Regarding the legitimacy of MTK forex brokers, it provides ASIC and WikiBit, .

Is MTK safe?

Pros

Cons

Is MTK markets regulated?

The regulatory license is the strongest proof.

ASIC Derivatives Trading License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

METARK TRADING PTY LTD

Effective Date:

2015-08-11Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2020-04-08Address of Licensed Institution:

MLADEN DJURIC, SuiTe 1904, 520 OxFord STreeT BONDI JUNCTION NSW 2022Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is MTK Safe or a Scam?

Introduction

MTK, short for Met Ark Trading, positions itself as a digital trading platform operating primarily in the forex market. Established in Australia, it claims to offer traders a wide array of trading options and tools. However, as the forex market continues to attract both seasoned investors and newcomers alike, it is crucial for traders to exercise caution and thoroughly evaluate any brokerage they consider engaging with. The potential for scams and fraudulent activities in the industry has led to an environment where due diligence is more important than ever.

This article aims to provide an objective analysis of whether MTK is a safe trading platform or if it exhibits signs of being a scam. Our investigation is based on a thorough review of various sources, including regulatory information, customer feedback, and industry reports. The evaluation framework includes an analysis of regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and an overall risk assessment.

Regulation and Legitimacy

The regulatory status of a brokerage is paramount in determining its legitimacy. In the case of MTK, the platform is reportedly operating under a suspicious ASIC (Australian Securities and Investments Commission) clone license. This raises significant concerns about its compliance and oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 476996 | Australia | Suspicious Clone |

The importance of regulation cannot be overstated. Regulatory bodies like ASIC enforce strict guidelines to protect investors and ensure fair trading practices. However, MTK's status as a clone raises red flags regarding its operational integrity. A clone broker typically mimics the branding and claims of a legitimate firm without any actual regulatory backing, which can lead to severe consequences for traders, including potential loss of funds without any legal recourse.

The absence of a genuine regulatory authority supervising MTK's activities further exacerbates concerns about its legitimacy. Traders must be aware that engaging with unregulated or suspiciously regulated brokers can result in significant financial risk, as there may be no recourse in cases of fraud or insolvency.

Company Background Investigation

To assess whether MTK is safe, it is essential to delve into the company's history and ownership structure. MTK, or Met Ark Trading, was established in Australia and has been in operation for approximately 5 to 10 years. However, the lack of transparency regarding its ownership and management team raises further questions about its credibility.

The management team‘s background is crucial in determining a brokerage's reliability. Unfortunately, information about the team behind MTK is scarce, making it difficult to evaluate their expertise and experience in the financial markets. A lack of transparency in a brokerage’s operations and ownership can often indicate potential issues, such as mismanagement or even fraudulent intentions.

Moreover, the companys website has been reported as inaccessible at times, which can hinder potential clients from obtaining critical information about its services and operations. This lack of accessibility can contribute to a negative user experience and raises concerns about the platform's overall professionalism and commitment to customer service.

Trading Conditions Analysis

When evaluating whether MTK is safe for trading, it is essential to analyze its trading conditions and fee structure. A transparent and fair fee structure is a hallmark of reputable brokers, and any irregularities can signal potential issues.

MTK claims to offer competitive trading conditions, but a closer examination reveals several concerning aspects. The overall fee structure lacks clarity, with reports of hidden fees and commissions that could catch traders off guard.

| Fee Type | MTK | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 5-10% | 2-5% |

The spread for major currency pairs at MTK is reported to be higher than the industry average, which can significantly affect trading profitability. Additionally, the variable commission model can lead to unexpected costs, making it difficult for traders to accurately assess their potential expenses. Such discrepancies in trading costs can be a warning sign that MTK may not be operating with the best interests of its clients in mind.

Customer Fund Security

Customer fund security is another critical aspect to consider when evaluating whether MTK is safe. A reputable brokerage will implement robust measures to protect client funds, including segregated accounts, investor protection schemes, and negative balance protection policies.

However, MTK's approach to fund security is unclear. There is little information available regarding whether client funds are held in segregated accounts or if there are any investor protection measures in place. The absence of such safeguards can expose traders to significant financial risks, especially in the event of the broker's insolvency or fraudulent activities.

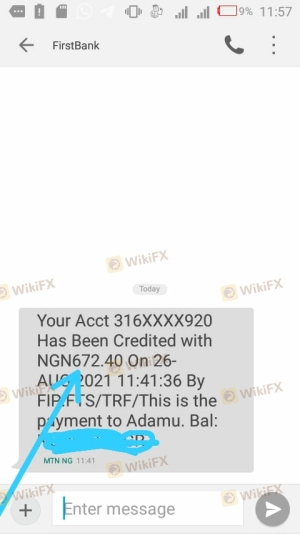

Historically, there have been concerns about the safety of funds with MTK, as some users have reported difficulties in withdrawing their funds. Such issues can indicate a lack of proper financial management and transparency, further questioning the platform's reliability.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a brokerage's reliability and service quality. Reviews and complaints about MTK reveal a mixed bag of experiences, with numerous users expressing dissatisfaction with the platform.

Common complaint patterns include issues with fund withdrawals, unresponsive customer support, and unclear fee structures. These complaints highlight potential operational shortcomings that traders should be wary of.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support | Medium | Limited Availability |

| Fee Transparency | High | Vague Information |

Several users have reported that their withdrawal requests were either delayed or outright denied, raising concerns about the platform's integrity. In one notable case, a trader reported waiting weeks for a withdrawal, only to be met with silence from customer support. Such experiences can be indicative of deeper issues within the brokerage and warrant caution from potential traders.

Platform and Trade Execution

The performance of the trading platform is crucial for a seamless trading experience. MTK utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its advanced functionalities. However, the overall user experience and execution quality are critical factors in determining whether MTK is safe.

Users have reported mixed experiences with MTK's platform, citing occasional stability issues and concerns about order execution quality. Instances of slippage and rejected orders have been noted, which can significantly impact trading outcomes. A reliable broker should ensure efficient order execution and minimal slippage, as these factors directly affect a trader's profitability.

Moreover, any signs of platform manipulation, such as artificially widening spreads during volatile market conditions, can further erode trust in the brokerage. Traders should remain vigilant for any irregularities in platform performance that may suggest underlying issues.

Risk Assessment

Engaging with MTK presents various risks that traders must consider. The lack of regulatory oversight, coupled with reported customer complaints and operational issues, creates a concerning environment for potential investors.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Suspicious ASIC clone status |

| Fund Security | High | Lack of transparency and safeguards |

| Customer Support | Medium | Reports of unresponsive service |

| Platform Stability | Medium | Occasional execution issues |

To mitigate these risks, traders should conduct thorough research before engaging with MTK. It is advisable to start with a small deposit, if at all, and to test the platform's functionality and customer service before committing significant funds. Additionally, exploring alternative, well-regulated brokers may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that MTK raises several red flags that warrant caution from potential traders. The suspicious regulatory status, lack of transparency, and numerous customer complaints indicate that MTK may not be a safe trading platform. Traders should be particularly wary of engaging with a broker that operates under an ASIC clone license, as this could expose them to significant financial risks.

For those considering trading with MTK, it is essential to weigh the potential benefits against the evident risks. If you are a beginner or risk-averse trader, seeking alternative brokers with solid regulatory backing and positive user experiences is highly advisable. Some reputable alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer a more secure trading environment.

Ultimately, the question of "Is MTK safe?" leans towards a cautious "no," and traders should exercise prudence in their investment decisions.

Is MTK a scam, or is it legit?

The latest exposure and evaluation content of MTK brokers.

MTK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MTK latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.