Is Murong safe?

Business

License

Is Murong Safe or Scam?

Introduction

Murong is a forex broker that has positioned itself in the competitive landscape of the foreign exchange market, offering a range of trading services and instruments. As the forex market continues to grow, the need for traders to carefully evaluate the legitimacy and reliability of brokers has become increasingly crucial. The presence of scams and unregulated brokers poses significant risks to traders' capital, making it imperative to conduct thorough due diligence before engaging with any trading platform. This article aims to analyze the safety and legitimacy of Murong by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. Our investigation is based on data gathered from various reputable sources, including regulatory databases and user reviews.

Regulatory Status and Legitimacy

When evaluating the safety of a forex broker, regulatory oversight is a key factor. A regulated broker is subject to stringent rules and compliance measures designed to protect traders. Murong, however, has been flagged for its lack of adequate regulation, raising concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA (National Futures Association) | Not authorized | USA | Not verified |

Murong is registered in the United Kingdom, but its regulatory status is questionable. The broker does not hold a license from any reputable authority such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission). The absence of a solid regulatory framework means that traders have limited recourse in case of disputes or issues with fund withdrawals. Moreover, the lack of oversight increases the likelihood of unethical practices, making it essential for traders to approach Murong with caution. Given these factors, many industry experts categorize Murong as a high-risk broker, which raises the question: Is Murong safe?

Company Background Investigation

Murong Investment Ltd. was established in July 2021, and while it claims to operate as a financial intermediary, its history is relatively short and lacks transparency. The company's ownership structure is not readily available, which is a significant red flag in the forex industry. A lack of transparency can often indicate potential issues, as reputable brokers typically provide detailed information about their corporate structure and key personnel.

The management team behind Murong consists of individuals with varying degrees of experience in finance, but specific details about their backgrounds remain unclear. This absence of information raises concerns about the broker's operational integrity and trustworthiness. Furthermore, the company's website does not provide comprehensive disclosures regarding its financial health or business practices, which is essential for assessing its reliability. In light of these factors, one must question whether Murong is safe for trading.

Trading Conditions Analysis

The trading conditions offered by a broker play a crucial role in determining its overall attractiveness. Murong presents an array of trading instruments, including forex currency pairs, commodities, and indices. However, it is essential to scrutinize its fee structure and trading conditions to gauge its competitiveness.

| Fee Type | Murong | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.8 pips (EUR/USD) | 1.0-1.5 pips |

| Commission Model | None specified | Varies by broker |

| Overnight Interest Range | High | Moderate |

While Murong offers competitive spreads, the lack of transparency regarding its commission structure and overnight interest rates raises concerns. Traders often face hidden fees, which can significantly impact profitability. Additionally, the absence of clear information about account types and their associated costs can lead to confusion and dissatisfaction among clients. This opacity makes it difficult to determine if Murong is safe for traders looking for a reliable and cost-effective trading environment.

Customer Funds Security

The safety of customer funds is paramount when choosing a forex broker. Murong claims to implement various security measures to protect clients' capital, but the effectiveness of these measures remains unverified. The broker's website does not provide clear information regarding the segregation of client funds or investor protection policies.

In the absence of regulatory oversight, the safety of funds becomes a significant concern. Traders often face challenges in recovering their investments if a broker engages in fraudulent activities or becomes insolvent. Additionally, the lack of negative balance protection means that traders could potentially lose more than their initial investment, further heightening the risks associated with trading with Murong. Given these factors, it is essential to ask: Is Murong safe?

