SGL 2025 Review: Everything You Need to Know

Executive Summary

SGL Group presents a complex picture in the financial services landscape. Various entities operate under the SGL umbrella across different sectors. This sgl review reveals that while SGL Insurance Services operates as an independent insurance brokerage in California, the broader SGL Group's financial trading operations face significant trust and regulatory concerns.

The company offers some competitive features including demo accounts and swap-free options with competitive spreads. It positions itself toward traders seeking low-cost trading solutions and practice environments. However, our analysis indicates that SGL Group is not bound by strict regulatory standards, which raises substantial concerns about client protection and operational transparency.

The lack of comprehensive regulatory oversight significantly impacts the overall trustworthiness of their trading services. Despite some positive employee feedback, with SGL Labs receiving a 4.1/5 rating from staff members, the absence of robust financial regulation makes this platform suitable primarily for experienced traders who understand the associated risks and prioritize demo trading capabilities over regulatory security.

Important Disclaimers

Due to SGL Group's lack of strict regulatory oversight, users across different regions should exercise extreme caution when considering their services. The regulatory landscape varies significantly, and potential clients must understand that limited regulatory protection means reduced recourse in case of disputes or operational issues.

This review is based on publicly available information, user feedback, and company-provided materials. Given the limited transparency in SGL Group's operations, some aspects of their service offering remain unclear or unverified through independent sources.

Rating Framework

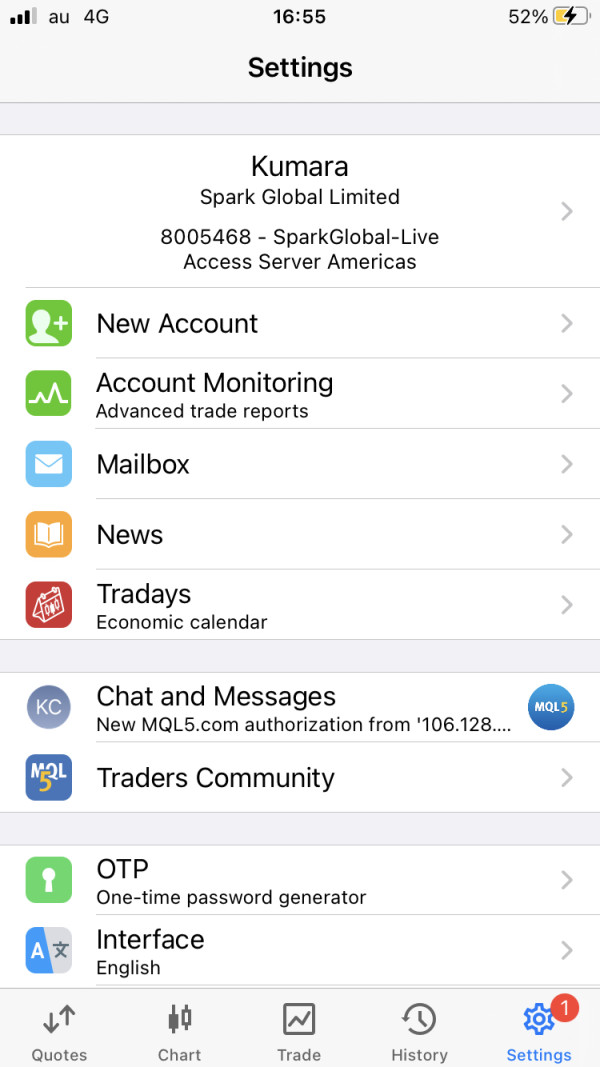

Broker Overview

SGL operates as a multi-faceted organization with different entities serving various financial sectors. SGL Insurance Services was established in California and functions as an independent insurance brokerage dedicated to serving individual and business insurance needs throughout the state. The company has built its foundation on providing comprehensive insurance solutions, though specific establishment dates remain unclear in available documentation.

