w2forex 2025 Review: Everything You Need to Know

Summary

W2Forex presents itself as an online trading platform offering access to forex and CFD markets. Our comprehensive w2forex review reveals significant concerns about this broker's legitimacy and regulatory standing, however. The platform operates without proper regulatory oversight from major financial authorities like the FCA or ASIC, and multiple sources have flagged W2Forex as a potentially fraudulent platform with mixed user feedback that leans heavily toward negative experiences.

The platform claims to provide access to various markets including forex, indices, and stocks. It positions itself as a multi-asset trading solution, but the lack of transparent information about trading conditions, customer support details, and regulatory compliance raises serious red flags for potential investors. User reviews indicate inconsistent service quality and concerning withdrawal issues, which creates additional concerns for potential clients.

W2Forex appears to target traders seeking high leverage and multi-market access. The absence of regulatory protection and numerous scam warnings make it a high-risk proposition, though. The platform's offshore operation structure and lack of compliance evidence suggest that traders should exercise extreme caution when considering this broker for their investment activities.

Important Notice

Regional Entity Differences: Due to W2Forex's unregulated status, users in different jurisdictions may face varying levels of legal protection and recourse options. The platform operates as an offshore entity without proper licensing from recognized financial regulators, which means investor protection schemes available in regulated markets may not apply to users of this service.

Review Methodology: This evaluation is based on publicly available information, user feedback from multiple sources, and industry reports. We have not conducted direct testing of the platform's services due to safety concerns regarding the broker's regulatory status and fraud warnings from various watchdog organizations, which limits our ability to provide first-hand experience data.

Rating Framework

Broker Overview

W2Forex operates as an unregulated offshore trading platform that claims to provide online investment services across multiple financial markets. The company lacks proper regulatory documentation and operates without oversight from major financial authorities, according to available information. The platform presents itself as a forex and CFD broker, but the absence of clear company registration details and regulatory compliance raises immediate concerns about its legitimacy and operational transparency.

The broker's business model appears to focus on attracting traders through claims of multi-market access and leverage trading opportunities. W2forex review sources consistently highlight the platform's lack of transparency regarding its operational structure, company ownership, and regulatory status, however. Multiple industry watchdogs have flagged W2Forex as a potentially fraudulent operation, with warnings appearing across various broker review platforms and scam alert websites that monitor the trading industry.

The platform's website may appear professionally designed. The lack of substantive information about trading conditions, company background, and regulatory compliance suggests a concerning disconnect between presentation and substance, though. Users considering this broker should be aware that the absence of proper regulatory oversight means they would have limited recourse in case of disputes or operational issues.

Regulatory Status: W2Forex operates without regulation from any major financial authority including the FCA, ASIC, CySEC, or other recognized regulators. This unregulated status significantly increases the risk for potential clients who choose to use their services.

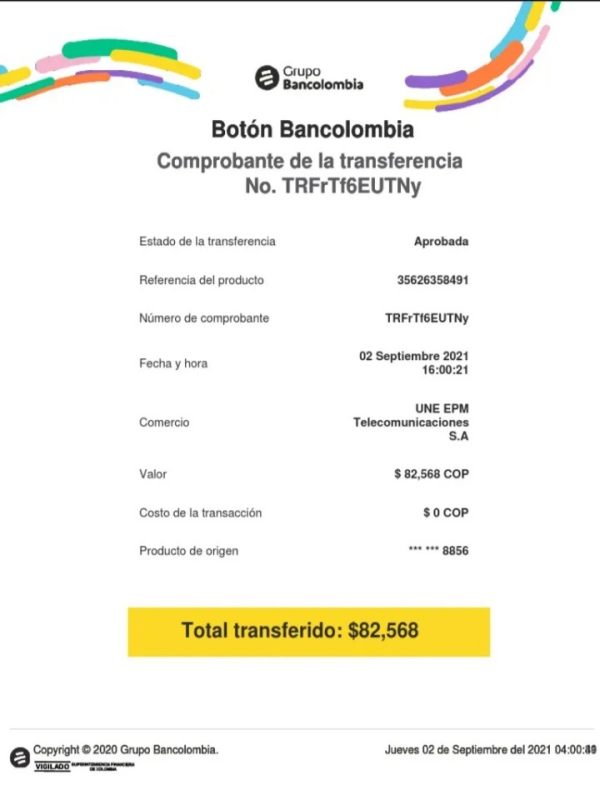

Deposit and Withdrawal Methods: Specific information about supported payment methods is not clearly disclosed in available materials. This lack of transparency is concerning for a legitimate trading platform.

