Big Uncle 2025 Review: Everything You Need to Know

Executive Summary

Big Uncle presents itself as an online forex broker offering trading services across multiple asset classes. This big uncle review reveals significant concerns that potential traders must carefully consider before making any decisions. Based on warnings from the New Zealand Financial Markets Authority and numerous user complaints, Big Uncle exhibits characteristics that raise serious questions about its legitimacy and trustworthiness.

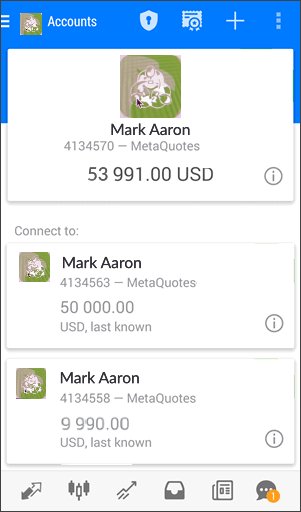

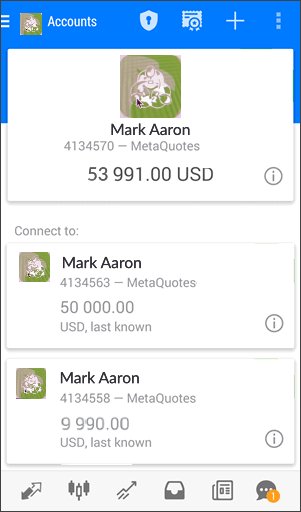

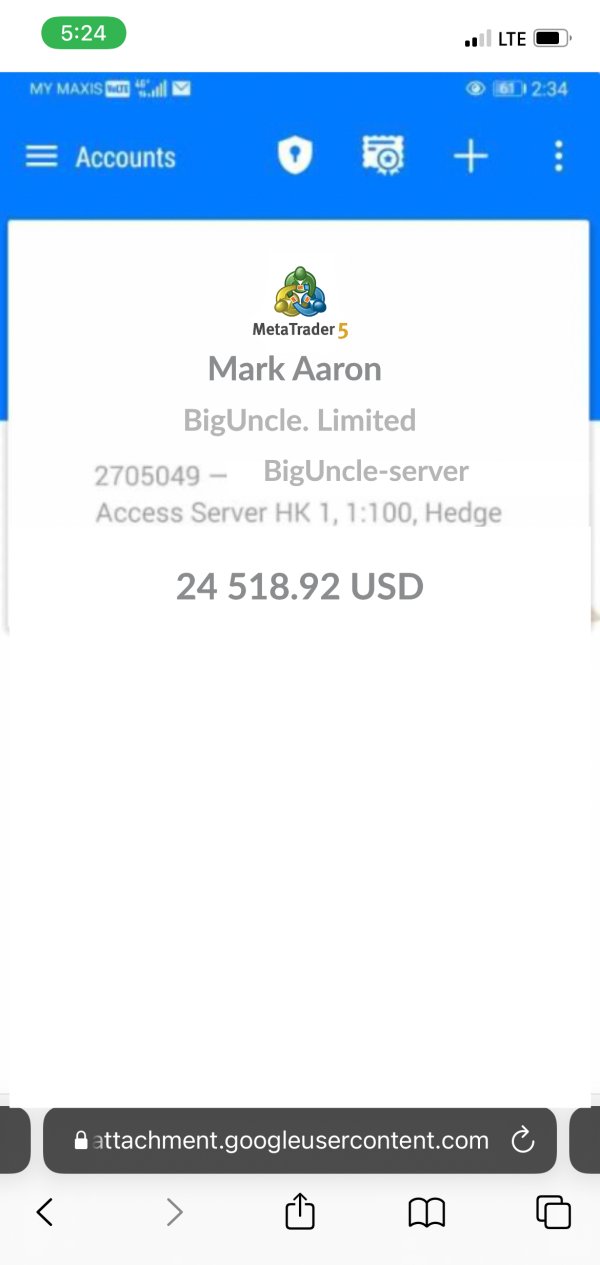

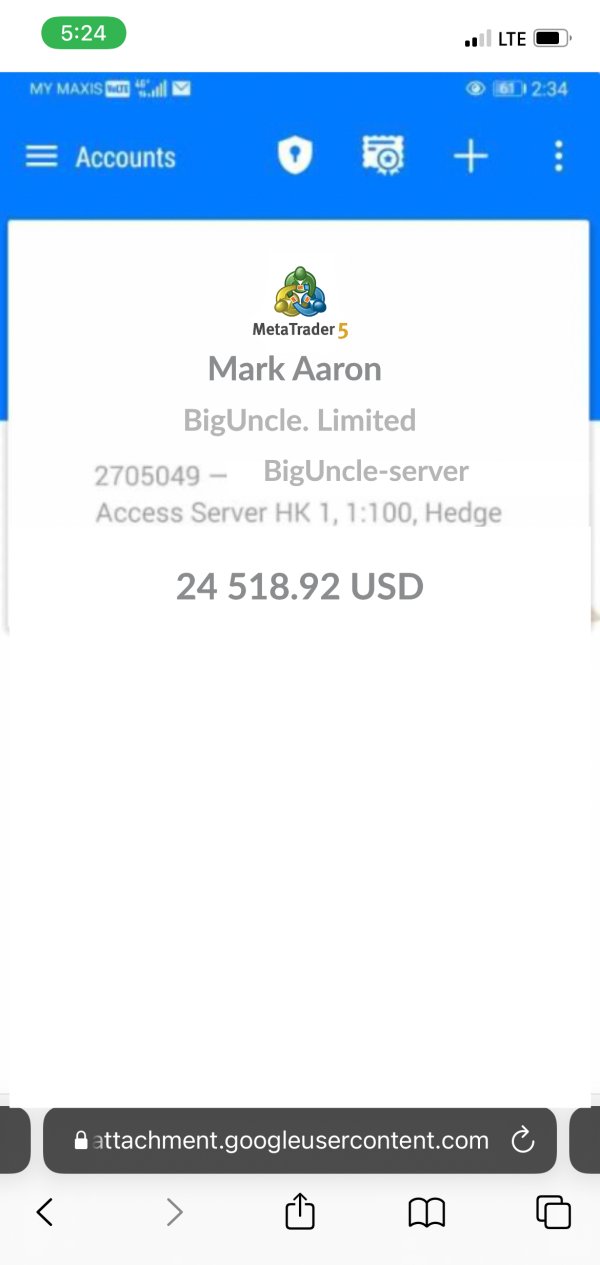

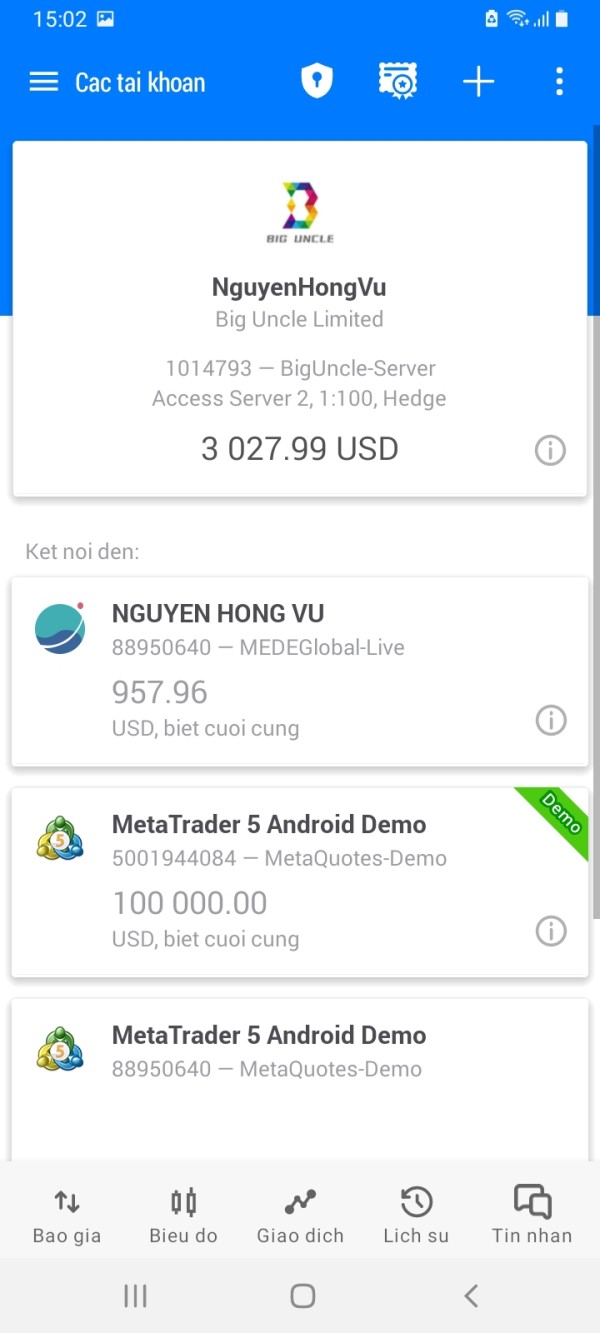

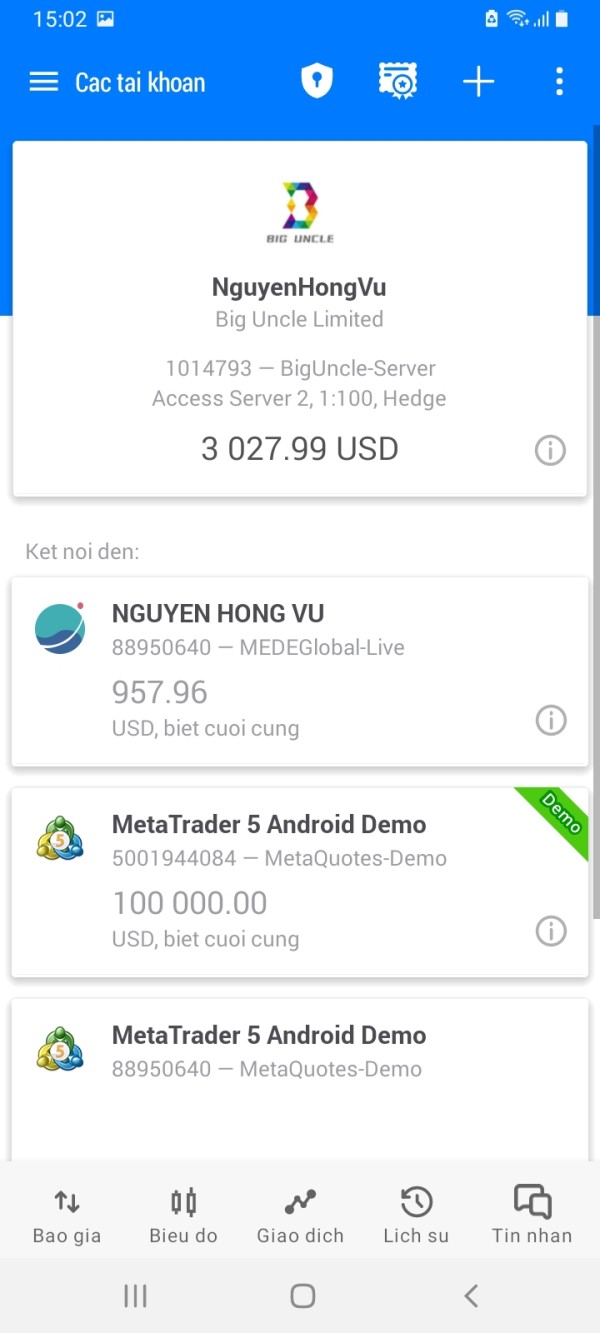

The broker claims to provide access to popular trading platforms including MT5 and MT Mobile. These platforms support various financial instruments such as forex pairs, indices, precious metals like gold and silver, and energy commodities including oil. However, the lack of transparent regulatory information and the absence of clear operational details create a concerning picture for potential clients who want reliable trading services.

Our comprehensive analysis indicates that while Big Uncle may appeal to traders seeking access to diverse asset classes through familiar platforms, the numerous red flags surrounding its operations make it unsuitable for most retail traders. The FMA's warning, combined with widespread user dissatisfaction and complaints about service quality, positions this broker in the high-risk category that requires extreme caution from anyone considering their services.

Important Notice

This evaluation is based on publicly available information and user feedback collected from various sources. Big Uncle's regulatory status varies across different jurisdictions, and traders should be aware that the broker's operations may not comply with regulatory standards in their respective countries. The New Zealand FMA has issued specific warnings regarding this entity, though no specific license number has been referenced in available documentation.