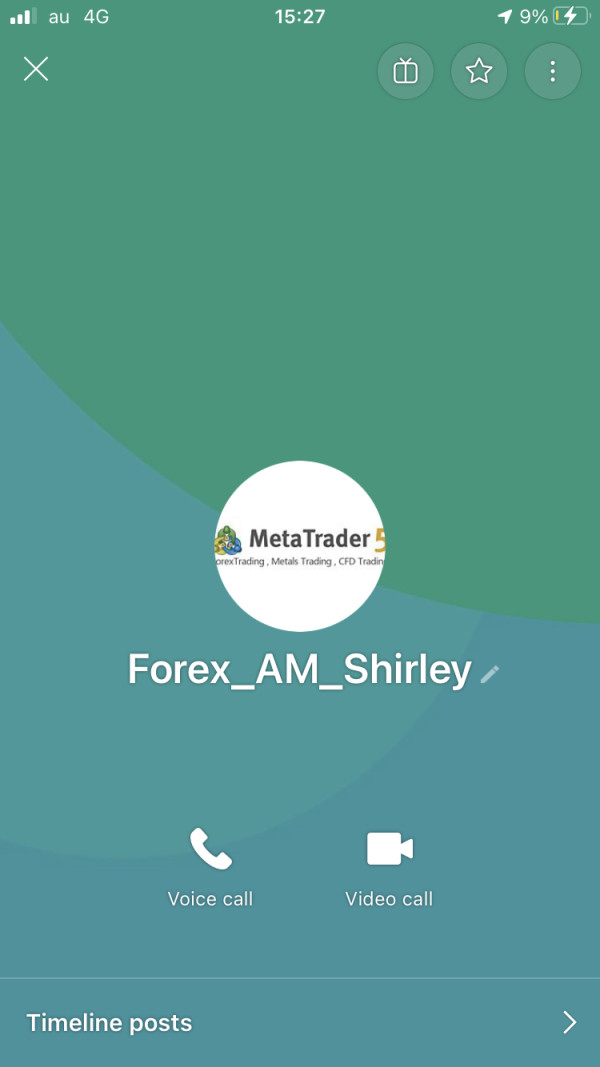

The broader SGL Group's business model extends beyond traditional insurance services into financial trading. This expansion raises questions about regulatory compliance and operational focus. According to available information, the company positions itself as serving clients who prioritize competitive pricing and flexible account options, including demo trading capabilities.

This sgl review reveals that while SGL maintains operations across multiple financial sectors, their trading services operate without the strict regulatory framework that characterizes reputable financial institutions. The company's approach appears to target cost-conscious traders willing to accept reduced regulatory protection in exchange for potentially lower trading costs and flexible account structures.

Regulatory Status: SGL Group operates without strict regulatory oversight from major financial authorities. This creates significant concerns about client protection and operational transparency. The lack of comprehensive regulation distinguishes them from established brokers operating under FCA, ASIC, or CySEC oversight.

