are not extensively detailed in current documentation, but the company operates under FCA regulation with license number FRN: 966753, which provides certain regulatory protections for eligible clients. However, this cxm prime review indicates that regulatory status alone may not address all concerns raised by users and industry observers.

Regulatory Jurisdiction: CXM Prime operates under the supervision of the UK Financial Conduct Authority with license number FRN: 966753. This regulatory framework provides certain protections for eligible clients under UK financial services regulations.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available materials. Potential clients must contact the broker directly for payment processing options.

Minimum Deposit Requirements: Current documentation does not specify minimum deposit amounts. Interested traders should inquire directly with CXM Prime for account opening requirements.

Bonuses and Promotions: Available materials do not mention specific bonus programs or promotional offers. This indicates either absence of such programs or lack of public disclosure of promotional terms.

Tradeable Assets: The broker offers trading in forex and CFD instruments. The specific range of currency pairs and CFD products is not extensively detailed in current documentation.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not specifically outlined in available materials. This represents a significant information gap for potential clients evaluating cost competitiveness.

Leverage Ratios: Current documentation does not specify maximum leverage ratios available to different client categories. This is crucial information for risk assessment.

Platform Options: Specific trading platform details are not comprehensively covered in available materials. Interested traders require further investigation.

Geographic Restrictions: While regulated in the UK, specific information about geographic restrictions for international clients is not detailed in current documentation.

Customer Support Languages: Available materials do not specify the range of languages supported by customer service teams.

This cxm prime review highlights significant information gaps that potential clients should address through direct communication with the broker before making trading decisions.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions at CXM Prime present a mixed picture due to limited publicly available information. Current documentation does not provide comprehensive details about account types, their specific features, or differentiation between various client categories, and this lack of transparency in account specifications represents a significant concern for potential traders seeking to understand their options.

Minimum deposit requirements are not specified in available materials. This makes it difficult for potential clients to plan their initial investment, while the absence of clear information about account opening procedures, required documentation, or verification timelines adds to the uncertainty surrounding account conditions.

User feedback regarding account conditions varies, with some clients expressing satisfaction with basic account functionality while others raise concerns about account management practices. The allegations of deceptive practices by business managers particularly impact the assessment of account conditions, as these claims suggest potential issues with how accounts are managed and guided.

Special account features such as Islamic accounts, professional client categorization, or other specialized services are not detailed in current documentation. This cxm prime review finds that the lack of comprehensive account information significantly impacts the overall assessment of account conditions, resulting in an average rating that reflects both the regulatory foundation and the information transparency concerns.

The analysis of trading tools and resources at CXM Prime is hampered by limited publicly available information about the broker's offering in this area. Current documentation does not provide detailed descriptions of trading tools, analytical resources, or educational materials available to clients.

Research and analysis resources, which are crucial for informed trading decisions, are not comprehensively outlined in available materials. The absence of information about market analysis, economic calendars, technical indicators, or research reports suggests either limited offerings or poor communication of available resources.

Educational resources, including webinars, tutorials, trading guides, or market education programs, are not detailed in current documentation. For a broker targeting small to medium-sized investors, the apparent lack of educational support represents a significant limitation.

Automated trading support, including information about Expert Advisors, algorithmic trading capabilities, or API access, is not mentioned in available materials. This absence of information about advanced trading tools may limit the broker's appeal to more sophisticated traders.

The overall assessment of tools and resources receives a below-average rating due to the lack of comprehensive information and apparent limited offerings in this crucial area of broker services.

Customer Service and Support Analysis (6/10)

Customer service and support at CXM Prime shows a more positive picture compared to other assessed areas. The broker has established a complaints handling policy with Peter Wilson designated as the senior manager responsible for overall complaints handling functions, indicating a structured approach to client issue resolution.

The company operates under FCA regulations, which include specific requirements for dispute resolution procedures as outlined in the FCA Handbook's Dispute resolution sourcebook. This regulatory framework provides clients with structured pathways for complaint resolution and escalation.

User feedback regarding customer service quality shows variation, with some clients reporting satisfactory support experiences while others express concerns about response times and issue resolution effectiveness. The mixed nature of user experiences suggests inconsistent service delivery across different client interactions.

Response times and service quality appear to vary based on user feedback. No specific service level agreements or guaranteed response times are mentioned in available documentation, while the absence of detailed information about customer service hours, available contact channels, or multilingual support capabilities represents areas where transparency could be improved.

