fullerton 2025 Review: Everything You Need To Know

1. Summary

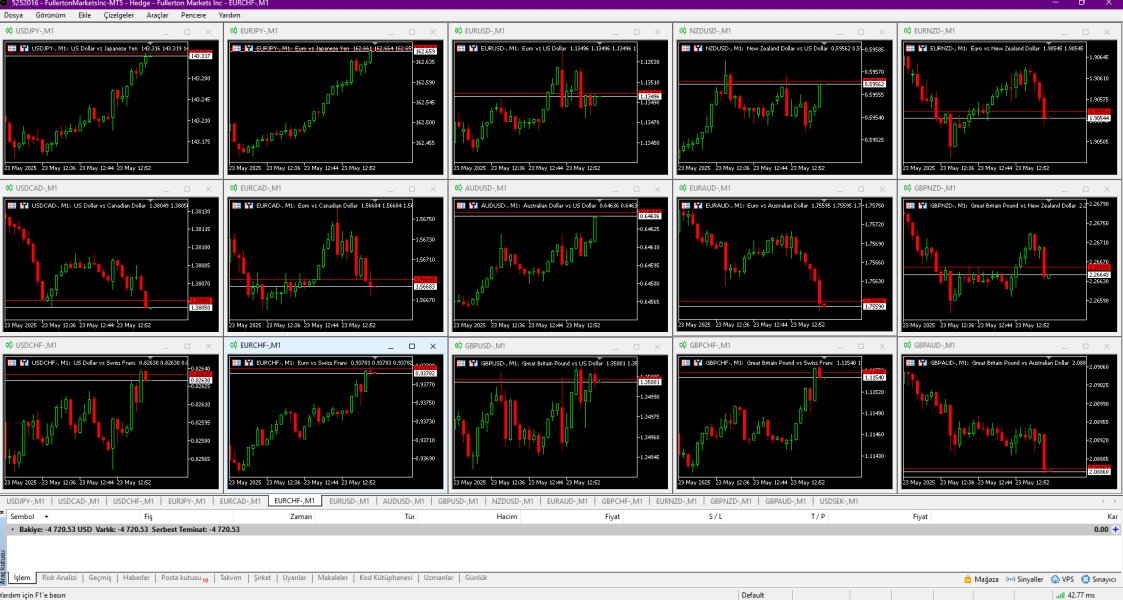

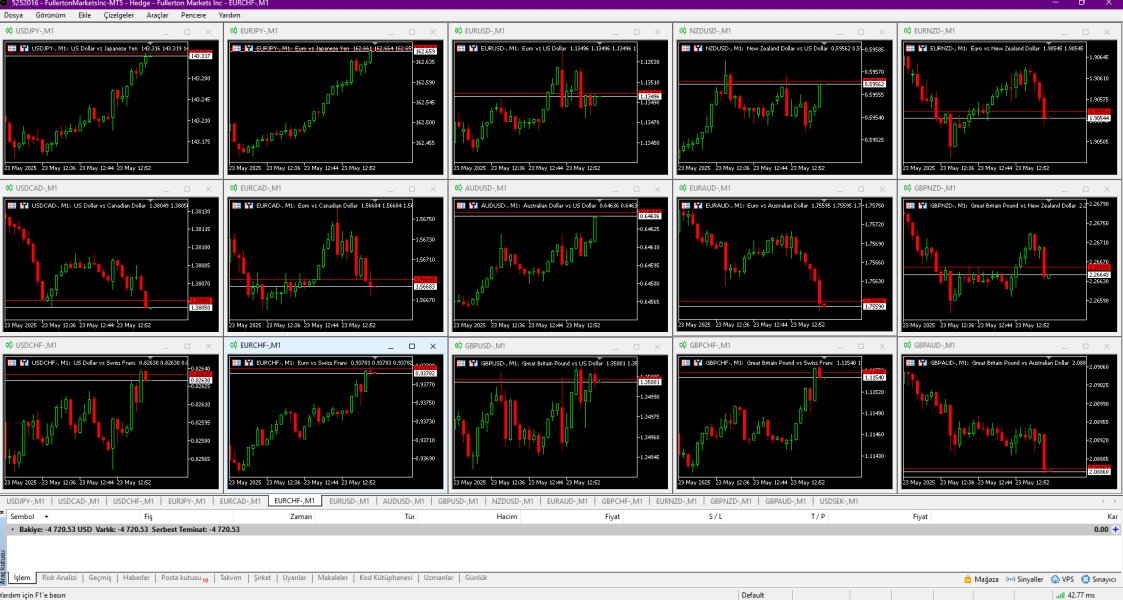

This fullerton review shows that Fullerton Markets is a regulated forex broker that offers different trading services to clients around the world. The broker works under New Zealand's rules and focuses on fast trade execution with 24/5 customer support. Fullerton Markets helps investors who want to trade forex and other assets like CFDs. The available information doesn't give full details about account conditions and trading tools, but the broker highlights fast execution and professional support as its main strengths. The broker also follows strict rules to keep traders safe. While some important details like account setup and advanced tools are missing, Fullerton Markets still attracts many investors by offering a strong, rule-following trading environment.

2. Notice

Differences may happen because of different rules in different places. Investors might see different trading conditions and fund protection based on where they live. This review uses key information along with user feedback and market performance data. The assessment relies on available rule details, company background, and promised service features. Specific information like detailed account types, deposit plans, and available trading platforms is either barely provided or completely missing. Readers must remember that while the review shows the known strengths of Fullerton Markets, some details about how it works remain unclear. The method here involves comparing reported features against industry standards and similar companies in the forex area.

3. Rating Framework

4. Broker Overview

Fullerton Markets is a global forex broker based in New Zealand that offers many trading services to different types of clients. The available information doesn't tell us when the company started, but the broker has built a reputation by focusing on following rules and fast trade execution. Fullerton Markets makes sure traders can get professional customer support 24 hours a day, five days a week. This service model makes the broker a good choice for investors who want quick responses and good communication. The company's main goal is to follow all the required rules, which makes the trading environment better in a very competitive market.

Fullerton Markets also works as a multi-asset broker, letting traders do forex and CFD transactions along with other asset classes. The broker works under New Zealand's Financial Markets Conduct Act, which is a set of rules designed to maintain strong financial practices and protect assets. While specific details about trading platforms and technology interfaces are not given, Fullerton Markets clearly commits to providing a secure and efficient trading experience. This fullerton review shows a broker that, despite some missing information about account details and advanced trading tools, continues to build its market reputation through following rules and providing dedicated support services.

-

Regulatory Regions :

Fullerton Markets is regulated under New Zealand's Financial Markets Conduct Act. This means the broker's operations follow strict financial rules designed to protect client interests. This regulatory status makes the broker more credible and provides security measures that traders can expect, though additional specific regulatory details are not provided in the available sources.

