Smart Trader 2025 Review: Everything You Need to Know

Executive Summary

Smart Trader is an online trading platform. The trading community has mixed feelings about this broker. This complete smart trader review looks at a broker that welcomes new traders with a $0 minimum deposit for all account types. The company started in 2019 and has its main office in Iraq. Smart Trader works as an open chart software platform that brings together multiple trading accounts for live trading.

The platform lets you trade forex, stocks, and cryptocurrency. This makes it appealing to traders who want different investment choices. But user reviews show big problems, with 53% of people on major review sites giving it only one star. Some users say the platform's help and tips improved their trading choices. Still, most people don't feel excited about it.

Smart Trader targets new traders and people who want low-risk investments. The zero minimum deposit is the main reason for this appeal. However, the missing regulatory details and mixed user reviews mean potential traders should be careful. This review will look at every part of the platform to give you a fair assessment.

Important Notice

This smart trader review uses available user feedback and market data. Readers should know that Smart Trader doesn't clearly show its regulatory information in available materials. This might mean the service offerings and rules are different in various regions.

The review here shows information available when we wrote this article. It may not include all recent changes or regional differences in the broker's services. Traders should do their own research and check current regulatory status before investing money.

Rating Framework

Broker Overview

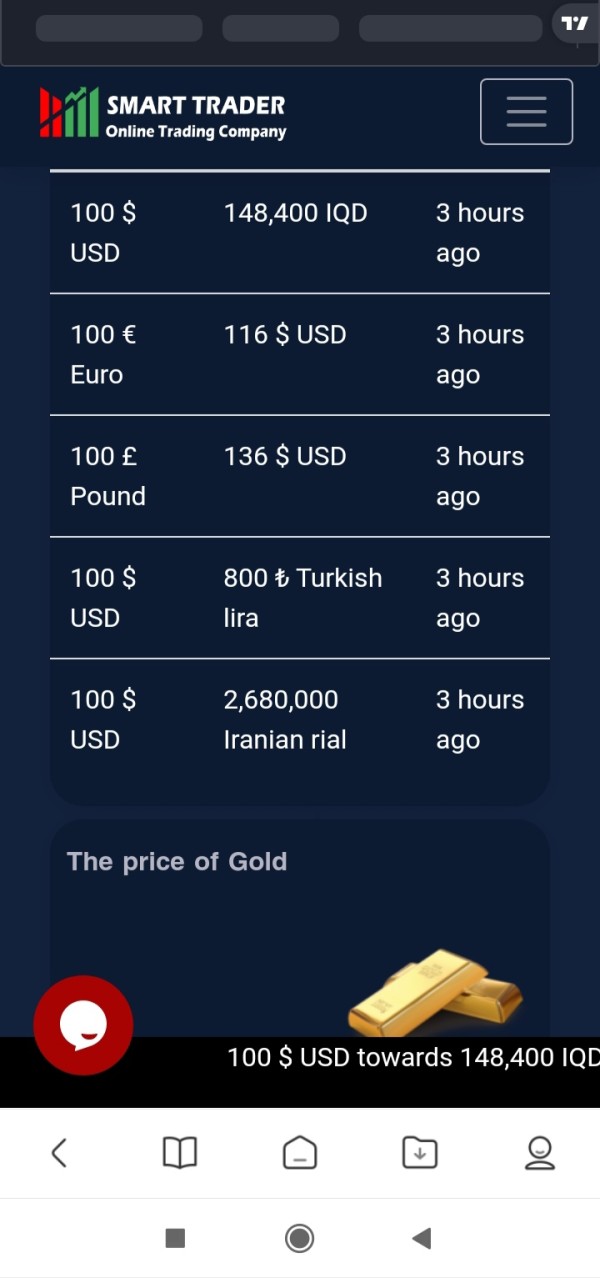

Smart Trader started in the online trading world in 2019. The company put its main office in Iraq. The platform aims to make financial markets easier to access through its unique system that combines multiple accounts. Smart Trader works by bringing together many trading accounts into one interface. This lets users make real-time trades across different financial tools from one central place.

