Industrial Futures 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Industrial Futures is a trading platform that offers a competitive edge through low fees and a diverse array of investment options, making it particularly appealing for experienced traders seeking cost-effective solutions. The platform supports various financial instruments, including futures and Contracts for Difference (CFDs), thus catering to those ready to handle a more complex trading landscape. However, potential investors should consider significant trade-offs, particularly the reported withdrawal challenges and mixed user feedback, which could pose risks.

Ideal Customer Profile

The ideal customers for Industrial Futures are experienced traders accustomed to navigating trading complexities, and who prioritize low-cost trading options and diverse financial products. However, prospective clients should weigh the platform's withdrawal issues and regulatory uncertainties carefully. As such, this platform may not be suitable for beginners or risk-averse individuals who place a strong emphasis on secure withdrawal processes and robust customer support.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement: Users should be aware that Industrial Futures has faced multiple reports of withdrawal issues and conflicting user reviews, which can compromise fund safety and trading reliability.

Potential Harms:

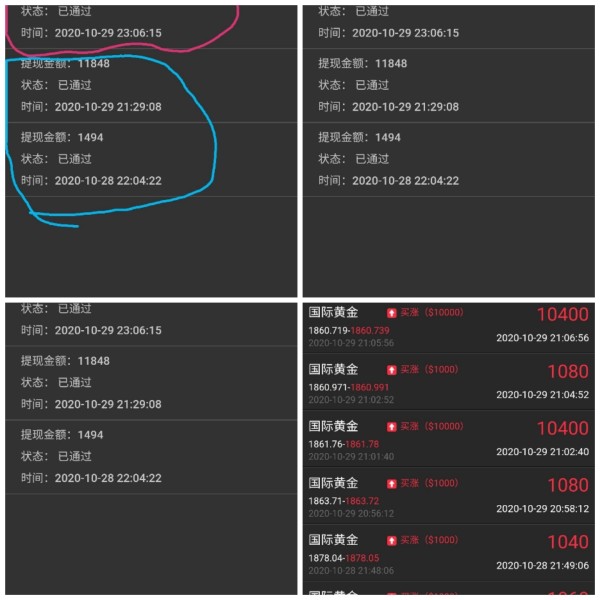

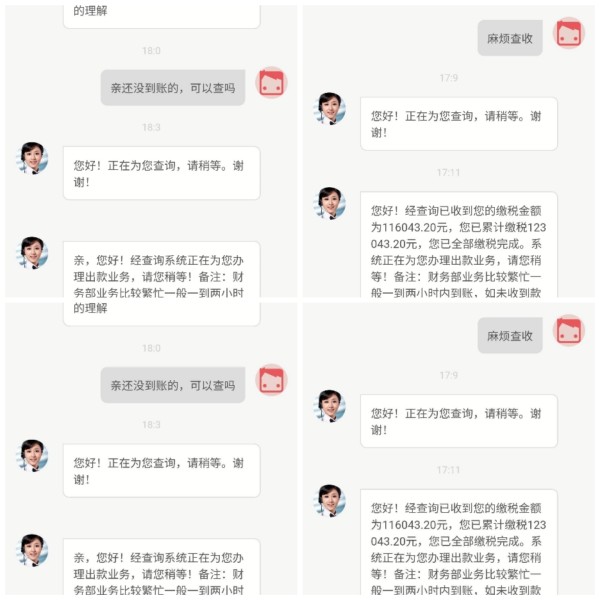

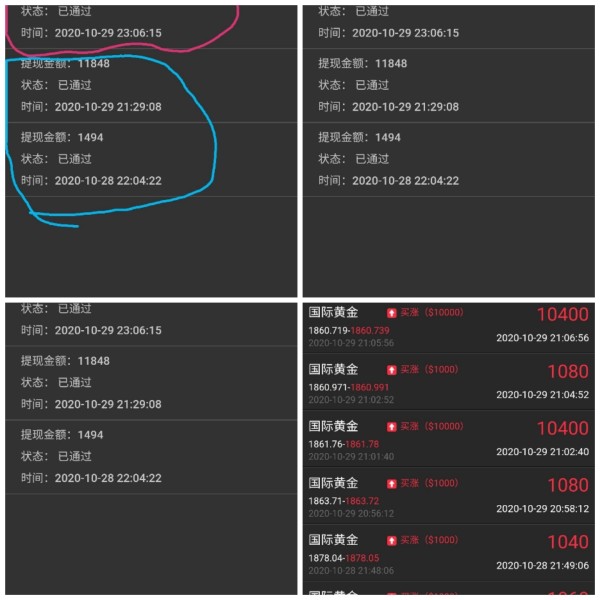

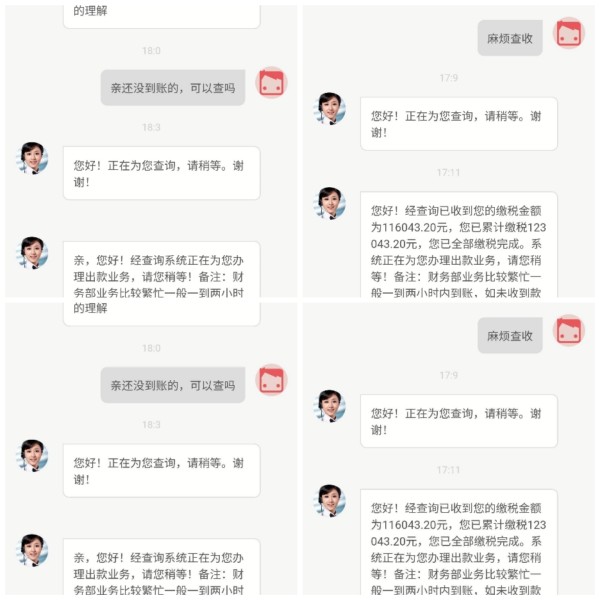

- Difficulty in withdrawing funds from accounts.

- Negative experiences due to customer service inefficiencies.

- Uncertainty regarding regulatory compliance.

How to Self-Verify

- Review Regulatory Standing: Check if the broker is registered with reliable regulatory bodies such as the National Futures Association (NFA) or the Commodity Futures Trading Commission (CFTC).

- Consult Online Reviews: Use trusted financial websites to read consumer feedback and professional reviews about Industrial Futures.

- Log Account Activity: Keep records of trading activity and withdrawal requests for transparency.

- Contact Customer Support: Reach out to customer support with specific inquiries to gauge responsiveness and reliability.