Readers should note that regulatory landscapes differ significantly between regions. What may be permissible in one jurisdiction could be prohibited in another, creating confusion for international traders. This review reflects the current state of available information and should not be considered as financial advice or a recommendation to engage with this broker.

Rating Framework

Broker Overview

Big Uncle operates as an online forex broker in the competitive retail trading market. Specific details about its establishment date and corporate background remain unclear in available documentation, which raises immediate concerns about transparency. The company positions itself as a provider of multi-asset trading services, targeting retail traders who seek access to various financial markets through established trading platforms.

According to available information, Big Uncle's business model centers on providing online brokerage services with a focus on forex trading. The company has expanded its offering to include other popular trading instruments, though the scope and quality of these services remain questionable. The broker's approach appears to target traders looking for platform diversity and asset variety, though this big uncle review reveals significant gaps in transparency and regulatory compliance.

The broker claims to offer MT5 and MT Mobile trading platforms. These platforms provide access to major asset classes including foreign exchange pairs, stock indices, precious metals such as gold and silver, and energy commodities including crude oil. However, the lack of detailed information about the company's operational structure, management team, and regulatory compliance raises substantial concerns about its legitimacy and long-term viability in the competitive brokerage landscape.

Regulatory Status: Big Uncle's regulatory situation presents significant concerns, with the New Zealand Financial Markets Authority issuing warnings about the entity's operations. Specific licensing details remain unclear in available documentation, creating uncertainty about the broker's legal standing.

