E*TRADE 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive e trade review examines one of America's pioneering online discount brokers. ETRADE continues to maintain its position as a top-tier platform for investors across all experience levels through its commitment to zero-commission trading on US-listed stocks and ETFs, coupled with robust educational resources and advanced trading platforms that cater to both novice investors purchasing their first shares and seasoned traders requiring sophisticated analytical tools. ETRADE from Morgan Stanley stands out in the competitive brokerage landscape.

The brokerage's key strengths include its powerful Power ETRADE platform, which provides comprehensive charting capabilities and technical analysis tools. The platform also offers an extensive library of educational materials including webinars and tutorials designed to help new users navigate the complexities of investing, making ETRADE's appeal extend to active traders who benefit from discounted options trading and access to thousands of no-transaction-fee mutual funds. This makes it a versatile choice for diverse investment strategies.

The platform particularly excels in serving both active traders seeking advanced functionality and long-term buy-and-hold investors who value simplicity and cost-effectiveness. With its mobile applications enabling trading from anywhere and a reputation built over decades of service, E*TRADE represents a well-established option in the online brokerage space, though potential users should be aware of certain limitations in administrative fees for more complex transactions that may impact overall costs.

Important Considerations

This evaluation focuses specifically on ETRADE's operations within the United States. ETRADE operates under the regulatory oversight of the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), where international investors should note that E*TRADE's services and features may not be available in all regions, and regulatory protections may differ significantly outside the US market.

The assessment presented here is based on publicly available information, user feedback from various financial platforms, and official company disclosures. Market conditions, fee structures, and platform features are subject to change. Potential users should verify current terms and conditions directly with E*TRADE before making investment decisions, as this review aims to provide an objective analysis while acknowledging that individual experiences may vary based on specific trading needs and investment objectives.

Rating Framework

Broker Overview

Company Foundation and Background

E*TRADE Financial Corporation was established in 1982. The company pioneered the online discount brokerage industry by democratizing access to financial markets for individual investors, with headquarters in Palo Alto, California, where the company was founded with the revolutionary concept of enabling average investors to execute trades without traditional broker intermediaries. This vision fundamentally transformed how Americans approach investing by eliminating the high costs and barriers associated with traditional full-service brokerages.

The company's business model centers on providing low-cost trading solutions while maintaining high-quality technological infrastructure and educational support. E*TRADE's acquisition by Morgan Stanley has further strengthened its position in the market by combining the innovative spirit of a fintech pioneer with the stability and resources of a major financial institution. This partnership has enhanced the platform's capabilities while preserving its core mission of accessible, affordable investing.

Platform and Service Offerings

ETRADE operates through its flagship Power ETRADE platform. This sophisticated platform serves as the cornerstone of its trading ecosystem by integrating advanced charting tools, technical analysis capabilities, and comprehensive research resources to support various trading strategies. The service portfolio encompasses a broad range of investment vehicles including stocks, exchange-traded funds (ETFs), mutual funds, and options trading.

According to industry reports, the platform distinguishes itself through thousands of no-transaction-fee mutual funds and competitive options pricing structures. The brokerage operates under strict regulatory supervision by the SEC and FINRA, ensuring compliance with federal securities laws and industry standards while this e trade review highlights how the platform's regulatory framework provides investor protections while maintaining the flexibility needed for active trading strategies.

Regulatory Environment: E*TRADE operates under comprehensive oversight from the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). This provides robust investor protections and ensures compliance with federal securities regulations.

Deposit and Withdrawal Methods: While specific details regarding funding options are not extensively detailed in available documentation, E*TRADE typically supports standard banking transfers and electronic funding methods common to major US brokerages.

Minimum Deposit Requirements: Current available information does not specify exact minimum deposit thresholds. The platform appears accessible to investors with varying capital levels.

Promotional Offers: Specific bonus structures and promotional campaigns are not detailed in current available materials. The broker occasionally offers incentives for new account holders.

