Provident Capital 2025 Review: Everything You Need to Know

In 2025, Provident Capital continues to raise eyebrows within the trading community due to its lack of regulation and numerous user complaints. This review will delve into the broker's offerings, user experiences, and expert opinions to provide a comprehensive overview of what potential traders should consider before investing.

Note: It's essential to highlight that Provident Capital operates across various jurisdictions with multiple entities, which may lead to confusion regarding its legitimacy and regulatory status. This review aims to present a fair and accurate assessment based on available information.

Ratings Overview

We rate brokers based on user feedback, expert insights, and factual data.

Broker Overview

Founded in 2017, Provident Capital is a multi-asset brokerage that claims to provide services in forex, cryptocurrencies, and CFDs. The broker operates on the MetaTrader 5 platform, which is widely recognized for its user-friendly interface and robust trading features. However, despite its claims of being based in the UK, many reviews suggest that Provident Capital lacks valid regulatory oversight, particularly from reputable bodies such as the FCA. The absence of regulation raises significant concerns about the safety of traders' funds and the overall reliability of the broker.

Detailed Section

Regulatory Status:

Provident Capital is not regulated, which is a significant red flag for potential traders. Several sources indicate that the broker falsely claims to be regulated by the FCA, as it does not appear in the agency's records. This lack of oversight leaves traders vulnerable to various risks, including potential fraud and difficulties in fund withdrawal.