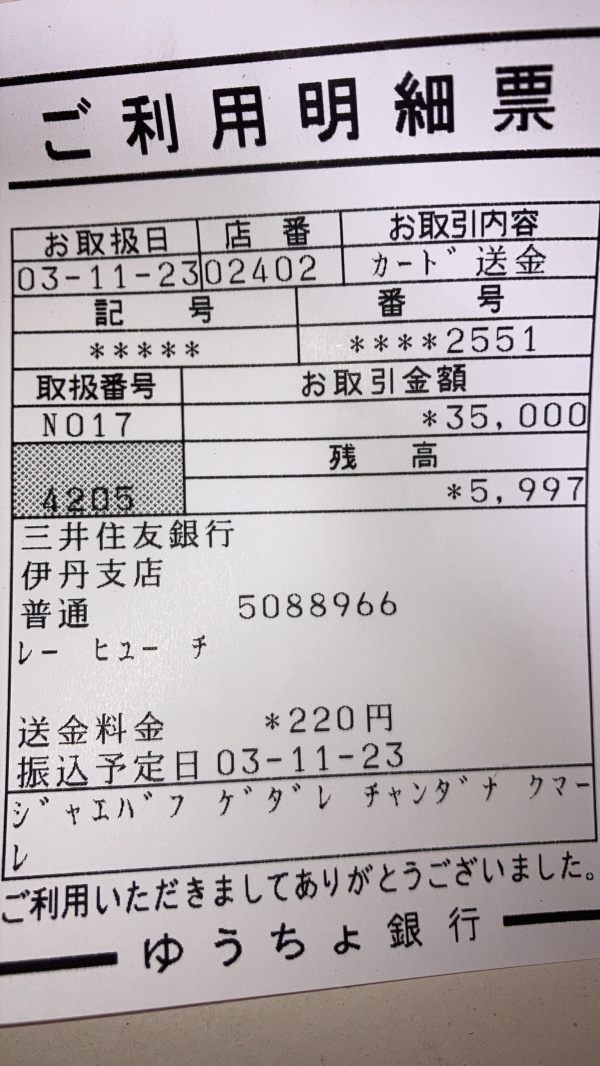

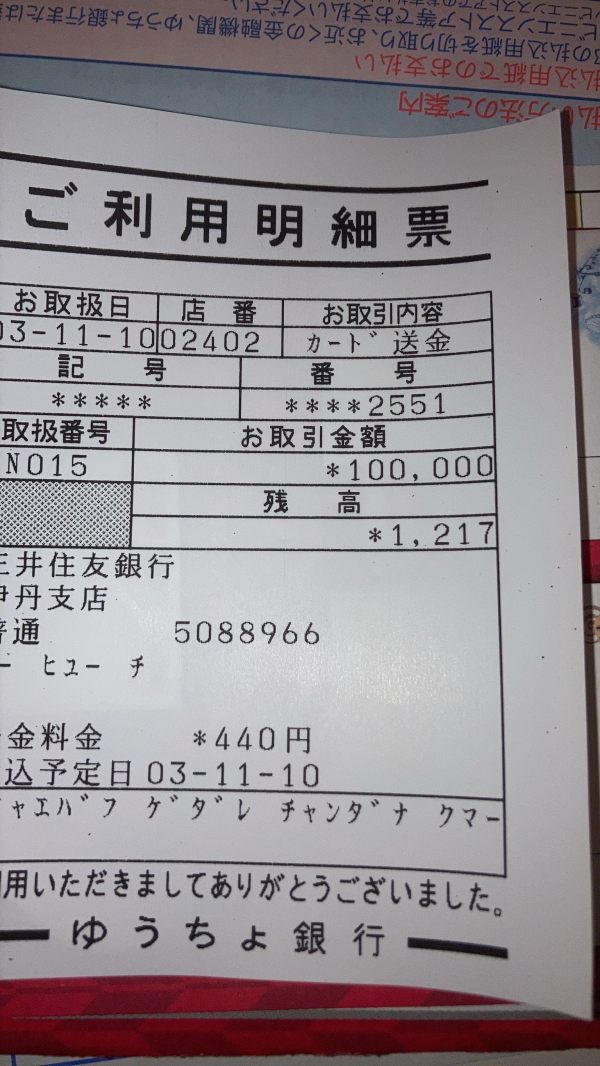

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and associated fees remains unclear in available documentation. This limits potential clients' ability to assess operational convenience.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available materials. This makes it difficult for potential traders to plan their initial investment.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs are not detailed in publicly available information.

Tradeable Assets: The platform focuses primarily on forex markets. The complete range of available currency pairs and other financial instruments requires clarification.

Cost Structure: While the company advertises competitive spreads, specific spread ranges, commission structures, and additional fees lack detailed disclosure in available materials.

Leverage Options: Maximum leverage ratios and margin requirements are not clearly specified in current documentation.

