Is FDC safe?

Pros

Cons

Is FDC Safe or Scam?

Introduction

FDC, or Forex Development Corporation, positions itself as a provider of technology solutions for forex trading, catering to both retail and institutional clients. In the rapidly evolving world of foreign exchange trading, the choice of a broker is crucial for traders aiming to maximize their investment potential. However, the presence of numerous unregulated and potentially fraudulent brokers necessitates a cautious approach. Traders must thoroughly evaluate brokers to ensure their safety and legitimacy. This article aims to assess whether FDC is a safe trading option or a potential scam by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy and safety. Regulation serves as a safeguard for traders, providing oversight and ensuring compliance with industry standards. In the case of FDC, it operates without any valid regulatory licenses, which raises significant concerns.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that FDC is not obligated to adhere to the strict standards imposed by recognized financial authorities. This lack of oversight can expose traders to various risks, including the potential for fraud. Furthermore, reports indicate that FDC has a history of complaints related to fund withdrawals and other operational issues, further questioning its legitimacy. The quality of regulation is paramount; without it, traders may find themselves vulnerable to unscrupulous practices.

Company Background Investigation

FDC was established in 2016, focusing on providing technology solutions for forex trading. However, the company lacks transparency regarding its ownership structure and operational history. The management team has limited public profiles, making it difficult to assess their professional backgrounds and expertise.

The absence of detailed information on the company's leadership raises concerns about its credibility. A reputable broker typically provides clear information about its management team, including their qualifications and experience in the financial industry. In FDC's case, the lack of such information can be viewed as a red flag, suggesting potential issues with transparency and accountability.

Trading Conditions Analysis

FDC's trading conditions are critical for evaluating its overall attractiveness to traders. The broker claims to offer competitive spreads and a variety of trading instruments. However, the absence of regulation raises questions about the true nature of these trading conditions.

| Fee Type | FDC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Low |

Reports suggest that FDC may impose unusual fees and commissions, which can significantly impact traders' profitability. The lack of clarity regarding its fee structure is concerning, as traders could face unexpected costs that diminish their returns. A transparent fee structure is essential for any broker, and the ambiguity surrounding FDC's fees raises further questions about its reliability.

Customer Fund Security

The security of customer funds is paramount in the forex trading industry. A trustworthy broker should implement robust measures to protect client deposits. Unfortunately, FDC's lack of regulatory oversight means there is no assurance of fund protection.

Traders should be aware that without proper regulatory backing, there is a risk of losing their investments in the event of the broker's insolvency. Furthermore, FDC has faced complaints from clients regarding difficulties in withdrawing funds, indicating potential issues with fund management and security.

Customer Experience and Complaints

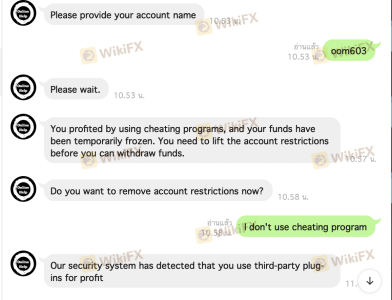

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of FDC reveal a pattern of negative experiences, particularly concerning fund withdrawals and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Inadequate |

Many users report being unable to withdraw their funds, which is a significant red flag for any broker. The inability to access one's capital raises concerns about the broker's financial stability and operational integrity. Additionally, FDC's customer support has been criticized for being unresponsive, further exacerbating traders' frustrations.

Platform and Trade Execution

The trading platform is another critical aspect of evaluating a broker's reliability. FDC claims to offer a user-friendly trading platform; however, the absence of regulatory oversight raises questions about its execution quality.

Reports of slippage and order rejections have surfaced, indicating potential issues with the platform's reliability. A trustworthy broker should ensure that trades are executed efficiently and transparently, without manipulation or undue delays. The lack of concrete information regarding FDC's platform performance adds to the uncertainty surrounding its safety.

Risk Assessment

Engaging with an unregulated broker like FDC carries inherent risks. Traders should be aware of the potential for fund loss, poor customer service, and inadequate trading conditions.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation increases fraud risk. |

| Financial Stability | Medium | Complaints about fund withdrawals raise concerns. |

| Trading Conditions | High | Lack of clarity regarding fees and spreads. |

To mitigate these risks, traders should conduct thorough research before engaging with any broker. It is advisable to start with a small deposit and monitor the broker's performance closely before committing larger sums.

Conclusion and Recommendations

In conclusion, the evidence suggests that FDC poses significant risks to potential traders. The absence of regulation, coupled with numerous customer complaints and a lack of transparency, raises serious concerns about its legitimacy. Traders are advised to exercise caution when considering FDC as a trading option.

For those seeking reliable alternatives, several regulated brokers offer robust trading conditions, transparent fee structures, and strong customer support. It is crucial for traders to prioritize safety and choose brokers that adhere to strict regulatory standards, ensuring their investments are protected.

In summary, is FDC safe? The answer appears to be no, and traders should remain vigilant and informed when selecting their trading partners.

Is FDC a scam, or is it legit?

The latest exposure and evaluation content of FDC brokers.

FDC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FDC latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.