FDC Review 1

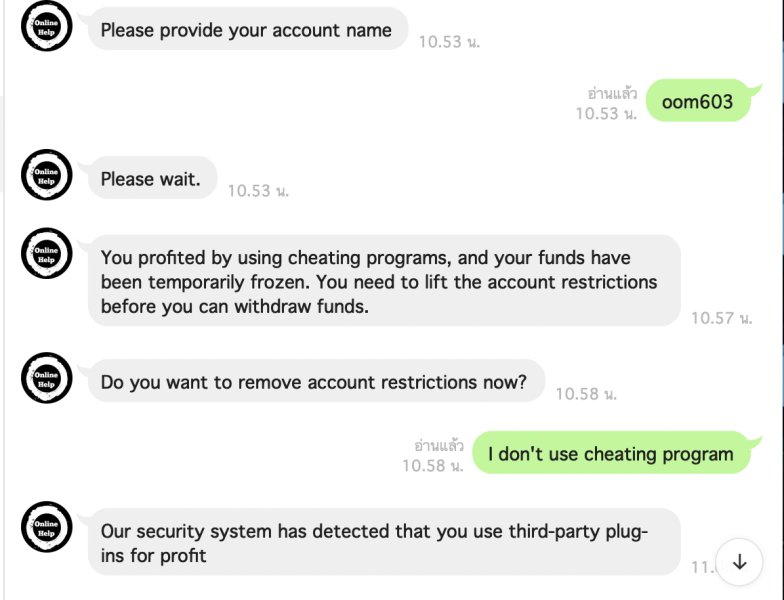

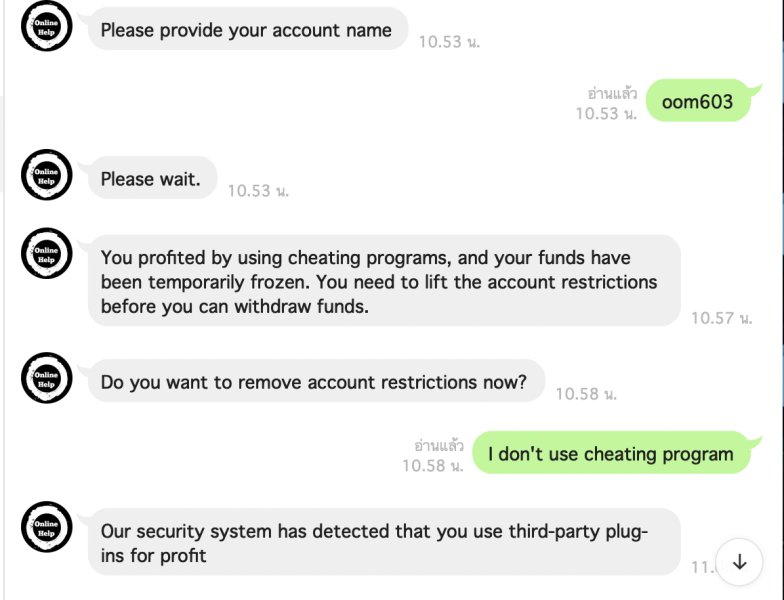

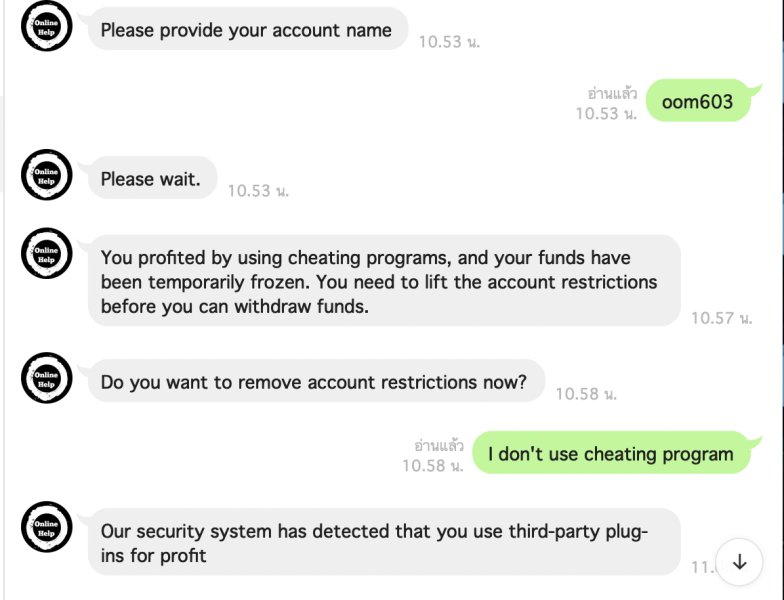

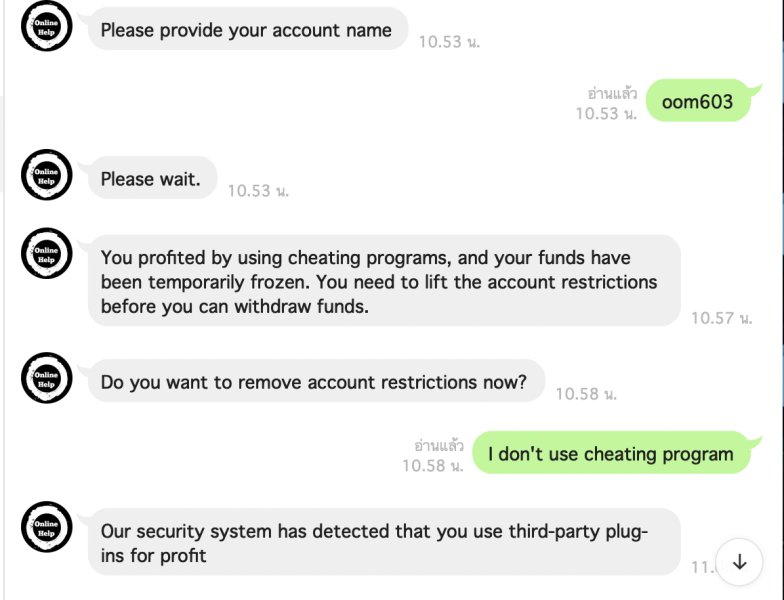

I have to pay 10% to unfreeze my money

FDC Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I have to pay 10% to unfreeze my money

FDC presents a complex picture in the forex brokerage landscape. The company operates as Foster Dykema Cabot & Partners, LLC and positions itself as an investment advisory firm specializing in forex trading technology solutions. However, our comprehensive fdc review reveals significant transparency concerns that potential traders should carefully consider.

The broker's regulatory status remains unclear. Available information suggests FDA oversight, though specific licensing details are not readily accessible. This lack of regulatory transparency, combined with limited information about trading conditions and absent customer feedback, results in a neutral overall assessment for FDC as a forex service provider.

FDC's primary strength lies in its background as a technology solutions provider for forex trading. This may appeal to investors seeking sophisticated technical infrastructure. The company targets clients looking for advanced trading technology rather than traditional retail forex services. However, the absence of detailed trading conditions, fee structures, and customer testimonials raises questions about its suitability for mainstream forex trading activities.

For potential clients, FDC appears most appropriate for institutional investors or sophisticated traders seeking specialized forex technology solutions rather than standard retail trading services. The limited public information available makes it challenging to recommend FDC for typical retail forex trading needs.

This evaluation of FDC is based on publicly available information and should be considered within the context of varying regulatory frameworks across different jurisdictions. The regulatory oversight mentioned may differ significantly depending on the geographical location and specific legal requirements of individual countries or regions.