Minimum Deposit Requirements: The platform has not transparently disclosed minimum deposit requirements. This makes it difficult for potential clients to understand account opening conditions.

Bonuses and Promotions: Available information does not detail any specific bonus structures or promotional offerings from the broker. This represents another gap in essential client information.

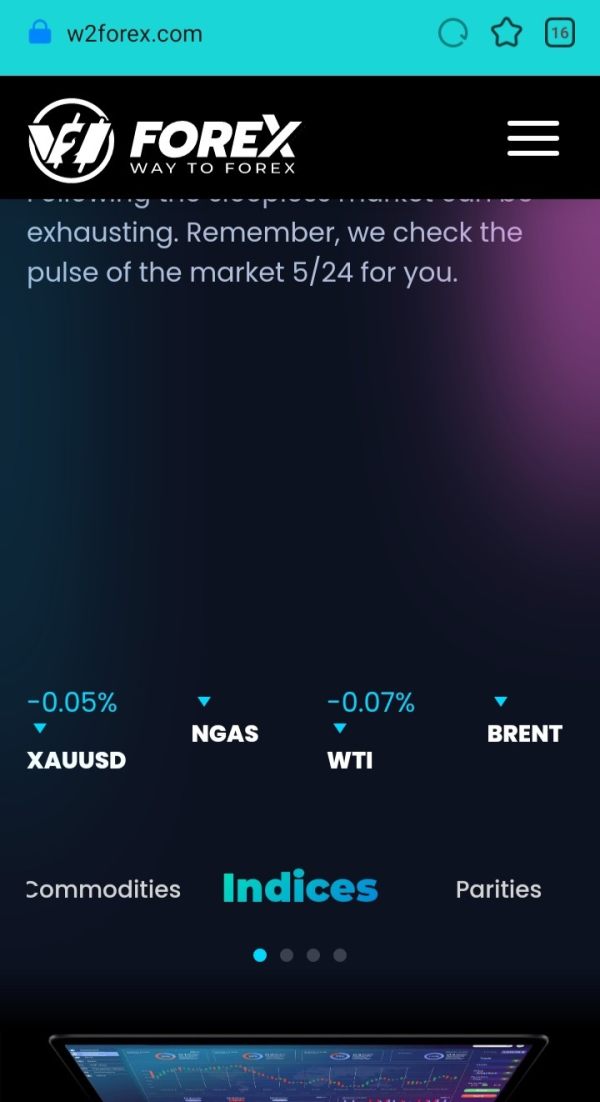

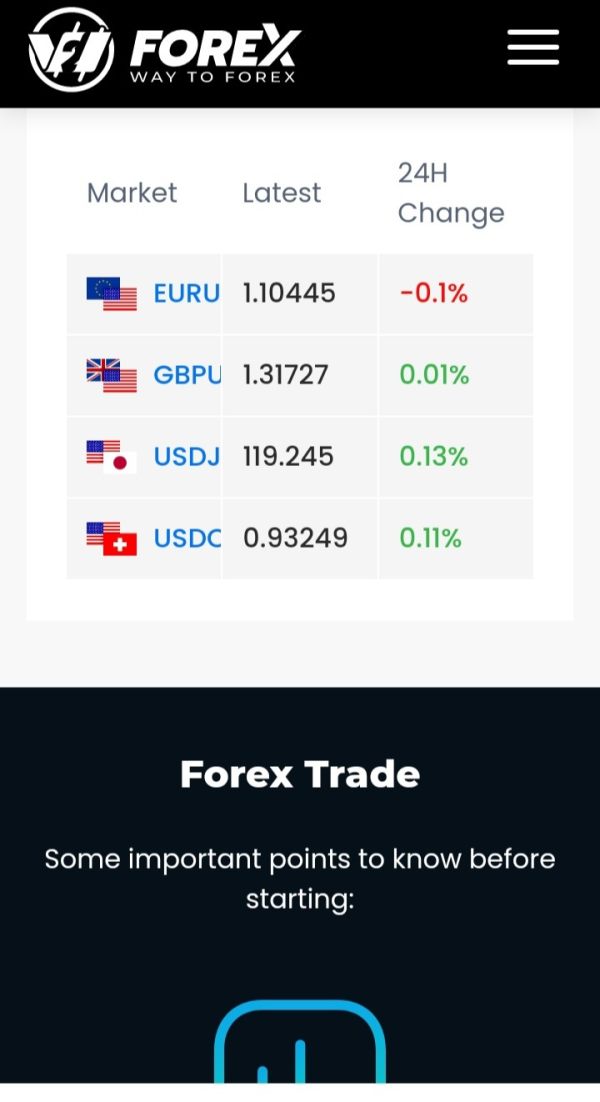

Tradeable Assets: W2Forex claims to offer access to forex pairs, stock indices, and individual stocks. The platform presents itself as a multi-asset trading solution for various market participants.

Cost Structure: Critical information about spreads, commissions, and other trading costs remains undisclosed in available public materials. This represents a significant transparency concern for potential clients.

Leverage Ratios: While the platform mentions offering leveraged trading services, specific leverage ratios and risk management policies are not clearly communicated. This lack of detail makes it difficult to assess trading conditions.

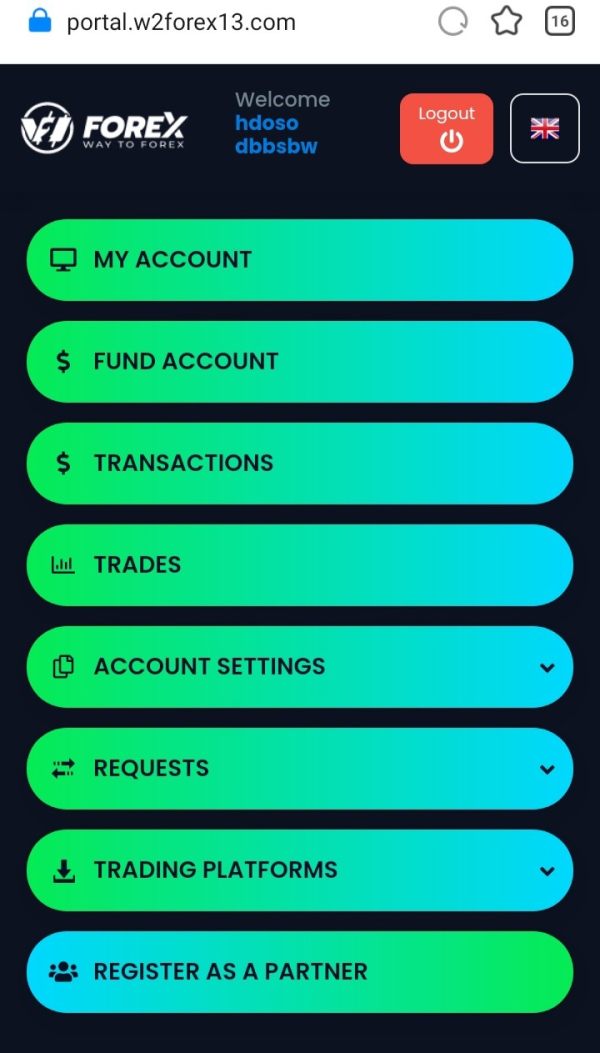

Platform Options: Available sources do not provide clear information about which trading platforms are supported. Popular options like MetaTrader 4 or 5 are not specifically mentioned in accessible materials.

Geographic Restrictions: Specific information about regional restrictions or availability is not detailed in accessible materials. This creates uncertainty for potential international clients.

Customer Support Languages: The range of supported languages for customer service is not specified in available documentation. This w2forex review reveals concerning gaps in essential information that legitimate brokers typically provide transparently to potential clients.

Detailed Rating Analysis

Account Conditions Analysis

W2Forex's account conditions receive a low rating of 4/10 due to significant transparency issues and lack of clear information about trading terms. The platform fails to provide essential details about account types, minimum deposit requirements, or specific trading conditions that traders need to make informed decisions, which creates immediate concerns about operational transparency. This opacity is particularly concerning when compared to regulated brokers who are required to clearly disclose all terms and conditions.