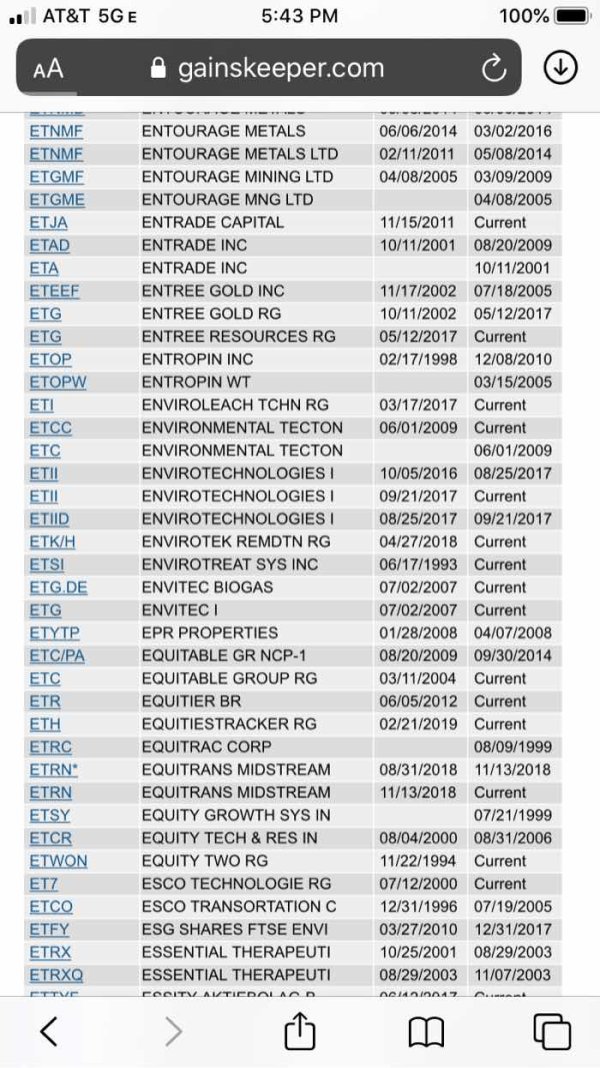

Tradeable Assets: The platform provides access to US-listed stocks, ETFs, mutual funds, and options contracts. It places particular emphasis on commission-free equity trading and discounted options transactions.

Cost Structure: E*TRADE maintains a zero-commission policy for US-listed stocks and ETF trades. This represents a significant cost advantage for active investors, though certain administrative actions may incur fees, with some services costing $49.95 for traders completing fewer than 30 quarterly trades, reduced to lower rates for more active participants.

Leverage Ratios: Specific margin and leverage information is not comprehensively detailed in available source materials.

Platform Options: Primary access through the Power E*TRADE platform and mobile applications. These are designed to facilitate trading across various devices and locations.

This e trade review emphasizes that while some specific details require direct verification with the broker, the overall service framework demonstrates E*TRADE's commitment to accessible, technology-driven investing solutions.

Detailed Rating Analysis

Account Conditions Analysis (Score: 8/10)

E*TRADE's account structure demonstrates significant strength in accessibility and cost-effectiveness. The platform particularly benefits active traders through its zero-commission approach to US equity trading, offering multiple account types designed to accommodate various investment strategies, from basic individual accounts to more sophisticated trading arrangements for experienced investors. According to user feedback, the account opening process is streamlined and user-friendly, allowing new investors to begin trading relatively quickly once verification requirements are met.

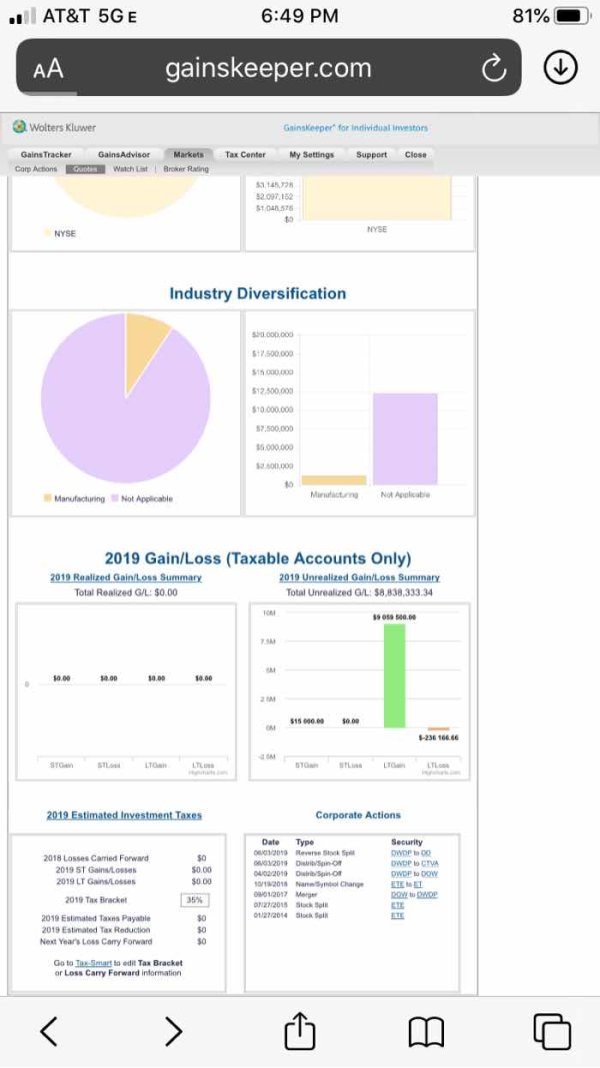

The brokerage's fee structure represents a major competitive advantage. The elimination of commissions on stock and ETF trades removes a significant barrier for frequent traders, though the platform does maintain certain administrative fees that can impact traders with lower activity levels, particularly the $49.95 charge for specific services that reduces for more active participants. While minimum deposit requirements are not extensively specified in available materials, user experiences suggest the platform remains accessible to investors across different capital levels.