The business focuses on giving new traders an easy starting point. At the same time, it keeps the advanced features that experienced traders need. Smart Trader removes traditional barriers like high minimum deposits. This strategy helps them get more retail traders who might avoid regular broker requirements.

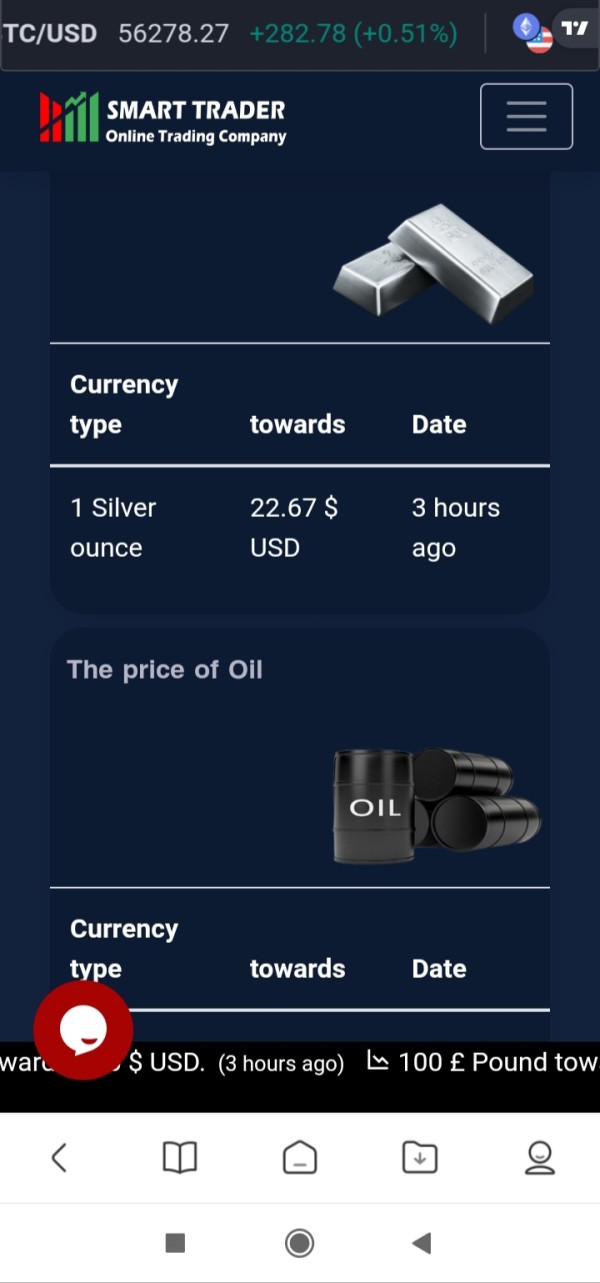

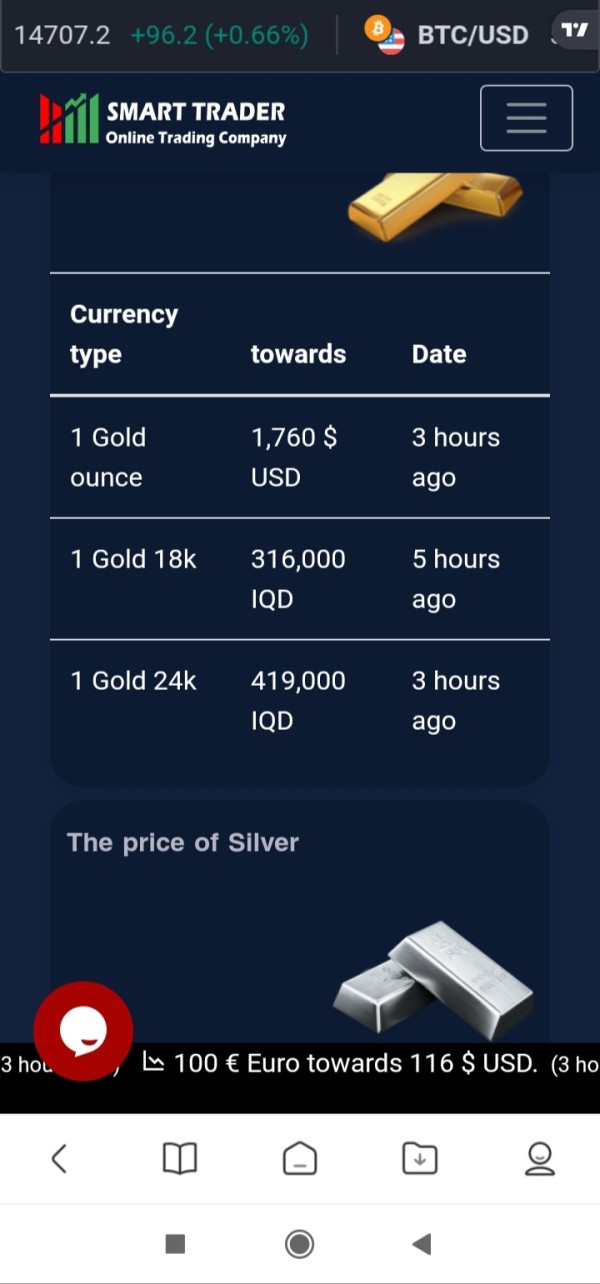

Smart Trader uses an open chart software system as its main trading platform. This technology supports its multi-account combination service. The platform lets you trade in three major areas: foreign exchange, stock markets, and cryptocurrency trading. This varied approach helps traders build different portfolios within one platform.