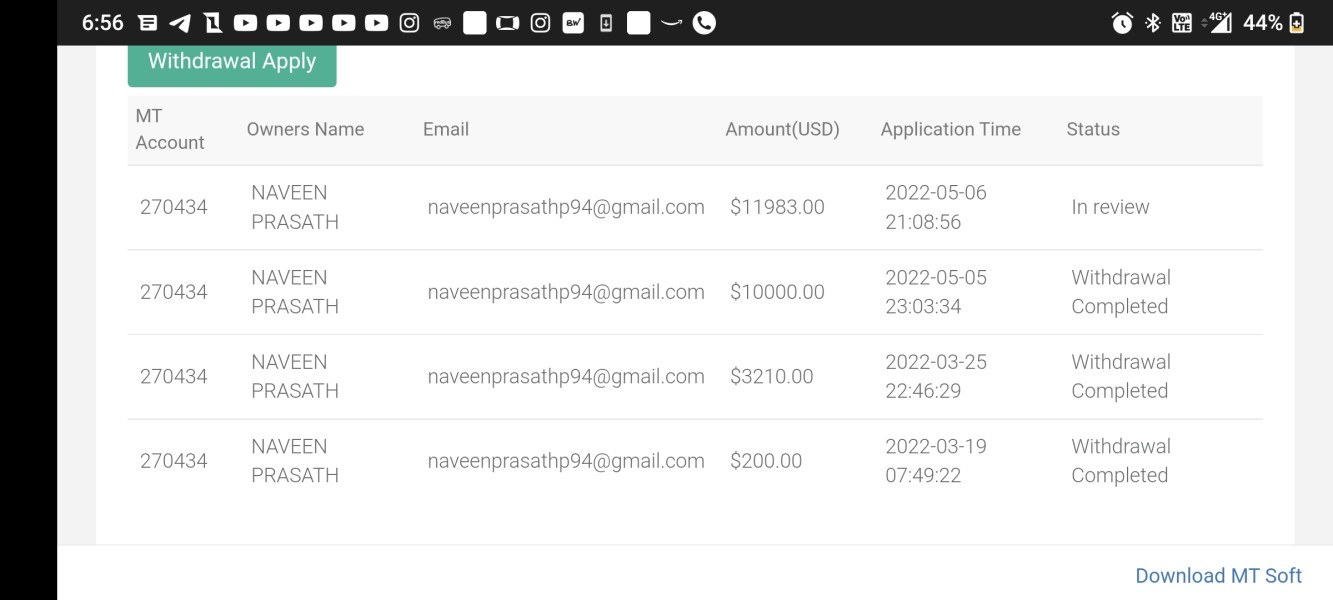

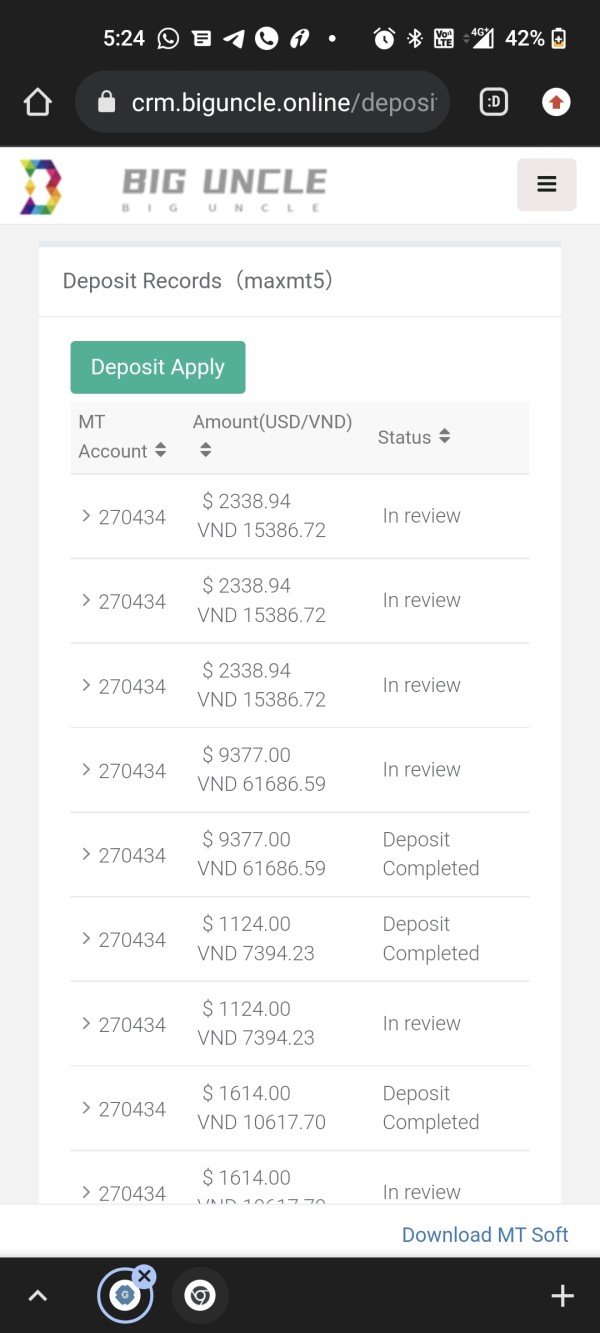

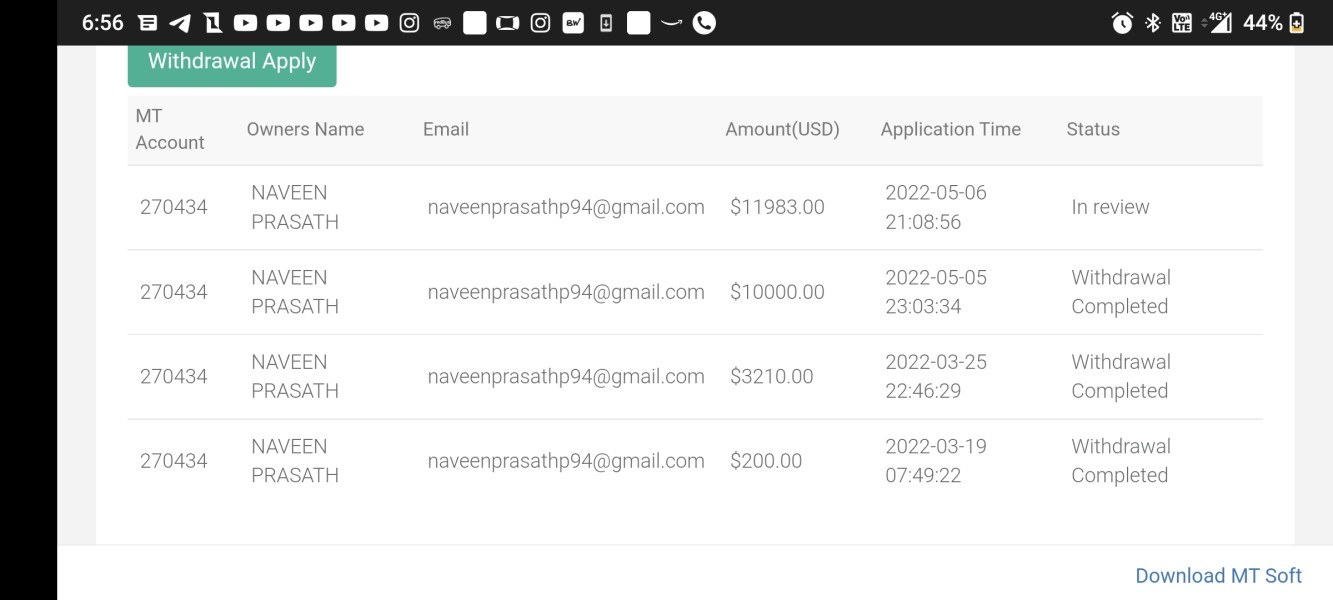

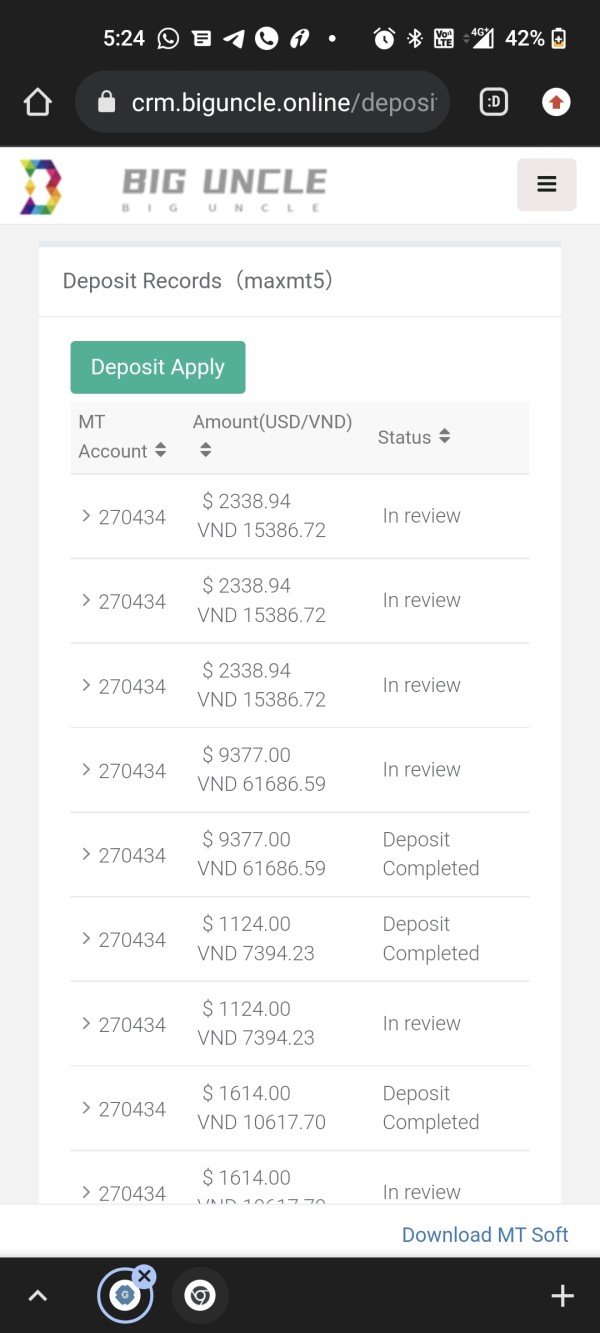

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available sources. This creates uncertainty for potential clients who need to understand how they can fund their accounts and access their money.

Minimum Deposit Requirements: The broker's minimum deposit requirements are not specified in available documentation. This makes it difficult for potential traders to assess accessibility and account opening requirements before committing to the platform.

Bonus and Promotional Offers: Information regarding welcome bonuses, promotional offers, or trading incentives is not available in current sources. This suggests either absence of such programs or lack of transparency in marketing materials, both of which are concerning for potential clients.

Available Trading Assets: The broker supports multiple asset classes including forex currency pairs, major stock indices, precious metals, and energy commodities. This provides traders with diversified market access opportunities, though the quality of execution across these assets remains questionable.