The account management features provide comprehensive tools for monitoring positions, analyzing performance, and executing various order types. Users particularly appreciate the integration between account management and educational resources, which helps newer investors understand the relationship between account features and trading strategies while this e trade review notes that while account conditions are generally favorable, some aspects of fee transparency could benefit from clearer documentation for potential users.

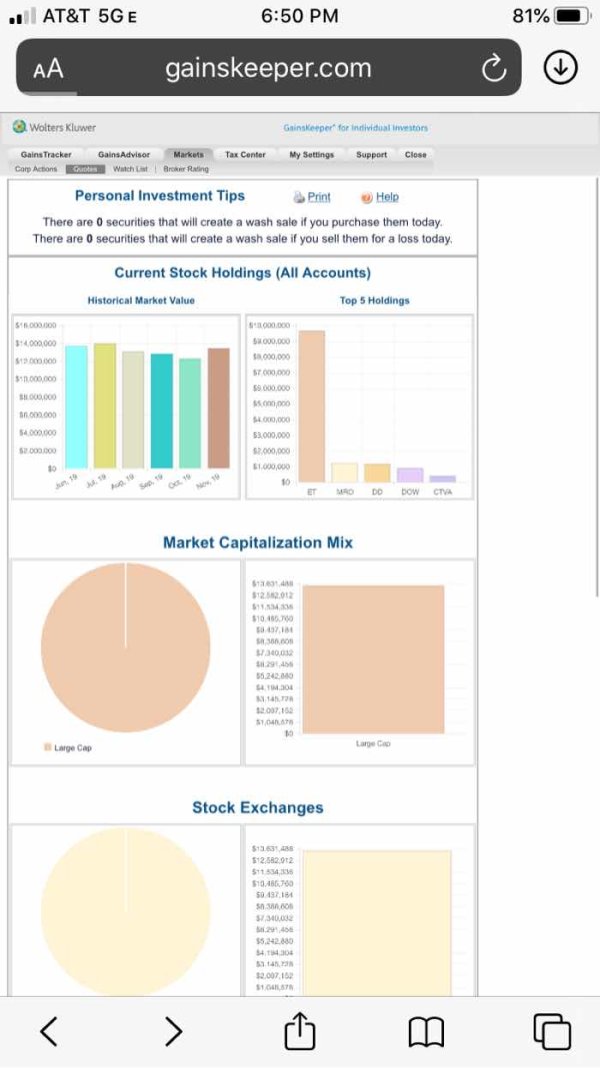

The Power E*TRADE platform represents one of the broker's strongest competitive advantages. It offers sophisticated charting capabilities and technical analysis tools that rival specialized trading software, with users consistently praising the platform's comprehensive research functionality, which includes real-time market data, analyst reports, and economic indicators that support informed decision-making across various investment strategies.

Educational resources constitute a particular strength. E*TRADE provides extensive webinars, tutorials, and market analysis content designed to help investors develop their skills and understanding, with the educational framework spanning from basic investing concepts for beginners to advanced trading strategies for experienced participants, creating a comprehensive learning ecosystem that supports user development over time.

The platform's research capabilities integrate fundamental and technical analysis tools. This provides users with multiple perspectives on potential investments, while advanced charting features include customizable indicators, pattern recognition tools, and historical data analysis that enable sophisticated market analysis. Mobile applications extend these capabilities to smartphones and tablets, ensuring users can access research and analysis tools regardless of location.

User feedback consistently highlights the quality and depth of available tools. Many note that the platform provides institutional-grade resources typically associated with more expensive brokerage services, while the integration of educational content with practical trading tools creates a synergistic environment where learning and application occur simultaneously, enhancing the overall user experience.

Customer Service and Support Analysis (Score: 7/10)

E*TRADE's customer service framework provides multiple contact channels including phone support, email assistance, and online chat capabilities. This ensures users can access help through their preferred communication method, with user feedback generally indicating positive experiences with customer service representatives, noting their professionalism and ability to address technical and account-related questions effectively.

Response times appear reasonable based on user reports. Phone support typically provides immediate assistance during business hours and electronic communications receive timely responses, while the customer service team demonstrates strong knowledge of platform features and can guide users through complex procedures or troubleshoot technical issues that may arise during trading activities.

