Bullseye 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive bullseye review examines the trading platform and services offered by Bullseye Markets. It focuses on their multi-asset trading capabilities and retail-focused approach. Based on available information, Bullseye operates primarily through their Bull's-Eye Broker 4 platform. This platform caters specifically to retail traders and investors seeking access to forex and CFD markets. The platform positions itself as a comprehensive solution for traders looking to engage with multiple asset classes through a single interface.

Our analysis reveals that while Bullseye offers modern trading technology through their Bull's-Eye Broker 4 system, there are significant gaps in publicly available information regarding regulatory oversight, detailed account conditions, and verified user feedback. The broker appears to target retail investors with their multi-asset platform approach. However, specific details about pricing structures, minimum deposits, and customer support remain limited in available documentation. This creates challenges for potential clients seeking comprehensive information before making trading decisions.

Important Notice

This evaluation is based on publicly available information about Bullseye's trading services and platforms. Readers should note that information regarding regulatory status across different jurisdictions was not clearly specified in available sources. Our assessment methodology incorporates analysis of platform features, available trading instruments, and publicly accessible broker information.

Due to limited detailed information in available sources, some aspects of this review may require direct verification with the broker. Potential clients are strongly advised to conduct independent research and verify all terms, conditions, and regulatory status before opening any trading accounts.

Rating Framework

Broker Overview

Bullseye Markets operates as a trading platform provider focusing on retail traders and individual investors through their proprietary Bull's-Eye Broker 4 system. According to available information from software review platforms, the broker has developed a multi-asset trading environment designed to accommodate various trading strategies and investment approaches. The platform appears to emphasize accessibility for retail participants while maintaining professional-grade trading capabilities.

The broker's primary business model centers around providing access to forex markets and contracts for difference. This enables clients to trade various financial instruments through a unified platform interface. Bull's-Eye Broker 4 represents their main technological offering, featuring tools and resources specifically designed for retail trading environments. The platform architecture suggests a focus on user-friendly design while maintaining the functionality required for serious trading activities.

Based on available documentation, Bullseye positions itself within the competitive retail trading space by offering multi-asset capabilities through their specialized platform. However, specific details regarding the company's establishment date, corporate background, and detailed operational history remain unclear in publicly accessible sources. This may be a consideration for traders seeking comprehensive broker transparency.

Regulatory Status: Available sources do not provide clear information about specific regulatory oversight or licensing jurisdictions for Bullseye Markets. This represents a significant information gap for potential clients.