Cost Structure: Specific details regarding spreads, commissions, overnight fees, and other trading costs are not clearly outlined in available information. This makes cost comparison with other brokers challenging for potential clients who need to understand the true cost of trading.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in current documentation. This leaves traders uncertain about available trading flexibility and risk management parameters, which are crucial for informed trading decisions.

Platform Options: Big Uncle provides MT5 and MT Mobile platforms, offering traders access to established and widely-used trading software. These platforms come with standard charting and analysis capabilities that many traders find familiar and useful.

Geographic Restrictions: Specific information about restricted countries or regional limitations is not detailed in available sources. Regulatory warnings suggest potential accessibility issues in certain jurisdictions, though the full scope remains unclear.

Customer Support Languages: Available customer service languages and communication options are not specified in current documentation. This potentially limits accessibility for international clients seeking this big uncle review information and ongoing support services.

Detailed Rating Analysis

Account Conditions Analysis

Big Uncle's account conditions receive a poor rating due to the significant lack of transparency in fundamental trading parameters. The absence of clear information regarding minimum deposit requirements makes it impossible for potential traders to assess the broker's accessibility or target market positioning effectively. Without specific details about account types, tier structures, or special features, traders cannot make informed decisions about whether the broker's offerings align with their trading needs and financial capabilities.

The lack of information about account opening procedures, verification requirements, and documentation processes raises additional concerns about operational transparency. Industry-standard brokers typically provide comprehensive details about their account structures, including demo account availability, Islamic account options for Sharia-compliant trading, and various account tiers with different features and benefits that help traders choose the right option.

User feedback suggests that account-related inquiries often go unanswered or receive inadequate responses. This indicates poor customer onboarding processes that can frustrate new clients from the very beginning of their relationship with the broker. The absence of clear terms and conditions regarding account maintenance, inactivity fees, or account closure procedures further compounds the uncertainty surrounding Big Uncle's account management practices.

Compared to established brokers in the industry, Big Uncle's lack of account condition transparency represents a significant disadvantage. This undermines trader confidence and makes it difficult to assess the broker's competitiveness in the market where transparency is increasingly valued by informed traders. This big uncle review finds that the broker's approach to account information disclosure falls well below industry standards.

Big Uncle receives an average rating for tools and resources, primarily based on its provision of MT5 and MT Mobile platforms. These are well-established and feature-rich trading environments that many traders appreciate for their comprehensive functionality. The MetaTrader 5 platform offers comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors, providing traders with industry-standard functionality for market analysis and trade execution.

The inclusion of MT Mobile extends trading accessibility to smartphone and tablet users. This allows for position monitoring and trade management while away from desktop computers, which is essential for modern traders who need flexibility. However, the quality of platform implementation, server reliability, and any customizations or additional features specific to Big Uncle remain unclear from available information.

The broker's asset coverage spanning forex, indices, precious metals, and energy commodities provides reasonable diversification opportunities. This appeals to traders seeking multi-market exposure through a single platform, though the execution quality across different asset classes remains questionable. However, the absence of detailed information about research resources, market analysis, educational materials, or proprietary trading tools limits the overall value proposition for traders seeking comprehensive support resources.

User feedback regarding platform performance and tool quality appears mixed. Some traders appreciate the familiar MT5 environment while others report concerns about execution quality and platform stability during volatile market conditions. The lack of information about additional resources such as economic calendars, market news feeds, or educational content suggests limited value-added services beyond basic platform access.