One important thing missing from available information is specific regulatory oversight details. This is a big consideration for potential users. The platform's structure and lack of clear regulatory badges might mean they have pending applications or work under different rules than traditional major brokers.

Regulatory Status: Smart Trader doesn't clearly show specific regulatory information in available documents. This may worry traders who want regulatory oversight and investor protection plans.

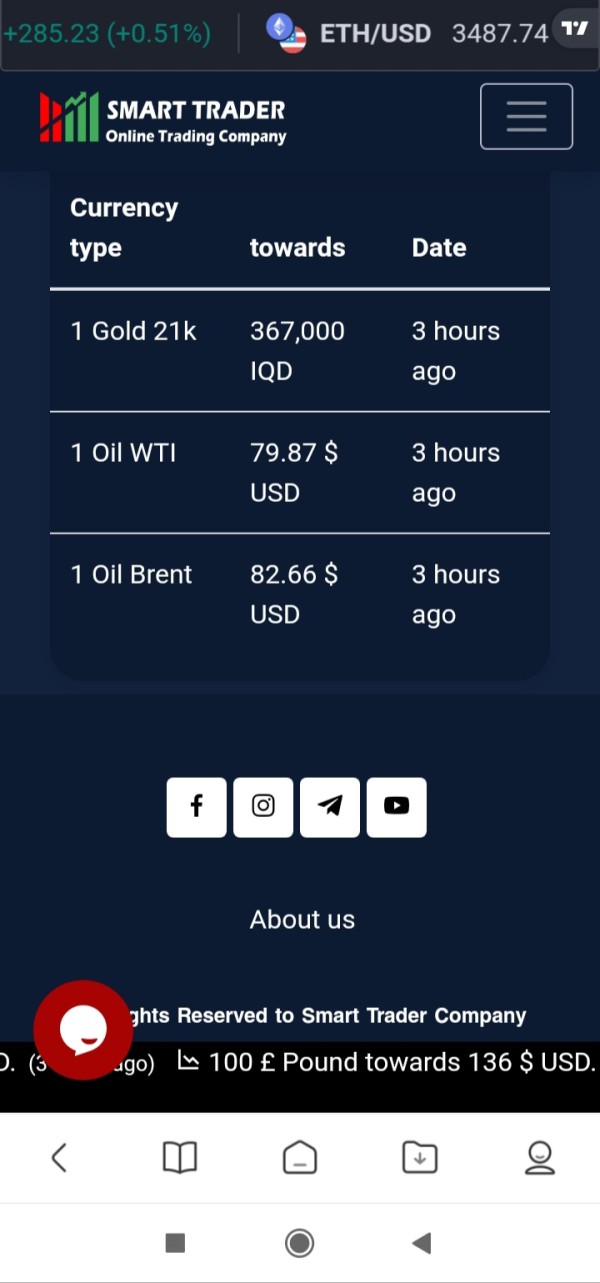

Deposit and Withdrawal Methods: The available payment methods for deposits and withdrawals are not listed in current materials.

