Regarding the legitimacy of Charterprime forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is Charterprime safe?

Pros

Cons

Is Charterprime markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

STARTRADER PRIME GLOBAL PTY LTD

Effective Date: Change Record

2012-09-03Email Address of Licensed Institution:

support@startraderprime.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 35 31 MARKET ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0290567412Licensed Institution Certified Documents:

Is CharterPrime Safe or a Scam?

Introduction

CharterPrime is a global financial services provider specializing in forex and CFD trading. Established in 2012, it has positioned itself as a player in the competitive forex market, offering various trading instruments and account types. However, as with any brokerage, traders must exercise caution and conduct thorough due diligence before committing their funds. The forex market is rife with both reputable and dubious brokers, and distinguishing between them is crucial for safeguarding investments. In this article, we will analyze CharterPrimes regulatory status, company background, trading conditions, and customer experiences to determine if it is a safe trading platform or a potential scam.

Regulation and Legitimacy

Regulation is a critical factor in assessing the safety of any forex broker. CharterPrime claims to be regulated by the Australian Securities and Investments Commission (ASIC) and holds a registration with the Financial Service Providers Register (FSPR) in New Zealand. These regulatory bodies are known for their stringent compliance requirements, which are designed to protect traders and ensure fair trading practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 421210 | Australia | Verified |

| FSPR | 348606 | New Zealand | Verified |

Despite its regulatory claims, there are concerns regarding CharterPrimes offshore operations in St. Vincent and the Grenadines, which is often associated with lower regulatory standards. While the ASIC oversight provides a level of security, the presence of an offshore entity raises questions about the overall regulatory framework. Additionally, CharterPrime has faced warnings from various regulatory bodies regarding unauthorized trading activities, which further complicates its legitimacy. Therefore, while CharterPrime is regulated in Australia, the dual nature of its operations necessitates a cautious approach when considering whether is CharterPrime safe for trading.

Company Background Investigation

CharterPrime was established in 2012 and has since expanded its operations globally, with offices in Australia and St. Vincent and the Grenadines. The company operates under a straight-through processing (STP) model, which is designed to provide transparency and avoid conflicts of interest. The management team consists of industry professionals with extensive experience in financial markets, which contributes to the companys credibility.

However, transparency regarding ownership and operational practices can be lacking. The companys information disclosure is not as comprehensive as one might expect from a regulated broker. While CharterPrime has received industry awards for its services, the lack of detailed information about its management and operational structure raises concerns. A transparent company should openly share information about its leadership and operational practices to build trust with its clients. Thus, while CharterPrime has a solid operational history, the opacity surrounding its management and ownership structure prompts skepticism about whether is CharterPrime safe for investors.

Trading Conditions Analysis

CharterPrime offers a variety of trading accounts, including standard, ECN, and swap-free accounts, with a minimum deposit requirement of $100. The broker provides leverage of up to 1:500, which can be appealing to traders looking to maximize their positions. However, high leverage also increases risk, making it essential for traders to understand the implications of their trading choices.

The fee structure includes variable spreads, which can be competitive compared to industry averages. However, there are reports of hidden fees and unclear commission structures that could catch traders off guard. Below is a comparison of key trading costs:

| Cost Type | CharterPrime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | $8 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

The presence of high spreads combined with potential hidden fees raises concerns about the overall trading cost transparency. Traders should be wary of any unexpected costs that may arise during their trading activities. Therefore, while CharterPrime offers competitive trading conditions, the lack of clarity regarding fees and commissions may lead one to question is CharterPrime safe for trading.

Client Fund Safety

The safety of client funds is paramount when evaluating a forex broker. CharterPrime claims to implement measures such as segregated accounts, where client funds are kept separate from the companys operational funds. This practice is essential for protecting traders' investments in the event of financial difficulties faced by the broker.

Additionally, CharterPrime does not provide negative balance protection, which means that traders could potentially lose more than their initial investment. This lack of protection can be concerning, especially for traders who may engage in high-leverage trading. Moreover, there have been historical complaints regarding fund withdrawals, with some users reporting delays and difficulties in accessing their money. These issues raise significant concerns about the reliability of CharterPrimes fund management practices.