Despite the regulatory framework and formal complaints handling structure, the overall customer service assessment reflects the mixed user experiences and limited transparency about service standards and capabilities.

Trading Experience Analysis (5/10)

The trading experience at CXM Prime receives an average rating due to mixed user feedback and limited specific information about platform performance and trading conditions. User reports suggest varying experiences with platform stability and functionality, indicating potential inconsistencies in trading environment quality.

Platform stability and execution speed show mixed reviews from users, with some reporting satisfactory performance while others express concerns about technical reliability. The absence of detailed technical specifications or performance metrics makes it difficult to assess the consistency of trading conditions across different market conditions.

Order execution quality is not comprehensively detailed in available materials. User feedback suggests varying experiences with trade execution, while the lack of specific information about execution statistics, slippage data, or order processing times represents a significant information gap for potential traders.

Mobile trading experience and platform functionality details are not extensively covered in current documentation. This limits the ability to assess the comprehensiveness of trading tools and features available to clients, and this cxm prime review notes that the absence of detailed platform specifications affects the overall assessment of trading experience.

The allegations of deceptive practices by business managers particularly impact the trading experience assessment, as these claims suggest potential manipulation of client trading outcomes, which would fundamentally undermine the integrity of the trading environment.

Trust and Safety Analysis (3/10)

Trust and safety represent the most concerning aspects of CXM Prime's offering. The broker maintains FCA regulation under license number FRN: 966753, but serious allegations have emerged that substantially impact trustworthiness assessments.

The most significant concern involves allegations that CXM Prime's business managers engage in deceptive technical practices. These accusations claim managers allegedly guide clients in ways that lead to account failures, and these accusations, if accurate, represent fundamental breaches of client trust and professional trading standards.

Regulatory oversight by the FCA provides certain protections and establishes compliance requirements. Regulatory status alone cannot address the specific allegations of deceptive practices, while the disconnect between regulatory compliance and alleged business practices creates significant trust concerns for potential clients.

Company transparency regarding business practices, fee structures, and operational procedures shows limitations based on the information gaps identified throughout this review. The lack of comprehensive disclosure about trading conditions, costs, and procedures affects overall transparency assessments.

Fund safety measures and client money protection are not detailed in available materials beyond basic regulatory requirements. This leaves questions about additional protective measures or insurance coverage that might benefit clients, while the combination of serious allegations, limited transparency, and information gaps results in significant trust and safety concerns that potential clients should carefully consider.

User Experience Analysis (4/10)

User experience at CXM Prime shows a below-average rating based on mixed feedback and several concerning elements that affect overall client satisfaction. User reviews present a polarized picture, with some positive experiences contrasted against serious negative feedback and allegations.

Overall user satisfaction appears divided, with positive reviews balanced against exposure of alleged deceptive practices. This polarization suggests that user experiences may vary significantly depending on individual circumstances and interactions with different aspects of the broker's services.

Interface design and usability details are not comprehensively covered in available documentation. This makes it difficult to assess the technical aspects of user experience, while the absence of detailed platform descriptions or user interface information represents a gap in understanding the practical aspects of using CXM Prime's services.

Registration and verification processes are not detailed in current materials. The broker operates under FCA regulations that require specific client onboarding procedures, but the lack of transparency about account opening procedures may create uncertainty for potential clients.

Common user complaints, based on available feedback, include concerns about business practices and allegations of account manipulation. These serious allegations significantly impact the overall user experience assessment and raise fundamental questions about the broker's approach to client relationships.

The mixed nature of user feedback, combined with serious allegations and limited transparency about user-facing processes, results in a below-average rating for overall user experience.

Conclusion

This cxm prime review reveals a complex picture of a broker that operates under proper regulatory oversight but faces serious allegations that significantly impact its overall assessment. While CXM Prime maintains FCA regulation and has established formal complaint handling procedures, the accusations of deceptive practices by business managers represent fundamental concerns that potential clients must carefully consider.

The broker may be suitable for small to medium-sized investors interested in forex and CFD trading who prioritize regulatory oversight. The serious allegations and mixed user feedback suggest that extreme caution is warranted, while potential clients should thoroughly investigate these concerns and consider alternative options with stronger trust profiles.

The main advantages include FCA regulation and formal complaint procedures. Significant disadvantages include serious allegations of deceptive practices, mixed user feedback, and limited transparency about trading conditions and costs, and these factors combine to create a risk profile that requires careful consideration by potential clients.