User feedback suggests that account opening processes are unclear. Several reports indicate confusion about requirements and procedures, which compounds the platform's transparency problems. The absence of detailed information about account features, such as whether Islamic accounts are available or what specific benefits different account tiers might offer, further undermines the platform's credibility and professional standing.

According to w2forex review sources, the platform's lack of regulatory oversight means that standard investor protections are not guaranteed. These protections include segregated client funds and compensation schemes that are standard at regulated brokers. This represents a significant disadvantage compared to regulated alternatives that must comply with strict client money handling rules.

The platform's failure to provide transparent pricing information creates additional problems for potential clients. Essential details including spreads, overnight financing charges, and commission structures remain undisclosed, which makes it impossible for traders to accurately assess the true cost of trading. This lack of transparency is a fundamental requirement violation for any legitimate brokerage operation.

The tools and resources offered by W2Forex score 5/10, reflecting the platform's basic market access claims while highlighting the lack of detailed information about tool quality and functionality. While the broker advertises access to forex and CFD markets across multiple asset classes, there is insufficient information about the specific analytical tools, charting capabilities, or research resources available to traders who might use their services.

User feedback indicates that the platform's trading tools may be limited compared to established brokers. Some reports suggest that technical analysis capabilities are basic at best, which could limit trading effectiveness. The absence of detailed information about educational resources, market analysis, or trading guides represents a significant gap for traders seeking comprehensive support and learning materials.

Available sources do not provide evidence of advanced trading features that are standard offerings from reputable brokers. These missing features include algorithmic trading support, advanced order types, and sophisticated risk management tools. This limitation could significantly impact trading effectiveness for more experienced traders who require advanced functionality.

The platform's claimed multi-market access, while potentially appealing, lacks verification through regulatory filings or third-party confirmations. This makes it difficult to assess the actual quality and reliability of market connectivity and execution capabilities that the broker claims to provide.

Customer Service and Support Analysis

W2Forex receives a poor rating of 3/10 for customer service and support, based on consistently negative user feedback and the absence of clear support channel information. Multiple user reports indicate slow response times, unprofessional communication, and inadequate problem resolution capabilities from the broker's support team, which creates significant concerns about service quality.

The platform fails to provide transparent information about available support channels, operating hours, or service level commitments. Legitimate brokers typically offer clear support information to help clients understand how to access assistance when needed. This lack of clarity about client support access is particularly concerning for a financial services provider where timely support can be critical.

User experiences documented in various w2forex review sources frequently mention difficulties in contacting support representatives. Many users report problems receiving meaningful assistance with account or trading issues, which suggests systemic support problems. Several reports suggest that customer inquiries are either ignored or handled with insufficient expertise to resolve problems effectively.

The absence of multilingual support information and unclear escalation procedures for serious issues further compound the customer service problems. Without proper regulatory oversight, clients have limited external recourse when internal support channels fail to address their concerns adequately, which creates additional risk for platform users.

Trading Experience Analysis

The trading experience with W2Forex receives a middle-ground rating of 5/10, reflecting the platform's basic multi-asset trading claims while acknowledging significant unknowns about execution quality and platform reliability. While the broker advertises access to various markets including forex, indices, and stocks, there is limited verified information about actual trading conditions and execution standards that clients can expect.

User feedback regarding trading experience is mixed. Some reports suggest acceptable basic functionality while others highlight concerns about order execution delays and platform stability issues, which creates uncertainty about service reliability. The lack of detailed information about execution speeds, slippage rates, and order fill quality makes it difficult to assess the true trading environment.

Available sources do not provide clear information about supported trading platforms, mobile trading capabilities, or advanced trading features. Experienced traders typically require reliable technology and comprehensive trading tools for effective market participation. This information gap represents a significant concern for traders who need dependable trading infrastructure.

The platform's unregulated status means that trading practices are not subject to regulatory oversight or best execution requirements. These standards protect clients at licensed brokers and ensure fair treatment. This w2forex review finding suggests that traders cannot rely on regulatory standards for fair and transparent trade execution.

Trust and Reliability Analysis

W2Forex receives the lowest rating of 2/10 for trust and reliability due to its unregulated status and multiple fraud warnings from industry watchdogs. The platform operates without proper licensing from any recognized financial regulator, which immediately raises serious concerns about client fund safety and operational legitimacy that potential users should carefully consider.