Customer Service Analysis

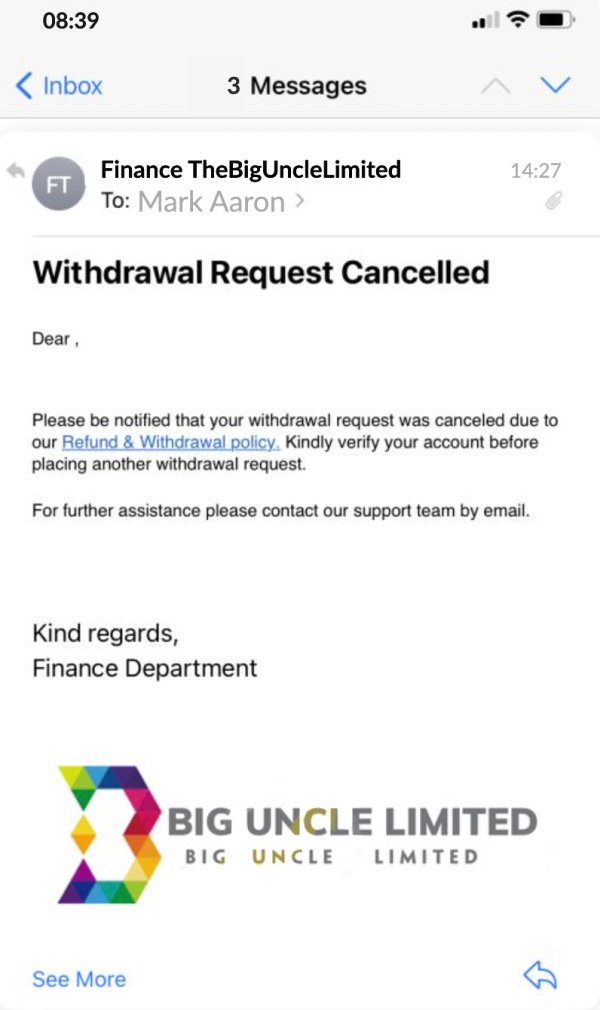

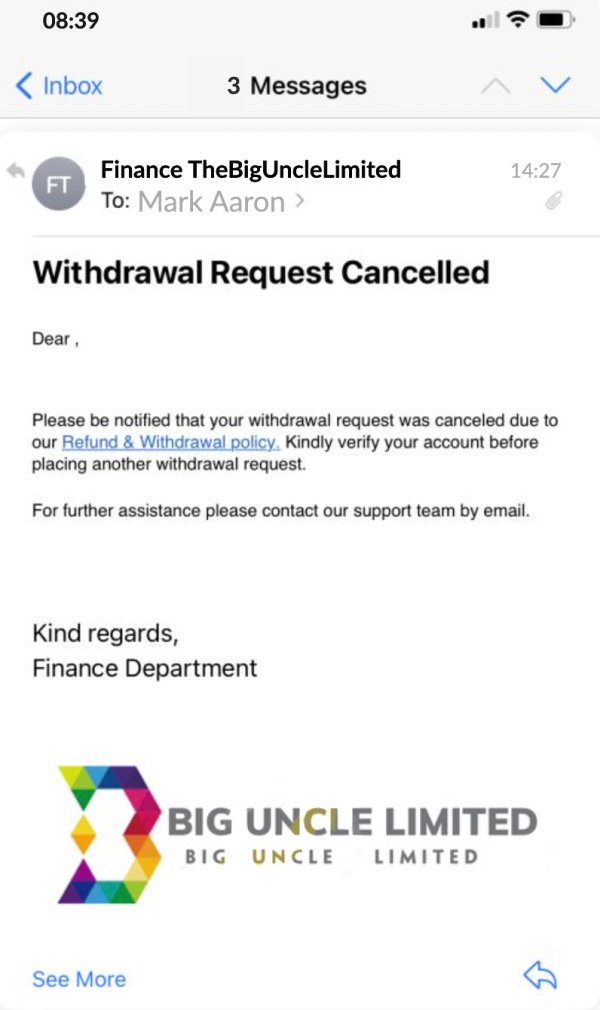

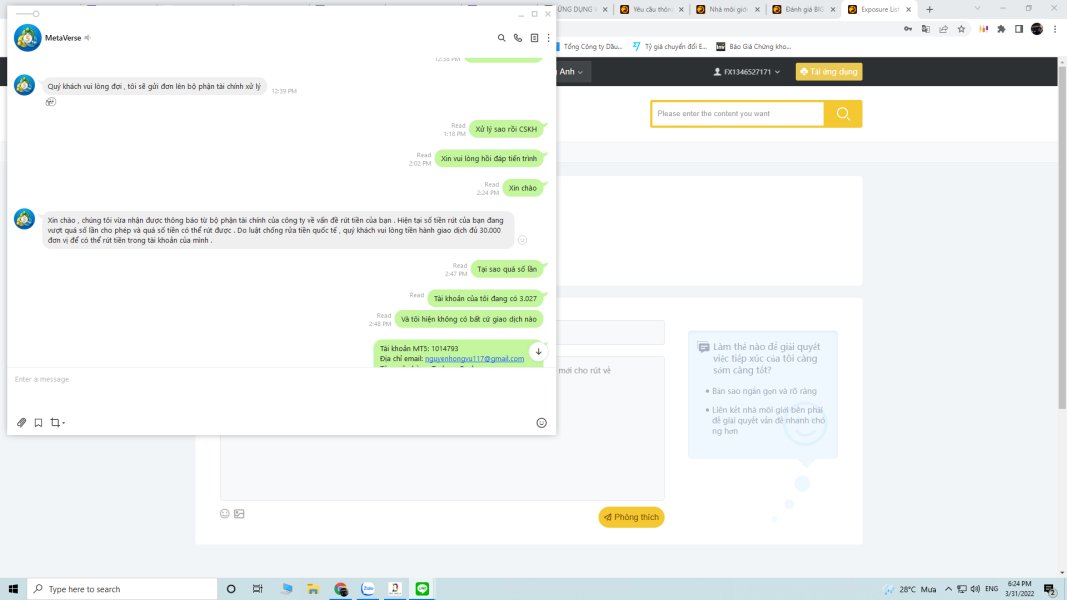

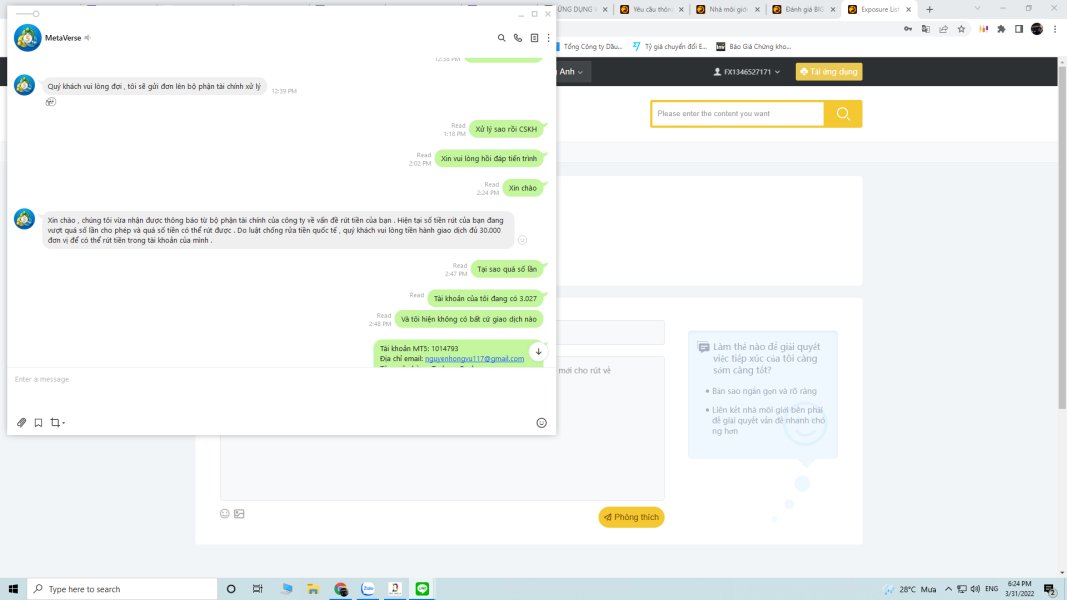

Customer service quality emerges as a significant weakness in this big uncle review. User feedback consistently highlights poor responsiveness and inadequate problem resolution capabilities that frustrate clients seeking basic support. Multiple complaints suggest that client inquiries often receive delayed responses or remain unaddressed entirely, creating frustration for traders seeking assistance with account issues, technical problems, or trading-related questions.

The absence of clear information about available support channels, operating hours, and response time commitments indicates a lack of structured customer service protocols. Professional brokers typically provide multiple contact methods including live chat, email, and telephone support with clearly defined service level agreements and multilingual capabilities to serve diverse client bases effectively.

User reports suggest that when responses are provided, the quality of assistance often falls short of resolving underlying issues. Support staff appear to lack adequate training or authority to address complex problems, leaving clients frustrated and without proper solutions. This pattern of inadequate service delivery significantly impacts user satisfaction and broker reliability perception.