In summary, while CharterPrime asserts that it prioritizes client fund safety, the absence of negative balance protection and reported withdrawal issues may lead traders to question is CharterPrime safe for their investments.

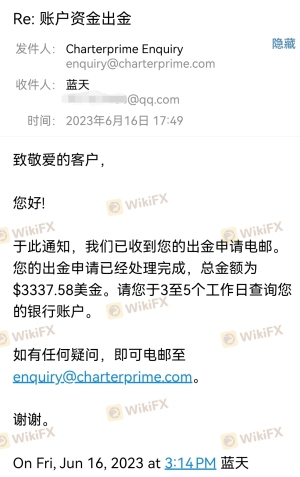

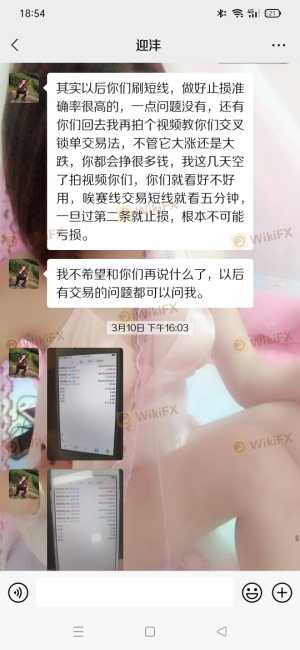

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of CharterPrime reveal a mixed bag of experiences, with some users praising the trading platform and execution speed, while others express frustration with customer support and withdrawal processes. Common complaints include delays in fund withdrawals, lack of effective customer service, and issues with account verification.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Account Verification Issues | Low | Delayed responses |

Several users have reported that their withdrawal requests took longer than expected, leading to dissatisfaction. In some cases, users experienced account freezes without clear communication from the broker. These patterns of complaints suggest that while CharterPrime may offer competitive trading conditions, its customer service and withdrawal processes need improvement. Therefore, potential traders should weigh these experiences when considering whether is CharterPrime safe for their trading needs.

Platform and Trade Execution

CharterPrime utilizes the widely-used MetaTrader 4 (MT4) platform, known for its robust features and user-friendly interface. The platform is generally stable, with users reporting satisfactory performance during trading sessions. However, there have been concerns about order execution quality, including instances of slippage and rejected orders during high volatility periods.

The execution speed is touted as one of CharterPrime's strengths, but the lack of transparency regarding execution policies may raise questions about potential manipulation. A reliable broker should provide clear information on how orders are executed, especially in fast-moving markets. Therefore, while the platform offers a familiar environment for traders, the absence of detailed execution policies may lead to concerns about whether is CharterPrime safe for trading.

Risk Assessment

Trading with CharterPrime comes with inherent risks, as is the case with any forex broker. The combination of high leverage, potential hidden fees, and customer service issues creates a complex risk profile for traders. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Offshore operations may lack stringent oversight. |

| Financial Risk | High | High leverage can lead to significant losses. |

| Operational Risk | Medium | Customer service issues may hinder trading experience. |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform and its features. Setting strict risk management parameters and avoiding high leverage can also help protect investments. Ultimately, understanding the risk landscape is essential for determining whether is CharterPrime safe for individual trading strategies.

Conclusion and Recommendations

In conclusion, the evidence surrounding CharterPrime presents a mixed picture. While the broker is regulated by ASIC and offers competitive trading conditions, concerns regarding its offshore operations, customer service quality, and withdrawal processes cannot be overlooked. Traders should exercise caution and conduct thorough research before engaging with CharterPrime.

For those considering trading with CharterPrime, it is advisable to start with a demo account and implement strict risk management practices. If the concerns outweigh the benefits, traders may want to explore alternative brokers with stronger reputations and more transparent practices. Reliable options include brokers regulated by top-tier authorities, offering robust customer support and clear fee structures. Ultimately, making an informed decision will help ensure a safer trading experience in the forex market.

Is Charterprime a scam, or is it legit?

The latest exposure and evaluation content of Charterprime brokers.

Charterprime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Charterprime latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.