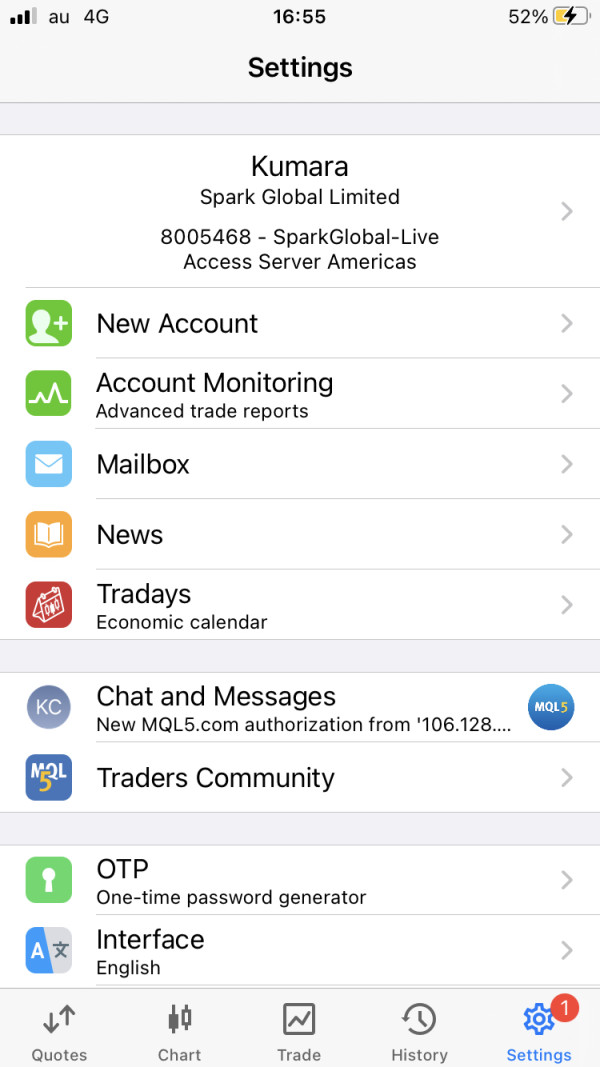

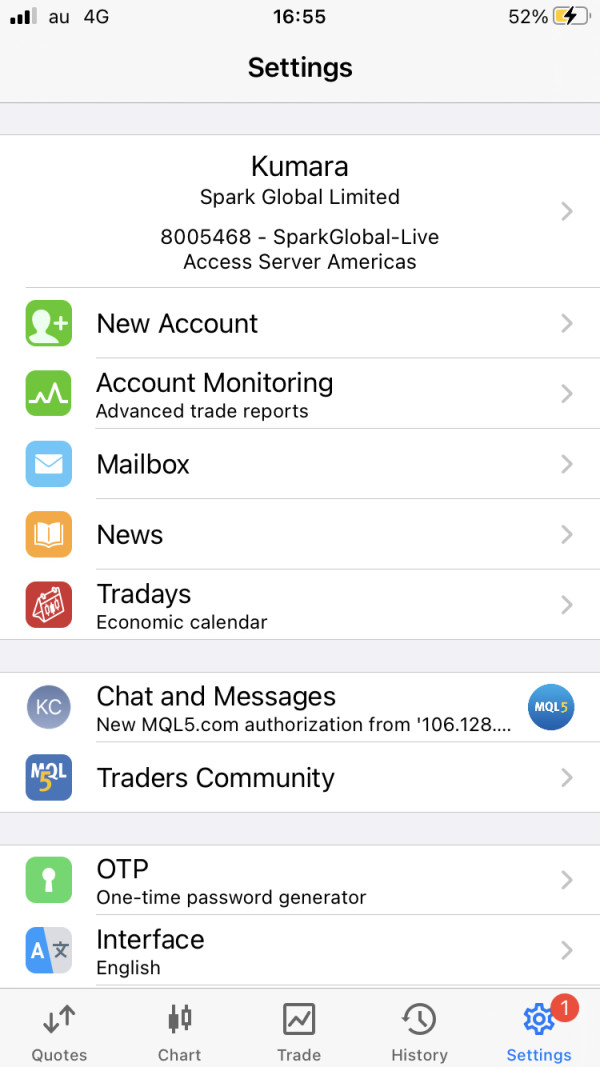

Platform Selection: Information about specific trading platforms, whether proprietary or third-party solutions like MetaTrader, remains unclear.

Geographic Restrictions: Specific countries or regions where services are unavailable are not clearly outlined in available materials.

Customer Support Languages: Available support languages and communication channels require clarification through direct contact with the company.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

SGL's account conditions present several uncertainties that impact the overall trading proposition. The lack of detailed information about account types, their specific features, and associated costs makes it challenging for potential clients to make informed decisions. While the company mentions competitive spreads and swap-free options, the absence of concrete numbers, comparison charts, or detailed fee schedules raises transparency concerns.

The minimum deposit requirements remain unspecified, which is unusual for legitimate brokers who typically provide clear entry-level investment amounts. This sgl review finds that without detailed account specifications, traders cannot adequately assess whether SGL's offerings align with their trading capital and strategy requirements.

Account opening procedures, verification requirements, and the time needed to activate trading capabilities are not clearly outlined. The mention of demo accounts provides some positive aspect, allowing potential clients to test services before committing real capital, though specific demo account limitations and features require clarification.

