Skilling 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive skilling review examines one of the emerging players in the online trading space. Skilling is a regulated online forex and CFD broker that has been serving traders since 2016, offering a diverse range of trading instruments across multiple platforms. The broker stands out through its commission-free trading model and multi-platform approach. It supports both proprietary trading platforms and popular third-party options including MetaTrader 4 and cTrader.

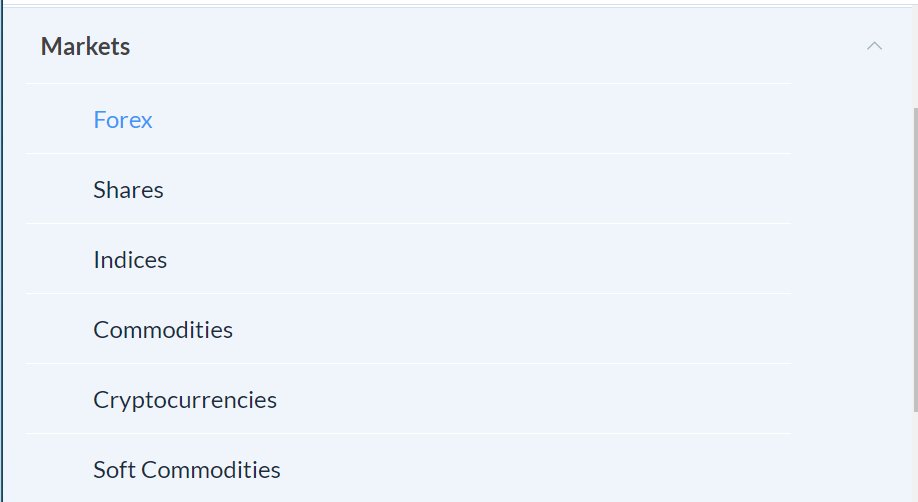

According to InvestingBrokers.com, Skilling provides access to CFDs on stocks, indices, commodities, and cryptocurrencies, alongside traditional forex trading. The broker has built a presence in over 100 countries and operates under the regulatory oversight of CySEC (Cyprus Securities and Exchange Commission) and FSA (Financial Services Authority), providing a foundation of regulatory compliance for its operations. Skilling's target demographic primarily consists of small to medium-sized retail investors seeking exposure to CFD and forex markets.

The broker's commission-free structure and multiple platform options make it particularly appealing to cost-conscious traders who value platform flexibility. With a broker trust rating of 75/100 as reported by various review platforms, Skilling positions itself as a mid-tier option in the competitive online brokerage landscape.

Important Disclaimers

Regional Variations: Skilling operates through different entities across various jurisdictions, and services may vary depending on your location. Regulatory requirements, available instruments, and terms of service can differ significantly between regions. Traders should verify which Skilling entity serves their jurisdiction and understand the applicable regulatory framework, tax implications, and investor protection schemes in their country of residence.

Review Methodology: This evaluation is based on publicly available information, user feedback from multiple review platforms, regulatory filings, and market analysis as of 2024-2025. The assessment aims to provide a comprehensive and objective evaluation of Skilling's services, but individual trading experiences may vary based on account type, trading volume, and regional factors.

Overall Rating Framework

Broker Overview

Founded in 2016, Skilling has established itself as a focused online broker specializing in CFD and forex trading. According to CompareBrokers.org, the company has built its business model around providing accessible trading solutions for retail investors, emphasizing cost-effective trading through its commission-free structure. The broker's relatively recent establishment in the market reflects the evolving landscape of online trading, where newer entrants attempt to differentiate themselves through competitive pricing and modern technology platforms.

Skilling's business approach centers on offering a comprehensive range of tradeable assets while maintaining operational efficiency through streamlined service delivery. The company serves over 100 countries, indicating a global ambition despite its relatively recent market entry. FxScouts Kenya reports that Skilling has focused on building a diverse product portfolio that includes traditional forex pairs alongside modern CFD instruments covering stocks, indices, commodities, and cryptocurrencies.

The broker operates through multiple trading platforms, providing traders with flexibility in their choice of trading environment. This skilling review found that the company offers three web-based platforms and two mobile applications, alongside support for established third-party platforms like MetaTrader 4 and cTrader. This multi-platform approach suggests Skilling's commitment to accommodating different trader preferences and experience levels, from beginners who might prefer simplified proprietary platforms to experienced traders who rely on advanced features available in MT4 or cTrader.

Key Trading Details

Regulatory Oversight: Skilling operates under dual regulatory supervision from CySEC (Cyprus Securities and Exchange Commission) and FSA (Financial Services Authority). This regulatory framework provides essential investor protections and ensures compliance with European financial services standards.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options was not detailed in available documentation, requiring direct verification with the broker for comprehensive payment method details.