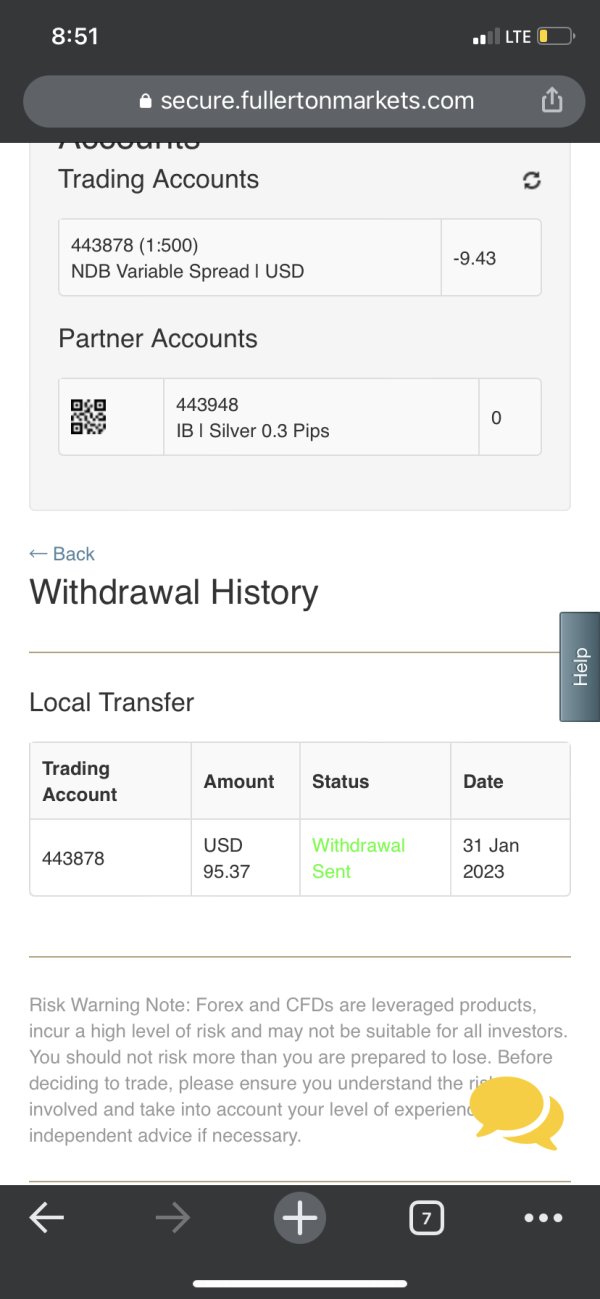

Deposit and Withdrawal Methods :

The available information does not detail the deposit and withdrawal methods offered by Fullerton Markets. Traders should check the broker's official resources for complete information about how funds are processed.

Minimum Deposit Requirement :

Specific minimum deposit requirements are not mentioned in the available materials. This important information has not been detailed, so potential traders need to ask the broker directly for clarification.

Bonuses and Promotions :

No clear details about bonuses or promotional offers are provided in the current information. Investors looking for bonus programs or special trading promotions may need to look at additional sources for updated details.

Tradable Assets :

Fullerton Markets supports multiple asset classes, mainly forex and CFDs. This multi-asset approach gives traders a chance to build diverse portfolios. However, more information on additional tradable instruments or specific market segments is not clearly detailed in the provided information.

Cost Structure :

Details about the cost structure, including spreads and commission fees, are not clearly mentioned in the available information. While the broker promotes fast execution, the lack of clear and detailed cost-related data makes it hard for traders to fully judge how competitive Fullerton Markets' fees are compared to other forex brokers. This lack of specific information represents a potential area that needs future clarification and improvement.

Leverage Ratios :

Information about the allowed leverage ratios is not shared in the materials provided. Future traders should ask the broker directly to understand the leverage options and related risk management strategies.

Platform Options :

Specific details on available trading platforms and technology solutions remain unspecified. Although fast execution is noted, complete information on the variety and functionality of trading platforms is lacking, which could be important for traders used to detailed technology insights.

Regional Restrictions :

No clear information on regional trading restrictions is provided in the available materials. This gap means that potential regional barriers may apply, and interested traders should check details with the broker.

Customer Service Languages :

The information does not specify the languages in which customer support is offered, aside from the promise of 24/5 service. Additional details would need to come directly from Fullerton Markets.

6. Detailed Score Analysis

6.1 Account Conditions Analysis

This section looks at the account conditions for Fullerton Markets, which remain one of the less detailed parts in the available information. The broker has not given specific insights into the range of account types available. There is also no detailed discussion about the minimum deposit requirements or the step-by-step process involved when opening an account. Information on any special account options—such as those for Islamic finance requirements or other specific markets—is not outlined. The lack of solid data creates a problem as investors might find it hard to judge whether the account conditions match their individual trading needs. In terms of user feedback, there is no direct reference to satisfaction about account setup or related features. Compared to other brokers, where a complete set of account options is often advertised, the lack of detailed information calls for a moderate score in this category. While Fullerton Markets' regulatory standing suggests a baseline of operational integrity, the minimal detail available about account conditions shows a need for more transparency.