Minimum Deposit Requirements: Smart Trader offers a $0 minimum deposit for their free account option. This makes it accessible to traders with limited starting money.

Bonus and Promotional Offers: Current promotional structures and bonus offerings are not detailed in available information.

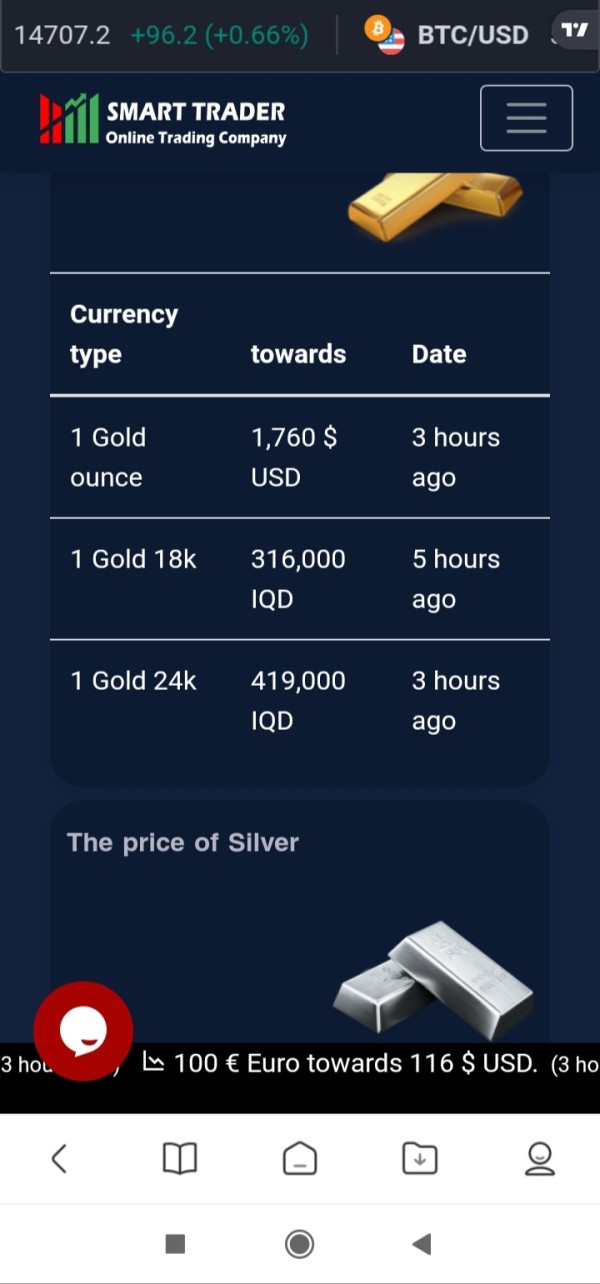

Available Trading Assets: The platform supports forex markets, stock markets, and cryptocurrency assets. This gives you different opportunities across traditional and digital asset classes.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not detailed in available materials. Traders should ask the platform directly about these costs.

Leverage Options: Leverage ratios and margin requirements are not listed in current documents.

Platform Options: Smart Trader works mainly through its own open chart software system. This serves as the main trading interface.

Geographic Restrictions: Specific regional limits or restrictions on service availability are not mentioned in available information.

Customer Support Languages: The range of supported languages for customer service is not listed in current materials.

This smart trader review notes that several key details need direct checking with the platform. Complete information is not easily available through standard channels.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

Smart Trader's account structure shows both good and bad points that lead to its moderate rating. The platform's biggest advantage is its $0 minimum deposit requirement. This removes one of the most common barriers that stop new traders from entering the market. This approach matches modern trends toward making trading access fair and open to everyone.

The broker offers multiple account types beyond the basic free account. However, specific details about tier structures, features, and benefits for each account level are not well documented in available materials. This lack of clear information is a big problem for traders who want to understand exactly what services they can expect at different investment levels.