Our assessment methodology combines analysis of available public information, regulatory data where accessible, and industry standards comparison. Due to limited publicly available customer feedback and detailed service information, this review relies primarily on corporate disclosures and regulatory filings. Potential clients should conduct independent due diligence and verify current regulatory status before engaging with any financial services provider.

| Criterion | Score | Rating |

|---|---|---|

| Account Conditions | 5/10 | Average |

| Tools and Resources | 4/10 | Below Average |

| Customer Service and Support | 5/10 | Average |

| Trading Experience | 5/10 | Average |

| Trust and Security | 6/10 | Above Average |

| User Experience | 5/10 | Average |

Overall Rating: 5.0/10

FDC operates as Foster Dykema Cabot & Partners, LLC. It functions primarily as an investment advisory company with a focus on forex trading technology solutions. The company's establishment date and detailed corporate history are not clearly documented in available public records, which reflects the broader transparency challenges surrounding this organization.

The firm's business model centers on providing technological infrastructure and advisory services for forex trading operations rather than traditional retail brokerage services. This positioning suggests FDC targets institutional clients and sophisticated investors who require specialized trading technology solutions rather than standard retail forex trading platforms. The company's approach differs significantly from conventional forex brokers who typically focus on providing direct trading access to individual retail customers.

FDC's regulatory framework involves oversight by the FDA. This regulatory designation appears unusual for a financial services provider and may indicate either a specialized service category or potential confusion in available documentation. The specific licensing numbers and detailed regulatory compliance information are not readily available in public records, which contributes to the overall transparency concerns surrounding the organization.

The broker's asset coverage, trading platform specifications, and available financial instruments remain undisclosed in accessible documentation. This lack of detailed service information makes it challenging for potential clients to evaluate FDC's suitability for their specific trading requirements and investment objectives.

FDC operates under FDA regulatory oversight. The specific nature of this regulation and relevant license numbers are not detailed in available public information. This regulatory designation raises questions about the scope and nature of services provided, as FDA oversight is uncommon for traditional forex brokers.

Information regarding minimum deposit requirements, available funding methods, and account opening procedures is not specified in accessible documentation. The absence of clear deposit and withdrawal information makes it difficult for potential clients to understand the financial requirements for engaging with FDC's services.

The fee structure, including spreads, commissions, and any additional charges, is not disclosed in available materials. This fdc review finds the lack of transparent pricing information concerning for potential clients seeking to evaluate the cost-effectiveness of FDC's services compared to alternative providers.

Specific information about tradeable assets, currency pairs, and market access is not provided in accessible documentation. The range of available financial instruments and markets remains unclear, limiting the ability to assess FDC's suitability for diverse trading strategies.

Details about the trading platform, technological infrastructure, and available trading tools are not specified in public information. Given FDC's positioning as a technology solutions provider, the absence of detailed platform specifications is particularly notable.

Leverage ratios, margin requirements, and risk management tools are not detailed in available documentation. This information gap makes it challenging for traders to understand the risk parameters and trading conditions offered by FDC.

The assessment of FDC's account conditions proves challenging due to limited available information. Without clear documentation of account types, minimum deposit requirements, or specific terms and conditions, potential clients face significant uncertainty when considering FDC's services. The absence of detailed account specifications suggests either a highly specialized service model targeting institutional clients or insufficient transparency in customer communication.

Industry standards typically require clear disclosure of account conditions. This includes various account types, funding requirements, and associated benefits or restrictions. FDC's lack of readily available account information falls short of these transparency expectations. This fdc review notes that the absence of standard retail account options may indicate the firm's focus on institutional or specialized advisory services rather than traditional forex brokerage.

The limited information available makes it impossible to evaluate the competitiveness of account conditions against industry benchmarks. Potential clients seeking standard forex trading accounts may find FDC's offering unclear or unsuitable for their needs, contributing to the average rating in this category.

FDC's positioning as a forex trading technology solutions provider suggests potential strength in trading tools and resources. However, the lack of detailed information about available tools, research capabilities, educational resources, and analytical support significantly impacts the evaluation. Without specific documentation of trading tools, technical analysis capabilities, or market research provision, it's impossible to assess the quality and comprehensiveness of FDC's resource offering.

