CharterPrime 2025 Review: Everything You Need to Know

CharterPrime has garnered attention in the forex and CFD trading space since its inception in 2012. This review synthesizes various sources to provide insights into the broker's strengths and weaknesses, focusing on user experiences, regulatory status, and key features. While many users appreciate CharterPrime's low minimum deposit and trading platforms, concerns about its regulatory framework and customer support persist.

Note: It is essential to recognize that CharterPrime operates under different regulatory entities, including ASIC in Australia and SVG FSA in St. Vincent and the Grenadines. This distinction is crucial for potential clients, as it affects the level of protection and oversight they may receive.

Rating Summary

How We Rate Brokers: Our ratings are based on a thorough analysis of available information, user feedback, and expert opinions.

Broker Overview

CharterPrime, established in 2012, is headquartered in Sydney, Australia, and operates under the regulations of the Australian Securities and Investments Commission (ASIC) and the St. Vincent and the Grenadines Financial Services Authority (SVG FSA). The broker offers access to popular trading platforms, primarily MetaTrader 4 (MT4) and MetaTrader 5 (MT5), allowing traders to engage with a range of assets including forex, commodities, and indices.

Detailed Breakdown

Regulated Geographical Areas:

CharterPrime is regulated in Australia by ASIC, which is known for its stringent regulatory standards. However, its offshore registration in St. Vincent and the Grenadines raises concerns about the level of protection for international clients.

Deposit/Withdrawal Currencies/Cryptocurrencies:

The broker supports multiple currencies including USD, EUR, AUD, and more. CharterPrime also allows deposits and withdrawals in cryptocurrencies like Bitcoin and Tether, which enhances its appeal to a broader audience.

Minimum Deposit:

The minimum deposit required to open an account with CharterPrime is $100, making it accessible for new traders looking to enter the forex market.

Bonuses/Promotions:

Currently, CharterPrime does not offer any bonuses or promotional incentives, which may be a drawback compared to some competitors that provide such benefits to attract new clients.

Tradeable Asset Classes:

Traders can access over 45 forex pairs, several indices, and a limited selection of commodities. Notably, CharterPrime does not offer cryptocurrency trading, which could deter potential clients interested in diversifying their portfolios.

Costs (Spreads, Fees, Commissions):

CharterPrime offers competitive spreads starting from 0.0 pips on its ECN accounts, while variable accounts typically have spreads from 1.5 pips. However, the ECN account incurs a commission of $8 per lot, which is relatively standard in the industry. Users have reported that the costs can be higher than some of its competitors, particularly for standard accounts.

Leverage:

The maximum leverage offered by CharterPrime is up to 1:500, which is attractive for experienced traders looking for high-risk opportunities. However, it is essential to note that high leverage also increases the risk of substantial losses.

Allowed Trading Platforms:

CharterPrime primarily utilizes MT4 and MT5, two of the most popular trading platforms in the industry. These platforms are well-regarded for their robust analytical tools and user-friendly interfaces.

Restricted Regions:

While CharterPrime accepts clients from various global regions, it does not provide services to residents in the USA, Japan, and several other countries, limiting accessibility for some potential traders.

Available Customer Service Languages:

CharterPrime offers customer support primarily in English and Chinese, which may pose challenges for non-English speaking clients seeking assistance.

Rating Summary (Repeated)

Detailed Analysis

Account Conditions:

CharterPrime provides a reasonable range of account types, including variable, ECN, and swap-free accounts, catering to different trading strategies. However, the absence of a proprietary platform and limited educational resources could hinder user experience, especially for beginners.

Tools and Resources:

While CharterPrime offers essential trading tools, the lack of comprehensive educational resources and market analysis tools is a notable drawback. Traders looking for in-depth training materials may need to seek external resources to enhance their knowledge.