The available information suggests SGL provides basic account management capabilities through an online portal. Comprehensive details about trading tools, analytical resources, and educational materials remain limited. Professional traders typically require advanced charting tools, technical indicators, economic calendars, and market analysis resources, yet SGL's specific offerings in these areas lack detailed documentation.

Research and analysis resources, which are crucial for informed trading decisions, are not prominently featured in available materials. Educational content, webinars, trading guides, and market commentary that help traders improve their skills appear to be absent or inadequately promoted.

Automated trading support, including Expert Advisor compatibility, API access, or algorithmic trading capabilities, remains unclear. Modern traders increasingly rely on automated solutions, and the absence of clear information about these features limits SGL's appeal to technically sophisticated clients.

Customer Service and Support Analysis (3/10)

Customer service quality represents a significant area of concern in this evaluation. Available information lacks specific details about support channels, response times, and service quality metrics that would allow potential clients to assess the level of assistance they can expect.

The absence of clear information about support availability hours, whether 24/7 support exists, and the expertise level of support staff creates uncertainty about problem resolution capabilities. Live chat availability, phone support options, and email response times are not clearly specified.

Multilingual support capabilities, which are essential for international clients, remain unclear. The lack of user testimonials or feedback specifically addressing customer service experiences makes it difficult to assess real-world support quality and effectiveness.

Trading Experience Analysis (4/10)

The overall trading experience with SGL lacks comprehensive documentation and user feedback that would provide insights into platform stability, execution speed, and overall functionality. Platform reliability, which is crucial for successful trading, cannot be adequately assessed based on available information.

Order execution quality, including slippage rates, requote frequency, and execution speed during volatile market conditions, remains undocumented. These factors significantly impact trading profitability and user satisfaction but are not addressed in available materials.

Mobile trading capabilities, which are increasingly important for modern traders, are not clearly outlined. The ability to monitor positions, execute trades, and manage accounts through mobile applications has become a standard expectation that requires clarification.

This sgl review notes that without comprehensive information about the trading environment, including platform features, execution quality, and user interface design, potential clients cannot adequately assess whether SGL meets their trading requirements and expectations.

Trust and Security Analysis (2/10)

Trust and security represent the most significant concerns in this evaluation. SGL Group's operation without strict regulatory oversight from recognized financial authorities creates substantial risks for potential clients. Established brokers typically operate under FCA, ASIC, CySEC, or similar regulatory frameworks that provide client protection, segregated funds, and dispute resolution mechanisms.

The absence of detailed information about client fund protection, segregated accounts, or compensation schemes raises serious questions about capital security. Legitimate brokers typically maintain client funds in segregated accounts with tier-1 banks and participate in investor compensation programs.

Company transparency regarding ownership structure, financial statements, and operational procedures appears limited based on available information. The lack of clear communication about regulatory status, compliance measures, and risk management procedures significantly impacts overall trustworthiness.

User Experience Analysis (6/10)

User experience shows some positive indicators, particularly the 4.1/5 employee rating for SGL Labs. This suggests reasonable internal satisfaction and potentially positive workplace culture. This internal satisfaction may translate to better service delivery, though direct client experience feedback remains limited.

The overall user interface design, navigation ease, and account management functionality require direct testing to assess properly. Registration and verification processes, which significantly impact initial user experience, lack detailed documentation about required documents, processing times, and approval procedures.

User feedback regarding common complaints, satisfaction levels, and recommendation rates is not readily available in public forums or review platforms. This absence of comprehensive user testimonials makes it challenging to assess real-world client satisfaction and identify potential service issues.

Conclusion

This comprehensive sgl review reveals a financial services provider with mixed characteristics and significant limitations. While SGL offers some attractive features such as demo accounts, swap-free options, and competitive spreads, the fundamental lack of strict regulatory oversight creates substantial concerns about client protection and operational transparency.

SGL appears most suitable for experienced traders who prioritize cost-effective trading conditions over regulatory security and are comfortable with increased risk exposure. The platform may appeal to traders seeking demo account capabilities and those interested in testing strategies without robust regulatory protection.

The primary advantages include competitive pricing structures and flexible account options, while the major disadvantages center on limited regulatory oversight, insufficient transparency, and unclear operational procedures. Potential clients should carefully consider these factors against their risk tolerance and trading requirements before engaging with SGL's services.