Minimum Deposit Requirements: Exact minimum deposit thresholds were not specified in the reviewed materials, indicating potential variation based on account type and regional requirements.

Promotional Offerings: Current bonus and promotional activities were not extensively documented in available sources, suggesting traders should consult directly with Skilling for up-to-date promotional information.

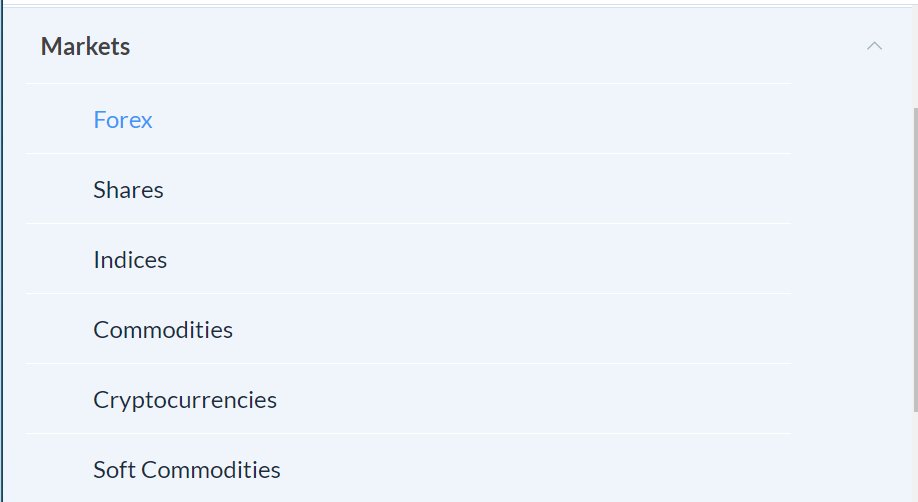

Available Trading Instruments: TraderFactor.com confirms that Skilling provides access to a comprehensive range of tradeable assets including forex currency pairs, stock CFDs, index CFDs, commodity CFDs, and cryptocurrency CFDs, offering diversified exposure across major asset classes.

Cost Structure: The broker operates on a commission-free model, though specific spread information and any additional fees require direct confirmation. This skilling review notes that while commission-free trading is advertised, traders should verify all applicable costs including spreads, overnight financing charges, and any administrative fees.

Leverage Ratios: Specific leverage information was not detailed in available documentation, though as a CySEC-regulated entity, Skilling likely adheres to European leverage restrictions for retail clients.

Platform Options: Skilling provides three proprietary web platforms and two mobile applications, complemented by support for MetaTrader 4 and cTrader platforms.

Geographic Restrictions: While Skilling serves 100+ countries, specific restrictions or limitations for certain jurisdictions were not detailed in reviewed materials.

Customer Support Languages: Specific language support information was not comprehensively documented in available sources.

Detailed Analysis

Account Conditions Assessment (7/10)

Skilling's account structure reflects a streamlined approach to online trading, though specific details about account tiers and requirements remain limited in publicly available documentation. The commission-free trading model represents a significant advantage for cost-conscious traders, particularly those engaging in frequent trading activities where commission costs can accumulate substantially over time.

The lack of detailed information regarding minimum deposit requirements and specific account types suggests that Skilling may operate with a simplified account structure, potentially offering uniform conditions across its client base. This approach can benefit new traders who might be overwhelmed by complex account hierarchies, though experienced traders seeking premium features might find the options limiting.

Account opening procedures and verification requirements were not extensively detailed in available materials, though as a regulated broker, Skilling must comply with standard KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements. The absence of specific information about Islamic accounts or other specialized account types indicates potential limitations for traders with specific religious or trading requirements.

This skilling review notes that while the commission-free structure is attractive, traders should carefully review all applicable costs including spreads, overnight financing, and any potential administrative fees that might not be immediately apparent in marketing materials.

Skilling demonstrates strength in its platform diversity and instrument range, offering traders multiple avenues for market access and analysis. The combination of proprietary platforms with established third-party options like MetaTrader 4 and cTrader provides flexibility for traders with different experience levels and preferences.

The broker's CFD offering spans major asset classes including stocks, indices, commodities, and cryptocurrencies, alongside traditional forex pairs. This comprehensive range allows traders to diversify their portfolios and take advantage of opportunities across different markets from a single account. AzForexBrokers.com indicates that this multi-asset approach aligns with modern trading preferences where investors seek exposure to various market sectors.

However, specific information about research tools, market analysis resources, and educational materials was not extensively documented in available sources. Modern traders increasingly expect comprehensive analytical tools, economic calendars, market commentary, and educational resources as standard offerings from their brokers.

The absence of detailed information about automated trading support, copy trading features, or advanced analytical tools represents a potential gap in Skilling's service offering compared to more established competitors who provide extensive research and analysis capabilities.