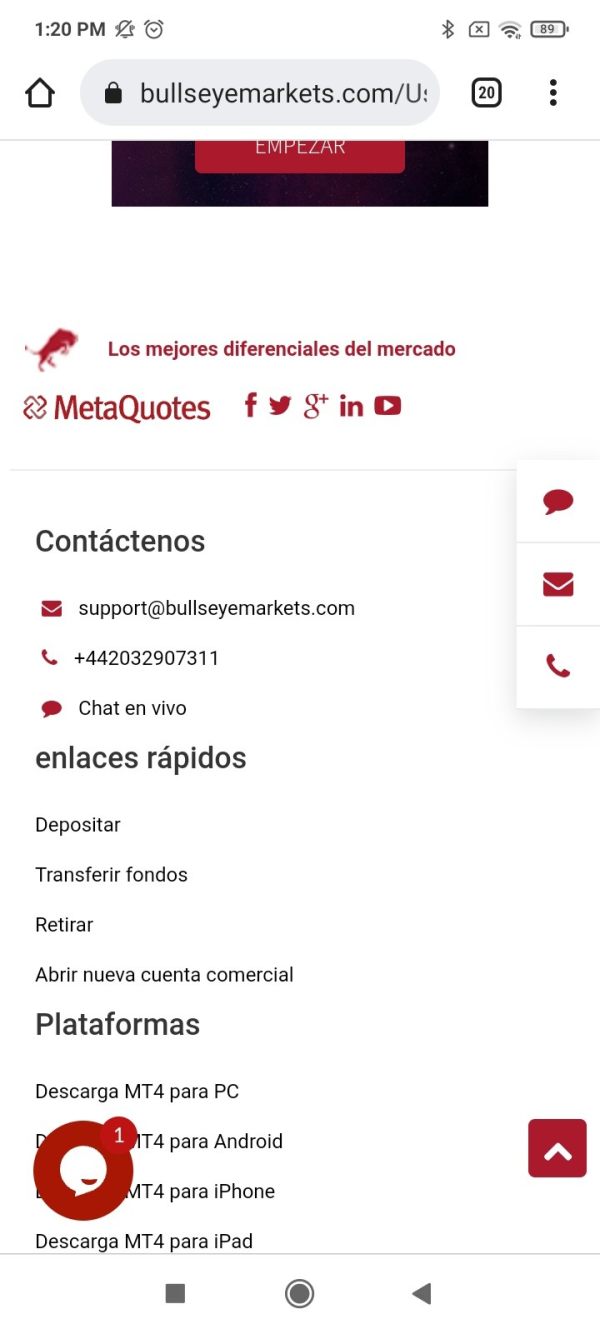

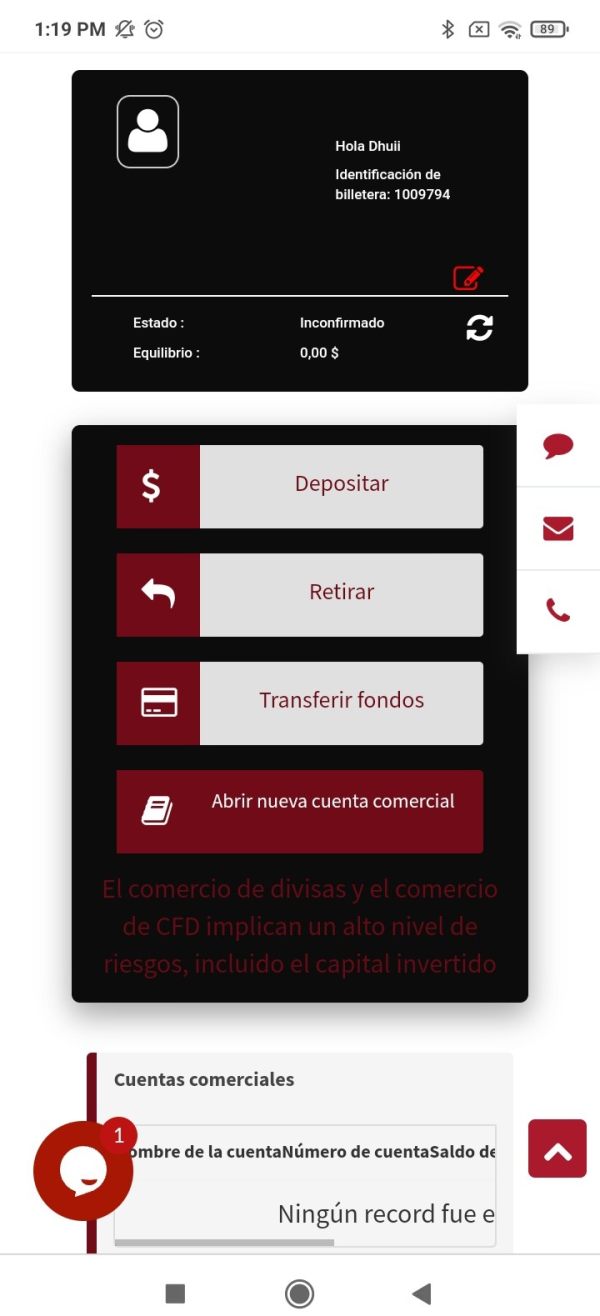

Deposit and Withdrawal Methods: Specific information regarding available funding methods, processing times, and associated fees was not detailed in accessible sources. This requires direct broker contact for clarification.

Minimum Deposit Requirements: Exact minimum deposit amounts and account funding requirements are not specified in available documentation. This makes it difficult to assess accessibility for different trader categories.