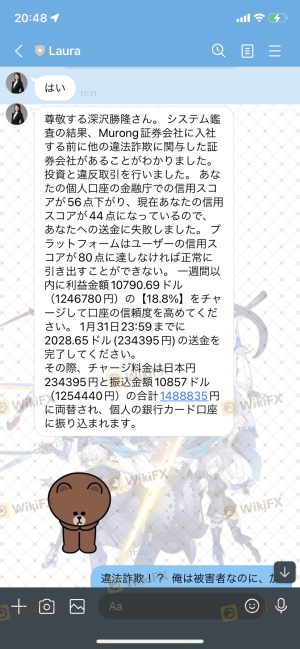

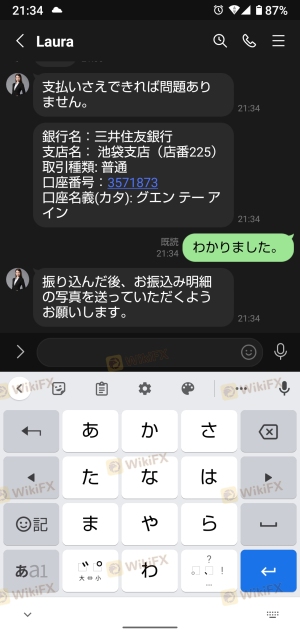

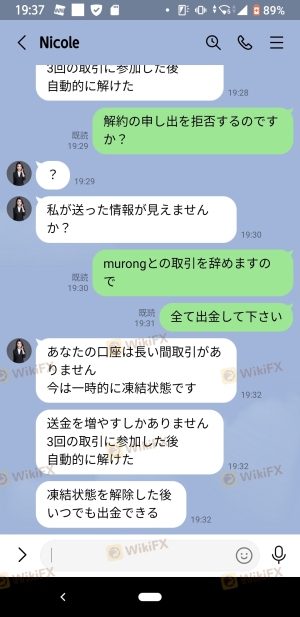

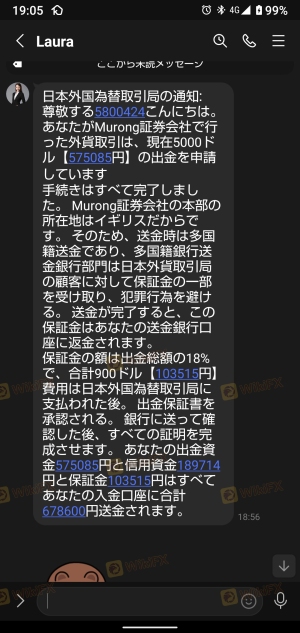

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding a broker's reputation and reliability. Reviews of Murong indicate a mixed experience among users, with several complaints regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Unresponsive |

| Poor Customer Support | Medium | Delayed responses |

Common complaints include difficulties in withdrawing funds and unresponsive customer support, which are significant red flags for any broker. In some cases, traders reported that their withdrawal requests were met with unnecessary delays or outright refusals. This pattern of complaints raises serious concerns about the broker's operational integrity and customer service quality.

For instance, one trader reported being unable to withdraw their funds for several weeks, leading to frustration and distrust. Such experiences prompt potential clients to question whether Murong is safe for trading.

Platform and Execution Quality

A broker's trading platform is a critical component of the trading experience. Murong offers access to the MetaTrader 5 platform, which is widely regarded for its user-friendly interface and advanced trading tools. However, the overall performance, stability, and execution quality of the platform must be assessed to ensure a seamless trading experience.

Traders have reported issues with order execution, including slippage and re-quotes, which can adversely affect trading outcomes. Additionally, there are concerns about the broker's potential manipulation of trading conditions, such as widening spreads during volatile market periods. These factors contribute to an uncertain trading environment, leading many to question if Murong is safe for their trading activities.

Risk Assessment

Using Murong as a forex broker involves various risks that traders must carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No substantial regulation |

| Fund Security Risk | High | Lack of fund segregation and protection |

| Withdrawal Risk | High | Complaints regarding withdrawal issues |

Given the high-risk categories associated with Murong, traders should exercise extreme caution. It is advisable to start with a small investment and thoroughly test the platform before committing larger sums. Additionally, traders should remain vigilant and be prepared to switch brokers if they encounter persistent issues.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the safety and legitimacy of Murong as a forex broker. The lack of regulatory oversight, transparency, and a history of customer complaints suggest that traders should approach this broker with caution.

While Murong may offer attractive trading conditions, the associated risks and negative feedback from users indicate that it may not be a reliable choice for traders. For those considering trading forex, it is advisable to seek out regulated brokers with a proven track record of customer satisfaction and transparency. Some reputable alternatives include brokers regulated by the FCA or ASIC, which provide a safer trading environment and better protection for clients' funds. Ultimately, the question remains: Is Murong safe? The evidence suggests that potential clients should carefully weigh their options before proceeding.

Is Murong a scam, or is it legit?

The latest exposure and evaluation content of Murong brokers.

Murong Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Murong latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.