The evaluation of Fullerton Markets' tools and resources shows that there is minimal detail available about the suite of trading tools provided to clients. Specific information on research platforms, technical analysis tools, or even educational materials is not provided in the summary. The lack of detailed descriptions of any proprietary software or third-party integrations means that traders are left without clear guidance on the resource quality. While the broker emphasizes fast trade execution, there is no information about automated trading support or algorithmic trading capabilities. The lack of transparency on these fronts suggests an area that could benefit from additional disclosure. Expert opinions and trader feedback about the utility and strength of available tools are also missing. As a result, while Fullerton Markets may offer basic functionalities, the limited details on resources and educational support result in a moderate rating in this category.

6.3 Customer Service and Support Analysis

Fullerton Markets stands out by offering 24/5 customer support, which includes several communication channels including telephone, email, and online chat. This complete support network is designed to make sure that traders can solve issues quickly during active trading periods. Although specifics about response times, the extent of support beyond business hours, or the availability of multilingual support are not provided, the existence of a continuous support system is a positive sign. The commitment to a 24/5 service model shows an effort to meet client needs and offers reassurance in a rapidly changing trading environment. While the provision of various customer support channels is good, the absence of detailed user feedback or expert evaluations about service quality leaves some questions unanswered. In this context, the broker appears reliable in its customer service delivery, yet there remains room for improving the transparency about support effectiveness.

6.4 Trading Experience Analysis

The trading experience with Fullerton Markets is highlighted mainly by the commitment to fast trade execution. Although the information emphasizes the promise of rapid order processing, there is a lack of detail about the stability, liquidity, and functionality of the trading platform itself. There is no specific mention of how the broker manages order slippage, execution speed during volatile market conditions, or the availability of mobile trading options, all of which are key parts of a positive trading environment. While traders might benefit from the stated speed in execution, the absence of solid platform performance data leaves a gap in fully judging the trading environment. User reviews and expert feedback about platform reliability and the execution quality remain unaddressed. The focused emphasis on fast trades does show an intention to deliver an effective experience; however, additional insights into platform versatility and consistency would be helpful for a more complete evaluation.

6.5 Trust Analysis

Trust is a critical dimension in evaluating any forex broker. Fullerton Markets benefits from its regulatory status under New Zealand's Financial Markets Conduct Act. This regulatory oversight provides a foundation for compliance and basic safeguards for client funds. Despite this regulatory reassurance, the available information does not detail specific measures about fund segregation, audit processes, or capital adequacy. The transparency of the company's operations, particularly about any historical issues or negative events, is not addressed in the provided summary. Such gaps in information leave room for uncertainty among potential users seeking in-depth verification of the broker's trustworthiness. The fact that Fullerton Markets maintains its status as a regulated entity is an important positive marker. Investor feedback related to trust, though minimal, points towards a general acceptance of the broker's commitment to compliance. Further detailed disclosures would be helpful for strengthening the trust factor among future traders.

6.6 User Experience Analysis

User experience for Fullerton Markets, based on available data, appears to be a mixed situation. While the broker promises a streamlined and efficient trading operation through fast execution and continuous support, detailed insights into the actual interface design, ease of navigation, and registration processes are notably absent. There is little information on whether the trading platform is intuitive or if the account verification process is particularly difficult. Feedback showing user satisfaction or common complaints about the online experience is lacking. Although the broker is noted to receive relatively positive mentions about its compliance and customer support, the overall user experience remains only moderately assured due to the minimal detail about interface usability and operational clarity. For traders, this might mean that while the basics are in place, there is an opportunity for improvement in making the platform more user-friendly and transparent about process flows.

7. Conclusion

In conclusion, Fullerton Markets emerges in this fullerton review as a regulated forex broker offering a dependable trading platform with strong customer support and fast execution speeds. The broker is best suited for investors interested in forex and multi-asset trading who value a compliant operational environment. Despite its regulatory credentials and robust support framework, the review identifies several areas requiring further transparency, including detailed account conditions, trading resources, and cost structures. Investors are encouraged to conduct further research for additional specifics before committing. While regulatory compliance is confirmed, several operational details remain unspecified.