Bonuses and Promotions: Current promotional offerings, welcome bonuses, or trading incentives were not mentioned in available sources. This suggests either no current promotions or limited public disclosure.

Tradeable Assets: The platform offers access to foreign exchange markets and contracts for difference. However, specific instrument counts and available markets require further verification.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs was not available in reviewed sources. This represents a crucial information gap for cost-conscious traders.

Leverage Ratios: Specific leverage offerings for different asset classes and account types were not detailed in available materials.

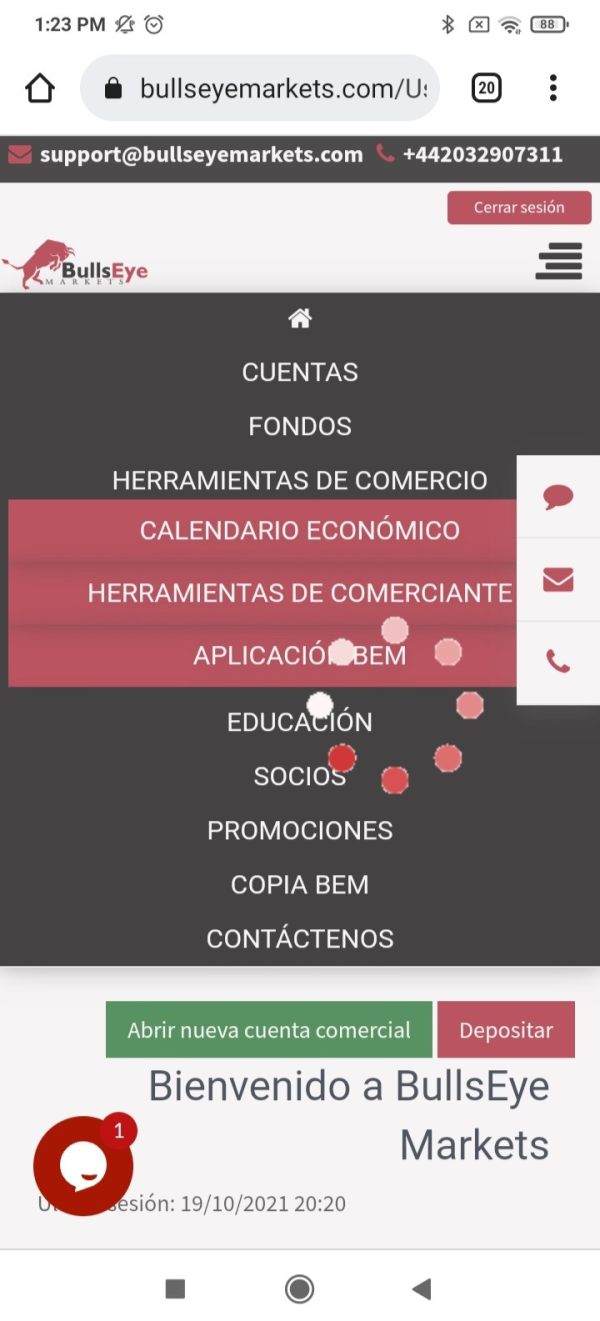

Platform Options: Bull's-Eye Broker 4 serves as the primary trading platform. Details about mobile applications, web-based access, or alternative platform options require clarification.

Geographic Restrictions: Information about restricted countries or regional limitations was not specified in available sources.

Customer Support Languages: Available language support for customer service was not detailed in reviewed materials.

This bullseye review highlights the need for potential clients to seek additional information directly from the broker regarding these essential trading details.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of Bullseye's account conditions faces significant limitations due to insufficient publicly available information. Standard account evaluation criteria including account types, minimum deposit requirements, account opening procedures, and special account features such as Islamic accounts could not be thoroughly evaluated based on available sources. This information gap represents a substantial concern for potential clients seeking to understand their options before committing to the platform.

Without detailed account specifications, it becomes challenging to determine whether Bullseye offers tiered account structures, professional account options, or specialized services for different trader categories. The absence of clear minimum deposit information also makes it difficult to assess the broker's accessibility for traders with varying capital levels. Account opening procedures, verification requirements, and timeframes remain unspecified. This could impact trader decisions regarding platform selection.