- Research Competitors: Compare Industrial Futures to other brokers in terms of fees, services, and user experiences to make an informed decision.

Rating Framework

Broker Overview

Company Background and Positioning

Founded more than two decades ago, Industrial Futures has positioned itself within the highly competitive broker landscape primarily catering to experienced and institutional traders. Headquartered in Cypriot Limassol, the firm is registered under the China Futures Association. Despite its foundational achievements, the broker's growth has been hampered by recurrent reports of fund withdrawal issues, which have diluted trust among potential users.

Core Business Overview

Industrial Futures specializes in futures trading and provides access to a variety of asset classes, including commodities, indices, forex, and cryptocurrencies. The platform is particularly aimed at self-directed traders who seek flexibility in their trading strategies. However, the broker has faced scrutiny regarding its regulatory standing, claiming oversight under a Chinese regulatory entity, which may not meet the standards expected by traders in more regulated markets.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Users report conflicting information regarding the regulatory framework governing Industrial Futures. While the broker claims compliance with CFFEX, confusion arises from its operational practices and reported withdrawal difficulties. This regulatory ambiguity signals potential risks, which traders must critically evaluate.

User Self-Verification Guide

To assess the reliability of Industrial Futures, follow this self-verification guide:

- Visit the NFA's BASIC database and search for the brokers registration status.

- Check authoritative regulatory websites for license verifications.

- Review complaints and reported issues noted on financial consumer protection sites.

- Analyze press releases or notices from financial authorities regarding the broker.

- Keep personal transaction records and review them against user feedback for accuracy.

Industry Reputation and Summary

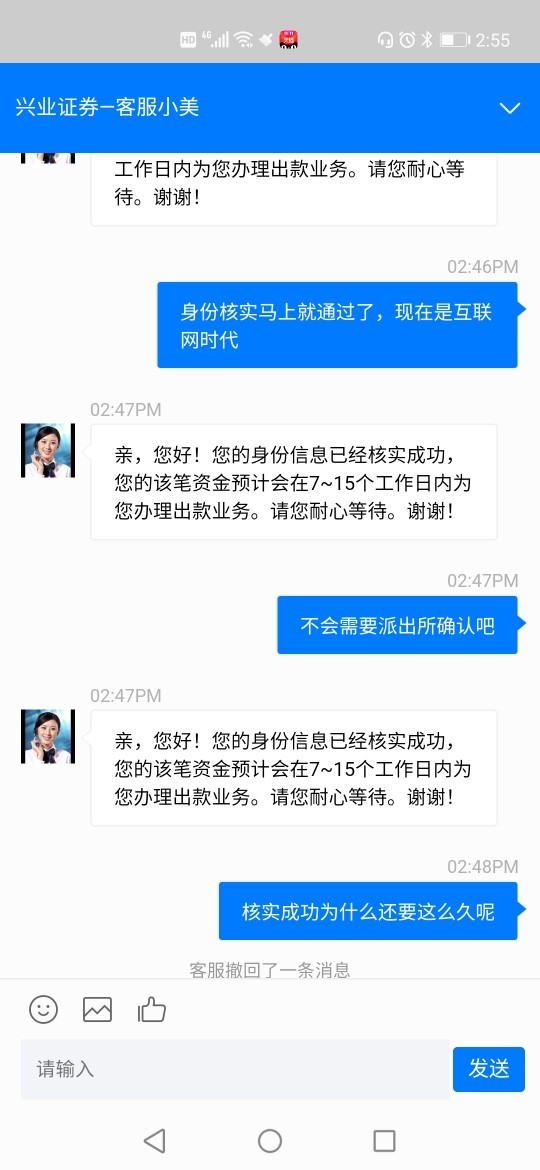

- “I attempted to withdraw funds and faced barriers for weeks. My account was frozen and I was charged $30 to get it back.” – a user from WikiBit.