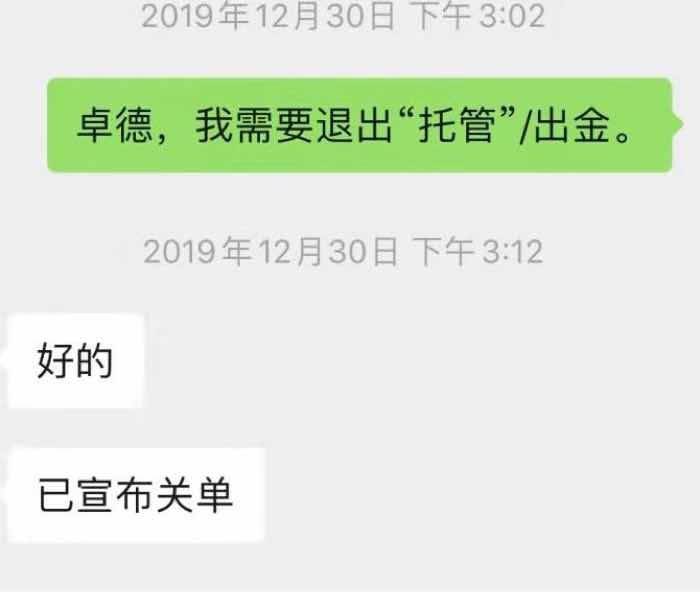

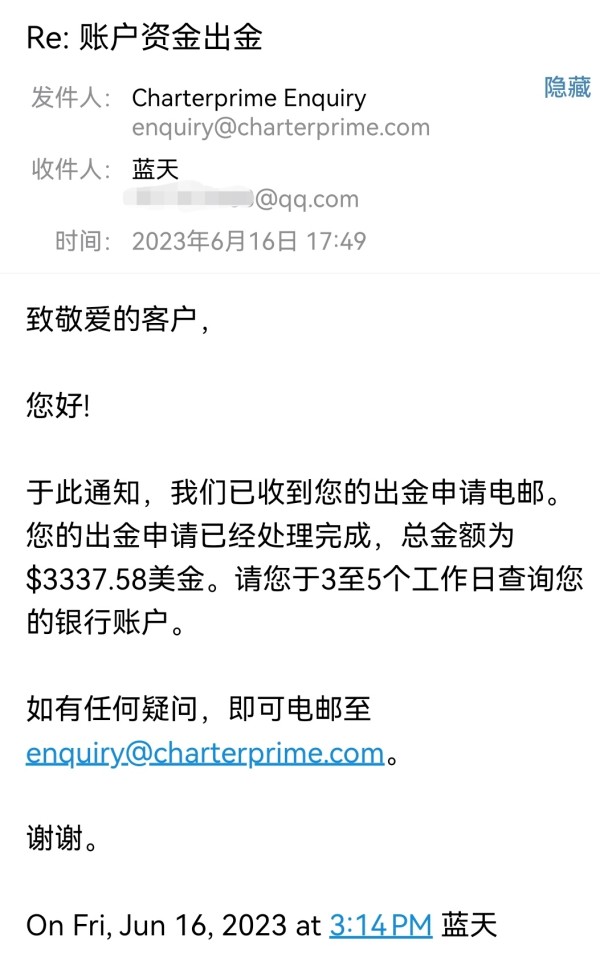

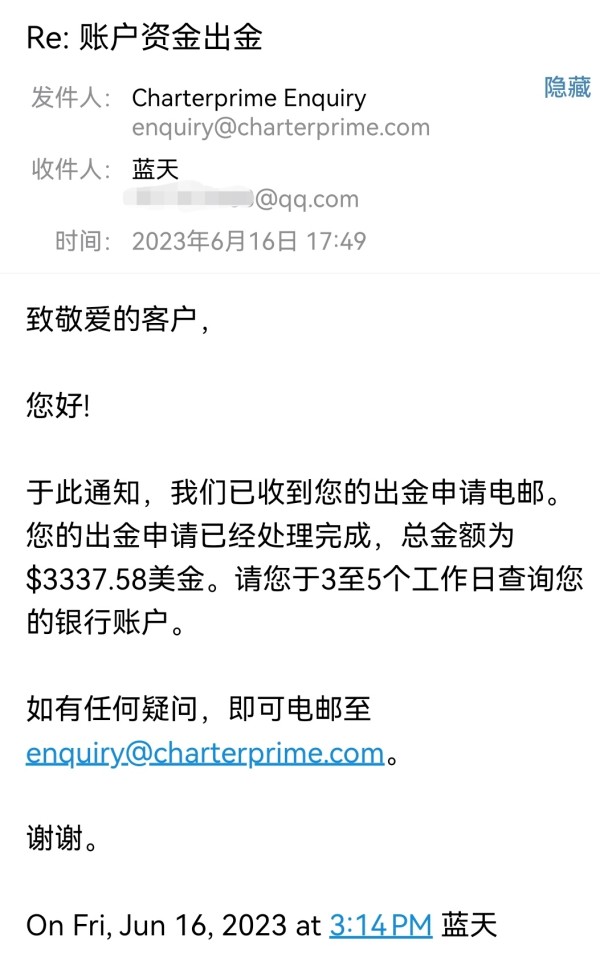

Customer Service and Support:

Customer service has received mixed reviews, with some users reporting slow response times and a lack of live chat support. This could be a significant disadvantage for traders who require immediate assistance, particularly those new to trading.

Trading Setup (Experience):

The trading experience on CharterPrime is generally positive, with users appreciating the fast execution speeds and the reliability of MT4 and MT5 platforms. However, the higher-than-average spreads and commissions on certain accounts can detract from overall satisfaction.

Trustworthiness:

CharterPrime's regulatory status is a double-edged sword. While it is regulated by ASIC, the offshore registration raises concerns about the level of protection for international clients. Users should be cautious and consider the implications of trading with an entity registered in a less regulated jurisdiction.

User Experience:

Overall, user experiences with CharterPrime vary. While some traders commend its competitive spreads and user-friendly platforms, others express concerns regarding customer support and the lack of educational resources.

In summary, CharterPrime presents a mixed bag of features and user experiences. While it offers competitive trading conditions and regulatory oversight in Australia, potential clients should weigh the benefits against the risks associated with its offshore operations and limited support resources.