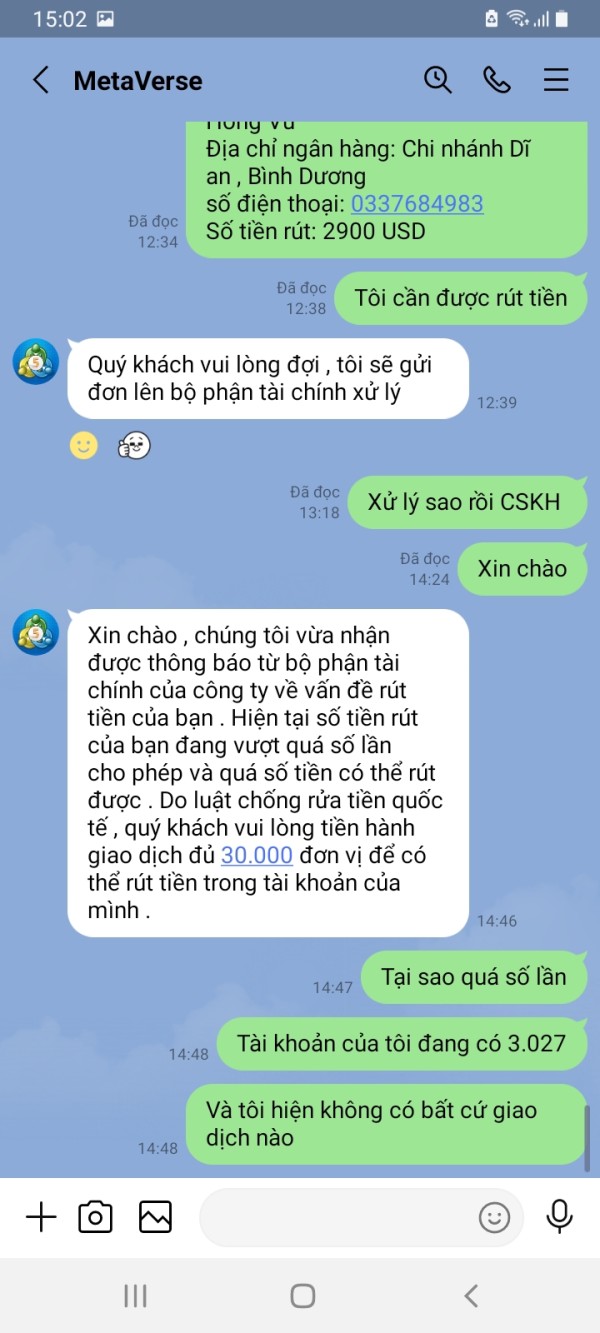

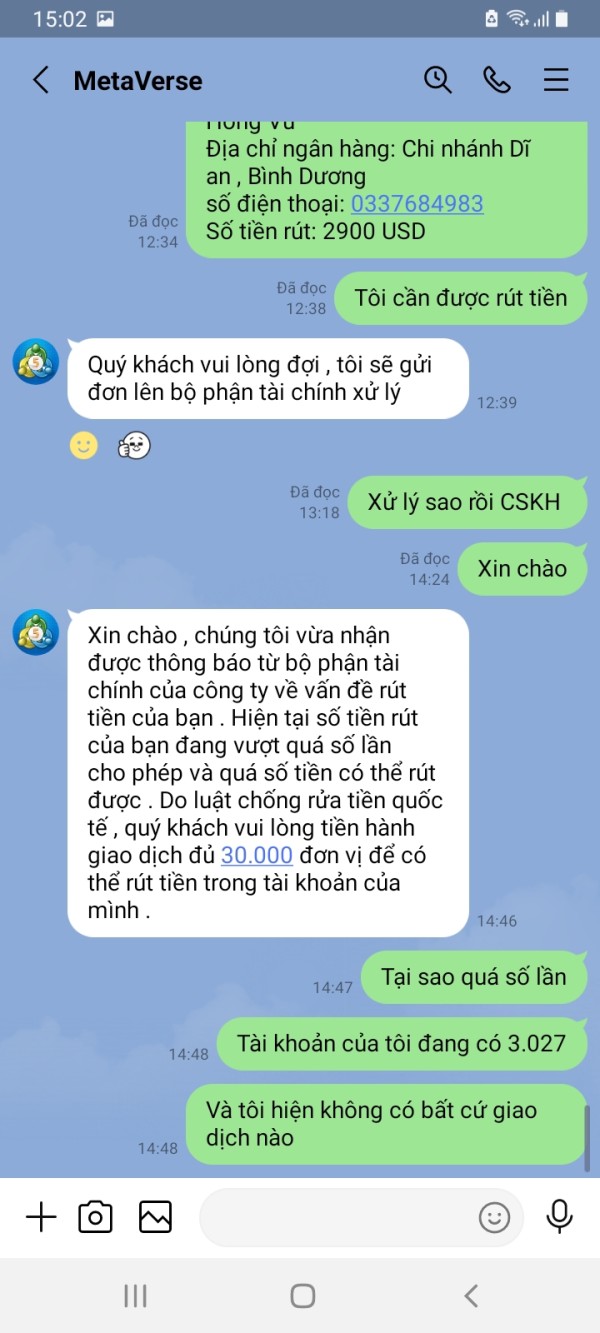

The customer service deficiencies become particularly problematic when combined with the regulatory concerns and transparency issues surrounding Big Uncle's operations. Traders facing account problems or withdrawal difficulties report limited success in obtaining satisfactory resolutions through official support channels. This contributes to the overall negative user experience and trust deficit that characterizes this broker's reputation.