Customer Service and Support Analysis (7/10)

Customer service quality represents a critical factor in broker selection, though specific information about Skilling's support infrastructure was not comprehensively detailed in available documentation. The absence of specific information about support channels, response times, and service quality metrics makes it challenging to provide a definitive assessment of this crucial service area.

Standard industry practice suggests that regulated brokers like Skilling should provide multiple contact methods including email, phone, and live chat support. However, without specific details about availability hours, response times, or multilingual support capabilities, traders cannot fully evaluate the adequacy of customer service provisions.

The lack of documented user feedback specifically addressing customer service experiences represents a significant information gap in this skilling review. User testimonials and service quality ratings are typically important indicators of a broker's commitment to client support and problem resolution capabilities.

Traders considering Skilling should directly verify customer service capabilities, including available contact methods, support hours, language options, and typical response times before committing to the platform, particularly if they anticipate requiring regular assistance or operate in non-standard time zones.

Trading Experience Assessment (8/10)

The trading experience evaluation benefits from Skilling's multi-platform approach, which accommodates different trader preferences and experience levels. The availability of both proprietary platforms and established third-party options like MetaTrader 4 and cTrader provides flexibility that many traders value highly.

User feedback generally indicates positive experiences with platform stability and functionality, though specific performance metrics such as execution speeds, slippage rates, or server uptime statistics were not detailed in available documentation. The commission-free trading model enhances the overall trading experience by reducing transaction costs, particularly beneficial for active traders.

Mobile trading capabilities through two dedicated applications suggest recognition of the growing importance of mobile trading, allowing traders to manage positions and monitor markets while away from desktop computers. However, specific features and capabilities of the mobile platforms were not extensively documented.

The absence of detailed information about order execution quality, including average execution speeds, slippage statistics, or requote frequencies, represents a limitation in fully assessing the trading experience. This skilling review notes that such technical performance metrics are increasingly important for traders evaluating potential brokers, particularly those engaging in short-term or high-frequency trading strategies.

Trust and Security Analysis (7/10)

Skilling's regulatory status under CySEC and FSA provides a foundation of institutional oversight and compliance requirements that enhance trader confidence. These regulatory bodies impose strict operational standards, capital requirements, and client protection measures that regulated brokers must maintain continuously.

The reported trust rating of 75/100 and risk assessment of 90/100 (low risk) from CompareBrokers.org suggests moderate confidence levels in Skilling's operational stability and reliability. While these ratings indicate general trustworthiness, they also suggest room for improvement in areas that influence trader confidence.

However, specific information about client fund protection measures, such as segregated account arrangements, deposit insurance coverage, or investor compensation schemes, was not detailed in available documentation. These protection mechanisms are crucial for trader security and represent standard expectations for regulated brokers.

The absence of information about any historical regulatory actions, compliance issues, or operational incidents limits the ability to fully assess Skilling's track record. Transparency regarding company financial health, operational history, and regulatory compliance status would strengthen the overall trust assessment for potential clients.

User Experience Evaluation (8/10)

Overall user satisfaction appears positive based on available feedback, though specific user experience metrics and detailed testimonials were not extensively documented in reviewed materials. The multi-platform approach and commission-free trading model likely contribute to positive user perceptions, particularly among cost-conscious traders.

The simplified account structure and streamlined service approach may appeal to traders seeking straightforward trading solutions without complex account hierarchies or extensive administrative requirements. However, more experienced traders might find the apparently limited customization options restrictive compared to brokers offering more sophisticated account management features.

Registration and verification processes were not specifically detailed, though compliance with regulatory requirements suggests standard industry procedures for identity verification and account approval. The efficiency and user-friendliness of these processes significantly impact initial user experience and broker selection decisions.

This evaluation notes that while general user satisfaction appears positive, the absence of specific feedback about common user complaints, platform issues, or service limitations represents a gap in comprehensive user experience assessment. Prospective traders would benefit from seeking current user reviews and testimonials to supplement this analysis.

Conclusion

This comprehensive skilling review reveals a broker that offers solid fundamentals for traders seeking commission-free CFD and forex trading across multiple platforms. Skilling's regulatory compliance, diverse instrument range, and multi-platform approach create a foundation suitable for small to medium-sized retail investors entering or participating in online trading markets.

The broker's primary strengths include its commission-free trading model, regulatory oversight from reputable authorities, and flexibility through multiple trading platforms. However, the evaluation also highlights significant information gaps regarding specific account conditions, customer service quality, and detailed operational metrics that modern traders typically expect when selecting a broker.

Skilling appears most suitable for cost-conscious traders who value platform flexibility and regulatory compliance over advanced features or premium services. The broker may be particularly appropriate for beginning to intermediate traders who prioritize straightforward trading conditions and competitive costs over sophisticated analytical tools or premium account features.