Account opening steps and verification requirements are unclear from available documents. This could create uncertainty for future clients about how long the onboarding process takes and what documents they need. The missing information about special account types, such as Islamic accounts for Sharia-compliant trading, may limit the platform's appeal to certain groups.

User feedback about account conditions is limited in available materials. This makes it hard to judge real-world experiences with account management, upgrades, or specific features. When compared to established brokers that typically require minimum deposits from $100 to $500, Smart Trader's zero-deposit approach certainly stands out as competitive. However, the overall value depends heavily on other service aspects that lack detailed documentation.

This smart trader review finds that while the accessible deposit requirements are good, the lack of complete account information prevents a higher rating in this important category.

Smart Trader's technology centers around its open chart software system. This represents a smart approach to multi-platform trading combination. The OSC system lets traders connect and manage multiple trading accounts from various providers within a single interface. This could make portfolio management and execution processes easier across different markets and asset classes.

The platform's support for forex, stocks, and cryptocurrency trading shows complete asset coverage. This can work with diverse trading strategies and preferences. This multi-asset approach gives traders chances to diversify their portfolios without needing separate accounts with specialized brokers for each asset class.

However, specific details about advanced charting abilities, technical analysis tools, fundamental analysis resources, or market research are not clearly outlined in available documents. The missing information about automated trading support, expert advisors, or algorithmic trading abilities may worry more advanced traders seeking sophisticated functionality.

Educational resources have become standard offerings among competitive brokers. These are not mentioned in available materials. This represents a missed opportunity, especially given Smart Trader's clear focus on attracting new traders who would benefit most from complete educational support and market analysis guidance.

User feedback suggests that some traders have found the platform's support and insights helpful for their trading decisions. This shows that there may be valuable resources available that are not prominently featured in marketing materials. The platform's combination model could potentially provide unique market insights by combining data from multiple sources. However, this advantage is not clearly highlighted or detailed.

Customer Service and Support Analysis (5/10)

Customer service represents one of Smart Trader's biggest challenges. User feedback data shows that 53% of reviews rate the service with just one star. This very negative response pattern shows systematic issues with support quality, responsiveness, or problem resolution abilities that significantly impact user satisfaction.

The high number of one-star ratings suggests that customer service problems are not isolated incidents. Instead, they reflect broader structural issues within the support organization. Such consistent negative feedback typically shows problems with response times, staff training, communication effectiveness, or the ability to resolve technical and account-related issues well.

Available information doesn't specify the customer support channels offered. These might include live chat, email, phone support, or help desk ticketing systems. The missing clear communication about support availability, including operating hours and expected response times, adds to uncertainty about the level of help traders can expect when issues arise.

Multilingual support abilities are not documented. This could create barriers for international traders who prefer to communicate in their native languages. Given Smart Trader's clear international focus, the lack of clear language support information represents a significant service gap.

The contrast between the very negative review statistics and occasional positive feedback about helpful insights suggests inconsistent service delivery. This may depend on individual representatives or specific issue types. This inconsistency prevents traders from having confidence in reliable support when needed. This is particularly problematic for active traders who require prompt help with time-sensitive issues.

Trading Experience Analysis (6/10)

The trading experience on Smart Trader's platform reflects the mixed nature of user feedback. Some positive elements are offset by areas of concern and uncertainty. The open chart software system represents an ambitious technological approach that could provide unique advantages through its multi-account combination abilities. This potentially allows traders to execute strategies across different providers and asset classes from a unified interface.

Platform stability and execution quality are not specifically addressed in available user feedback. This leaves important questions about system reliability during high-volume trading periods or market volatility unanswered. For active traders, platform uptime and order execution speed are critical factors that require reliable performance under various market conditions.

The diversity of supported asset classes suggests that traders can implement varied strategies. These include forex, stocks, and cryptocurrencies without requiring multiple platform logins or account management across different providers. This consolidation could make trading workflows smoother and provide better portfolio oversight for traders managing positions across multiple markets.

However, the lack of detailed information about order types, execution methods, slippage control, or advanced trading features limits the ability to assess the platform's suitability for different trading styles. Scalpers, day traders, and algorithmic traders have specific requirements that are not clearly addressed in available documentation.