Multiple industry sources have flagged W2Forex as a potentially fraudulent operation. Scam warnings appear on various broker review platforms and financial watchdog websites that monitor trading industry safety. These warnings consistently highlight the platform's lack of regulatory compliance and transparency issues as primary concerns for potential clients.

The absence of proper regulatory oversight means that standard investor protections are not available to W2Forex clients. These protections include segregated client accounts, deposit insurance, and regulatory compensation schemes that provide safety nets for traders. This represents a fundamental security risk that legitimate regulated brokers are required to address through compliance programs.

The platform's poor industry reputation and lack of verifiable company information further undermine its trustworthiness. Without proper regulatory documentation, company registration details, or third-party auditing, clients have no reliable way to verify the broker's financial stability or operational integrity, which creates significant uncertainty about platform safety.

User Experience Analysis

W2Forex's user experience receives a rating of 4/10, reflecting predominantly negative user feedback and concerning reports about platform functionality and customer treatment. While some users may have had acceptable experiences, the overall pattern of feedback suggests significant issues with service quality and platform reliability that potential clients should consider carefully.

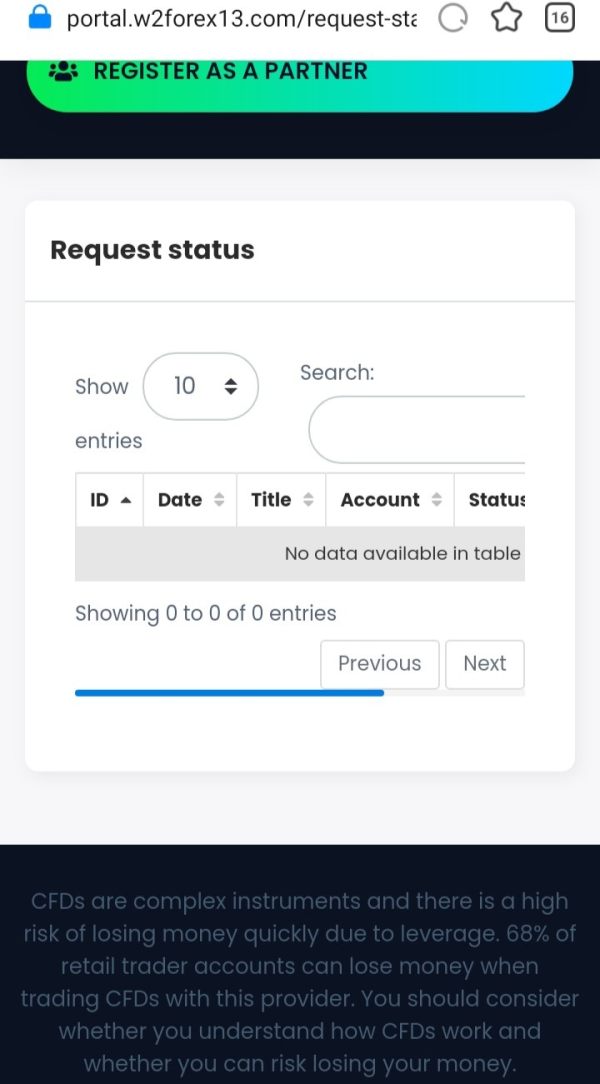

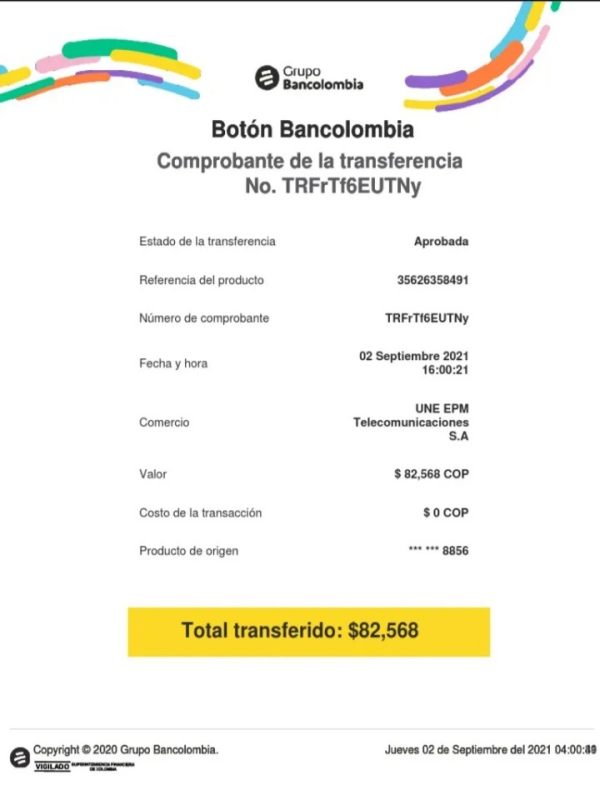

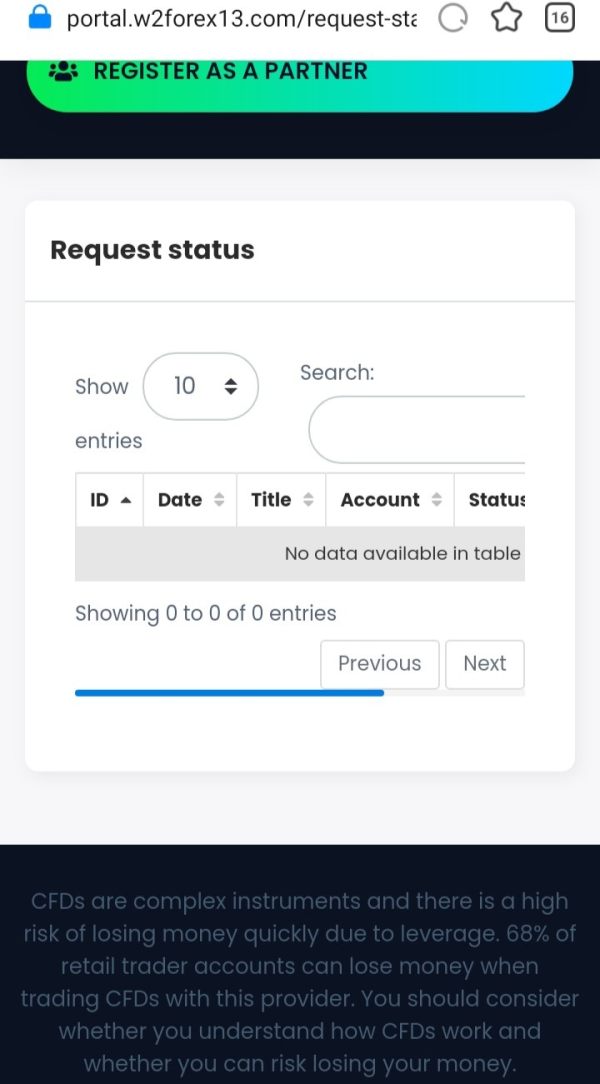

User reviews consistently highlight problems with account management, withdrawal processing, and customer support responsiveness. Many reports indicate that users face difficulties when attempting to withdraw funds or resolve account issues, which are critical concerns for any trading platform where clients need reliable access to their money.