However, some limitations exist in the scope of support services. These particularly affect advanced trading strategies or detailed investment advice, which aligns with the self-directed nature of discount brokerage services, though users report successful resolution of account access issues, technical problems, and general inquiries, while more complex situations may require extended interaction or escalation to specialized departments.

The support infrastructure includes comprehensive FAQ sections and help documentation that enable users to resolve common issues independently. While the overall service quality meets industry standards, there remains room for improvement in areas such as extended support hours and more specialized assistance for advanced platform features.

Trading Experience Analysis (Score: 8/10)

The trading experience on ETRADE's platform demonstrates strong stability and performance. Users report reliable order execution and minimal technical disruptions during normal market conditions, while the Power ETRADE platform provides responsive performance that supports active trading strategies, and the intuitive interface design enables efficient navigation between different functions and market sectors.

Order execution quality appears consistent based on user feedback. The platform shows minimal reports of significant slippage or requoting issues that could impact trading outcomes, supporting various order types including market, limit, and stop orders, providing flexibility for different trading approaches and risk management strategies. Users appreciate the real-time updates and confirmation systems that provide transparency throughout the execution process.

Mobile trading capabilities extend the full trading experience to smartphones and tablets. This enables users to monitor positions and execute trades from any location with internet connectivity, while the mobile applications maintain the functionality and reliability of the desktop platform while optimizing the interface for smaller screens and touch-based navigation.

Platform stability during high-volume trading periods generally meets user expectations. Some users note occasional slowdowns during extreme market volatility, though the integration of research tools with trading capabilities creates an efficient workflow that supports informed decision-making without requiring multiple platform switches. This e trade review recognizes that while the trading experience is generally positive, continued technological improvements could further enhance performance during peak usage periods.

Trustworthiness Analysis (Score: 9/10)

E*TRADE's regulatory standing provides a strong foundation for user trust. Oversight from both the SEC and FINRA ensures compliance with federal securities laws and industry standards, while the brokerage's long-standing presence in the financial industry, dating back to 1982, demonstrates operational stability and regulatory compliance across multiple market cycles and regulatory changes.

The acquisition by Morgan Stanley has further enhanced the platform's credibility. This associates it with one of the most established names in financial services, providing additional resources and stability while maintaining the innovative approach that originally distinguished E*TRADE in the discount brokerage space. Users benefit from the combined strengths of fintech innovation and traditional banking stability.

Industry reputation remains strong based on recognition from financial publications and regulatory compliance records. The company's transparency regarding fee structures, terms of service, and regulatory obligations provides users with clear understanding of their rights and responsibilities, while public financial disclosures and management information contribute to overall transparency and accountability.

Third-party evaluations consistently recognize E*TRADE as a reputable broker with strong operational standards and customer protections. User feedback regarding fund security and account protection indicates confidence in the platform's safety measures, though specific details about insurance coverage and security protocols require direct verification with the company.

User Experience Analysis (Score: 8/10)

Overall user satisfaction with E*TRADE reflects positively on the platform's design and functionality. Users show particular praise for the intuitive interface and comprehensive feature integration, with users across different experience levels reporting successful adaptation to the platform, suggesting effective design that accommodates both novice and experienced investors without compromising functionality for either group.

The registration and account verification process receives generally positive feedback for its efficiency and clarity. This enables new users to begin investing without excessive delays or complications, while interface design balances comprehensiveness with usability, providing access to advanced features while maintaining straightforward navigation for basic functions.

Fund management operations, including deposits and withdrawals, appear to function smoothly based on user reports. Specific processing times and methods require verification with current account holders, though the integration of educational resources with practical trading tools creates a cohesive experience that supports user development and confidence building.

Some user feedback identifies concerns regarding payment for order flow arrangements. These can impact execution quality and trading costs despite zero nominal commissions, representing an area where improved transparency could enhance user understanding and satisfaction. The platform generally succeeds in creating an accessible, feature-rich environment that serves diverse investment needs while maintaining professional-grade capabilities for serious traders.

Conclusion

This comprehensive e trade review reveals a well-established, reliable brokerage platform. E*TRADE successfully serves a diverse range of investors from beginners to experienced traders through its combination of zero-commission stock trading, robust educational resources, and sophisticated analytical tools that create a compelling value proposition in the competitive online brokerage landscape.

The platform particularly excels for active traders who benefit from advanced charting capabilities and research tools. It simultaneously provides accessible entry points for new investors through comprehensive educational materials and intuitive interface design, while the regulatory oversight from SEC and FINRA, combined with the backing of Morgan Stanley, provides strong credibility and user protection.

While areas such as fee transparency and payment for order flow arrangements present opportunities for improvement, the overall package represents solid value for investors. E*TRADE offers a comprehensive, technology-driven brokerage solution with strong educational support and professional-grade trading capabilities.