This feedback reflects significant concerns over fund accessibility and illuminates the broader reputational issues standing against Industrial Futures.

Trading Costs Analysis

Advantages in Commissions

Industrial Futures boasts a competitive fee structure with low trading commissions, often starting as low as $0.25 per contract, which is appealing for active traders.

The "Traps" of Non-Trading Fees

Despite its low trading fees, users commonly face hidden costs, especially withdrawal fees. Reports state that withdrawing funds can incur fees as high as $30, leading to negative perceptions among users.

- “They charge me for every withdrawal and $30 just to process paperwork!” – an unhappy customer from WikiBit.

Cost Structure Summary

While the low trading costs can be advantageous for high-frequency traders, the associated withdrawal fees may turn potentially lucrative trades into a costly experience, especially for less seasoned investors who may overlook these details when choosing a broker.

Industrial Futures offers a traditional trading platform lacking advanced features. While it supports both web and mobile versions, user reviews indicate that a mismatch exists between professional needs and what the platform delivers.

Tools for market analysis and order execution are underwhelming by industry standards. Users often cite a lack of comprehensive analytical tools, which can inhibit performance against competitors that provide robust educational resources and market insights.

User feedback highlights a common sentiment: trading is cumbersome due to platform limitations.

“Navigating the platform feels tedious and confusing—most tools seem outdated.” – a regular user review.

User Experience Analysis

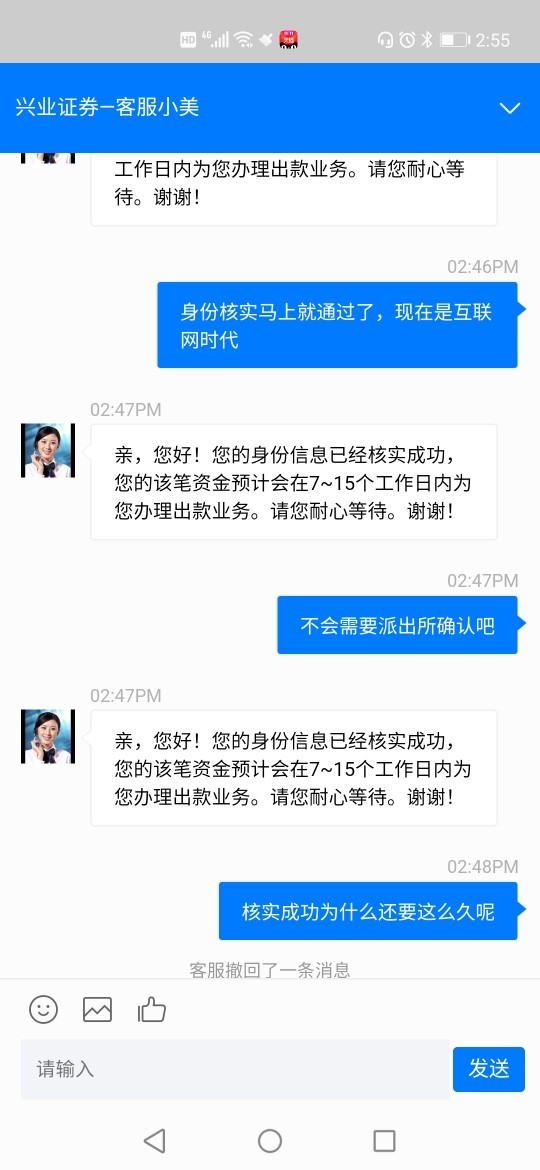

- Feedback Analysis: Reports hint at an inefficient customer support experience that is critical during withdrawal attempts.

- User Interface Concerns: Many users have expressed frustration regarding the trading interface, noting that it lacks intuitiveness.

Customer Support Analysis

Customer support has drawn criticism for slow response times, especially during withdrawal requests. Users have noted that repeat inquiries often yield lengthy wait periods for resolution.

- “I had a situation that needed urgent attention, but it took days to get any sort of feedback.” – feedback from WikiBit.

Account Conditions Analysis

Industrial Futures mandates a high withdrawal fee and does not offer flexibility in account types. This rigidity can deter potential traders who prefer accessible terms.

- “The fees for moving my money out make me question if it's worth continuing here.” – an account holder.

Conclusion

While Industrial Futures presents a tantalizing option for experienced traders through its low-cost trading model and multifaceted product offerings, prospective investors must approach with caution. The withdrawal challenges and mixed user feedback underscore significant risks that could jeopardize fund safety and overall investment experience. Consequently, this broker may be best suited for seasoned traders who are fully aware of the complexities of futures trading, whereas newcomers and risk-averse individuals should consider more stable alternatives.