The absence of information about educational materials, market analysis, or trading support tools raises concerns about the firm's commitment to client development and ongoing support. Industry-leading brokers typically provide extensive educational resources, real-time market analysis, and sophisticated trading tools to support client success.

The below-average rating reflects the significant information gap regarding tools and resources. This may indicate either a specialized service model that doesn't emphasize these features or insufficient public disclosure of available capabilities.

Customer service evaluation for FDC is hampered by the absence of specific information about support channels, availability hours, response times, and service quality metrics. Without documented customer feedback, support structure details, or service level commitments, it's challenging to assess the effectiveness of FDC's customer support operations.

The lack of visible customer testimonials, complaint resolution procedures, or support contact information suggests either a highly specialized client base that doesn't require traditional customer service channels or insufficient transparency in service provision. Standard industry practice includes multiple support channels, clearly defined response timeframes, and accessible customer service information.

The average rating reflects the uncertainty surrounding customer support capabilities rather than any specific deficiencies. However, the lack of transparency itself represents a potential concern for prospective clients requiring reliable support services.

Evaluating FDC's trading experience requires information about platform stability, execution quality, order processing speed, and overall trading environment. The absence of detailed platform specifications, performance metrics, or user experience documentation makes it impossible to assess the quality of the trading experience provided by FDC.

Without information about platform features, mobile trading capabilities, order execution statistics, or trading environment characteristics, potential clients cannot make informed decisions about platform suitability. The lack of user feedback or performance data further complicates the assessment of trading experience quality.

This fdc review assigns an average rating due to the information void rather than documented deficiencies. However, the lack of transparency itself may impact user confidence in the trading experience quality.

FDC's trust and security assessment benefits from its regulatory oversight. The unusual FDA regulatory designation raises questions about the specific nature of oversight and compliance requirements. The company's operation as an investment advisory firm provides some foundation for trust, though the lack of detailed regulatory information and specific license numbers limits the confidence level.

The absence of information about client fund segregation, security measures, insurance coverage, or financial stability indicators prevents a comprehensive trust assessment. Industry best practices include clear disclosure of regulatory compliance, fund protection measures, and security protocols to ensure client confidence.

The above-average rating reflects the existence of some regulatory oversight and the firm's advisory company status. However, significant transparency improvements would be necessary to achieve higher trust ratings. The regulatory framework, while present, lacks the clarity and detail typically expected from established forex brokers.

User experience evaluation for FDC is severely limited by the absence of customer feedback, usability information, and detailed service descriptions. Without user testimonials, satisfaction surveys, or documented user journeys, it's impossible to assess the actual experience of working with FDC.

The lack of information about account opening procedures, platform usability, customer onboarding processes, and ongoing service delivery suggests either a highly specialized user base or insufficient attention to user experience documentation. Standard industry practice includes user-friendly interfaces, streamlined processes, and positive user feedback collection and publication.

The average rating reflects the uncertainty about user experience quality rather than documented problems. However, the information gap itself may indicate potential user experience challenges for those seeking transparent, well-documented services.

This comprehensive fdc review reveals a complex service provider that operates outside the typical retail forex broker model. FDC's positioning as Foster Dykema Cabot & Partners, LLC, focusing on investment advisory services and forex trading technology solutions, may serve specific institutional or sophisticated investor needs. However, the significant lack of transparency regarding trading conditions, regulatory details, and customer feedback presents considerable challenges for evaluation.

FDC appears most suitable for institutional investors or sophisticated traders specifically seeking specialized forex technology solutions rather than traditional retail trading services. The company's background as a technology solutions provider represents its primary strength, though this advantage is diminished by the lack of detailed service information and customer testimonials.

The main limitations include insufficient transparency regarding trading conditions, unclear regulatory framework details, absence of customer feedback, and limited publicly available service specifications. These factors combine to create uncertainty about FDC's suitability for mainstream forex trading needs and suggest the service may be better suited for specialized applications rather than general retail forex trading requirements.

FX Broker Capital Trading Markets Review