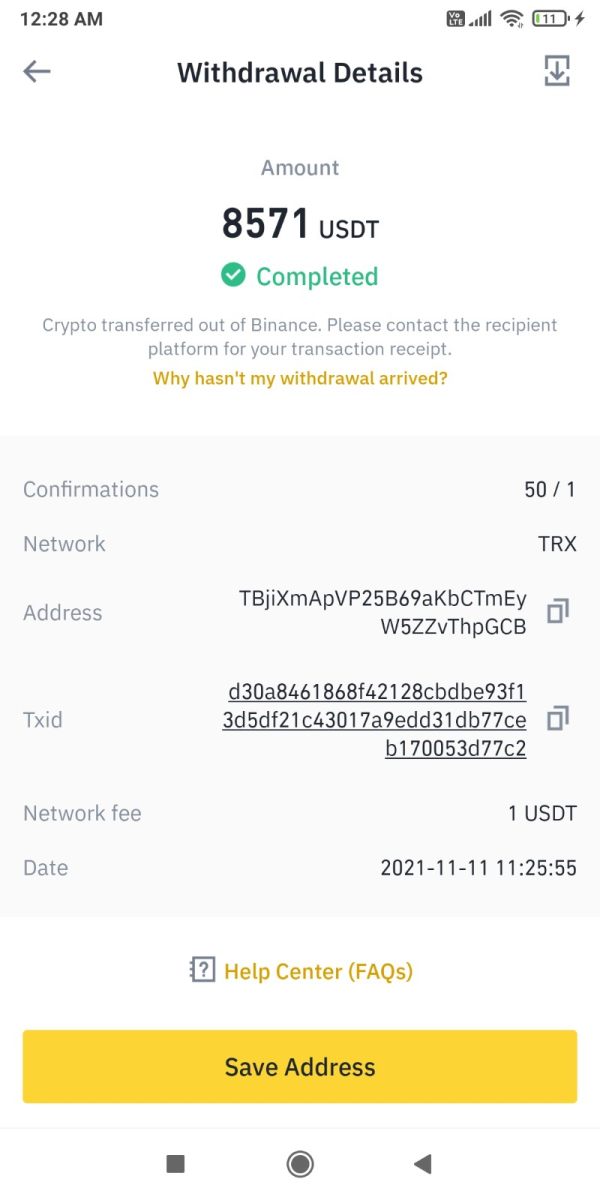

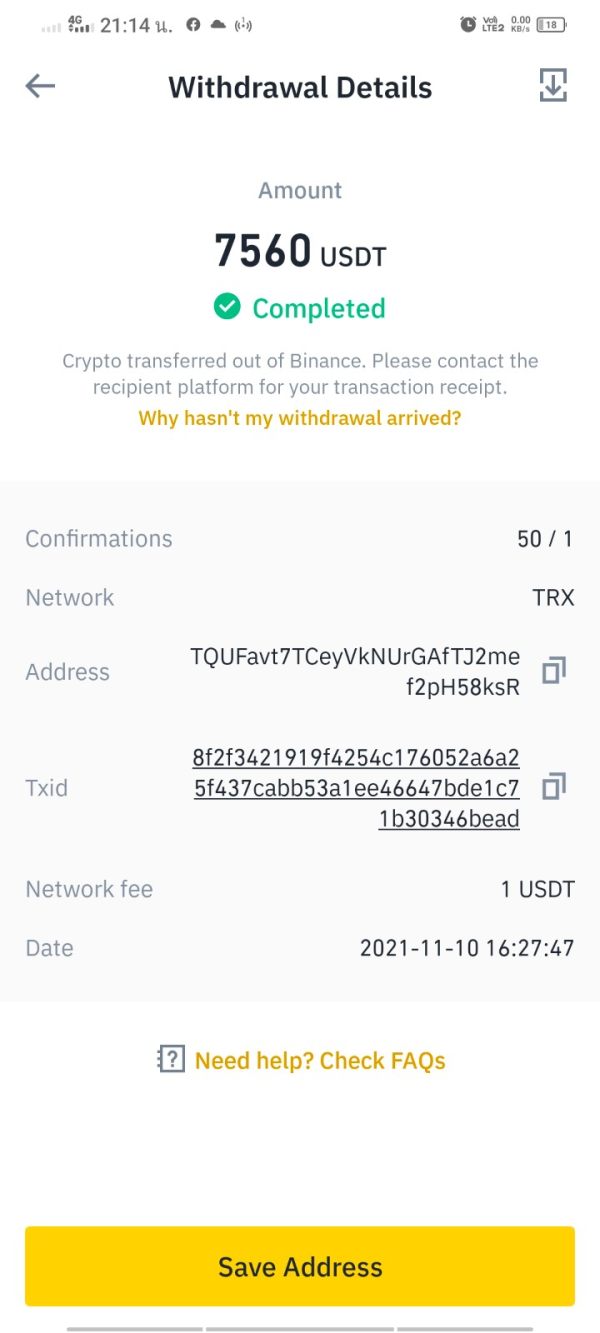

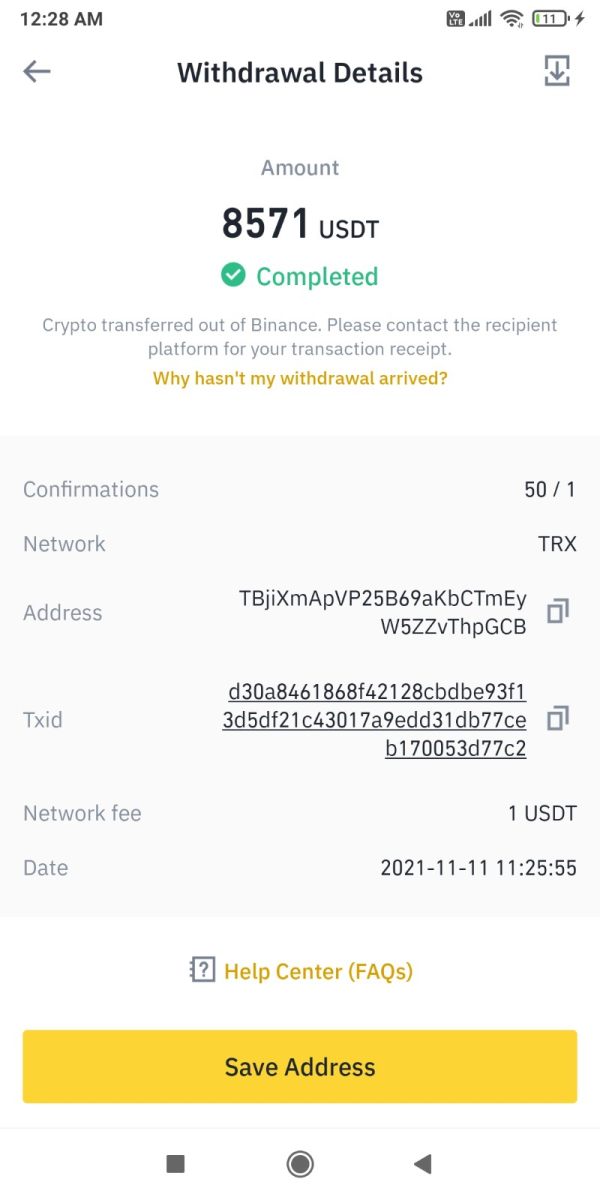

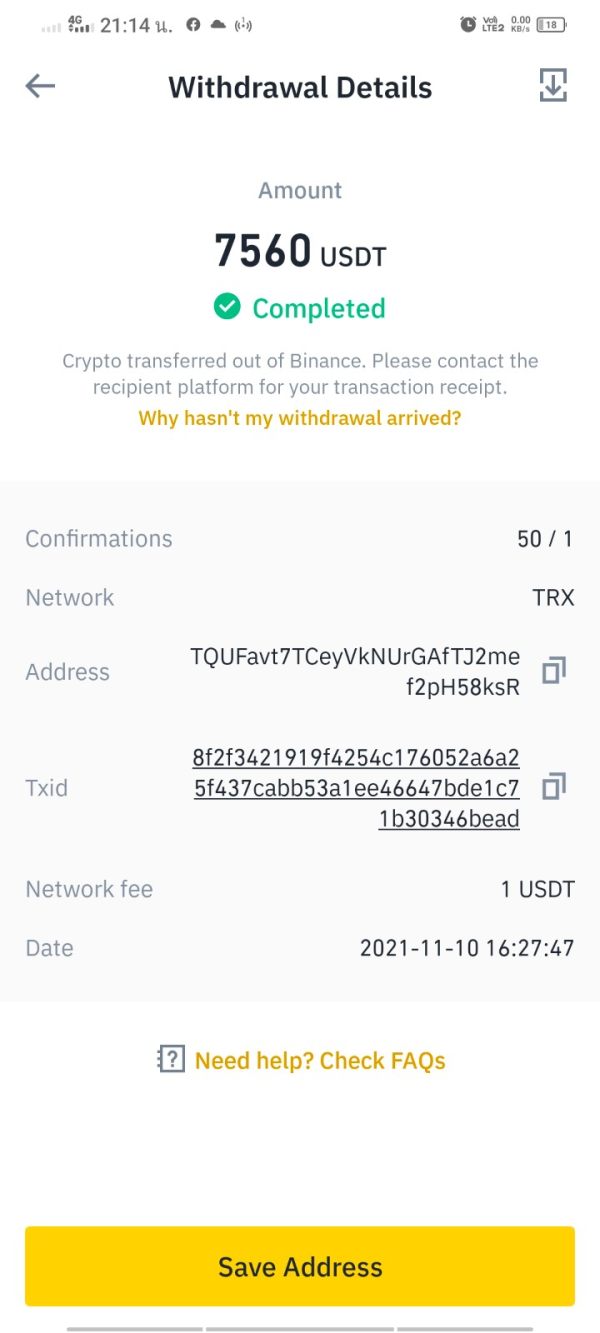

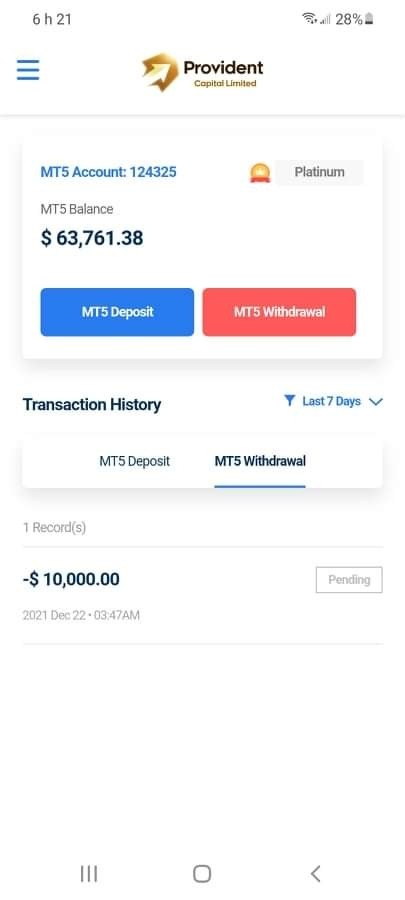

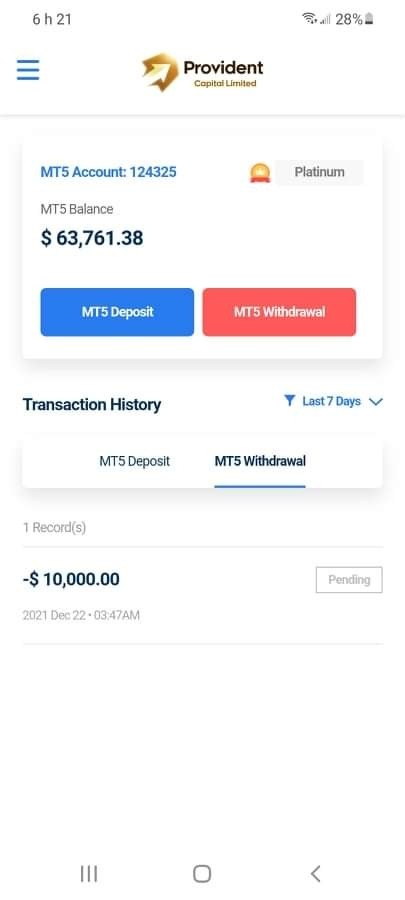

Deposit/Withdrawal Methods:

The broker offers a minimum deposit of $100 for a normal account, $3,000 for a VIP account, and $10,000 for a platinum account. However, user experiences suggest that there are frequent issues with withdrawals, with many users reporting difficulties in accessing their funds.

Bonuses/Promotions:

Currently, Provident Capital does not offer any bonuses or promotions, which is a common practice among regulated brokers to attract new clients.

Tradeable Asset Classes:

Provident Capital claims to provide access to a range of asset classes, including forex, cryptocurrencies, stocks, and commodities. However, the actual availability of these assets may vary, and user reviews indicate that the trading conditions may not be favorable.

Costs (Spreads, Fees, Commissions):

The broker's spreads range from 1.5 pips on the normal account to 0.1 pips on the platinum account, with a maximum leverage of 1:500. While high leverage can be appealing, it also poses significant risks, especially for inexperienced traders.

Allowed Trading Platforms:

The only trading platform offered by Provident Capital is MetaTrader 5, which is known for its advanced trading tools and features. However, the platform's effectiveness may be compromised by the broker's overall reliability.

Restricted Areas:

There is limited information regarding specific regions where Provident Capital is restricted, but the lack of regulation suggests that it may not be compliant with local laws in various jurisdictions.

Available Customer Service Languages:

Customer support appears to be limited, with many users reporting inadequate assistance and a lack of direct contact options. The absence of a dedicated customer service line or email address further exacerbates the concerns surrounding user experience.

Repeated Ratings Overview

Detailed Breakdown

Account Conditions:

While the minimum deposit requirement is relatively low, the overall account conditions are deemed unfavorable due to the broker's unregulated status. Users have reported issues with fund withdrawals, raising concerns about the safety of their investments.

Tools and Resources:

Provident Capital offers basic market news and analysis but lacks comprehensive educational resources. This may not suffice for novice traders seeking to enhance their trading skills.

Customer Service and Support:

User feedback consistently highlights poor customer service, with many traders struggling to get timely responses to their inquiries. The absence of direct contact options is a significant drawback for traders who value reliable support.

Trading Setup/Experience:

The trading experience may be hindered by the broker's questionable practices, including price manipulation and freezing positions, as reported by users. This can lead to frustration and potential financial loss.

Trustworthiness:

With a low trust rating, Provident Capital is viewed skeptically by many users. The broker's lack of transparency and regulatory oversight raises significant concerns about its reliability.

User Experience:

Overall, user experiences with Provident Capital have been largely negative, with many traders expressing dissatisfaction with the broker's practices and support. This is a critical factor for anyone considering opening an account.

In conclusion, while Provident Capital may offer some attractive features, the overall assessment suggests that potential traders should exercise caution. The broker's lack of regulation, numerous user complaints, and inadequate customer support make it a risky choice for trading. As always, it is advisable to opt for regulated brokers that provide a higher level of security and transparency.