Regarding the legitimacy of INDUSTRIAL FUTURES forex brokers, it provides CFFEX and WikiBit, .

Is INDUSTRIAL FUTURES safe?

Pros

Cons

Is INDUSTRIAL FUTURES markets regulated?

The regulatory license is the strongest proof.

CFFEX Derivatives Trading License (AGN)

China Financial Futures Exchange

China Financial Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

兴业期货有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Industrial Futures Safe or Scam?

Introduction

Industrial Futures is a brokerage firm that positions itself within the forex and futures trading markets, catering to a diverse clientele seeking to engage in speculative trading and hedging strategies. With the rise of online trading platforms, the importance of evaluating the safety and reliability of forex brokers like Industrial Futures has become paramount. Traders need to ensure that their funds are secure and that they are dealing with a reputable entity, as the financial landscape is fraught with potential scams and unreliable platforms. This article aims to provide a comprehensive analysis of Industrial Futures, examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile to determine whether it is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a broker is crucial in assessing its legitimacy. Industrial Futures is regulated by the China Financial Futures Exchange (CFFEX), which provides a level of oversight intended to protect investors and maintain market integrity. Below is a summary of the key regulatory information regarding Industrial Futures:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | 0306 | China | Verified |

The regulation by CFFEX signifies that Industrial Futures operates under a recognized regulatory framework, which is essential for ensuring compliance with industry standards. However, the quality of regulation can vary significantly across jurisdictions. In this case, while CFFEX offers oversight, there have been concerns about the effectiveness of regulatory enforcement within China, particularly regarding investor protection and the transparency of broker operations. Historical compliance issues in the region could raise red flags for potential investors. Therefore, while Industrial Futures is technically regulated, traders should approach with caution and conduct further due diligence.

Company Background Investigation

Industrial Futures, known in Chinese as 兴业期货有限公司, has a history that spans several years in the financial services sector. The company has evolved to offer a range of trading services, including futures and forex trading. The ownership structure appears to be centralized, with key management personnel holding significant stakes in the company.

The management team comprises seasoned professionals with backgrounds in finance, trading, and risk management, contributing to the firms operational integrity. However, transparency regarding the company's ownership and the specific identities of its key executives is somewhat limited, which can be a concern for potential clients.

Moreover, the level of information disclosure regarding the company's operations and financial health is crucial for establishing trust. While Industrial Futures does provide some educational resources and market analysis tools, the overall transparency of its operations and performance metrics remains less than ideal. This lack of clear communication can lead to uncertainty about the firm's reliability, further emphasizing the need for potential investors to exercise caution.

Trading Conditions Analysis

When evaluating whether Industrial Futures is safe, it is essential to analyze its trading conditions, particularly its fee structure and trading costs. The overall fee structure of Industrial Futures is competitive, but it is crucial to identify any hidden fees or unusual policies that could impact traders negatively. Below is a comparison of key trading costs:

| Fee Type | Industrial Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 2% - 5% | 1% - 3% |

The spread on major currency pairs at Industrial Futures is slightly higher than the industry average, which could affect profitability, especially for high-frequency traders. Additionally, the commission model is variable, which may lead to unexpected costs depending on trading volume and market conditions. The overnight interest rates also appear to be higher than average, potentially impacting long-term positions.

These factors warrant careful consideration, as they could erode trading profits. Traders should ensure they fully understand the fee structure before committing capital to avoid any unpleasant surprises.

Client Fund Security

The safety of client funds is a critical aspect when assessing whether Industrial Futures is safe. The firm reportedly implements several measures to protect client funds, including segregated accounts, which are essential for ensuring that client deposits are kept separate from the company's operational funds. This practice helps to safeguard investors' capital in the event of financial difficulties faced by the broker.

Additionally, Industrial Futures claims to offer negative balance protection, which is vital for preventing clients from losing more than their deposited amount. However, the effectiveness of these measures is contingent upon the broker's adherence to regulatory requirements and its operational integrity.

Historically, there have been instances where brokers have faced scrutiny regarding their fund security practices. While there are no significant reports of fund security issues associated with Industrial Futures, potential clients should remain vigilant and conduct thorough research to ensure their funds are adequately protected.

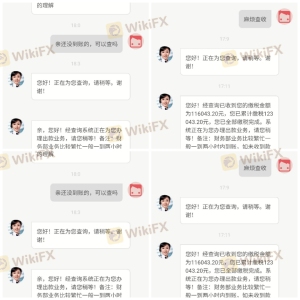

Customer Experience and Complaints

Customer feedback is an invaluable resource for gauging the reliability of a broker. An analysis of reviews and testimonials regarding Industrial Futures reveals a mixed bag of experiences. Many users have reported positive experiences, particularly regarding the availability of educational resources and user-friendly trading platforms. However, there are notable complaints, particularly concerning withdrawal processes and customer service responsiveness.

The following table summarizes the primary types of complaints received about Industrial Futures:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Availability | Medium | Average |

| Fee Transparency | Medium | Inconsistent |

A particularly concerning complaint involved a user being unable to withdraw funds, leading to frustration and dissatisfaction with the company's customer service. Such issues highlight the importance of having responsive support systems in place, as they can significantly impact client trust and satisfaction. While Industrial Futures has received positive feedback for its trading platform, the recurring complaints about withdrawals and customer service suggest that potential clients should be cautious and prepared for possible challenges.

Platform and Execution

The performance and reliability of the trading platform are critical factors in determining whether Industrial Futures is safe. The platform is generally regarded as stable and user-friendly, providing traders with access to various market instruments. However, the quality of order execution, including slippage and rejection rates, is crucial for effective trading.

Reports indicate that while the platform performs well under normal conditions, some users have experienced issues with slippage during volatile market periods. Additionally, there are no significant indications of platform manipulation, which is a positive sign for traders concerned about fairness and transparency in execution.

Overall, while the platform offers a satisfactory trading experience, users should remain vigilant during high-volatility events and be prepared for potential execution challenges.

Risk Assessment

Using Industrial Futures carries a range of risks that traders should be aware of. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Potential compliance issues with local regulations. |

| Financial Risk | High | High leverage can lead to significant losses. |

| Operational Risk | Medium | Concerns about withdrawal processes and customer service. |

| Market Risk | High | Volatility in forex markets can lead to rapid losses. |

Traders should implement robust risk management strategies when trading with Industrial Futures. This includes setting stop-loss orders, diversifying trading positions, and maintaining a clear understanding of market conditions.

Conclusion and Recommendations

In conclusion, while Industrial Futures operates under regulatory oversight and offers a range of trading services, several aspects warrant caution. The mixed customer feedback, particularly concerning withdrawal issues and customer service responsiveness, raises concerns about the overall reliability of the broker.

While there are no overt signs of fraud, potential clients should be aware of the risks associated with trading with Industrial Futures. For traders who prioritize strong customer support and a transparent fee structure, it may be advisable to explore alternative brokers with a more established reputation for reliability and customer service.

If you are considering trading with Industrial Futures, ensure you conduct thorough research and consider starting with a demo account to familiarize yourself with the platform before committing significant capital. Additionally, brokers such as Interactive Brokers or Charles Schwab may offer more robust customer service and trading conditions, making them worthy alternatives for potential forex traders.

Is INDUSTRIAL FUTURES a scam, or is it legit?

The latest exposure and evaluation content of INDUSTRIAL FUTURES brokers.

INDUSTRIAL FUTURES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INDUSTRIAL FUTURES latest industry rating score is 7.80, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.80 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.