The lack of detailed account condition information in this bullseye review suggests that potential clients must engage directly with the broker to obtain essential details about account setup, funding requirements, and available account features. This additional step may be inconvenient for traders comparing multiple brokers simultaneously.

Bullseye demonstrates strength in their platform offerings through the Bull's-Eye Broker 4 system. According to software review platforms, this system provides multi-asset trading capabilities designed for retail traders and investors. The platform appears to incorporate various trading tools and features necessary for comprehensive market participation. However, specific tool descriptions and capabilities require further investigation.

The multi-asset nature of the Bull's-Eye Broker 4 platform suggests integration of various analytical tools, charting capabilities, and trading features within a unified interface. This approach can benefit traders seeking comprehensive functionality without managing multiple platform relationships. However, detailed information about specific research resources, market analysis tools, educational materials, and automated trading support was not available in reviewed sources.

While the platform receives recognition in software directories for its multi-asset capabilities, the absence of detailed tool specifications, research resource descriptions, and educational support information limits the ability to provide comprehensive assessment. Advanced features such as algorithmic trading support, advanced charting packages, and integrated market research remain unspecified in available documentation.

Customer Service and Support Analysis

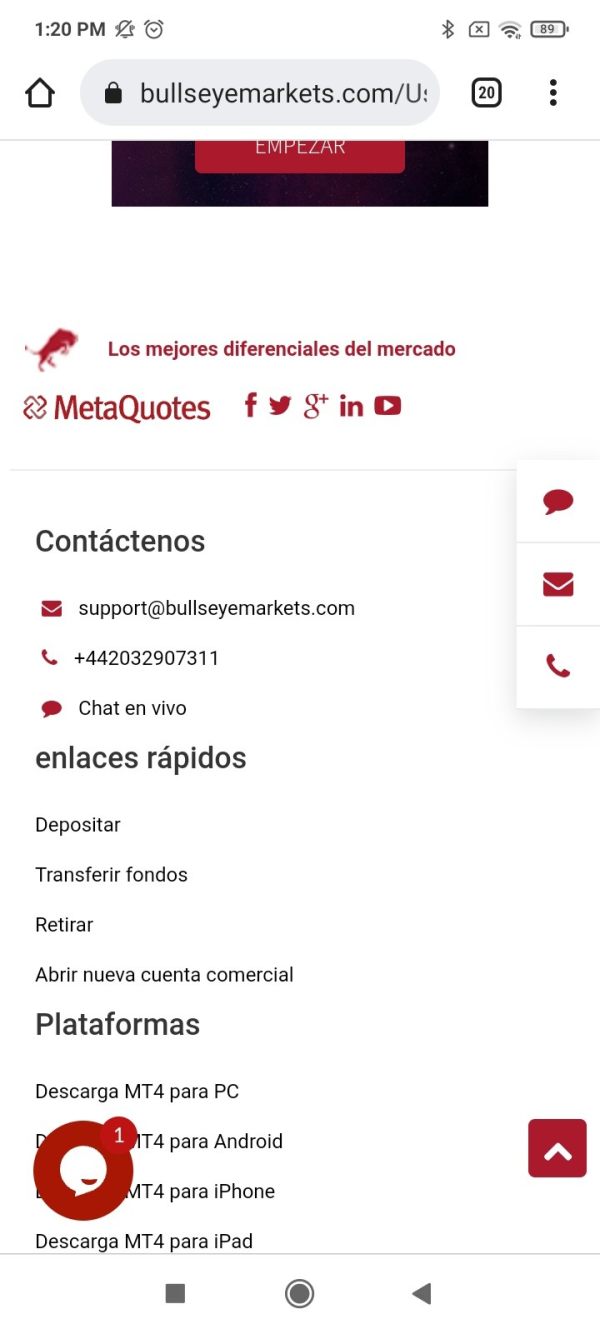

Evaluation of Bullseye's customer service capabilities faces significant constraints due to limited available information about support channels, response times, and service quality metrics. Essential customer service elements including available contact methods, support hours, language options, and response time expectations were not detailed in accessible sources. This makes comprehensive assessment impossible.