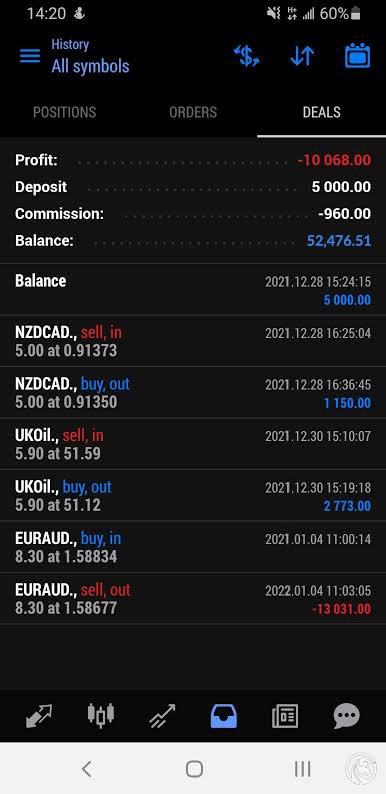

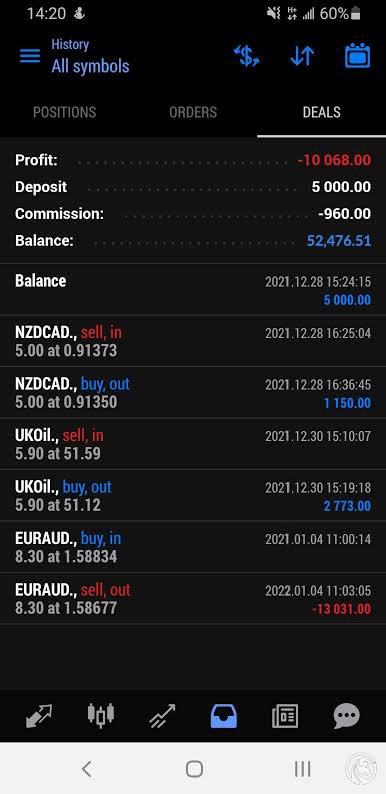

Trading Experience Analysis

The trading experience with Big Uncle receives a middling rating, reflecting the mixed nature of user feedback regarding platform performance and execution quality. While the MT5 platform provides a familiar and feature-rich trading environment, user reports suggest inconsistent performance in critical areas such as order execution speed, price accuracy, and platform stability during volatile market conditions that can significantly impact trading results.

Some traders report experiencing slippage and execution delays, particularly during high-impact news events or periods of increased market volatility. These execution issues can significantly impact trading performance and profitability, especially for strategies that rely on precise entry and exit timing or scalping approaches that require minimal latency for success.

The mobile trading experience through MT Mobile appears to provide basic functionality for position monitoring and trade management. Specific user feedback about mobile platform performance and feature completeness is limited in available sources, making it difficult to assess the quality of mobile trading capabilities. The absence of detailed performance metrics or third-party testing data makes it difficult to objectively assess the technical quality of the trading infrastructure.

Platform stability concerns and occasional connectivity issues have been reported by some users. The frequency and severity of these problems remain unclear from available feedback, though any technical disruptions can be costly for active traders. The overall trading experience appears adequate for basic trading activities but may not meet the expectations of professional or high-frequency traders who require consistently reliable execution and minimal technical disruptions.

This big uncle review indicates that while the fundamental trading infrastructure exists, the quality and reliability concerns prevent Big Uncle from achieving a higher rating in this category.

Trust and Reliability Analysis

Trust and reliability represent the most significant concerns in this comprehensive evaluation. Big Uncle receives a very poor rating due to multiple red flags that seriously undermine confidence in the broker's legitimacy and operational integrity. The warning issued by New Zealand's Financial Markets Authority represents a major regulatory concern that directly impacts the broker's credibility and trustworthiness in the eyes of potential clients.

The absence of clear regulatory licensing information, combined with limited transparency about corporate structure, management team, and operational history, creates an environment of uncertainty. This uncertainty is incompatible with the trust requirements of retail forex trading where clients must feel confident about their broker's legitimacy. Legitimate brokers typically provide comprehensive regulatory disclosures, licensing details, and corporate transparency to build client confidence and demonstrate their commitment to proper business practices.

User complaints and negative feedback patterns suggest systemic issues with the broker's operations. These include difficulties with withdrawals, poor customer service, and questionable business practices that raise serious concerns about the broker's intentions. These recurring themes in user feedback indicate fundamental problems with the broker's approach to client relationships and service delivery.

The lack of segregated account information, client fund protection details, and transparent risk disclosures further compounds trust concerns. Professional brokers operating under proper regulatory oversight typically provide clear information about client fund protection, regulatory compensation schemes, and risk management protocols that help clients understand how their investments are protected.

Third-party evaluations and industry assessments consistently highlight concerns about Big Uncle's operations. Multiple sources advise caution when considering this broker for trading activities, creating a consensus of concern within the trading community.

User Experience Analysis

The overall user experience with Big Uncle falls below industry standards. User feedback reveals significant dissatisfaction across multiple touchpoints of the client journey, from initial contact through ongoing trading relationships. From initial account inquiries through ongoing trading activities, users report frustrations with communication quality, service responsiveness, and problem resolution effectiveness.

The account opening and verification process appears to lack the streamlined efficiency that modern traders expect from professional brokers. Some users report delays and confusion regarding documentation requirements and approval timelines, creating negative first impressions that impact long-term satisfaction. The absence of clear guidance and proactive communication during onboarding creates negative first impressions that impact overall satisfaction.

Ongoing platform interaction reveals mixed experiences, with some users appreciating the familiar MT5 environment while others encounter technical issues. Execution problems or platform instability disrupt trading activities and create frustration for users who need reliable access to markets. The lack of comprehensive user guides, tutorial resources, or educational support materials limits the overall user experience quality.

Fund management experiences, including deposits and withdrawal processes, generate particular user frustration based on available feedback. Reports of delayed withdrawals, unclear fee structures, and poor communication regarding fund transfers contribute significantly to negative user perceptions and satisfaction ratings. The cumulative effect of these user experience deficiencies creates an environment where traders feel unsupported and uncertain about their broker relationship, leading to the below-average rating in this critical evaluation category.

Conclusion

This comprehensive big uncle review reveals a broker that presents significant risks and concerns that outweigh any potential benefits for retail traders. While Big Uncle offers access to popular trading platforms and multiple asset classes, the fundamental issues surrounding regulatory compliance, transparency, and service quality make it unsuitable for most trading needs where reliability and trust are paramount.

The broker may initially appeal to traders seeking diverse asset access through familiar platforms like MT5. However, the regulatory warnings, poor customer service, and trust deficits create an environment of unacceptable risk for serious trading activities. The lack of transparency in critical areas such as costs, terms, and operational details further compounds these concerns and makes informed decision-making nearly impossible.

The primary advantages include platform variety and multi-asset access, but these are significantly overshadowed by major disadvantages. These disadvantages include regulatory concerns, poor customer support, limited transparency, and widespread user dissatisfaction that characterizes the overall Big Uncle experience. Traders would be better served by selecting established, properly regulated brokers that prioritize client protection and service quality over flashy marketing claims.