Mobile trading abilities have become essential for modern traders. These are not specifically mentioned in available materials. The missing information about mobile apps or responsive web platforms could show limitations in trading flexibility for users who need to manage positions while away from desktop computers.

This smart trader review notes that while the combination concept shows promise, the lack of complete performance data and mixed user feedback prevent a more favorable rating in this critical category.

Trust and Safety Analysis (4/10)

Trust and safety concerns represent Smart Trader's most significant weakness. This is primarily due to the missing clear regulatory information and the high number of negative user reviews. The lack of prominent regulatory badges, license numbers, or oversight authority mentions raises important questions about investor protection and operational compliance standards.

Regulatory oversight provides crucial safeguards including segregated client funds, compensation schemes, and standardized complaint resolution procedures. The missing clear regulatory information means traders cannot easily verify what protections are in place for their deposits and trading activities. This uncertainty is particularly concerning for traders considering larger deposits or more significant trading volumes.

The 53% one-star review rate shows widespread user dissatisfaction that extends beyond simple service issues. This potentially includes more serious concerns about platform reliability, fund security, or business practices. Such consistently negative feedback patterns often reflect fundamental problems that affect user trust and confidence in the platform's long-term viability.

Fund security measures are not detailed in available materials. These might include segregated accounts, insurance coverage, or third-party auditing. The missing information about financial safeguards leaves traders uncertain about the security of their deposits and trading profits. Established brokers typically provide clear documentation about fund protection measures as a key trust-building element.

Company transparency about ownership, financial backing, and operational history is limited in available documentation. While the platform's 2019 establishment and Iraq headquarters are mentioned, broader corporate structure and financial stability information that would support user confidence is not readily available.

The combination of regulatory uncertainty and negative user feedback creates a challenging trust environment. This requires careful consideration by potential users, particularly those planning significant trading activity or larger deposits.

User Experience Analysis (5/10)

User experience on Smart Trader reflects the platform's mixed reception. Feedback ranges from positive comments about helpful insights to the concerning 53% one-star review rate that shows widespread dissatisfaction. This polarized response pattern suggests that user experience may vary significantly depending on individual circumstances, trading requirements, or specific platform interactions.

The zero minimum deposit requirement creates a positive initial user experience. It removes financial barriers to account opening and platform exploration. New traders can test the platform's abilities without financial commitment. This represents a user-friendly approach that aligns with modern expectations for accessible trading platforms.

However, the high number of negative reviews suggests that initial positive impressions may not continue through ongoing platform use. Common user experience problems in trading platforms include interface complexity, slow execution, inadequate customer support, or unexpected costs that emerge during active trading.

Interface design and navigation ease are not specifically addressed in available user feedback. This leaves questions about the platform's usability for traders with different experience levels. The combination model could potentially create interface complexity as multiple account types and asset classes are managed through a single system.

Registration and verification processes are not detailed in available materials. This makes it difficult to assess the smoothness of the onboarding experience. Account verification delays or complex documentation requirements can significantly impact initial user satisfaction and platform adoption.

The missing detailed positive user testimonials or case studies limits the ability to identify specific user experience strengths. These might offset the negative feedback patterns. For a platform targeting new traders, complete user experience documentation and positive user stories would be valuable for building confidence and demonstrating value.

Conclusion

Smart Trader presents a mixed proposition in the competitive online trading landscape. Notable strengths in accessibility are offset by significant concerns about service quality and transparency. The platform's zero minimum deposit requirement and multi-asset trading abilities represent genuine advantages for new traders and those seeking diversified investment opportunities without substantial initial capital requirements.

However, the overwhelming negative user feedback shows systematic issues that potential users must carefully consider. 53% of reviews rate the service at just one star. The missing clear regulatory information further adds to trust concerns, particularly for traders prioritizing investor protection and operational transparency.

Smart Trader appears most suitable for new traders willing to explore the platform with minimal financial risk. The zero deposit requirement makes this possible. However, the mixed user experiences and service quality concerns suggest that serious traders or those planning significant trading activity should approach with considerable caution and thorough research.

The platform's combination concept shows promise. However, it requires substantial improvements in customer service, transparency, and user satisfaction to compete effectively with established brokers in the increasingly competitive online trading market.