The absence of customer service information raises questions about support accessibility, particularly for traders requiring assistance during different market hours or in various languages. Without details about available support channels such as live chat, telephone support, email assistance, or help desk tickets, potential clients cannot adequately assess whether the broker's support infrastructure meets their requirements.

Customer service quality indicators such as average response times, issue resolution procedures, escalation processes, and customer satisfaction metrics remain unspecified. This information gap extends to support availability during different market sessions, weekend support options, and emergency contact procedures. All of these can be crucial for active traders requiring timely assistance.

Trading Experience Analysis

Assessment of the trading experience with Bullseye's Bull's-Eye Broker 4 platform encounters limitations due to insufficient user feedback and detailed performance data in available sources. Platform stability, execution speed, order processing quality, and overall trading environment characteristics could not be thoroughly evaluated based on accessible information.

The multi-asset platform design suggests potential for comprehensive trading experiences across different market segments. However, specific performance metrics, execution statistics, and user experience data remain unavailable. Mobile trading capabilities, platform responsiveness, and cross-device functionality details were not specified in reviewed materials. This limits the ability to assess modern trading requirements.

Without verified user feedback regarding platform performance, order execution quality, system reliability, and overall trading satisfaction, this bullseye review cannot provide definitive conclusions about the practical trading experience. Technical performance data, uptime statistics, and execution speed measurements would be necessary for comprehensive trading experience evaluation.

Trust and Regulation Analysis

The trust and regulatory assessment of Bullseye faces substantial challenges due to the absence of clear regulatory information in available sources. Regulatory oversight, licensing jurisdictions, compliance standards, and supervisory authority details were not specified. This creates significant uncertainty regarding the broker's regulatory status and associated client protections.

Fund safety measures, segregation policies, compensation schemes, and deposit protection arrangements remain unspecified in available documentation. These elements are crucial for trader confidence and regulatory compliance assessment. Without clear regulatory framework information, potential clients cannot adequately evaluate the safety and security of their trading capital.

Company transparency metrics including ownership disclosure, financial reporting, regulatory filing access, and corporate governance information were not available in reviewed sources. The absence of regulatory verification data, compliance history, and supervisory authority relationships represents a significant concern for traders prioritizing regulatory oversight and client protection measures.

User Experience Analysis

User experience evaluation for Bullseye encounters significant limitations due to minimal available user feedback and experience data in accessible sources. Overall user satisfaction metrics, platform usability assessments, interface design feedback, and general user sentiment remain largely unspecified. This prevents comprehensive user experience analysis.

The target demographic appears to focus on retail traders and individual investors based on the Bull's-Eye Broker 4 platform positioning. However, specific user experience data supporting this assessment is limited. Registration procedures, account verification processes, funding experience, and general platform navigation feedback were not detailed in available sources.

Without substantial user feedback compilation, common user concerns, satisfaction ratings, and experience testimonials, this assessment cannot provide definitive conclusions about actual user satisfaction levels. Platform usability, learning curve considerations, and overall user journey quality require additional verification through direct user input and comprehensive feedback collection.

Conclusion

This bullseye review reveals that while Bullseye Markets offers trading services through their Bull's-Eye Broker 4 platform with multi-asset capabilities, significant information gaps exist regarding essential broker details including regulatory status, account conditions, and verified user experiences. The platform appears designed for retail traders and investors seeking access to forex and CFD markets. However, comprehensive evaluation requires additional information gathering.

The primary strength identified lies in the multi-asset trading platform approach, which could benefit traders seeking unified access to different market segments. However, the absence of detailed regulatory information, cost structures, and user feedback represents substantial limitations for potential clients requiring comprehensive broker assessment before making trading decisions.

Potential clients should conduct thorough due diligence including direct broker contact to verify regulatory status, account conditions, costs, and service details before proceeding with account opening or trading activities.