Is AICHI safe?

Pros

Cons

Is Aichi Safe or Scam?

Introduction

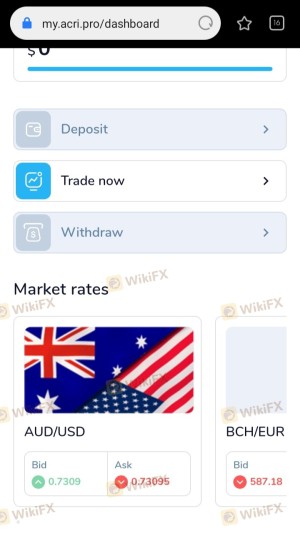

Aichi is a forex broker that has gained attention in the trading community for its various offerings and trading conditions. As the forex market continues to expand, traders are increasingly cautious about selecting brokers, given the prevalence of scams and fraudulent activities. It is crucial for traders to thoroughly evaluate brokers like Aichi to ensure they are making informed decisions about where to invest their money. This article aims to provide a comprehensive analysis of Aichi's legitimacy and safety by examining its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

One of the most critical factors in determining whether Aichi is a safe broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect investors. Aichi currently operates without any significant regulatory oversight, which raises questions about its legitimacy. The absence of regulation can often be a red flag for potential traders.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of a regulatory framework means Aichi is not subject to routine audits or compliance checks, which could leave traders vulnerable to unethical practices. Furthermore, brokers without regulation may not provide investor protection schemes, leaving clients exposed in case of financial mismanagement. Historically, unregulated brokers have been associated with issues such as fund misappropriation and lack of transparency. Therefore, the absence of regulatory oversight is a significant concern when evaluating whether Aichi is safe.

Company Background Investigation

Aichi's company history and ownership structure are also essential components of its credibility. Established relatively recently, Aichi has not built a long-standing reputation in the forex market. The management team behind Aichi lacks extensive experience in the financial sector, which can be a critical factor in a broker's operational integrity.

Information about Aichi's ownership is sparse, which raises concerns about transparency. A reliable broker typically provides detailed information about its founders and management team, allowing potential clients to assess their expertise and track record. The lack of such information could indicate a lack of accountability and transparency, further questioning whether Aichi is safe for trading.

Trading Conditions Analysis

When evaluating Aichi's trading conditions, it is essential to consider the overall fee structure and any unusual charges that may apply to traders. A comprehensive understanding of the costs involved in trading can help traders make informed decisions and avoid unexpected expenses.

| Fee Type | Aichi | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Variable | 1.0 - 2.0 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | High | Low |

Aichi's fee structure is characterized by variable spreads, which can be higher than industry standards. This variability can lead to increased trading costs, particularly during volatile market conditions. Additionally, the absence of a clear commission model raises concerns about hidden fees. Traders should remain vigilant regarding these costs, as they can significantly impact profitability.

Client Fund Security

The security of client funds is paramount when assessing whether Aichi is safe. A reputable broker should implement robust measures to protect client deposits, including segregated accounts and investor compensation schemes. However, Aichi's lack of regulation raises concerns about the safety of client funds.

Aichi does not appear to offer any investor protection measures, which could leave clients vulnerable in case of financial issues. The absence of negative balance protection is another significant risk, as it means traders could lose more than their initial investment. Historical issues regarding fund security have been reported with unregulated brokers, making it crucial for potential clients to consider these factors seriously.

Customer Experience and Complaints

Analyzing customer feedback is vital in evaluating Aichi's reputation. Many users have reported mixed experiences, with some expressing satisfaction with the trading platform while others have raised concerns about withdrawal difficulties and lack of customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Platform Stability | Low | Acceptable |

Common complaints include difficulties in withdrawing funds, which is a significant red flag for any broker. Additionally, the slow response rate from customer support has been a recurring theme, indicating potential operational inefficiencies. Such issues can severely affect traders' experiences and raise concerns about Aichi's overall safety.

Platform and Trade Execution

The performance and reliability of Aichi's trading platform are crucial for traders. A well-functioning platform should provide seamless execution, low slippage, and minimal rejections of orders. However, user reviews suggest that Aichi's platform may not consistently meet these standards.

Traders have reported instances of slippage and order rejections, which can adversely affect trading outcomes. Moreover, any signs of platform manipulation can indicate deeper issues within the broker's operational integrity. The quality of trade execution is a vital factor in determining whether Aichi is safe for trading.

Risk Assessment

In evaluating the risks associated with Aichi, it is essential to consider various factors that could impact traders' experiences and investments.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of investor protection |

| Operational Risk | Medium | Complaints about support and withdrawals |

| Market Risk | Medium | Variable spreads and high overnight interest |

Given the high-risk levels associated with Aichi, potential traders should approach with caution. It is advisable to consider alternative brokers that offer better regulatory oversight and client protection.

Conclusion and Recommendations

In conclusion, after a thorough investigation, it appears that Aichi poses several risks that warrant caution. The absence of regulation, coupled with a lack of transparency and common customer complaints, raises significant concerns about its safety. Traders should be particularly wary of withdrawal issues and the potential for hidden fees.

For those looking for reliable alternatives, it is advisable to consider brokers that are regulated by reputable authorities such as the FCA or ASIC, which ensure better protection for client funds and more transparent trading conditions. Overall, while Aichi may provide certain trading opportunities, the potential risks associated with this broker suggest that it may not be the safest option available in the forex market.

Is AICHI a scam, or is it legit?

The latest exposure and evaluation content of AICHI brokers.

AICHI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AICHI latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.