The platform's target demographic appears to be traders seeking high leverage and multi-market access. User feedback suggests that the actual experience often falls short of expectations, however. Common complaints include unclear terms and conditions, unexpected fees, and poor communication from the broker.

According to this w2forex review analysis, the combination of unregulated status and negative user experiences creates a high-risk environment. This environment is particularly unsuitable for risk-averse investors or those seeking reliable long-term trading relationships with trustworthy service providers. The lack of regulatory protection means users have limited recourse when problems arise.

Conclusion

This comprehensive w2forex review reveals that W2Forex operates as an unregulated offshore platform with significant red flags that make it unsuitable for most traders. The broker's lack of proper regulatory oversight, combined with multiple fraud warnings from industry sources and predominantly negative user feedback, creates an unacceptably high-risk trading environment that poses serious concerns for potential clients.

The platform may appeal to traders seeking multi-market access and leverage trading opportunities. The absence of regulatory protection and transparency issues far outweigh any potential benefits, however. Risk-averse investors and those seeking reliable, long-term trading relationships should avoid this broker entirely.

The main advantages claimed by W2Forex include multi-asset market access and leverage trading services. These are significantly overshadowed by critical disadvantages including unregulated status, poor customer support, lack of transparency, and multiple scam warnings from industry watchdogs, though. Traders are strongly advised to consider regulated alternatives that provide proper investor protection and transparent operating conditions for safer trading experiences.